How Long Is Assurance Americas Grace Period

AssuranceAmerica policyholders face critical deadlines: The grace period for late payments is shorter than many realize, putting coverage at immediate risk. Failure to pay premiums promptly can lead to policy cancellation, leaving drivers uninsured.

This article clarifies AssuranceAmerica's grace period policy, details the repercussions of missed payments, and provides crucial steps for policyholders to maintain continuous coverage. Understanding these terms is vital to avoid unexpected lapses in insurance protection.

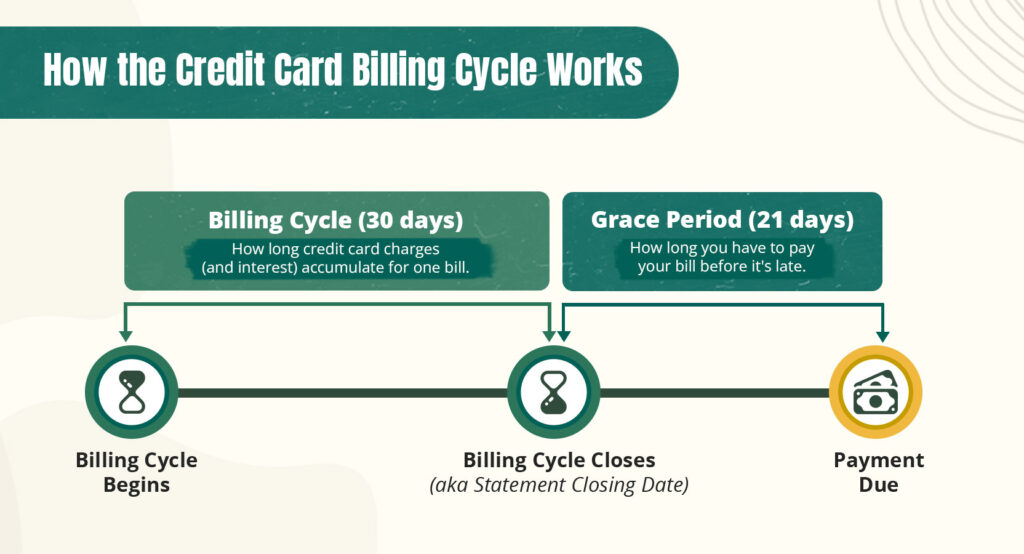

Understanding AssuranceAmerica's Grace Period

The standard grace period offered by AssuranceAmerica is typically 10 days from the premium due date. This timeframe allows policyholders a brief window to remit payment without immediate cancellation of their policy.

However, specific terms can vary based on individual policy agreements and state regulations. Always refer to your policy documents for the precise grace period applicable to your coverage.

Contacting AssuranceAmerica directly is advisable for personalized clarification. Their customer service representatives can confirm the exact terms for your specific policy.

Consequences of Missed Payments

Failing to pay within the grace period triggers policy cancellation. This results in a lapse in insurance coverage, exposing drivers to significant financial and legal risks.

Driving without insurance can lead to fines, license suspension, and even vehicle impoundment. Moreover, in the event of an accident, the uninsured driver is personally liable for all damages and injuries.

Beyond immediate legal repercussions, a lapse in coverage can affect future insurance rates. Insurers often view gaps in coverage negatively, resulting in higher premiums when seeking new policies.

Reinstatement and Policy Revival

In some cases, a policy may be eligible for reinstatement after cancellation. However, reinstatement is not guaranteed and usually requires immediate payment of the outstanding premium plus potential reinstatement fees.

The eligibility for reinstatement often depends on the length of the lapse and the policyholder's payment history. A prolonged lapse significantly reduces the chances of successful reinstatement.

Contact AssuranceAmerica immediately to inquire about reinstatement options. Be prepared to provide all necessary information and promptly address any outstanding payments.

State-Specific Regulations

Insurance regulations vary considerably by state. Some states may mandate longer grace periods or offer additional protections for policyholders facing financial hardship.

It is crucial to understand the specific insurance laws in your state. These laws can impact the grace period, cancellation policies, and reinstatement options available to you.

Consult your state's Department of Insurance for detailed information on insurance regulations. Their website or contact number will provide valuable insights into your rights and responsibilities as a policyholder.

Preventative Measures

Setting up automatic payments is the most reliable way to avoid missed payments. AssuranceAmerica typically offers this option, ensuring timely payment without manual intervention.

Review your policy documents regularly to stay informed about due dates and grace periods. Proactive awareness prevents unexpected lapses in coverage.

Contact AssuranceAmerica promptly if you anticipate difficulty making a payment. Exploring options like payment plans or policy adjustments might help maintain continuous coverage.

Customer Service and Support

AssuranceAmerica provides customer service support through various channels. These channels include phone, email, and online portals.

Utilize these resources to address any questions or concerns regarding your policy. Do not hesitate to seek clarification on payment schedules, grace periods, or other policy-related matters.

Keep a record of all communications with AssuranceAmerica for future reference. This documentation can be helpful in resolving any potential disputes or misunderstandings.

Who to Contact

For specific policy inquiries, contact AssuranceAmerica's customer service department directly. Their trained representatives can provide personalized assistance and address any concerns you may have.

Check the AssuranceAmerica website for their customer service phone number and email address. Having your policy number readily available will expedite the assistance process.

You can also contact your independent insurance agent for help navigating your policy. Agents are familiar with AssuranceAmerica's policies and can provide valuable guidance.

Next Steps and Ongoing Developments

Policyholders should immediately verify their policy's specific grace period with AssuranceAmerica. This crucial step ensures awareness of the timeframe for timely payments.

Monitor your mail and email for policy updates and payment reminders. Staying informed about policy-related communications is essential for proactive management.

Stay tuned for further updates on insurance regulations and policy changes. This information will help you remain compliant and maintain continuous coverage.