How Much Does A Business Owner Pay Himself

Imagine a crisp autumn morning, the scent of coffee swirling in the air, as a small business owner, Sarah, reviews her company's financials. The question lingering in her mind isn't about profits or expansion, but something more personal: "How much should I pay myself?" It's a dilemma countless entrepreneurs face, a balancing act between reinvesting in their dream and recognizing their own worth.

Navigating the complexities of owner's compensation is a significant hurdle for small business owners. It directly impacts both their personal financial well-being and the long-term health of their businesses. This article delves into the factors influencing owner's pay, explores common compensation strategies, and offers insights to help business owners strike a sustainable balance.

The Balancing Act: Business Needs vs. Personal Needs

The first step is understanding the intricate dance between business needs and personal financial demands. Reinvesting profits into growth, such as marketing campaigns or equipment upgrades, is crucial for long-term success. However, owners also need to meet their personal obligations: mortgages, family expenses, and retirement savings.

Several factors influence how a business owner approaches this decision. These factors include the business's profitability, the industry, the owner's role within the company, and the local cost of living. A startup with limited revenue will have a vastly different approach than a mature, established business.

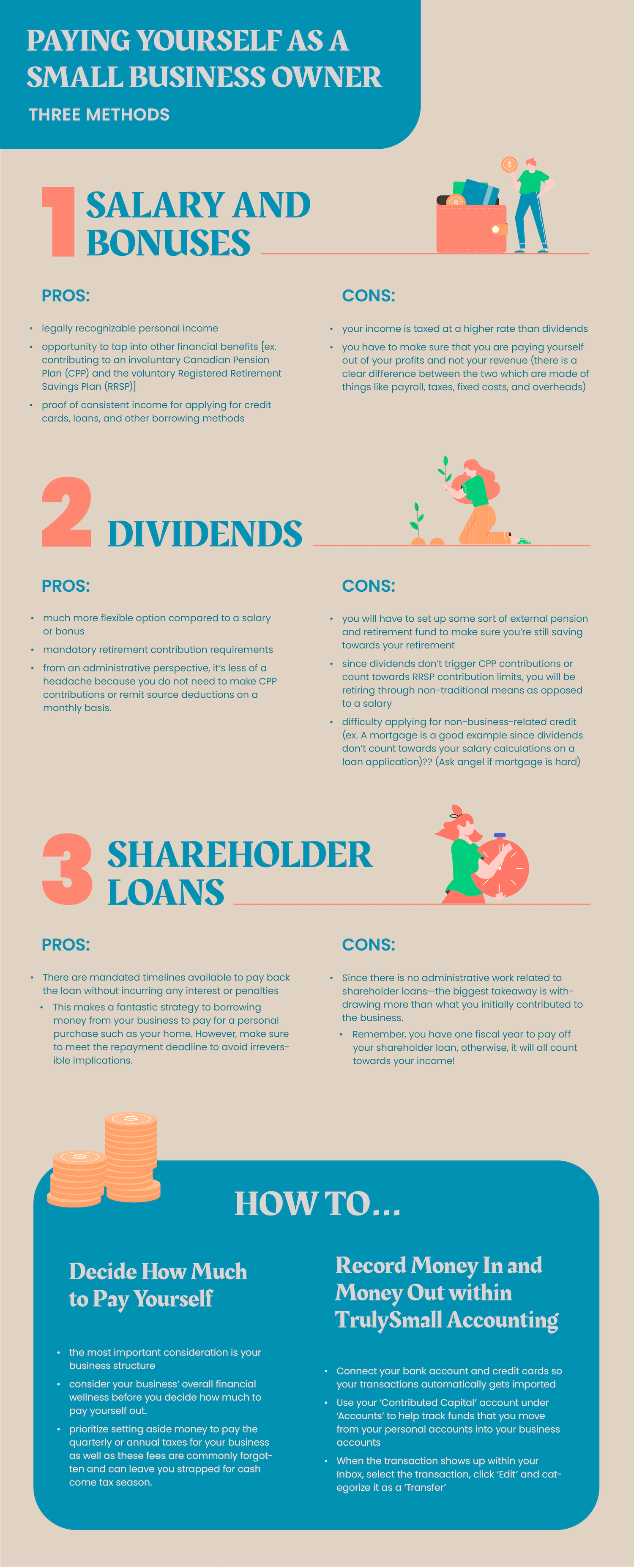

