How Much Do It Cost To Start A Business

The burning question for aspiring entrepreneurs: How much cash do you *really* need to launch a business? Startup costs vary wildly, but understanding the key expenses is crucial to avoid financial pitfalls.

This article provides a concise breakdown of typical startup costs, covering everything from legal fees and marketing to inventory and operational expenses. Knowing these figures will empower you to plan effectively and secure the necessary funding.

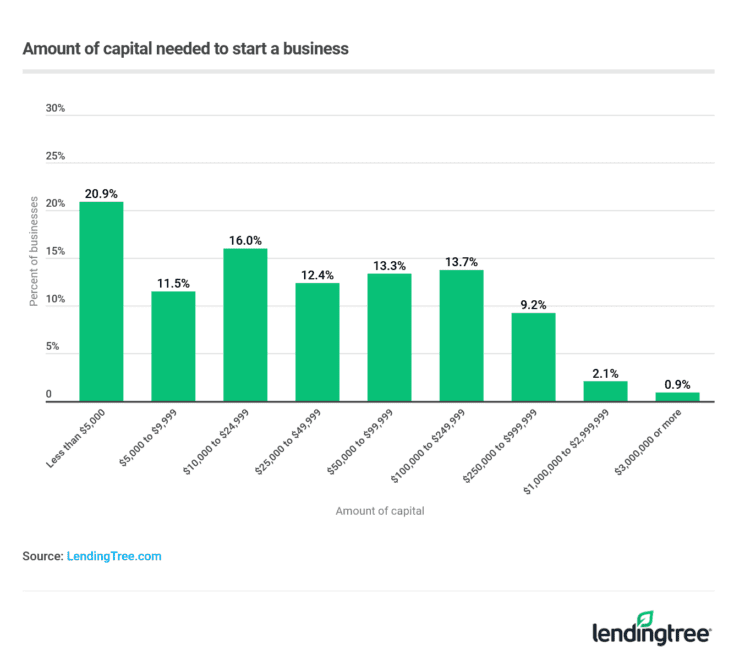

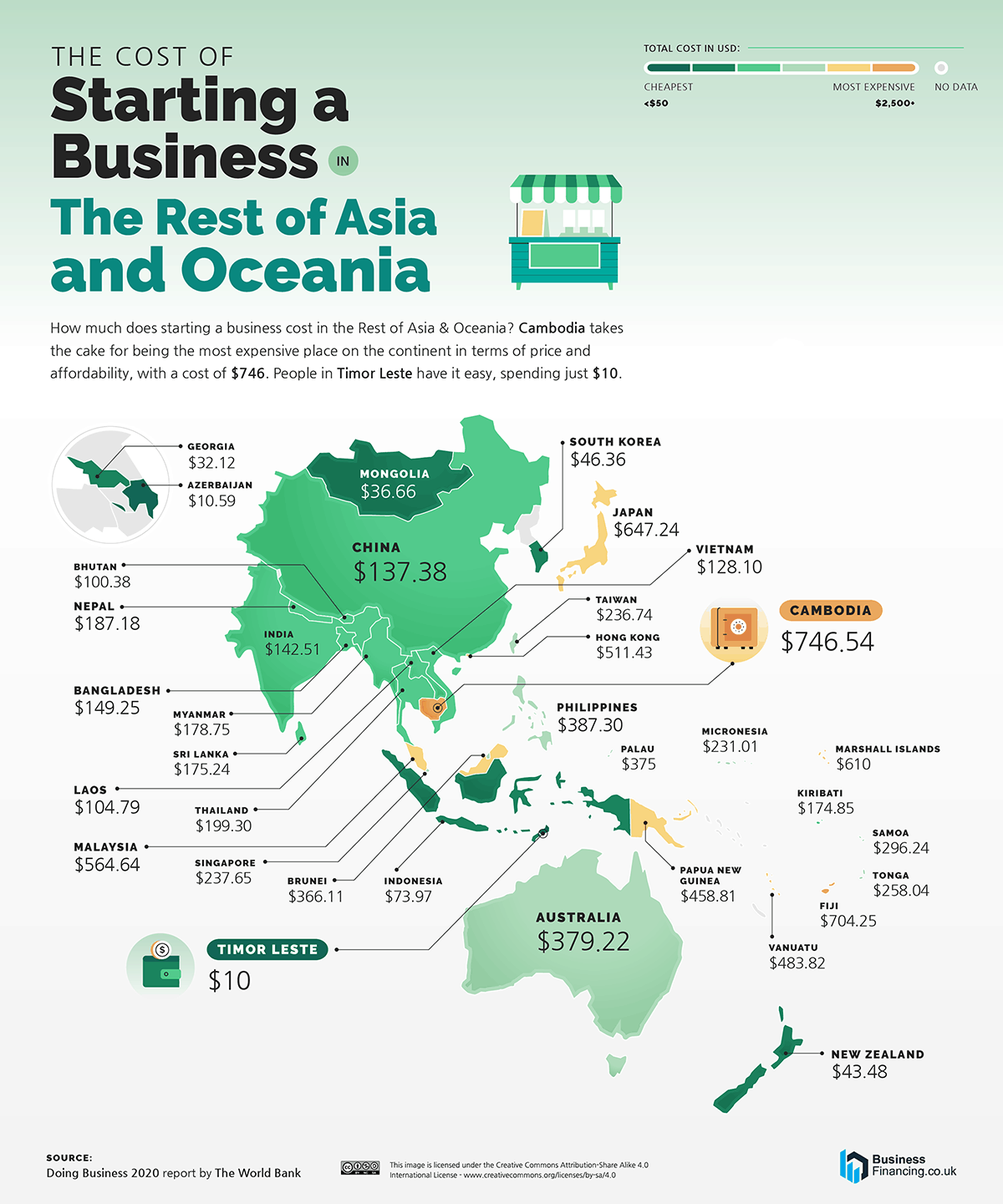

The Startup Cost Spectrum

It's impossible to provide a one-size-fits-all answer. According to the Small Business Administration (SBA), microbusinesses can launch with as little as $3,000, while larger ventures may require hundreds of thousands, or even millions.

