How Much Do Merrill Lynch Financial Advisors Charge

Merrill Lynch clients face a crucial question: how much are they really paying for financial advice? Understanding the fees charged by Merrill Lynch advisors is paramount for anyone seeking to maximize their investment returns.

This article cuts through the complexity to deliver a concise breakdown of Merrill Lynch's fee structure, empowering you to make informed financial decisions. We'll delve into the common charges, hidden costs, and alternatives to ensure you're not overpaying for your financial guidance.

Merrill Lynch's Fee Structure: A Deep Dive

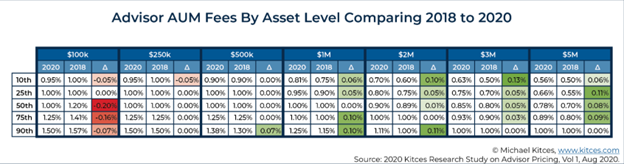

Merrill Lynch operates with a tiered fee structure, often based on assets under management (AUM). This means the more assets you entrust to Merrill Lynch, the more you'll pay in fees.

The typical AUM fee ranges from 0.50% to over 1.50% annually, depending on the account size and services provided. Larger accounts may qualify for discounted rates, while smaller accounts could face higher percentage charges.

Understanding the AUM Model

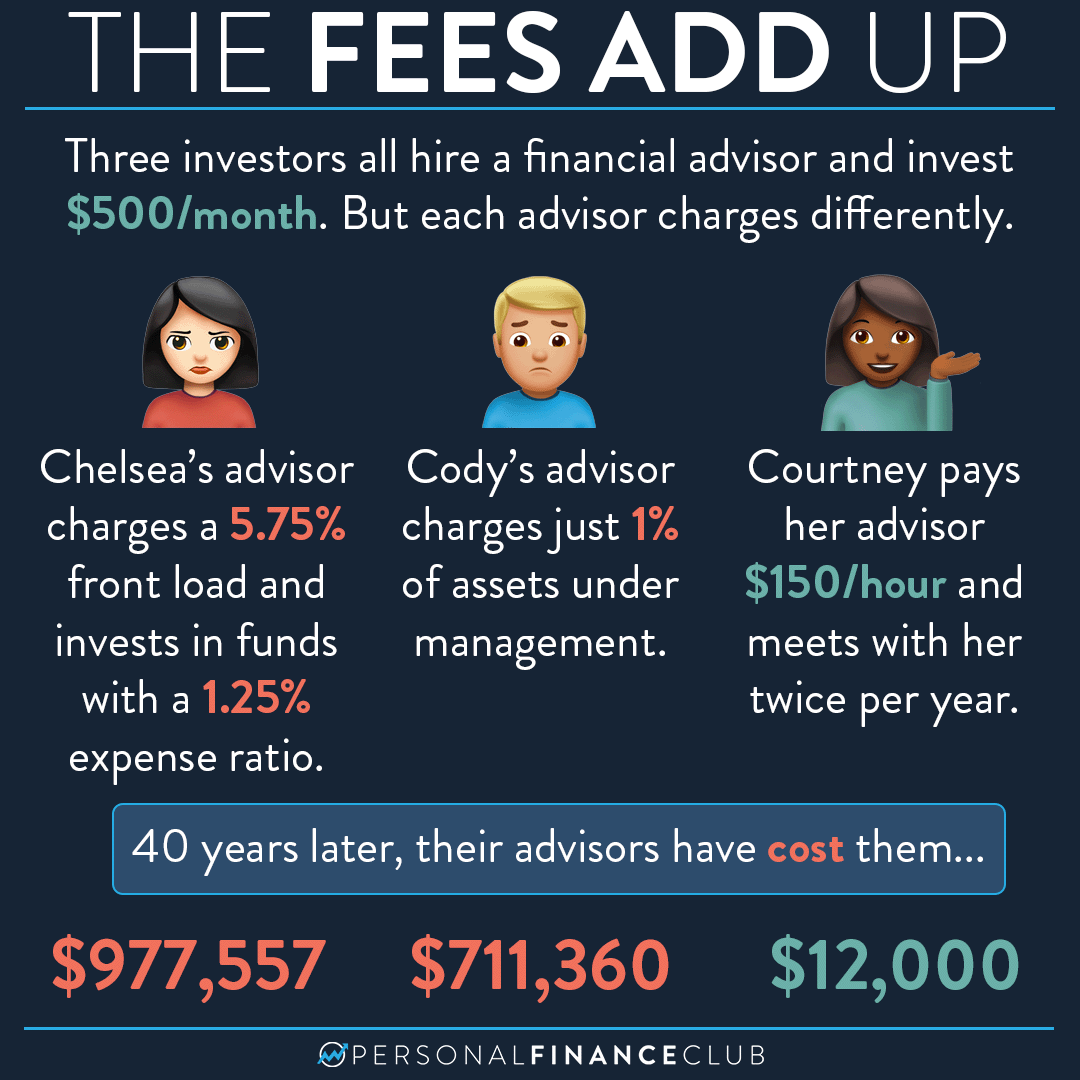

The AUM model is straightforward: a percentage of your total assets is charged as a fee. For example, an account with $1 million under management, charging a 1% AUM fee, incurs a $10,000 annual charge.

This fee covers investment advice, portfolio management, and financial planning services. However, it's vital to understand precisely what services are included and if they align with your needs.