Common Compensation Strategies

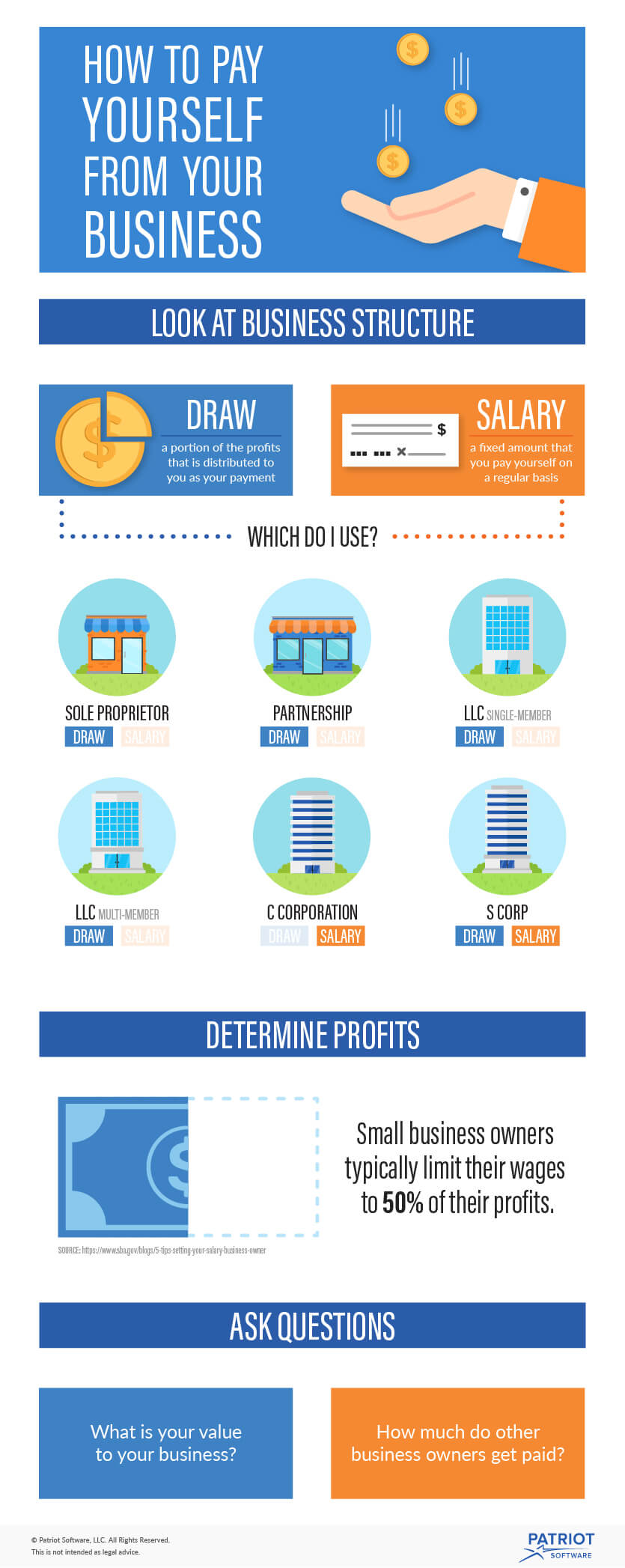

There isn't a one-size-fits-all solution to determining owner's pay. However, several common strategies can guide the decision-making process. These often depend on the legal structure of the business.

Salary

For owners of S corporations or C corporations, paying themselves a salary is a standard practice. This offers the benefit of predictable income and allows the business to deduct the salary as a business expense, reducing taxable income.

According to the Small Business Administration (SBA), determining a reasonable salary involves researching industry benchmarks for similar roles and responsibilities. Sites like Salary.com or Glassdoor can provide valuable insights into comparable salaries.

Owner's Draw

In sole proprietorships, partnerships, and limited liability companies (LLCs), owners typically take an "owner's draw." This involves withdrawing funds from the business for personal use.

Unlike a salary, an owner's draw isn't subject to payroll taxes. However, owners are still responsible for paying self-employment taxes on their share of the business's profits.

Profit Distribution

Another strategy involves distributing a portion of the business's profits to the owners at regular intervals, such as quarterly or annually. This allows owners to directly benefit from the company's success.

Profit distributions are often used in conjunction with a salary or owner's draw. This ensures a baseline income while also rewarding owners for their contributions to profitability.

