How Long Is 240 Months In Years

In an era defined by rapid technological advancement and ever-increasing complexities in personal and professional planning, a seemingly simple question – "How long is 240 months in years?" – has surfaced with surprising frequency across various platforms. From calculating mortgage terms to projecting long-term investment growth, understanding the relationship between months and years remains a fundamental skill.

This article delves into the precise conversion of 240 months into years, exploring the contexts in which this calculation is crucial and examining the potential pitfalls of inaccurate conversions. We aim to provide a comprehensive and definitive answer, backed by verifiable data and contextual understanding.

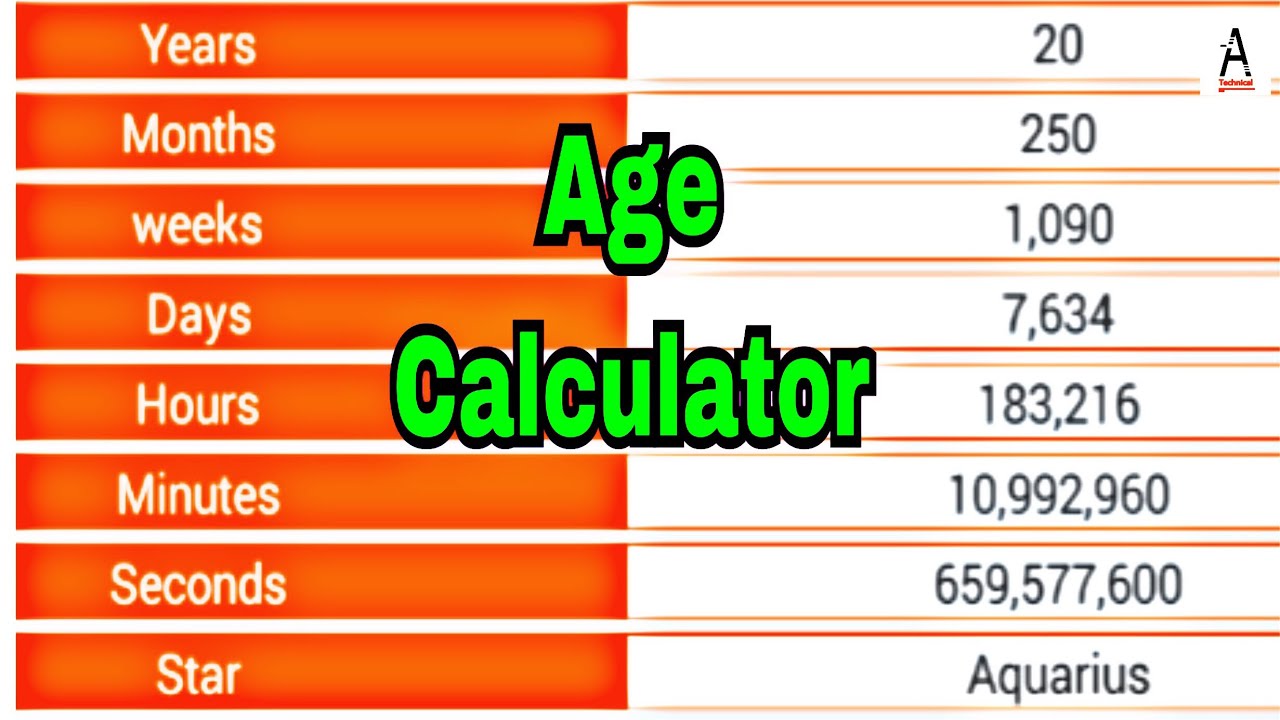

The Straightforward Calculation

The basic mathematical operation is quite simple: divide the number of months by the number of months in a year.

Since there are 12 months in a year, we divide 240 by 12.

The result is 20. Thus, 240 months is equivalent to 20 years.

Practical Applications in Finance

One of the most common scenarios where this conversion is essential is in the realm of finance. Mortgages, loans, and investment horizons are frequently expressed in months.

