How Many Payday Loans Can You Have At Once

The shimmering promise of quick cash from payday loans can be tempting, especially when facing unexpected expenses. However, the accessibility of these loans often masks a complex web of regulations designed to protect consumers from falling into a cycle of debt.

Understanding the limitations on the number of payday loans one can have simultaneously is crucial for responsible borrowing and avoiding potential financial pitfalls. These limitations vary significantly by state, creating a patchwork of regulations across the country.

Varying State Regulations: A Complex Landscape

The question of "how many payday loans can you have at once?" doesn't have a simple, universal answer. It's heavily dependent on the specific regulations within each state.

Some states permit multiple outstanding loans, while others strictly prohibit them. This variance stems from different approaches to consumer protection and varying opinions on the potential harms and benefits of payday lending.

States with Restrictions on Concurrent Payday Loans

Many states have implemented databases to track payday loan activity and enforce limitations. These databases, often managed by state agencies or third-party vendors, allow lenders to verify whether a borrower already has outstanding loans.

States like Florida, Illinois, and Oklahoma utilize such databases to prevent borrowers from exceeding the legal limit on concurrent loans. In these states, the number of allowed loans is typically capped at one or two.

For example, Oklahoma allows a maximum of two outstanding payday loans at any given time, according to the Oklahoma Department of Consumer Credit. Similarly, Florida law prohibits borrowers from having more than one outstanding payday loan at a time.

States with No Specific Limits on Concurrent Loans

Conversely, some states have no specific laws restricting the number of payday loans a borrower can hold concurrently. This doesn't necessarily mean it's advisable to take out multiple loans.

In these states, lenders may have their own internal policies limiting the number of loans they'll extend to a single borrower. Furthermore, even without legal limits, taking out multiple payday loans can quickly lead to a cycle of debt.

"While a state might not explicitly prohibit multiple loans, the high interest rates and short repayment terms can make it incredibly difficult to manage multiple debts simultaneously," explains Sarah Miller, a financial advisor with ClearPath Financial Planning.

The Impact of Payday Loan Limitations

The restrictions on the number of payday loans are intended to protect consumers from predatory lending practices. By limiting the number of loans, states aim to prevent borrowers from becoming trapped in a cycle of debt where they constantly borrow to repay existing loans.

However, some argue that these restrictions limit access to credit for individuals who may genuinely need it. The Consumer Financial Services Association of America (CFSA), a trade association representing the payday loan industry, maintains that payday loans provide a valuable service for consumers facing unexpected financial emergencies.

"Payday loans are designed to be short-term solutions, and responsible lenders work to ensure that borrowers can repay their loans on time," stated a CFSA spokesperson. They also suggest borrowers to follow the best practices to prevent payday loan dependency.

The Cycle of Debt: A Real Concern

The high interest rates and short repayment terms associated with payday loans can quickly lead to a cycle of debt. Borrowers often find themselves unable to repay the loan on its original due date and are forced to roll over or renew the loan, incurring additional fees and interest.

Over time, these fees can accumulate, making it increasingly difficult to escape the cycle. Even in states with restrictions on concurrent loans, the ease of obtaining a loan can make it tempting to take out multiple loans from different lenders, potentially circumventing the regulations.

Maria Rodriguez, a single mother from Ohio, shared her experience. "I took out a payday loan to cover a car repair, and before I knew it, I was taking out more loans just to pay the fees on the original one. It felt like I was drowning."