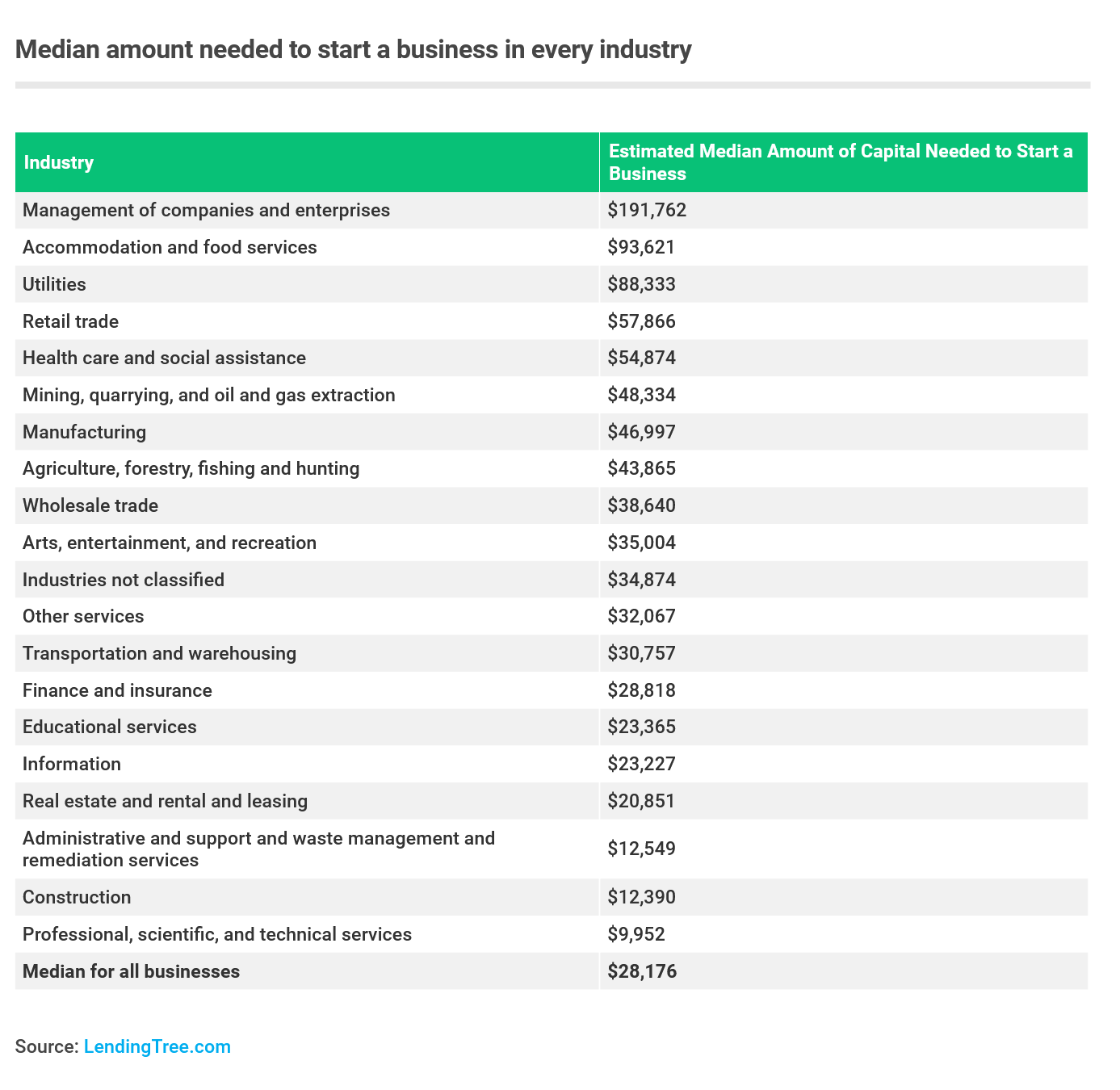

Understanding Initial Investments

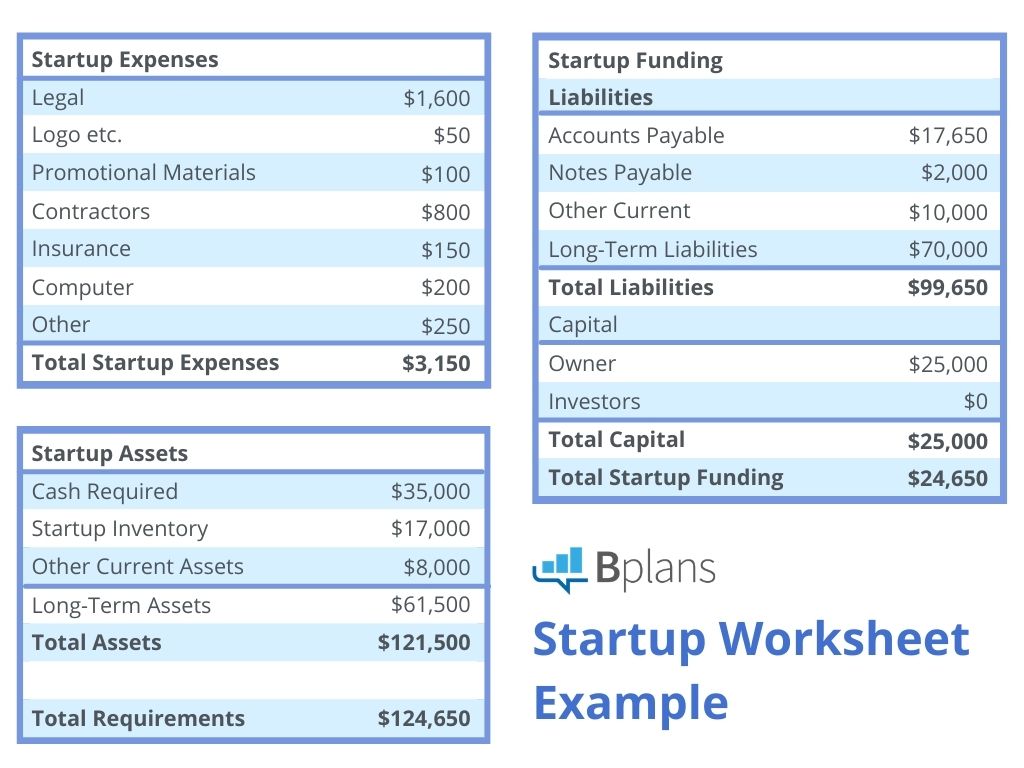

Legal and licensing fees are often underestimated. Forming a Limited Liability Company (LLC) can range from $50 to $500 depending on the state. Obtaining necessary licenses and permits adds to this initial outlay, varying by industry and location.

