How Long Does It Take To Open An Account

Opening a new bank account, once a time-consuming ritual of paperwork and in-person visits, is undergoing a transformation. The speed at which consumers can access financial services is increasingly crucial, impacting everything from personal budgeting to small business operations.

This article explores the current landscape of account opening times, examining the factors influencing the process and the implications for consumers and financial institutions. The focus will be on understanding the typical timelines, the advancements streamlining the process, and the potential challenges that still exist.

The Shifting Sands of Account Opening Times

Traditionally, opening a bank account could take days, even weeks. Verification processes, manual data entry, and the reliance on physical documents contributed to these lengthy delays.

However, the rise of digital banking and fintech solutions has dramatically altered the landscape. Many institutions now offer online account opening, promising near-instant access.

What Influences Account Opening Speed?

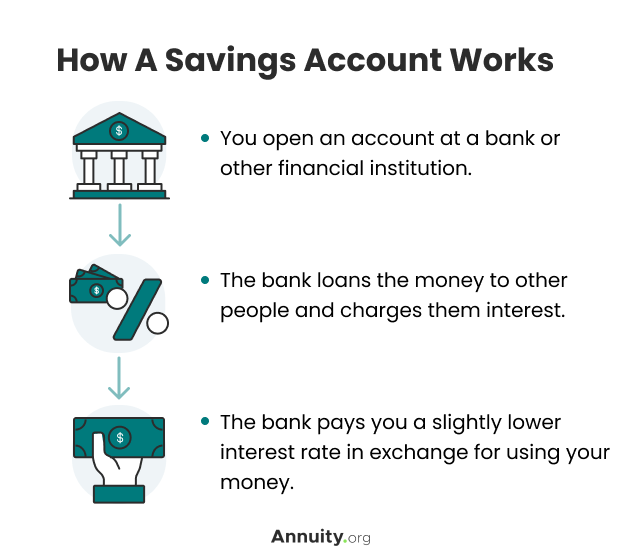

Several factors determine how quickly you can open an account. One crucial aspect is the type of account. For example, a simple checking account is generally faster to open than a complex investment account.

Identity verification is another significant factor. Institutions are legally obligated to comply with Know Your Customer (KYC) regulations, requiring them to verify the identity of their customers.

The verification can involve automated checks against databases or, in some cases, manual review of documents. The method of application, whether online or in-person, also plays a critical role.

