How Much Does It Cost To Make A Small Business

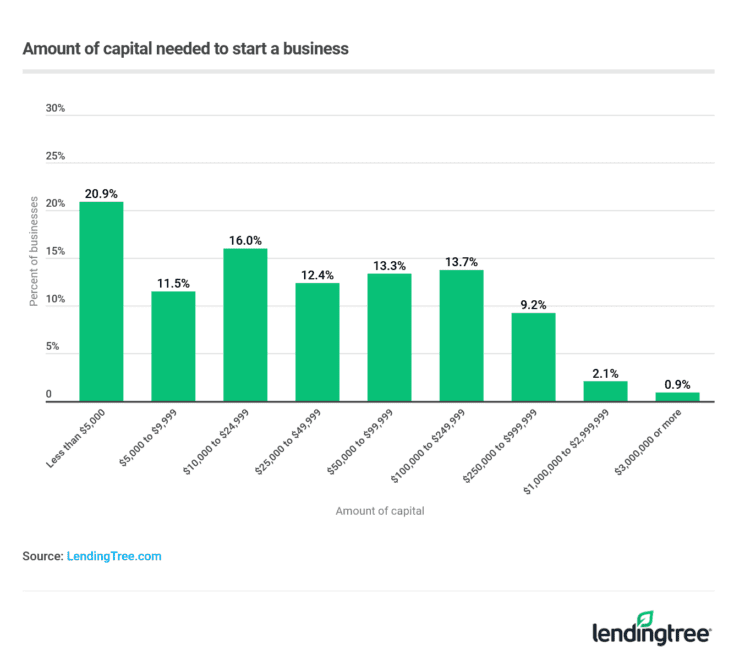

The dream of launching a small business resonates deeply with many, fueled by the promise of independence and the potential for financial reward. However, the path to entrepreneurial success is often paved with a critical question: how much capital is truly needed to get started?

Estimating the cost of launching a small business is a complex undertaking, heavily influenced by factors like industry, business model (brick-and-mortar vs. online), location, and the owner's personal financial situation. This article delves into the diverse financial landscape of launching a small enterprise, exploring the key expenses, available funding options, and strategies for managing costs effectively.

Startup Costs: A Detailed Breakdown

Startup costs can be broadly categorized into one-time expenses and ongoing operational costs.

One-Time Expenses

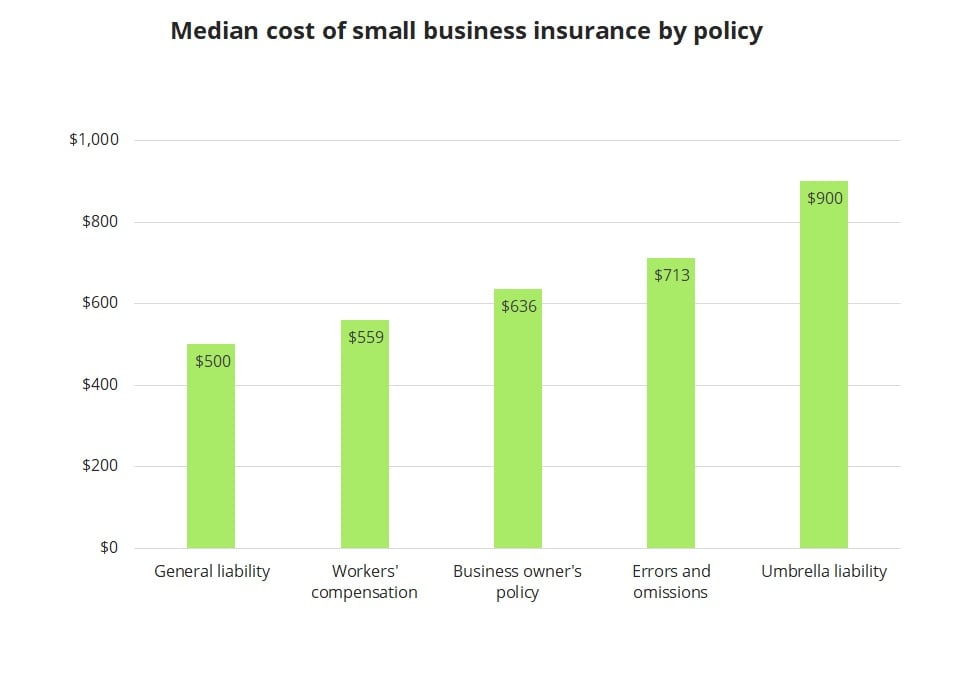

Business Formation: This includes fees for registering the business name, obtaining licenses and permits, and potentially hiring legal counsel. According to the Small Business Administration (SBA), these costs can range from a few hundred dollars to several thousand, depending on the complexity of the business structure and local regulations. For example, forming a Limited Liability Company (LLC) often requires filing fees with the state.

