How Long Does Opening A Bank Account Take

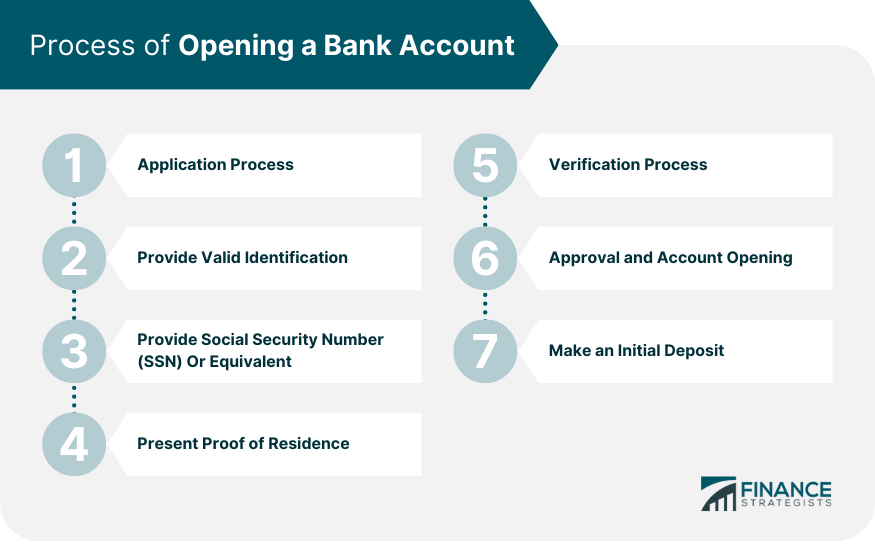

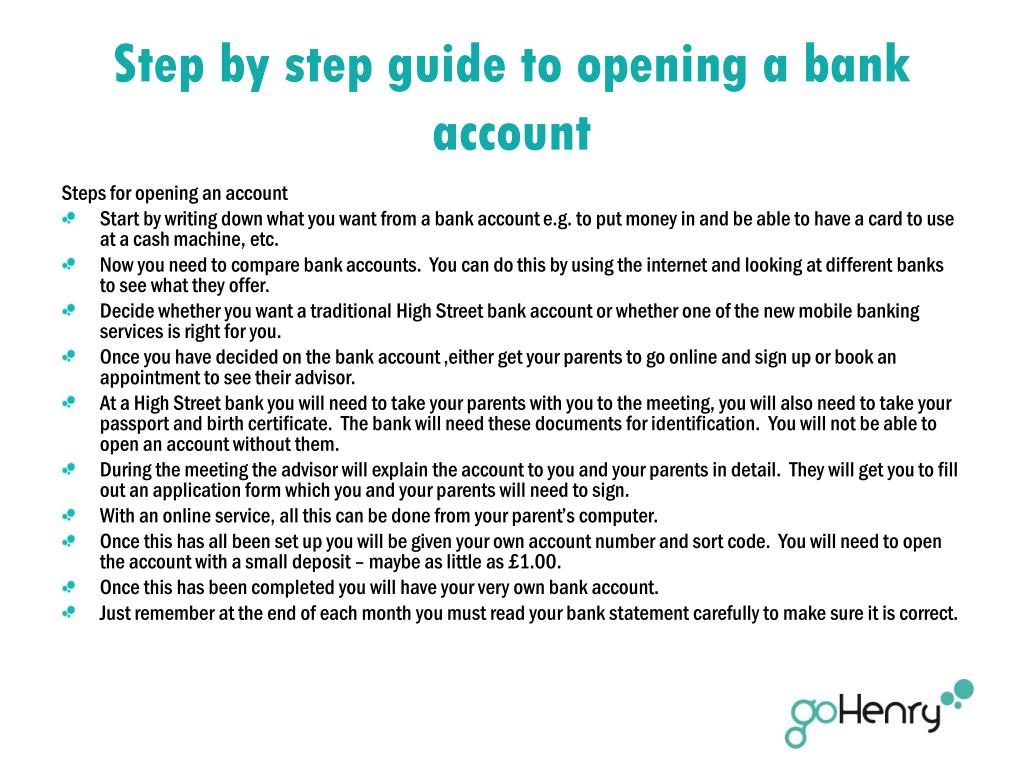

Opening a bank account, a seemingly simple task, can vary significantly in its time commitment depending on several factors. From online applications to in-person visits, the process involves identity verification, document submission, and account setup, each contributing to the overall timeframe.

