How Long Does It Take To Take Out A Loan

Loan approval times are in flux, impacting borrowers across the nation. Delays in processing are causing frustration and potentially jeopardizing time-sensitive purchases.

The time it takes to secure a loan, from application to funding, is now a critical factor for anyone seeking financing. Understanding the current landscape is vital to navigating the lending process effectively.

The Current Timeline

Mortgage approvals are currently averaging 30-45 days, according to a recent report by Ellie Mae, a leading mortgage technology provider. This timeframe is significantly longer than pre-pandemic averages. The delays are attributed to increased application volume and staffing shortages within lending institutions.

For personal loans, the timeline is generally shorter, ranging from a few days to two weeks. However, approval speed depends heavily on the lender and the applicant's creditworthiness. Some online lenders boast near-instant approval, but these often come with higher interest rates.

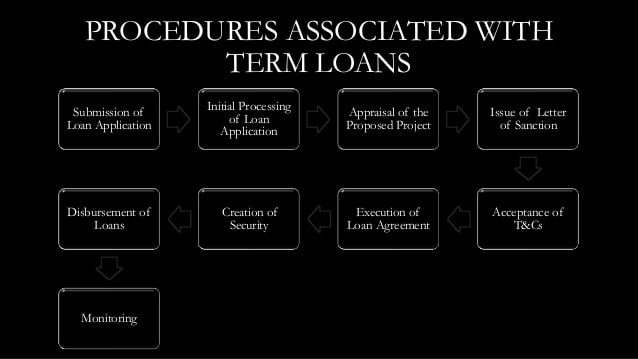

Small business loans present a more complex picture. According to the Small Business Administration (SBA), the average SBA loan takes 2-3 months to finalize. This lengthy process is due to rigorous documentation requirements and extensive underwriting procedures.

Factors Affecting Loan Approval Time

Several factors influence how long it takes to get a loan approved. Your credit score is a primary determinant. A higher credit score typically leads to faster approval and better loan terms.

The completeness and accuracy of your application are also crucial. Missing documents or inconsistencies can cause significant delays. Lenders need to verify your income, employment, and assets, so be prepared to provide all necessary information promptly.

The type of loan you're seeking also plays a major role. Mortgages, with their extensive appraisal and title search requirements, naturally take longer than personal loans. SBA loans, with their government backing, involve additional layers of bureaucracy.

Tips to Expedite the Process

To speed up the loan approval process, start by checking your credit report for errors. Correcting any inaccuracies can improve your credit score and expedite your application.

Gather all necessary documentation before you apply. This includes pay stubs, tax returns, bank statements, and any other relevant financial records.

Communicate proactively with your lender. Respond promptly to their requests and address any questions or concerns they may have.

The Road Ahead

Industry experts predict that loan approval times will remain elevated for the foreseeable future. Borrowers should factor these delays into their financial planning and avoid making hasty decisions.

The Federal Reserve's interest rate policies will continue to impact the lending landscape. Keep a close watch on these developments as they can influence both approval times and loan costs.

Consult with a financial advisor to explore your options and develop a sound borrowing strategy. This can help you navigate the complexities of the loan market and secure the financing you need in a timely manner.

-min.png?format=1500w)

.png)