Real estate costs can be substantial. Leasing office space or a storefront demands a security deposit and first month's rent, potentially totaling thousands. Consider working from home or utilizing a co-working space to minimize these expenses.

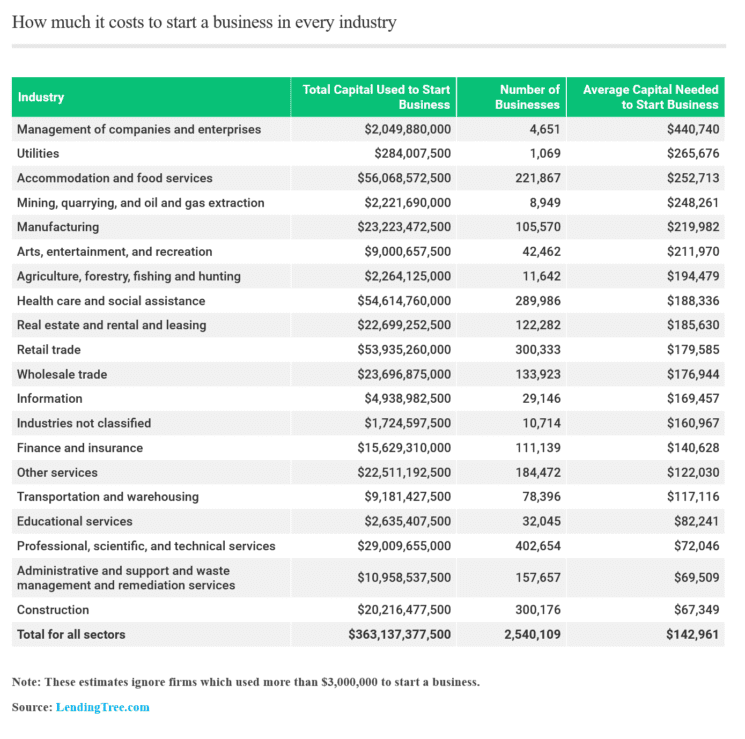

Inventory and equipment needs are sector-specific. A retail business requires purchasing inventory upfront, while a manufacturing company needs specialized equipment. The cost will depend on the quality and amount needed.

Key Expense Categories

Marketing and advertising are essential for visibility. Budget for website development, social media marketing, and potentially paid advertising. Online marketing budgets can start as low as $500 per month, but can easily scale into thousands.

Operational expenses cover day-to-day activities. Include utilities, insurance, software subscriptions, and employee salaries (if applicable). These recurring costs directly impact cash flow.

Technology expenses are a necessity. Consider computers, software licenses (such as Microsoft Office or Adobe Creative Suite), and point-of-sale (POS) systems. Cloud-based solutions offer more flexibility.

Financing Options

Personal savings are the most common funding source. Many entrepreneurs bootstrap their businesses initially before seeking external investment.

Small business loans are available from banks and credit unions. The SBA guarantees loans, making them more accessible for startups, but the application process can be rigorous.

Venture capital and angel investors provide larger funding rounds. These investors typically seek equity in exchange for their investment, targeting high-growth potential businesses.

Real-World Examples

Starting an online business: Can require as little as $500 - $5,000 if you're selling digital products or drop shipping.

Opening a brick-and-mortar restaurant: Can range from $100,000 to $500,000+, considering rent, equipment, inventory and staffing costs.

Launching a tech startup: Often demands significant investment in product development and marketing, easily exceeding $50,000 to $1,000,000+.

Next Steps

Create a detailed business plan, including a comprehensive budget. This document serves as a roadmap and is crucial for securing funding. Thorough research of your industry and target market are essential.

Explore available resources from the SBA and local business development centers. These organizations provide free counseling and training.

Continually monitor and adjust your budget as your business evolves. Flexibility and adaptability are vital for long-term success.