How Many Quarter In 10 Dollars

Calculating the number of quarters in ten dollars might seem like a simple arithmetic problem, but it serves as a fundamental example of everyday financial literacy. Understanding basic currency conversions is essential for everyone, from young children learning about money to adults managing their household budgets. This article explores the straightforward calculation, its underlying principles, and its significance in practical financial situations.

The core question, "How many quarters are in ten dollars?" is easily answered through division. However, the exercise provides a valuable lesson in understanding the relationship between different denominations of currency. Knowing how to perform such calculations quickly and accurately can be surprisingly useful in various daily scenarios.

The Calculation: A Simple Division

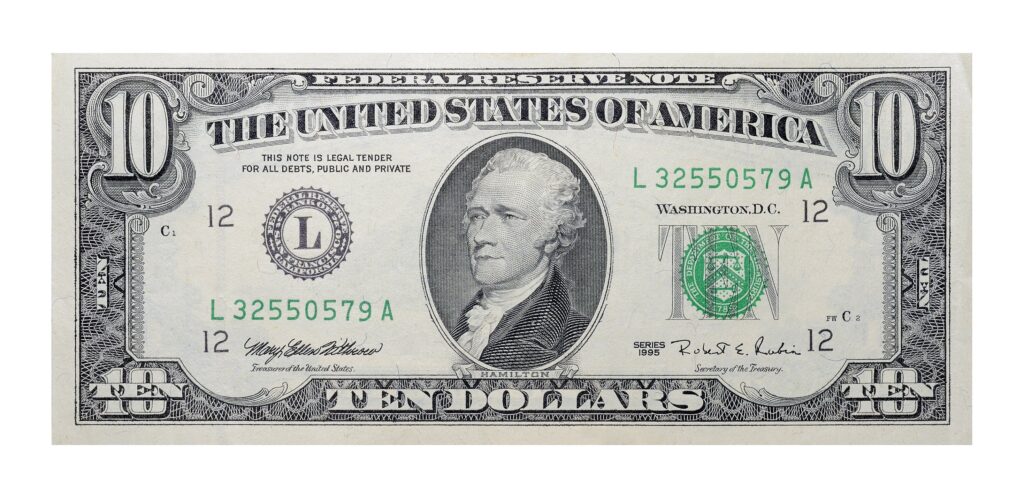

A quarter is worth 25 cents, or $0.25. To find out how many quarters are in ten dollars, we need to divide the total amount ($10.00) by the value of a single quarter ($0.25). The equation is: $10.00 / $0.25 = 40.

Therefore, there are 40 quarters in ten dollars. This calculation highlights the relationship between dollars and cents, and the value of each coin denomination.

The Underlying Principles

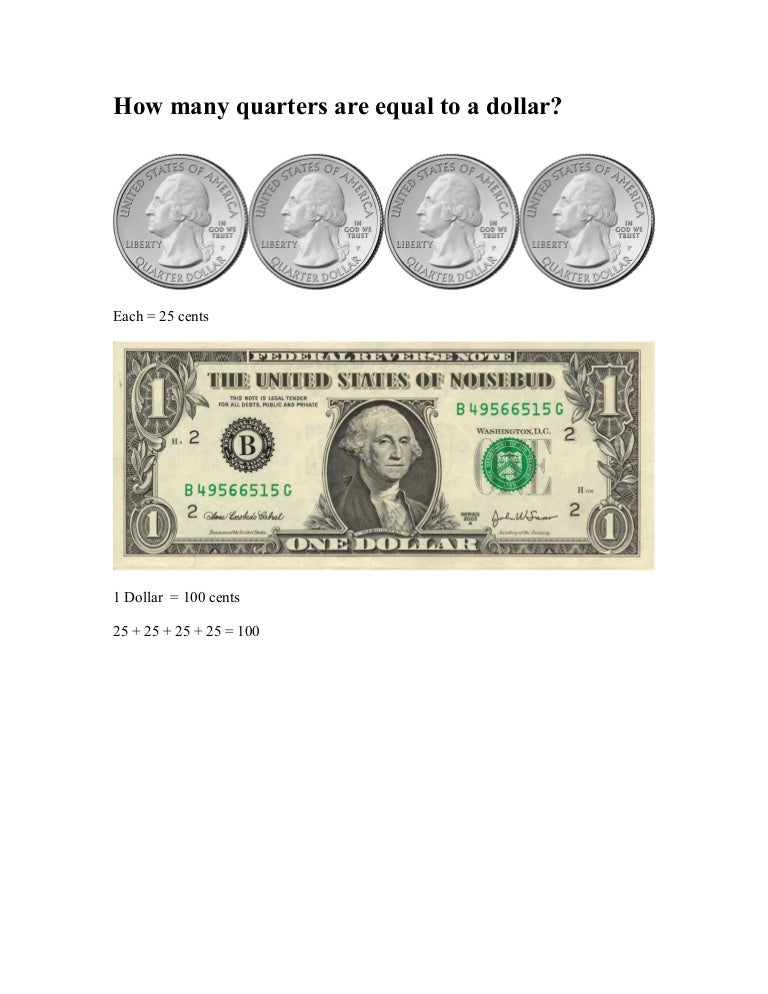

This simple calculation demonstrates the concept of division as it applies to real-world financial situations. It reinforces the understanding that a larger value can be broken down into smaller, equal parts. Furthermore, it emphasizes the decimal system that underlies our currency, where 100 cents make up one dollar.