The Digital Advantage

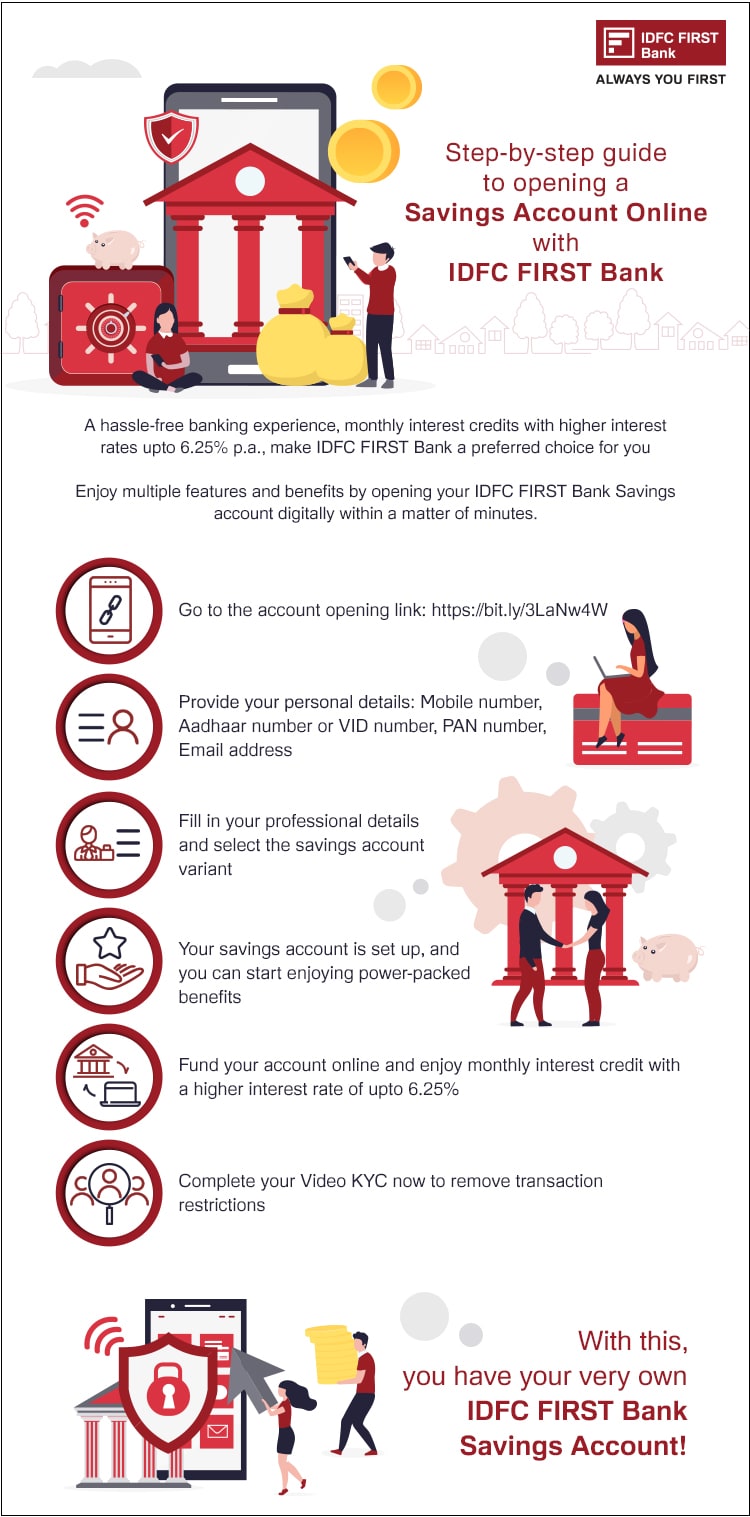

Online account opening has become increasingly prevalent. Fintech companies and traditional banks alike are leveraging technology to streamline the process.

Automated identity verification, using techniques like facial recognition and document scanning, can significantly reduce processing times. Some banks claim to offer accounts open in as little as minutes, pending successful verification.

However, it's important to note that not all applications are instantly approved. Discrepancies in information or incomplete documentation can trigger manual review, adding to the processing time.

Potential Roadblocks and Delays

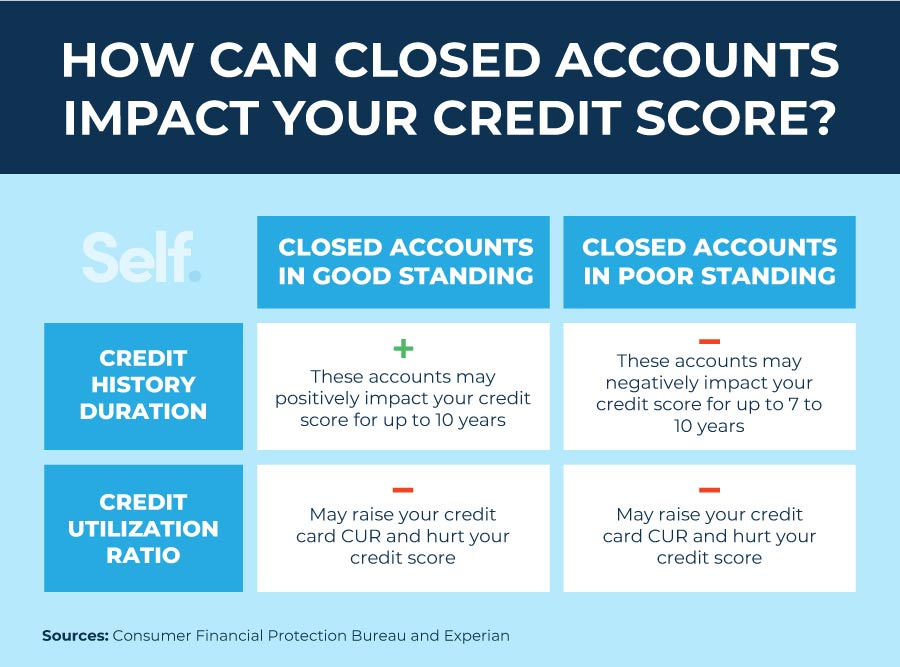

Even with technological advancements, challenges remain. Issues with credit history or prior banking relationships can trigger further scrutiny.

According to the Consumer Financial Protection Bureau (CFPB), consumers should be aware of their rights and understand the reasons for any delays. Institutions are expected to provide clear explanations for any rejection or extended processing time.

"Consumers should be proactive in ensuring they provide accurate information and address any potential issues upfront," says a statement released by the CFPB. This includes verifying information and resolving any outstanding debts or discrepancies with credit reports.

A Human Perspective

For small business owners, the speed of account opening can be critical for managing cash flow and seizing opportunities. Sarah Chen, owner of a local bakery, recently experienced frustration when opening a business account.

"I needed the account open quickly to receive payments from a large catering order," Chen explained. "The process took longer than expected due to some issues with my business license verification, causing unnecessary stress."

Chen's experience highlights the real-world impact of account opening times on individuals and businesses.

"It's not just about convenience; it can directly affect your ability to operate and grow," Chen added.

The Future of Account Opening

The trend towards faster, more efficient account opening is likely to continue. Banks are investing in artificial intelligence and machine learning to further automate verification processes and improve the customer experience.

Biometric authentication, using fingerprints or voice recognition, is also gaining traction as a secure and convenient method of identity verification. These technological advancements aim to reduce fraud and improve efficiency.

The industry is expected to see even more innovation in the coming years, driving down account opening times and making financial services more accessible to everyone.