How Much Does Colonial Life Short-term Disability Pay Per Month

Did you know that unexpected illnesses or injuries can sideline your employees, impacting productivity and potentially creating financial strain for both them and your business? Understanding short-term disability (STD) benefits, like those offered by Colonial Life, is crucial for responsible business planning.

This article explores the ins and outs of Colonial Life's STD payments, helping you understand what your employees might receive and how it benefits your business. Navigating these details is key to offering competitive benefits and supporting your workforce.

Why Understanding Colonial Life STD Payments Matters

Offering competitive benefits is not just a perk; it's a strategic advantage. It attracts and retains talent, boosting morale and productivity. Understanding Colonial Life's STD plan is a vital component of a comprehensive benefits package.

When an employee is unable to work due to illness or injury, STD benefits provide income replacement. This financial safety net allows them to focus on recovery without undue stress. It benefits both them and your company.

Reduced employee stress typically equates to a quicker return to work and a more engaged workforce. It is important to consider it.

Decoding Colonial Life STD Payment Calculations

Colonial Life's STD payments are generally calculated as a percentage of the employee's pre-disability earnings. This percentage varies based on the plan selected by the employer.

Common percentages range from 50% to 70% of the employee's weekly wage. The specific amount is outlined in the policy documents.

For example, if an employee earns $1,000 per week and the policy pays 60%, the weekly benefit would be $600.

It is important to consult the plan document for specifics.

Key Factors Influencing Monthly Payments

Several factors influence the monthly payment amount. These are:

- Weekly Wage: Higher wages generally result in larger benefit payments, based on the percentage outlined in the plan.

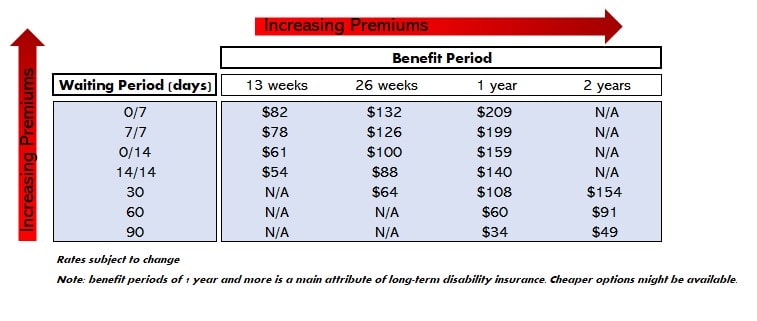

- Benefit Percentage: The chosen percentage (e.g., 50%, 60%, or 70%) directly impacts the amount received.

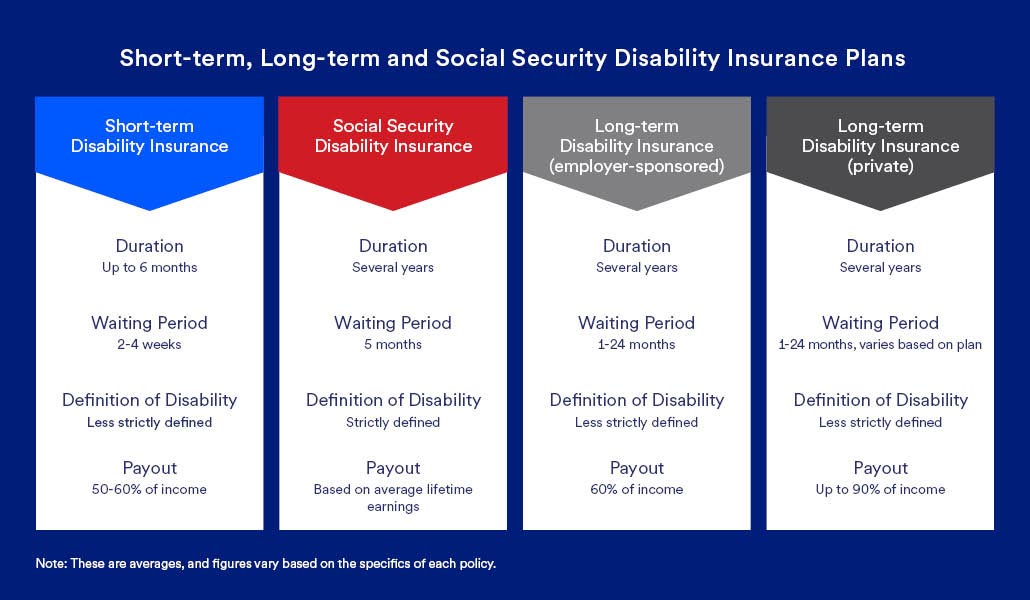

- Elimination Period: This is the waiting period before benefits begin. A longer elimination period might affect the total amount received during the disability.

- Maximum Benefit Period: This defines the length of time benefits are paid. Colonial Life offers various maximum benefit periods, such as 3 months, 6 months or 12 months.

- Policy Maximums: The policy specifies a maximum weekly or monthly benefit amount.

It is essential to review these factors with your Colonial Life representative to understand your specific coverage.

Example Scenarios: Monthly Payment Estimates

Let's illustrate with a couple of examples:

Scenario 1: An employee earning $4,000 per month has a policy that pays 60% of their pre-disability earnings, with a one-week elimination period. Their estimated monthly benefit would be $2,400 (60% of $4,000), starting after the first week of disability.

Scenario 2: An employee earning $6,000 per month has a policy paying 70%, but the policy has a maximum monthly benefit of $3,500. Even though 70% of their salary would be $4,200, they would only receive the $3,500 due to the policy's maximum.

Important Considerations and Caveats

It's important to remember that STD benefits are subject to certain limitations and exclusions. For example, pre-existing conditions or disabilities resulting from self-inflicted injuries may not be covered.

Also, benefits may be reduced if the employee receives income from other sources, like worker’s compensation.

Understanding these limitations helps manage employee expectations and ensure accurate benefits administration. Consult the policy document for a detailed list.

The Employer's Role in Facilitating STD Benefits

As an employer, your role extends beyond simply offering the benefit. Effective communication is key. Clearly explain the policy details to your employees.

Assist employees with the claims process. Provide necessary documentation and support them through the application. Prompt claims processing can ease the burden during a challenging time.

By actively managing the STD process, you contribute to a smoother experience for your employees and reduce potential disruptions to your business.

According to a study by the Integrated Benefits Institute, "integrated disability management programs can reduce lost workdays and improve employee productivity." (Integrated Benefits Institute, "Measuring the Impact of Integrated Medical, Absence, and Disability Management Programs," 2017).

Working with Colonial Life for Optimal Outcomes

Colonial Life provides resources and support to help employers manage their STD programs effectively. Leverage these resources.

Your Colonial Life representative can provide detailed policy information, answer questions, and assist with claims administration. Regular communication ensures you're informed and equipped to support your employees.

By partnering closely with Colonial Life, you can optimize your STD program and maximize its value to both your employees and your business.