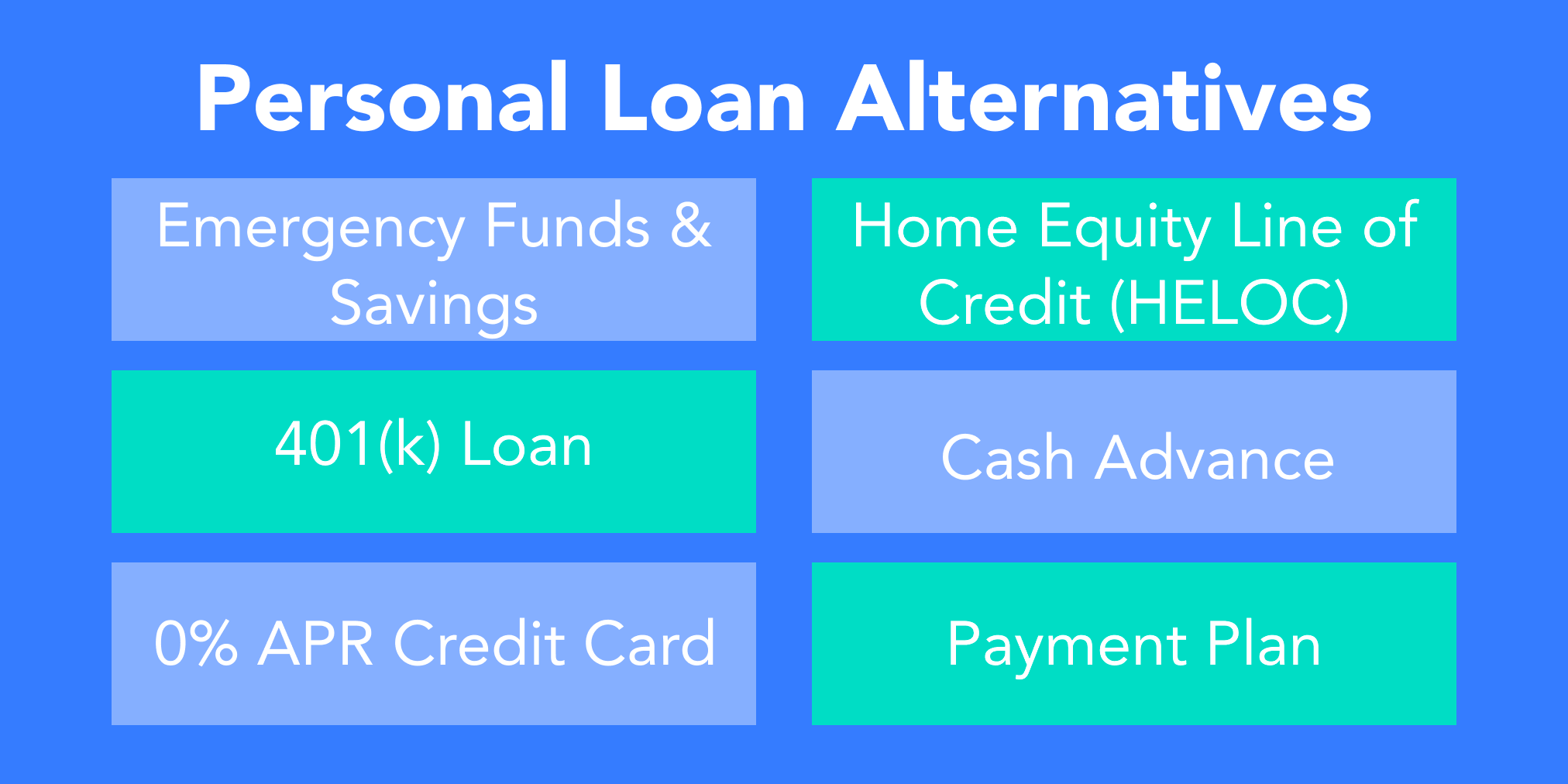

Alternatives to Payday Loans

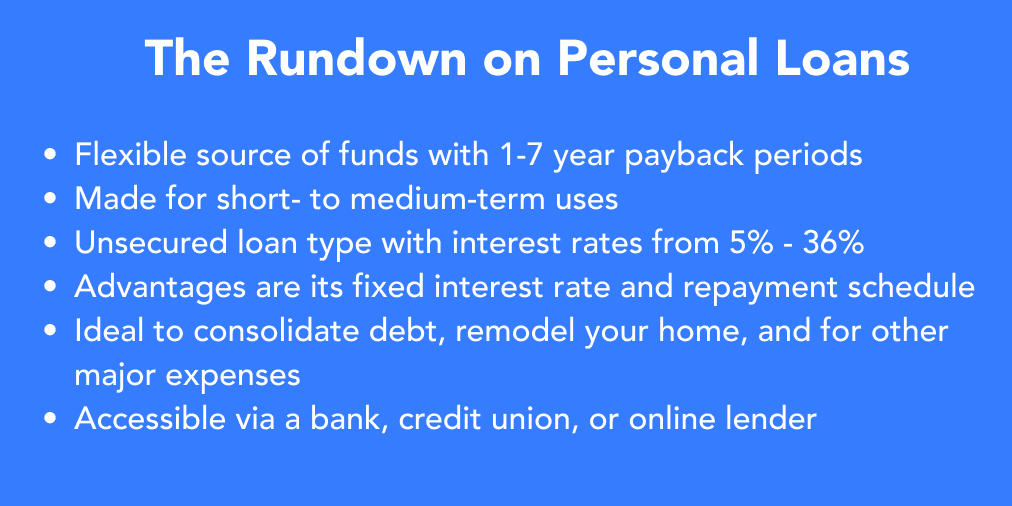

Given the potential risks associated with payday loans, it's crucial to explore alternative options. These alternatives include personal loans from banks or credit unions, credit card cash advances, and borrowing from friends or family.

Non-profit organizations and community-based financial institutions may also offer assistance to individuals facing financial hardship. Credit counseling services can provide guidance on managing debt and developing a budget.

Before resorting to a payday loan, carefully consider all available options and weigh the potential costs and benefits. Understanding the regulations in your state is also essential to avoid inadvertently violating the law or falling into a debt trap.

In conclusion, the number of payday loans you can have at once is not a universally defined number. Regulations vary widely by state, and understanding these regulations is vital for responsible borrowing. While payday loans may seem like a quick fix, they can quickly lead to a cycle of debt, making it crucial to explore alternatives and exercise caution.

![How Many Payday Loans Can You Have At Once How Many Personal Loans Can You Have at Once? [2024]](https://trybeem.com/blog/wp-content/uploads/2023/10/personal-loans-1024x576.webp)