For example, a 240-month mortgage is, in reality, a 20-year mortgage. Understanding this equivalence is crucial for borrowers to accurately assess the long-term financial implications of their decisions.

Miscalculating the term can lead to significant discrepancies in budgeting and financial planning.

Mortgage Terms and Amortization

Mortgages are often structured with terms ranging from 15 to 30 years. A 20-year mortgage, equivalent to 240 months, presents a middle ground in terms of monthly payments and total interest paid over the loan's lifetime.

Shorter terms, like 15 years, result in higher monthly payments but lower overall interest. Longer terms, such as 30 years, reduce monthly payments but increase the total interest burden.

The 240-month (20-year) term offers a balance that suits many homeowners' financial needs.

Investment Planning

Investment strategies also rely heavily on accurate time conversions. Projecting returns on investments over a 240-month period requires understanding that you're looking at a 20-year timeframe.

This is particularly relevant for retirement planning, where individuals often need to estimate the growth of their investments over several decades. Incorrectly calculating the time horizon can lead to unrealistic expectations and poor financial outcomes.

Consulting with a financial advisor can provide personalized guidance on aligning investment strategies with long-term goals.

Business and Project Management

In the business world, long-term projects and strategic planning often span several years. Converting months into years is crucial for setting realistic timelines and milestones.

For example, a project with a duration of 240 months is essentially a 20-year undertaking. Recognizing this allows project managers to allocate resources effectively and monitor progress against long-term objectives.

Accurate time conversion ensures that stakeholders have a clear understanding of the project's scope and duration.

Contractual Agreements

Contracts frequently specify durations in months. A lease agreement, for instance, might be for 240 months. This translates directly to a 20-year lease.

Clarity in understanding these terms is vital for both landlords and tenants to avoid potential disputes and ensure compliance with the agreed-upon conditions.

Legal professionals emphasize the importance of verifying the accuracy of all time-related clauses in contracts.

Potential Sources of Confusion

While the conversion from months to years seems straightforward, confusion can arise in certain contexts.

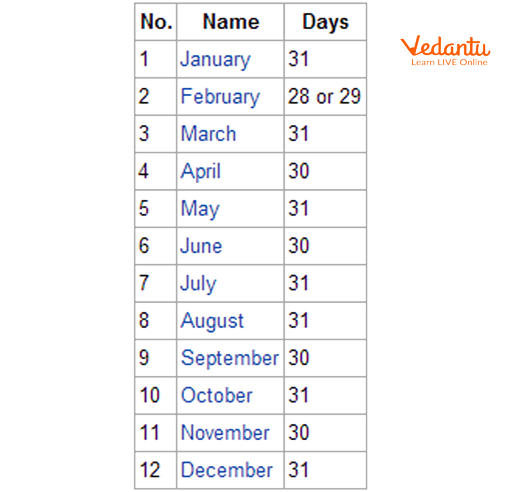

One common misconception is assuming that all months have the same length. In reality, months vary in length from 28 to 31 days.

However, for the purpose of converting 240 months into years, we use the standard convention of 12 months per year, which averages out the variations in monthly lengths.

Leap Years

Leap years, which occur every four years, add an extra day to February. This can slightly alter calculations involving very precise timeframes.

However, for most practical purposes, the impact of leap years on the conversion of 240 months to 20 years is negligible.

The standard conversion remains accurate for general financial and planning purposes.

Conclusion: A Matter of Clarity and Precision

The seemingly simple question of how long 240 months is in years highlights the importance of clarity and precision in time-related calculations.

While the answer is a straightforward 20 years, understanding the contexts in which this conversion is applied – from finance to business to legal agreements – is crucial for effective decision-making.

By ensuring accuracy and avoiding potential pitfalls, individuals and organizations can better manage their resources, plan for the future, and achieve their long-term goals. As technology evolves, accessible and reliable tools will be available to ensure time-related conversions are accurate, further increasing the precision of planning across all aspects of life.