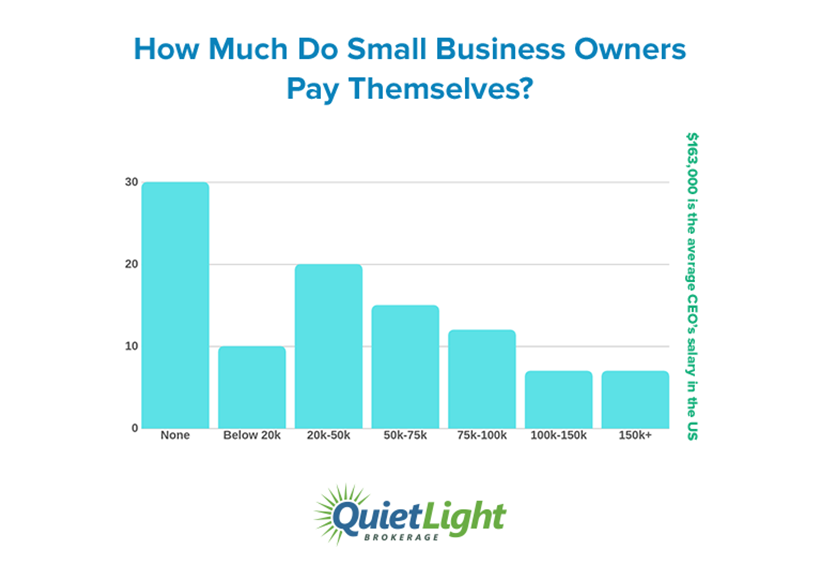

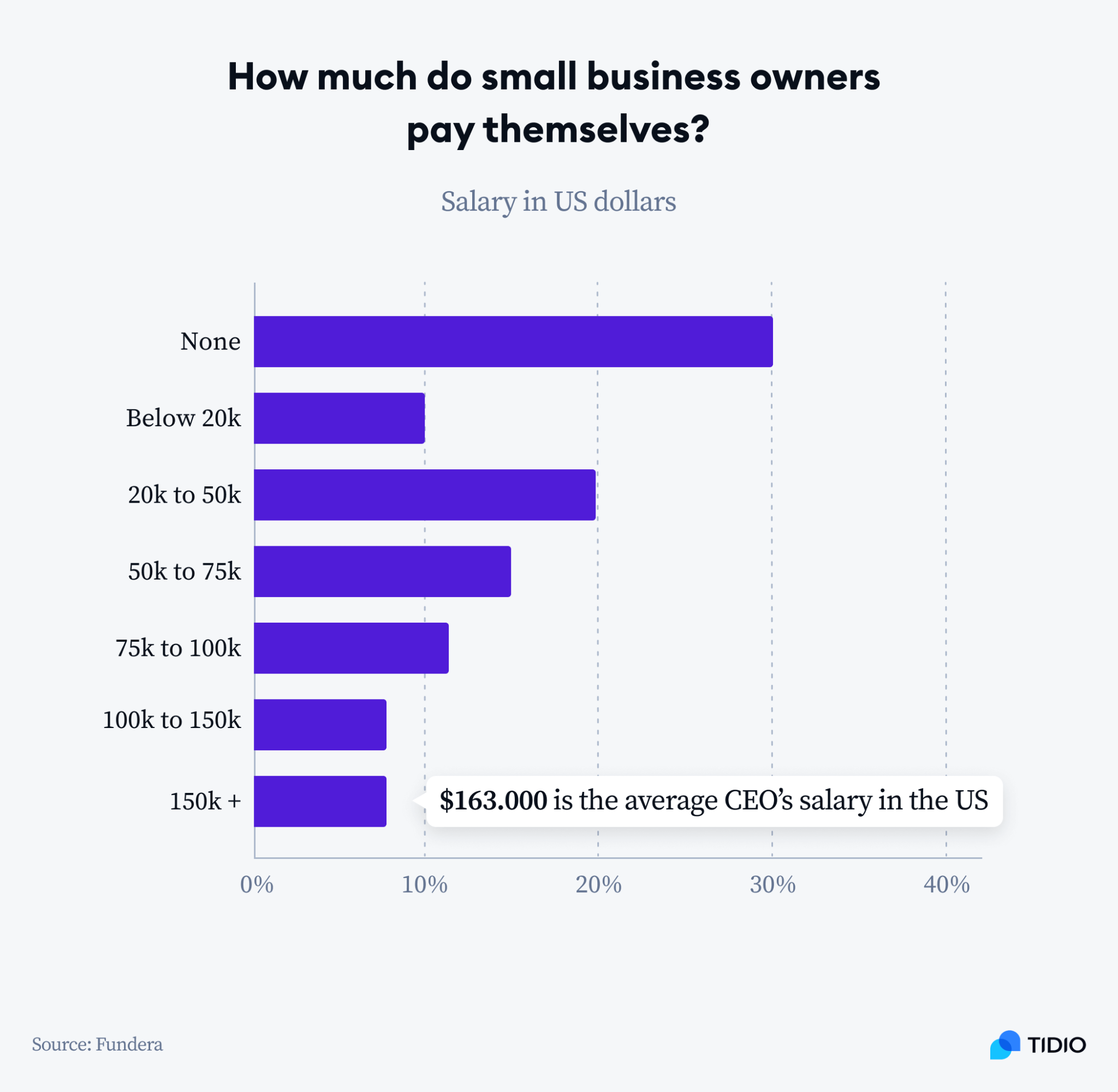

Benchmarking and Industry Standards

Researching industry standards is crucial for determining a fair and reasonable owner's compensation. Trade associations and industry publications often publish data on average salaries and compensation packages for various roles.

Financial advisors and accountants can provide valuable insights into industry benchmarks. They can also help owners tailor their compensation strategies to their specific business and financial circumstances.

The Importance of Sound Financial Management

Regardless of the chosen compensation strategy, sound financial management is paramount. Accurately tracking income and expenses, creating a budget, and regularly reviewing financial statements are essential for making informed decisions.

Regularly consulting with a financial professional can help owners stay on track and avoid common pitfalls, such as overspending or neglecting tax obligations. These professionals can also assist with long-term financial planning, including retirement savings and wealth management.

For Sarah, the small business owner, navigating her compensation wasn't easy. Through careful planning, industry research, and advice from a financial advisor, she established a system that fairly compensated her while allowing her business to thrive. Like Sarah, every business owner has to weigh his or her own priorities, and those of the business.