How Much Does Fidelity Charge To Buy Stock

For investors looking to navigate the complexities of the stock market, understanding the costs associated with trading is paramount. Fidelity Investments, a major player in the brokerage industry, offers a variety of options for buying and selling stocks, and its fee structure is a key consideration for both novice and experienced traders.

This article breaks down Fidelity's stock trading fees, providing clarity on what investors can expect to pay when using the platform. Understanding these costs is crucial for maximizing investment returns and making informed financial decisions.

Commission Fees for Stock Trades

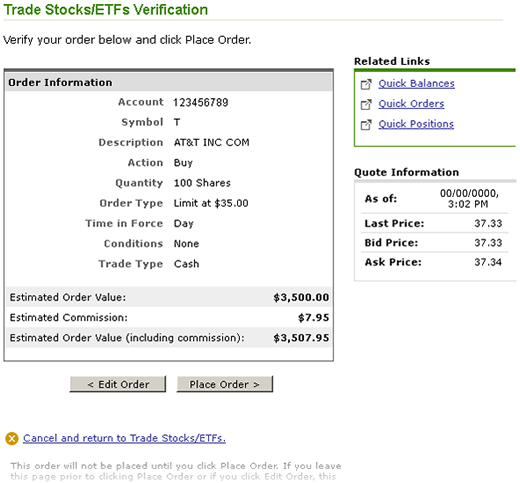

One of the most significant advantages of trading with Fidelity is its commission-free structure for online stock trades. In 2019, Fidelity joined other major brokerages in eliminating commissions for trading stocks, exchange-traded funds (ETFs), and options.

This means that investors can buy and sell these securities without paying a per-trade commission, a significant cost savings compared to brokerages that still charge commissions.

However, it's essential to note that while Fidelity doesn't charge commission fees for online stock trades, certain regulatory fees may still apply.

Other Potential Fees

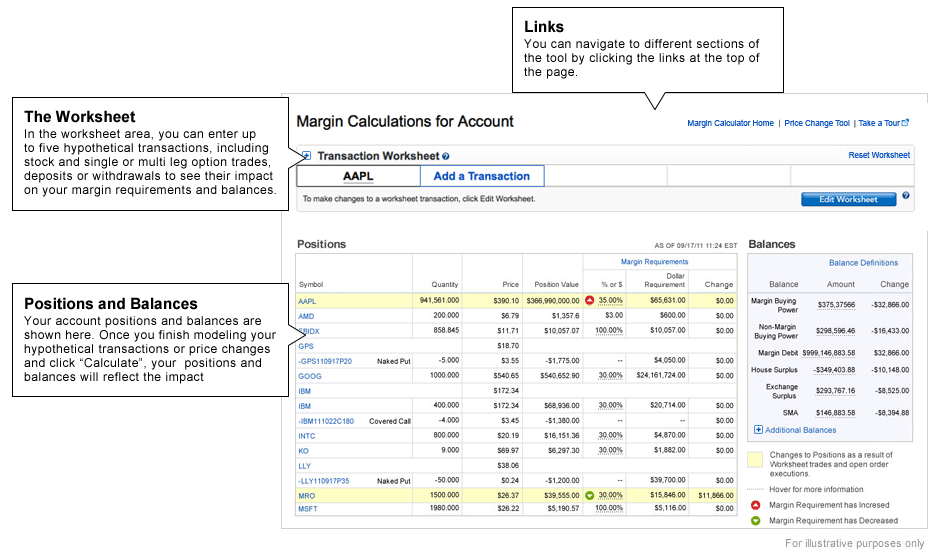

While the absence of commission fees is a major draw, investors should be aware of other potential charges. These can include fees for certain types of transactions or account services.

For example, broker-assisted trades, where an investor places a trade through a live broker, may incur a commission. Similarly, certain specialized services, such as wire transfers or paper statements, might also carry fees.