Understanding the potential duration is crucial for individuals planning financial transitions, managing their time effectively, and avoiding unnecessary delays in accessing banking services. This article delves into the variables affecting account opening times, providing insights into what consumers can expect and how to streamline the process.

Factors Influencing Account Opening Time

The time required to open a bank account isn't fixed; it's a fluid process influenced by several key elements. These range from the method of application to the complexity of the account type.

Application Method: Online vs. In-Person

Online applications generally offer the quickest route to opening an account. Many banks, like Chase and Bank of America, boast streamlined digital platforms that can process applications within minutes, assuming all required information is readily available and the applicant's identity can be verified electronically.

Conversely, in-person applications at a physical branch typically take longer. This involves waiting in line, interacting with a bank representative, and physically submitting documents. The entire process could range from 30 minutes to an hour or more.

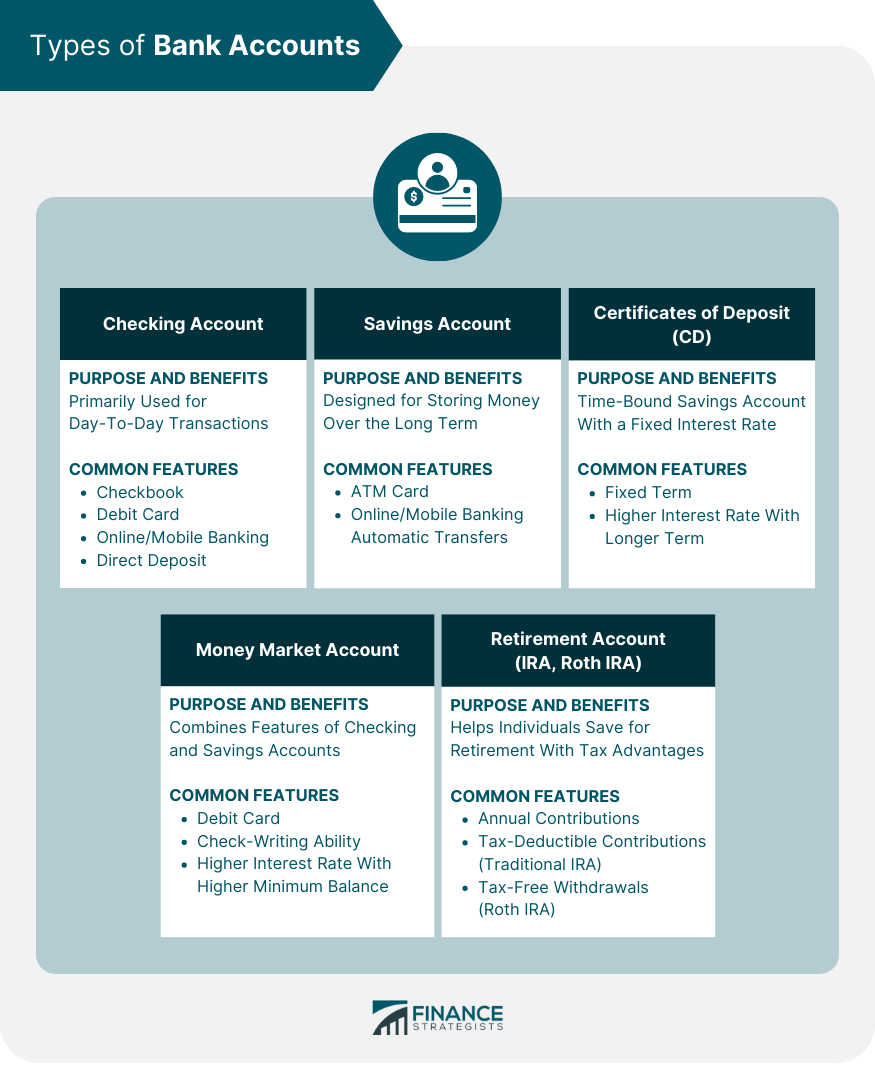

Account Type and Complexity

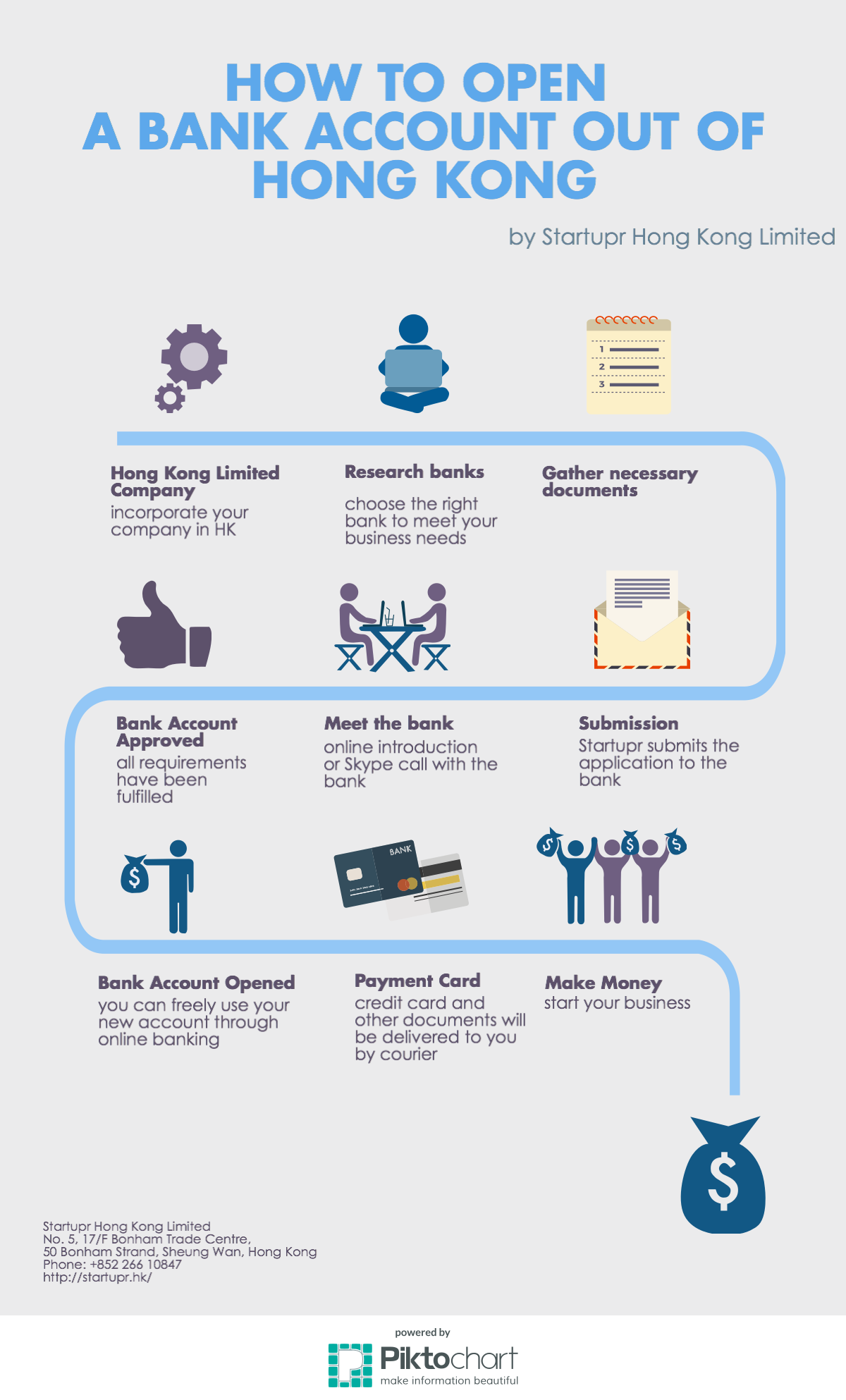

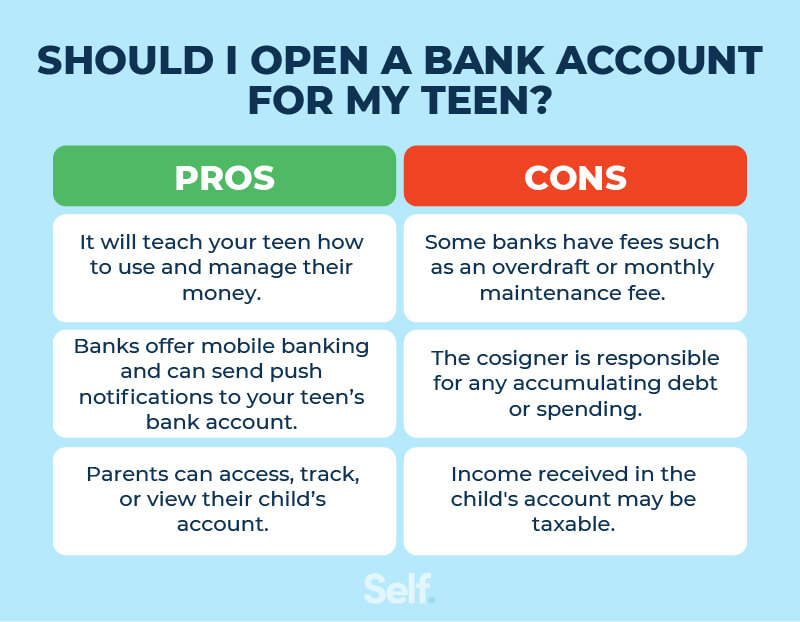

Simple checking or savings accounts are usually the fastest to open. More complex accounts, such as business accounts or those requiring specialized services, necessitate additional scrutiny and paperwork, extending the opening timeframe.

Opening a business account, for example, often requires providing articles of incorporation, employer identification numbers (EIN), and other documentation that proves the business's legitimacy, as explained by SBA.gov.

Identity Verification and Security Checks

Banks are legally obligated to verify the identity of their customers to comply with Know Your Customer (KYC) regulations and anti-money laundering (AML) laws. This involves cross-referencing submitted information with credit bureaus and government databases.

Any discrepancies or flags raised during these checks can significantly delay the account opening process. A representative from Wells Fargo stated that "Identity verification is paramount to prevent fraud and ensure the security of our customer's accounts," highlighting the importance of accurate and complete documentation.

Average Timeframes: What to Expect

While the exact timeframe can vary, some general averages can provide a helpful benchmark.

Online: Most sources indicate that online account opening, when successful, often takes between 15 minutes to a few days to be fully functional.

In-Person: In-person account opening can take between 30 minutes to 1 hour or more, depending on branch traffic and complexity. This does not include the potential delay of the bank verifying the documents.

Experian reported that while some banks offer instant online approvals, others may take a couple of business days to finalize the process.

