How Much Do Raw Diamonds Sell For

Raw diamond prices are fluctuating wildly, leaving miners and buyers scrambling to understand the current market value. The complex pricing system makes it difficult to pinpoint exact costs, creating uncertainty across the industry.

This report delves into the multifaceted world of rough diamond valuation, examining the factors impacting prices and providing a snapshot of current market conditions.

The Elusive Price of Rough Diamonds

Determining the cost of raw diamonds is far from straightforward. Unlike commodities traded on open exchanges, rough diamonds lack a unified global price list. De Beers and Alrosa, historically dominant players, influence prices, but independent miners and dealers operate under varied conditions.

The 4Cs – Plus More

The well-known 4Cs (Carat, Clarity, Color, Cut) are crucial, but apply differently to rough stones. Carat weight is straightforward, but assessing clarity and color in an uncut stone requires expertise.

Shape and size distribution within a parcel also significantly affect value. A parcel with many small stones will be worth less per carat than one with a few large, high-quality stones. Inclusions and potential yield are key considerations.

Rough diamonds are assessed for their potential to yield polished stones. This requires skilled sorters and graders who can predict the final polished outcome from the raw material.

Market Dynamics and Pricing Factors

Several market factors complicate the pricing process. Demand for polished diamonds directly influences rough diamond prices. Economic downturns can dampen demand, leading to price drops.

Supply constraints, whether due to mine closures or geopolitical instability, can also drive prices up. Recent sanctions against Alrosa, a major Russian diamond producer, have introduced significant uncertainty into the market.

Currency fluctuations play a role, especially for producers and buyers operating in different countries. Exchange rate volatility can impact profitability.

The Role of Diamond Bourses and Trading Centers

Major diamond bourses in Antwerp, Mumbai, and Tel Aviv serve as hubs for rough diamond trading. These centers offer platforms for buyers and sellers to connect and negotiate prices.

Rough diamond auctions, often organized by mining companies, provide price discovery mechanisms. These auctions attract buyers from around the world, and the results offer insights into current market sentiment.

However, auction prices can be volatile, influenced by factors such as the specific stones on offer and the number of bidders.