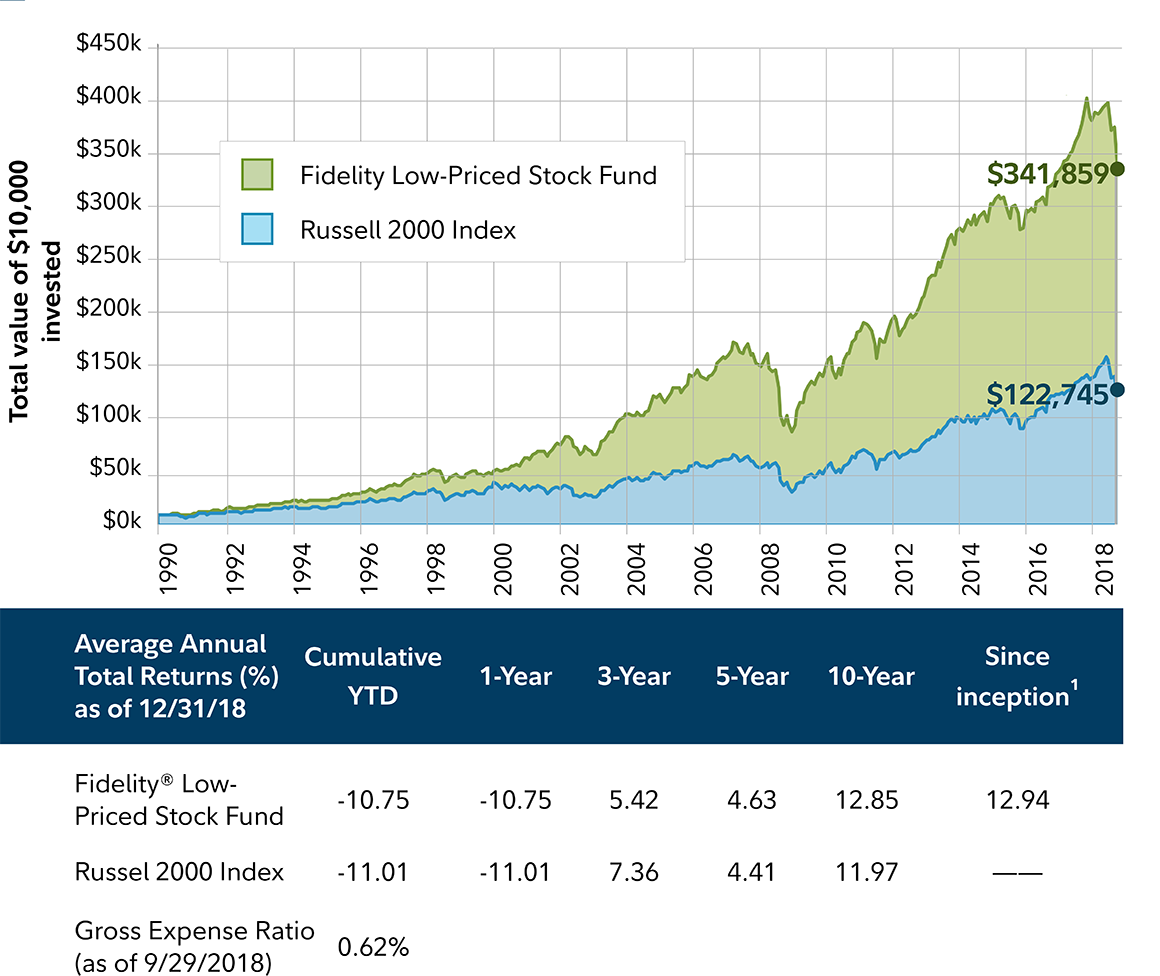

Fidelity also charges fees for certain types of investments, such as mutual funds with expense ratios, which are ongoing fees charged by the fund to cover its operating expenses.

Options Contract Fees

While Fidelity offers commission-free trading on options, it does charge a per-contract fee. As of 2024, this fee is $0.65 per contract.

This means that if you buy or sell an options contract, you will pay $0.65 for each contract traded, regardless of the number of shares the contract covers.

This fee is important to consider, especially for frequent options traders, as it can add up over time.

Impact on Investors

The elimination of commission fees by Fidelity has had a significant impact on investors. It lowers the barrier to entry for new investors and makes it more cost-effective for experienced traders to execute their strategies.

By reducing trading costs, investors can potentially improve their overall returns, particularly for those who trade frequently or in small amounts.

However, it's essential to remember that commission-free trading doesn't mean that investing is without risk. Investors should still conduct thorough research and carefully consider their investment goals and risk tolerance.

Account Minimums

Fidelity generally does not have account minimums for opening a brokerage account. This makes it accessible to investors with varying levels of capital.

This low barrier to entry allows individuals to start investing with small amounts of money and gradually build their portfolios over time.

However, some specialized accounts or services may have minimum balance requirements, so it's important to check the specific terms and conditions.

Conclusion

Fidelity's commission-free trading for stocks and ETFs makes it an attractive option for investors seeking to minimize trading costs. While regulatory and options contract fees exist, the overall fee structure is competitive.

Investors should carefully review Fidelity's fee schedule and understand the potential costs associated with different types of transactions and services. This knowledge will help them make informed decisions and optimize their investment strategies.

Ultimately, understanding the cost of trading is just one piece of the puzzle. Successful investing requires careful planning, research, and a long-term perspective.