How Many Streams Of Income Should I Have

Warning: Relying on a single income stream is a financial tightrope walk. Diversifying your income is crucial for stability and long-term wealth.

Financial experts are increasingly urging individuals to explore multiple income sources to mitigate risk and build a more secure financial future.

The Magic Number: Is There One?

There's no one-size-fits-all answer. Financial advisors at Vanguard report that the optimal number of income streams depends on individual circumstances, goals, and risk tolerance.

However, a common recommendation is to aim for at least three diverse income streams.

Why Three?

Three income streams provide a safety net if one falters. This reduces your vulnerability to job loss, economic downturns, or unforeseen circumstances.

According to a recent Bankrate survey, individuals with multiple income sources report significantly higher levels of financial security and peace of mind.

Also, multiple streams accelerates wealth creation through increased cash flow and investment opportunities.

Building Your Income Streams: Where to Start

Explore various options. Consider a mix of active and passive income sources.

Active income involves trading time for money, such as a part-time job, freelance work, or consulting. Data from Indeed shows a significant increase in available freelance opportunities across various sectors.

Passive income requires upfront investment and generates revenue with minimal ongoing effort, like rental properties, dividend stocks, or online courses. A report by Statista indicates a growing interest in passive income strategies, particularly among millennials.

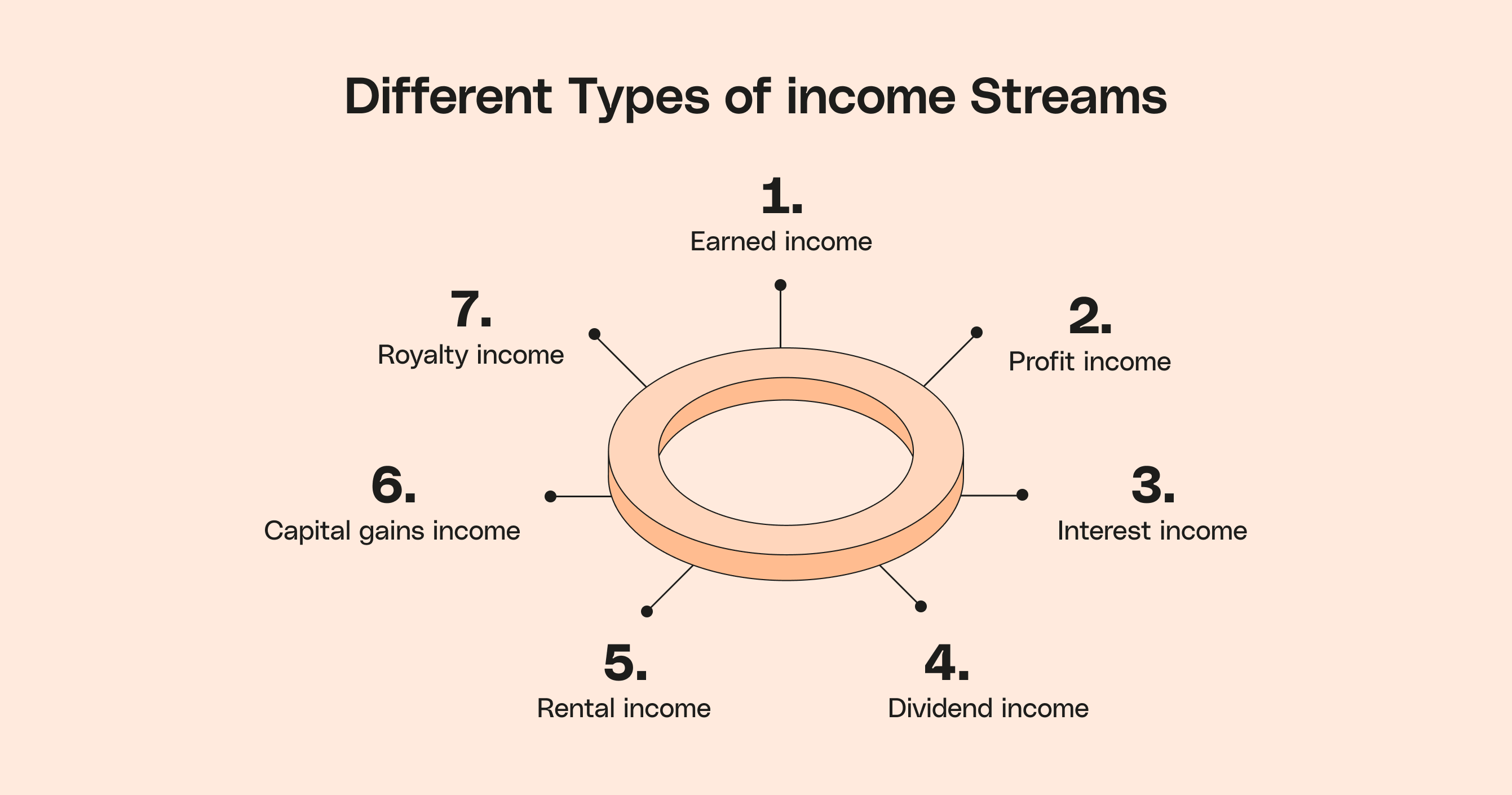

Examples of Income Streams:

Active: Freelance writing, tutoring, driving for a rideshare service, consulting in your field, part-time retail job.

Passive: Rental property income, dividend stocks, royalties from creative work (e.g., books, music), affiliate marketing, online courses, high yield savings account.

Hybrid: Selling products online, starting a blog or YouTube channel (monetization requires effort but can become passive over time), network marketing.

Remember to factor in tax implications for each income source. Seek professional tax advice to optimize your financial strategy.

The Urgency of Diversification

The current economic climate emphasizes the importance of income diversification. Inflation, market volatility, and job insecurity are real concerns.

Delaying diversification can leave you vulnerable. Don't wait until you're in a financial crisis to start building multiple income streams.

Next Steps: Take Action Now

Assess your skills and interests. Identify potential income streams that align with your capabilities and passions.

Develop a plan. Research the requirements and resources needed for each chosen income source.

Start small and scale up gradually. Don't try to do everything at once. Focus on building one income stream at a time.

Regularly review and adjust your strategy. Market conditions and your personal circumstances may change over time.

Consult with a financial advisor. Professional guidance can help you develop a personalized income diversification plan tailored to your specific needs.