How Many Payday Loans Can I Get

Navigating the world of short-term loans can be tricky, especially when unforeseen expenses arise. Many individuals turn to payday loans for quick financial relief, but it's crucial to understand the limitations and regulations surrounding these loans. Understanding how many payday loans one can have simultaneously is essential for responsible borrowing.

This article explores the complexities of payday loan limits, providing a clear overview of the regulations and potential consequences of taking out multiple loans. It will cover the variations in regulations across different states, the impact on borrowers, and the importance of exploring alternative financial solutions.

State Regulations on Payday Loan Limits

The number of payday loans a person can have at one time is largely determined by state regulations. Each state has its own set of laws governing the payday lending industry, including restrictions on loan amounts, interest rates, and the number of outstanding loans allowed.

For example, some states like North Carolina and Georgia have effectively banned payday lending altogether. Other states have strict limits, allowing only one outstanding loan at a time to prevent borrowers from becoming trapped in a cycle of debt.

In contrast, some states have more lenient regulations, allowing borrowers to take out multiple loans simultaneously. However, even in these states, there may be overall loan amount limits to prevent excessive borrowing.

The Impact of Multiple Payday Loans

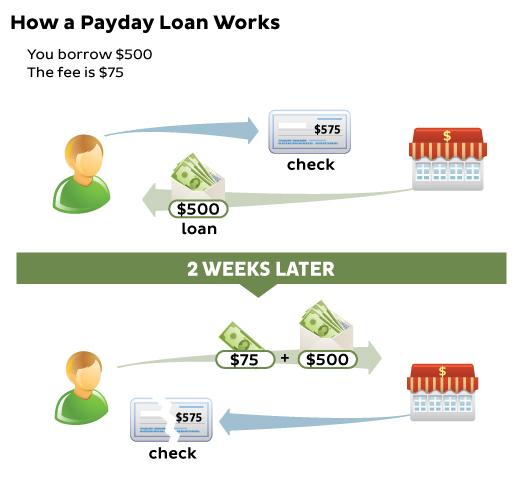

Taking out multiple payday loans can have significant financial consequences. The high interest rates and fees associated with these loans can quickly accumulate, making it difficult to repay the debt on time.

Borrowers who juggle multiple payday loans often find themselves in a cycle of debt, where they are forced to take out new loans to cover existing ones. This cycle can lead to financial instability and damage credit scores.

The Consumer Financial Protection Bureau (CFPB) has raised concerns about the potential harm of payday lending, particularly for vulnerable consumers. They emphasize the importance of responsible lending practices and consumer education.

How Payday Loan Limits Work

Many states that allow payday lending use a statewide database to track loan activity. This database allows lenders to verify whether a borrower already has an outstanding payday loan before issuing a new one.

These databases help enforce loan limits and prevent borrowers from exceeding the maximum number of loans allowed. Lenders are required to check the database before approving a loan, and they may face penalties for violating the regulations.

However, not all states have such a database. In states without this system, it is easier for borrowers to take out multiple loans from different lenders without detection, increasing the risk of over-indebtedness.

Finding Alternative Financial Solutions

For individuals struggling with short-term financial needs, exploring alternatives to payday loans is crucial. Options such as credit union loans, personal loans, or borrowing from friends and family may offer more favorable terms and lower interest rates.

Credit counseling services can also provide valuable assistance in managing debt and developing a budget. These services can help individuals assess their financial situation and create a plan to address their debt.

Additionally, some employers offer employee assistance programs (EAPs) that provide financial counseling or short-term loans to employees in need. These programs can be a valuable resource for those facing financial challenges.

The Role of Lenders in Responsible Lending

Lenders have a responsibility to ensure responsible lending practices. This includes verifying a borrower's ability to repay the loan, disclosing all fees and interest rates clearly, and adhering to state regulations.

Some lenders offer extended payment plans or other options for borrowers who are struggling to repay their loans. However, these options may come with additional fees or interest charges.

Consumers should be wary of lenders who engage in predatory lending practices, such as charging excessively high interest rates or pressuring borrowers to take out more loans than they can afford. Reporting such practices to the appropriate authorities is essential.

The Future of Payday Loan Regulations

The future of payday loan regulations remains uncertain, with ongoing debates about the need for stronger consumer protections. The CFPB has played a key role in shaping these regulations at the federal level, but state laws continue to be the primary source of regulation.

Advocates for stricter regulations argue that payday lending is inherently predatory and that more needs to be done to protect vulnerable consumers. They call for lower interest rates, stricter loan limits, and increased enforcement of existing regulations.

Conversely, industry representatives argue that payday loans provide a valuable service to consumers who need quick access to credit. They maintain that stricter regulations could limit access to credit and drive borrowers to alternative, potentially riskier, options.

Conclusion

Understanding the regulations surrounding payday loans, particularly the limits on the number of loans one can have, is crucial for responsible borrowing. State laws vary widely, and borrowers should be aware of the specific regulations in their state.

Taking out multiple payday loans can lead to a cycle of debt and significant financial hardship. Exploring alternative financial solutions and seeking professional financial advice can help individuals avoid the pitfalls of payday lending.

Ultimately, a combination of responsible borrowing practices, strong regulatory oversight, and access to affordable financial alternatives is needed to protect consumers from the potential harms of payday lending. Borrowers should always prioritize understanding the terms and conditions of any loan before signing on the dotted line.