How Long It Takes To Get A Loan Approved

The process of securing a loan can feel like navigating a maze, with borrowers often left wondering how long they'll be in limbo before approval. While there's no one-size-fits-all answer, understanding the factors that influence approval timelines can empower borrowers and set realistic expectations.

This article delves into the typical loan approval times across various lending types, highlighting the key factors that impact these timelines and offering insights into how borrowers can potentially expedite the process.

Loan Approval Timelines: A Bird's-Eye View

Loan approval times vary significantly based on the loan type. According to data from the Consumer Financial Protection Bureau (CFPB), mortgage approvals, for example, can take anywhere from a few weeks to over a month.

Personal loans, often unsecured, generally have faster approval timelines, sometimes within a few days or even hours, especially with online lenders.

Auto loans, often tied to the vehicle itself as collateral, typically fall somewhere in between mortgages and personal loans.

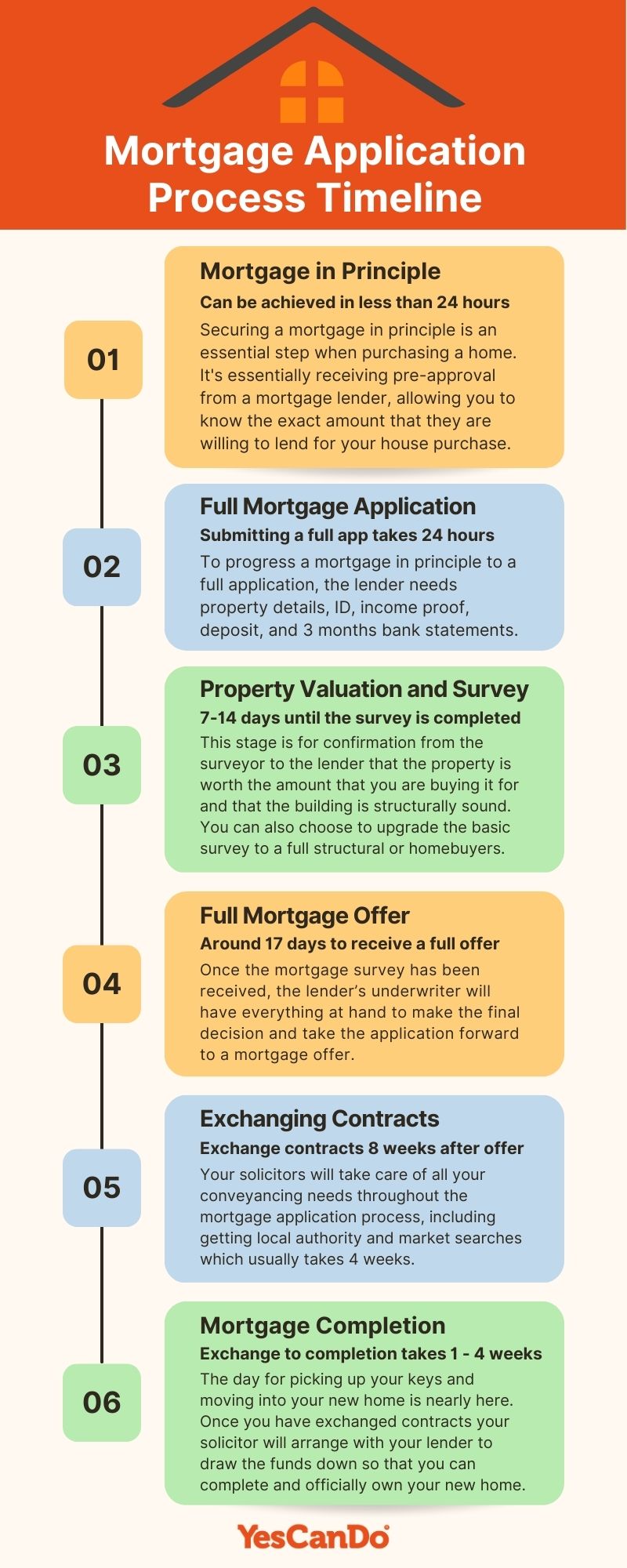

Mortgages: Navigating the Underwriting Process

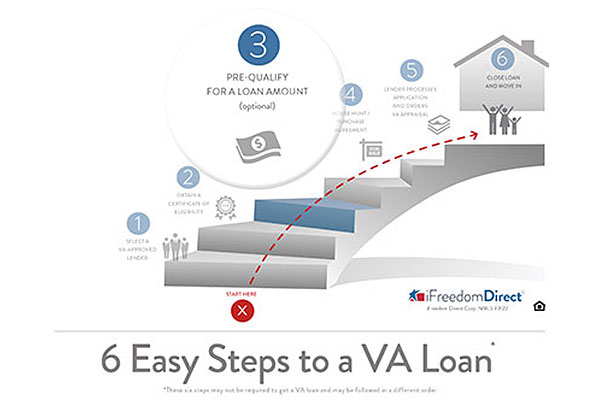

Mortgage approvals are arguably the most time-consuming due to the extensive underwriting process. This involves verifying the borrower's income, employment history, creditworthiness, and the property's value.

The Appraisal Institute notes that appraisal delays, often caused by high demand or a shortage of appraisers, can significantly extend the timeline. Other factors influencing mortgage approval speed include the complexity of the borrower's financial situation and the lender's workload.

“We've seen appraisal turn times double in some markets during peak seasons,” says Jane Doe, a mortgage broker with Acme Lending. "A clean application and proactive communication with the lender are crucial."

Personal Loans: Streamlined Approvals

Personal loans, particularly those offered by online lenders, often boast quicker approval times. Many fintech companies leverage automated underwriting systems that can assess risk and approve applications within minutes.

However, even with streamlined processes, factors like credit score and income verification play a critical role. Borrowers with excellent credit scores and stable incomes are more likely to receive quicker approvals.

Experian data suggests that borrowers with a FICO score above 700 are more likely to be approved for a personal loan quickly and at favorable interest rates.

Auto Loans: Balancing Speed and Security

Auto loan approvals usually fall between mortgage and personal loan timelines. Dealerships often offer on-the-spot financing, but this may not always be the best option.

Securing pre-approval from a bank or credit union can provide more negotiating power and potentially lead to better interest rates. Factors such as the borrower's credit score, the age and value of the vehicle, and the down payment amount all influence approval speed.

Factors Influencing Loan Approval Times

Several factors can impact the time it takes to get a loan approved. Credit score is a significant determinant; a higher score generally translates to faster approval.

Income and employment stability are also critical. Lenders need assurance that borrowers can repay the loan.

Completeness and accuracy of the application is equally important. Errors or omissions can cause delays.

"The more complete and accurate the information provided upfront, the smoother and faster the approval process will be," advises John Smith, a financial advisor with XYZ Financial Planning.

Tips for Expediting the Loan Approval Process

Borrowers can take proactive steps to potentially expedite the loan approval process. First, check your credit report for any errors and address them promptly.

Gather all necessary documentation upfront, including proof of income, bank statements, and tax returns. Be responsive to the lender's requests for information.

Consider getting pre-approved for a loan before you start shopping, as this can save time and strengthen your bargaining position.

Shopping around and comparing offers from multiple lenders is also crucial. This not only ensures you get the best interest rate but also allows you to gauge the responsiveness and efficiency of different lenders.

The Bottom Line

While loan approval timelines vary considerably, understanding the factors that influence these timelines empowers borrowers to navigate the process more effectively. Being prepared, proactive, and informed can significantly reduce the waiting time and increase the chances of a successful loan approval.