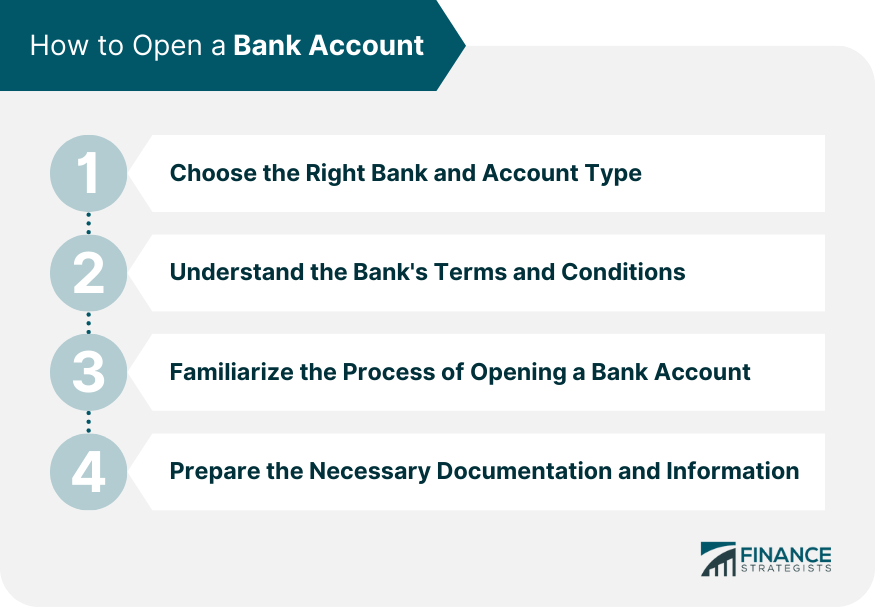

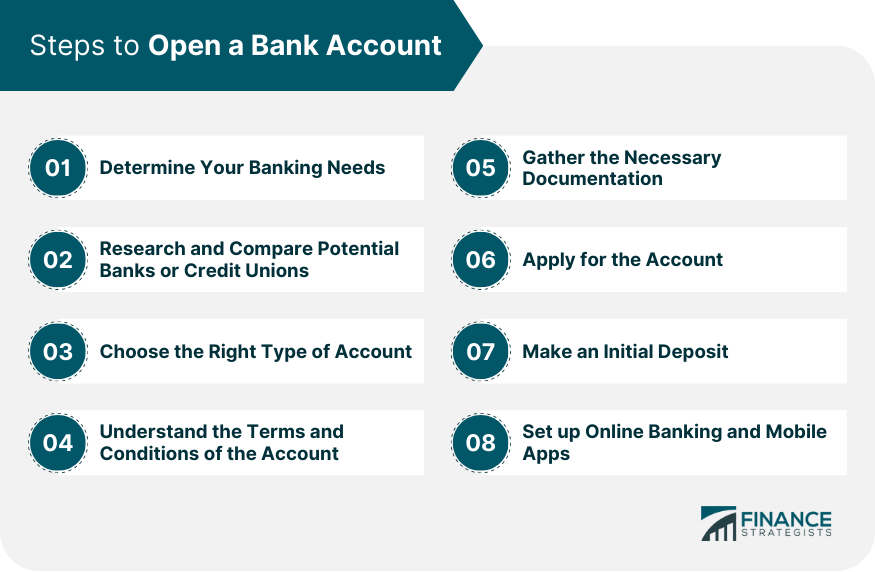

Tips for Speeding Up the Process

Several steps can be taken to accelerate the account opening process.

Gather all necessary documents beforehand: This includes a valid photo ID (driver's license, passport), Social Security number, proof of address (utility bill, lease agreement), and initial deposit funds.

Ensure all information is accurate and consistent. Errors or discrepancies can trigger delays for additional verification.

Choose the right time to visit a branch. Avoid peak hours, such as lunch breaks or weekends, when branches tend to be busier.

Prepare questions. Having the questions ready may help clarify and fasten the process.

Potential Impact on Individuals and Businesses

Understanding the time investment required to open a bank account is crucial for financial planning.

Individuals relocating, starting a new job, or needing access to banking services for other reasons need to factor in the potential timeframe to avoid disruptions. Businesses seeking to establish a new banking relationship require precise time scales.

Delays in account opening can lead to missed opportunities and financial inconveniences. Consumer Reports suggest checking the requirements from different banks to reduce such issues.

Conclusion

The time to open a bank account varies greatly, influenced by application method, account complexity, and identity verification procedures. While online applications often offer speedier solutions, in-person visits provide personalized assistance but might take longer.

By understanding these factors and taking proactive steps to prepare, individuals and businesses can navigate the account opening process more efficiently and minimize potential delays.

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)