It's important to note that this model may incentivize advisors to prioritize growing assets rather than focusing solely on optimal investment returns, which could create a conflict of interest.

Transaction Fees and Other Charges

Beyond AUM fees, some Merrill Lynch clients may encounter transaction fees, particularly for specific trades. These fees can include commissions on buying or selling stocks, bonds, or other securities.

Mutual fund expenses are another crucial cost to consider. The expense ratios charged by the funds held within your portfolio directly impact your overall returns.

Be aware of potential hidden costs like account maintenance fees, wire transfer fees, and fees for specialized services. Full transparency is crucial when discussing fees with your advisor.

Alternatives and Fee Negotiation

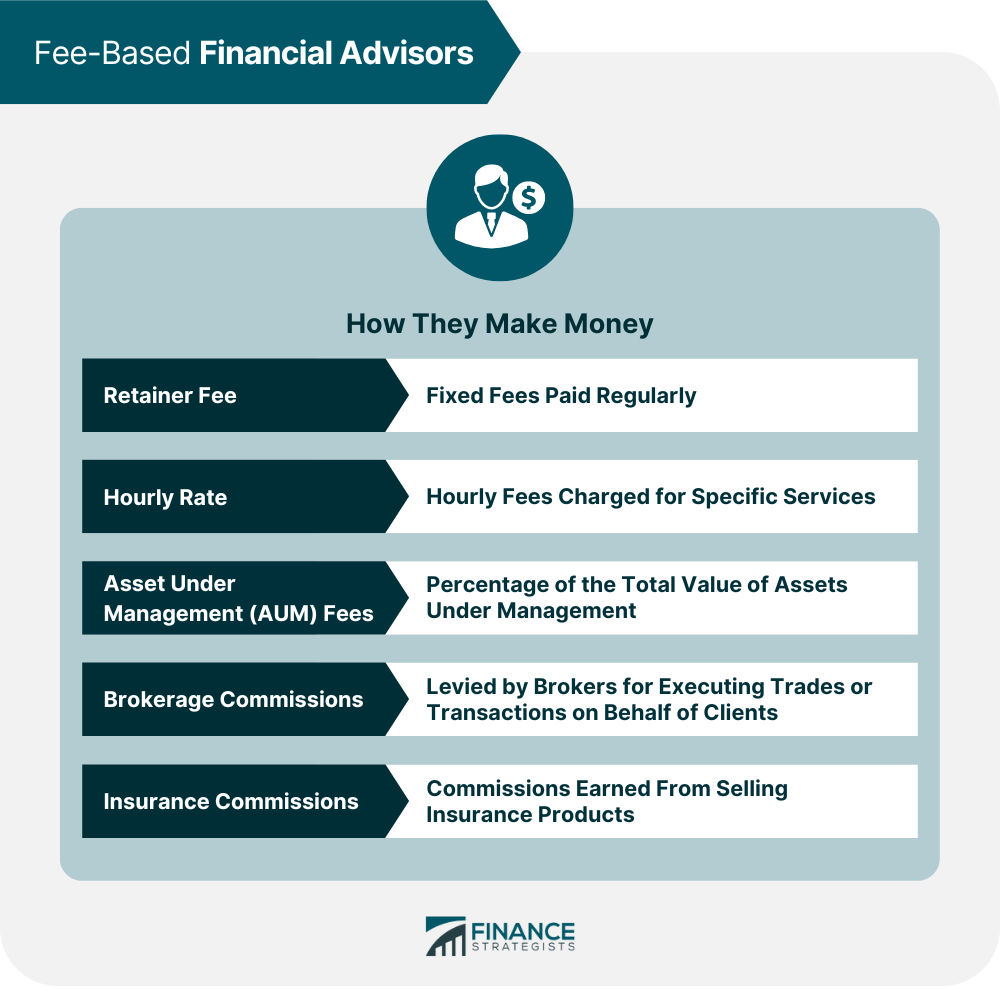

Consider exploring alternative fee arrangements, such as a flat fee or hourly rate, especially if your needs don't align with the AUM model. Discussing fee negotiation is always an option.

Many independent registered investment advisors (RIAs) offer fee-only services, meaning they are only compensated by their clients and do not receive commissions from third parties. This can reduce potential conflicts of interest.

Compare the services and fees of multiple financial advisors before making a decision. Use online resources and tools to benchmark Merrill Lynch's fees against industry averages.

Don't hesitate to ask your Merrill Lynch advisor for a detailed breakdown of all fees and charges. Request examples showing the total cost you can expect to pay based on different asset levels.

Who is Impacted and When?

This fee structure impacts all Merrill Lynch clients, existing and new, regardless of their investment goals. The impact can be felt monthly, quarterly, or annually, depending on how the fees are deducted from your account.

Clients who have recently onboarded or are considering engaging Merrill Lynch's services are particularly vulnerable to being unclear about the full fee implications. Understanding fees upfront is paramount.

Merrill Lynch clients need to proactively review and understand their fees annually to ensure they are in line with their financial goals and expectations. Market fluctuations might not always translate to an equivalent decrease in fees.

Next Steps

If you're a Merrill Lynch client, immediately review your account statements and fee schedules. Contact your advisor to clarify any uncertainties and explore potential fee negotiation options.

Consider seeking a second opinion from an independent financial advisor. Comparing services and fees is a prudent step in ensuring you're receiving the best value for your money.

Stay informed about ongoing developments in financial advisor compensation and regulations. Proactive engagement is key to safeguarding your financial future.