Price Ranges and Recent Trends

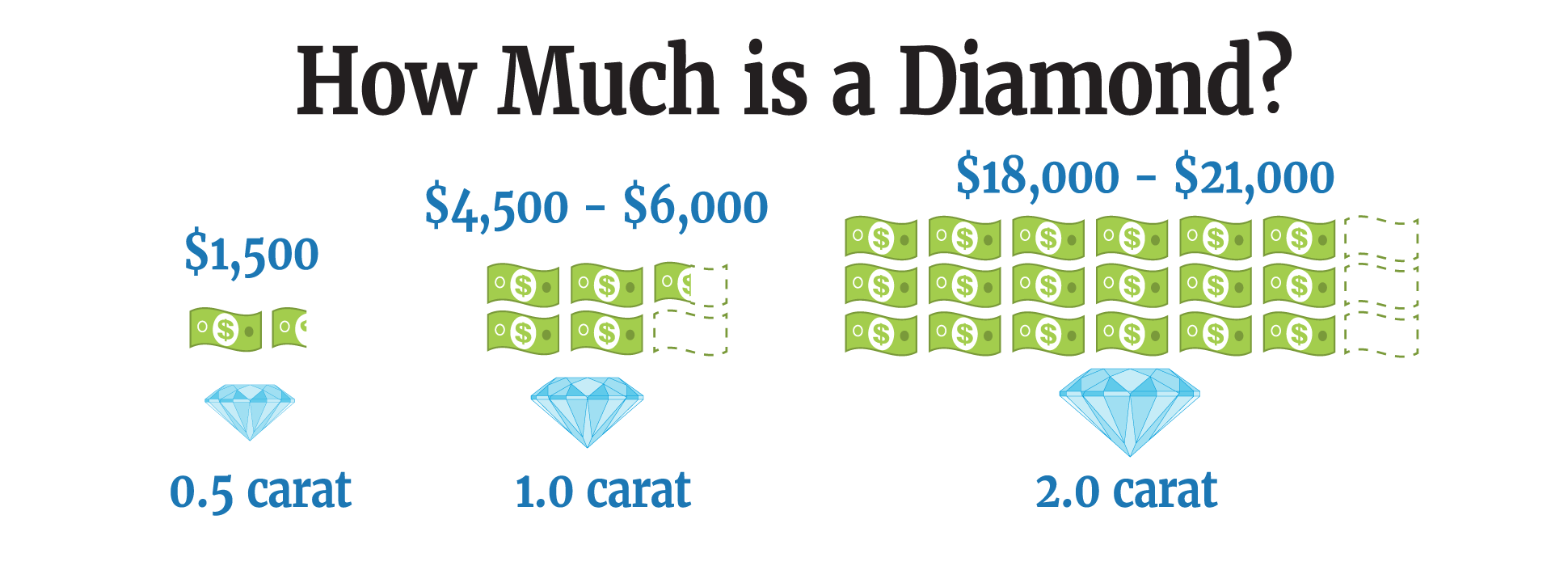

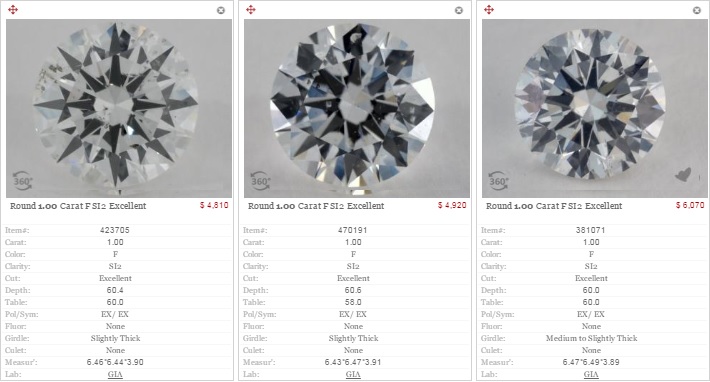

Due to the individualized nature of rough diamond pricing, providing a single "price per carat" is impossible. Prices range from under $100 per carat for low-quality, small stones to thousands of dollars per carat for exceptional, gem-quality diamonds.

Recent reports indicate a softening in rough diamond prices compared to peaks reached in 2022. This is partly attributed to weaker demand in key consumer markets, such as China and the United States.

According to a recent industry analysis, the average price of rough diamonds has fallen by approximately 10-15% in the past year. However, prices for specific categories of diamonds, such as those suitable for high-end jewelry, have remained relatively stable.

The Impact of Sanctions and Ethical Sourcing

Sanctions against Alrosa have disrupted the global diamond supply chain. This has led to increased scrutiny of diamond sourcing and a greater emphasis on ethical and transparent practices.

Initiatives such as the Kimberley Process, designed to prevent the trade of conflict diamonds, are facing increased pressure to adapt to new challenges. Consumers are increasingly demanding assurance that their diamonds are ethically sourced.

The rise of lab-grown diamonds is also impacting the natural diamond market. Lab-grown diamonds offer a more affordable and often more traceable alternative, putting pressure on natural diamond producers to demonstrate value and ethical sourcing.

Future Outlook and Market Predictions

The rough diamond market is expected to remain volatile in the near term. Geopolitical uncertainties, economic conditions, and evolving consumer preferences will continue to shape prices.

Industry analysts predict a gradual recovery in demand as economic conditions improve. However, the long-term impact of lab-grown diamonds and the ongoing scrutiny of ethical sourcing remain significant factors.

Miners and buyers will need to adapt to these evolving market dynamics by embracing transparency, investing in technology, and focusing on meeting the changing needs of consumers.

Ongoing Developments

Industry stakeholders are closely monitoring the impact of sanctions and the evolution of ethical sourcing standards. Discussions are underway to strengthen the Kimberley Process and enhance traceability throughout the supply chain.

New technologies, such as blockchain, are being explored to improve transparency and provide greater assurance to consumers.

Stay tuned for further updates as the situation unfolds.