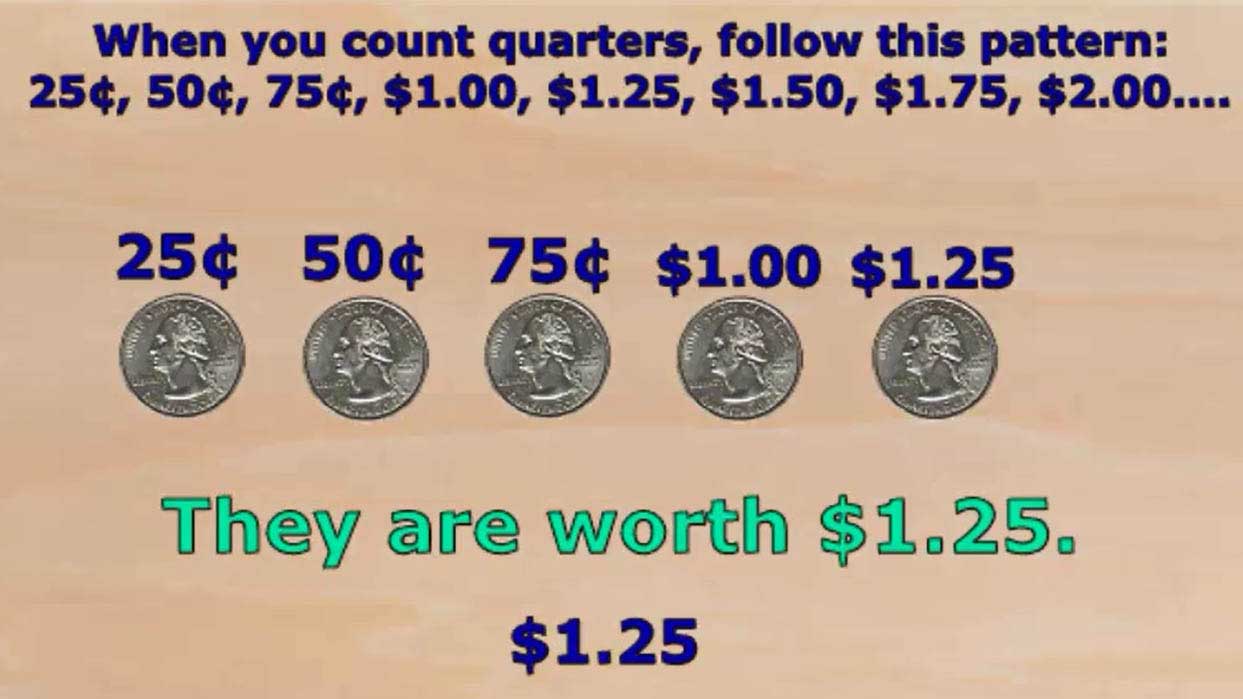

Understanding this principle allows for easy conversion between different denominations. For instance, knowing there are four quarters in a dollar automatically implies that there are 40 quarters in ten dollars (4 quarters/dollar * 10 dollars = 40 quarters).

Practical Applications in Daily Life

Knowing the number of quarters in a dollar, and consequently in other dollar amounts, has numerous practical applications. Consider situations involving vending machines, laundry facilities, or toll booths that accept only quarters.

Imagine needing to use a vending machine that only accepts quarters and requires $3.50. Quick calculation reveals that you would need 14 quarters (3.50 / 0.25 = 14). Without this basic skill, one might fumble around trying to figure it out, potentially delaying the transaction. These small instances underscore the value of financial literacy.

For parents, teaching children about money and coin values is an important part of their financial education. Using quarters as a visual and tangible tool to learn about division and multiplication can make the learning process more engaging and effective.

Beyond Quarters: Expanding Financial Literacy

The exercise of calculating quarters in dollars serves as a gateway to more complex financial concepts. Understanding percentages, budgeting, and saving all rely on a strong foundation in basic arithmetic. Building upon this knowledge will allow individuals to navigate financial decision-making with greater confidence and competence.

For example, calculating the number of quarters needed for a specific purchase can transition into discussing the impact of saving money. If a child wants to buy a toy that costs $20, they can calculate that they need 80 quarters. This simple act can motivate them to save their allowance and witness the tangible result of their efforts.

Furthermore, understanding how many quarters constitute a certain dollar amount can be crucial in situations requiring accurate coin counting. This is especially relevant in roles such as retail, banking, or even volunteer positions involving fundraising events.

Conclusion: A Building Block for Financial Success

While calculating the number of quarters in ten dollars may seem trivial, it represents a fundamental aspect of financial literacy. This simple arithmetic problem provides a foundation for understanding currency conversions and making informed financial decisions.

By mastering these basics, individuals gain confidence in managing their finances and navigating everyday financial situations with ease. As Benjamin Franklin wisely stated, "A penny saved is a penny earned." That philosophy starts with understanding the value of all denominations, including the humble quarter.

Therefore, understanding the number of quarters in a dollar amount is not just about arithmetic. It's about building a foundation for financial intelligence and securing a more prosperous future.

/number-of-coins-in-roll-768862_final-5b3f7ec046e0fb00371742cb.png)