Equipment and Supplies: This category varies dramatically depending on the business type. A software startup might only need laptops and software subscriptions. Conversely, a restaurant requires ovens, refrigerators, furniture, and a significant inventory of food supplies.

Real Estate: For brick-and-mortar businesses, securing a physical location is a major expense. This encompasses rent or mortgage payments, security deposits, and potential renovation costs. Choosing a less expensive location or opting for a co-working space can significantly reduce this burden.

Marketing and Advertising: Creating a brand identity, designing a website, and implementing initial marketing campaigns are essential for attracting customers. These costs can range from a few hundred dollars for basic online advertising to thousands for professional branding services.

Ongoing Operational Costs

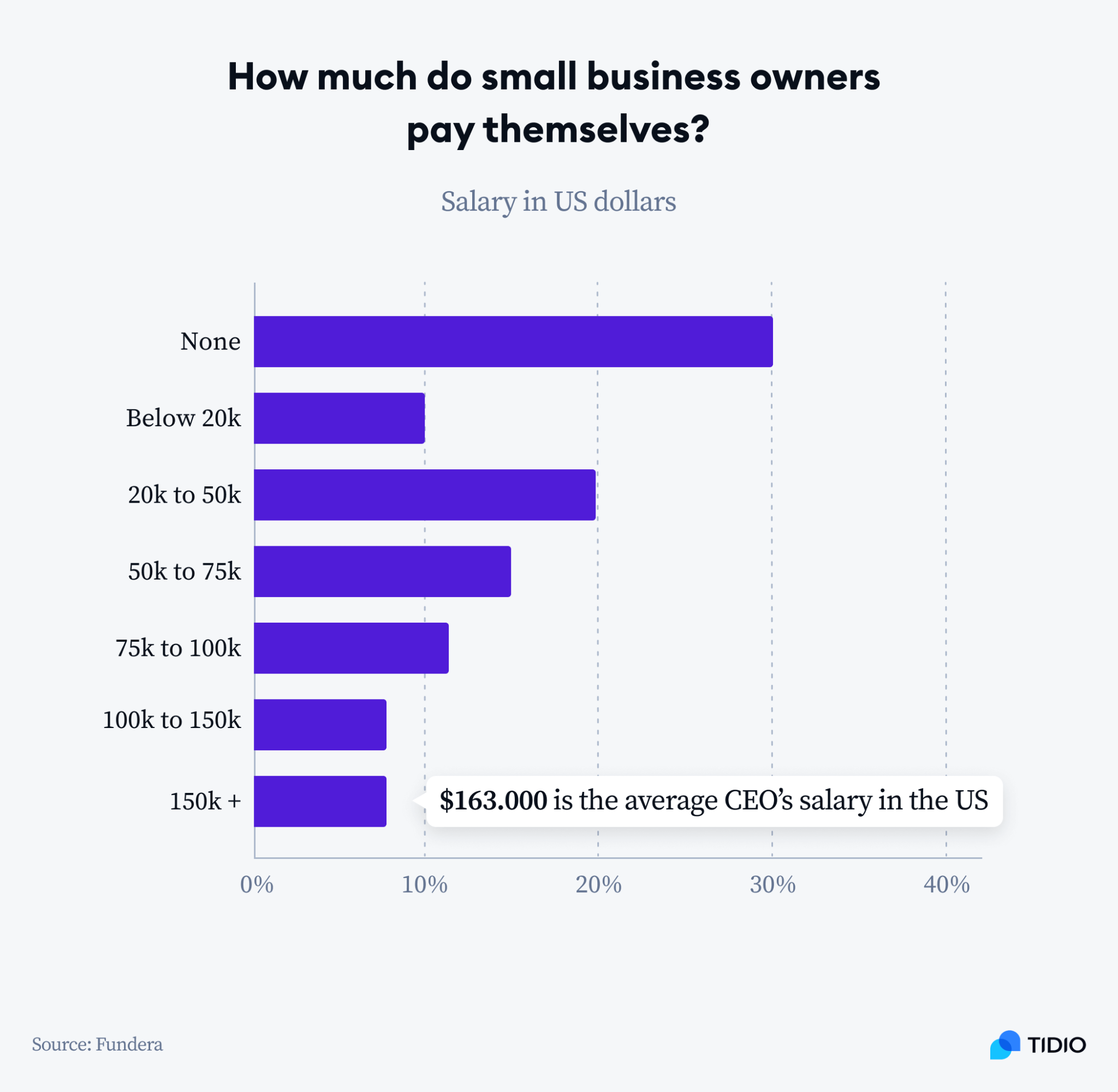

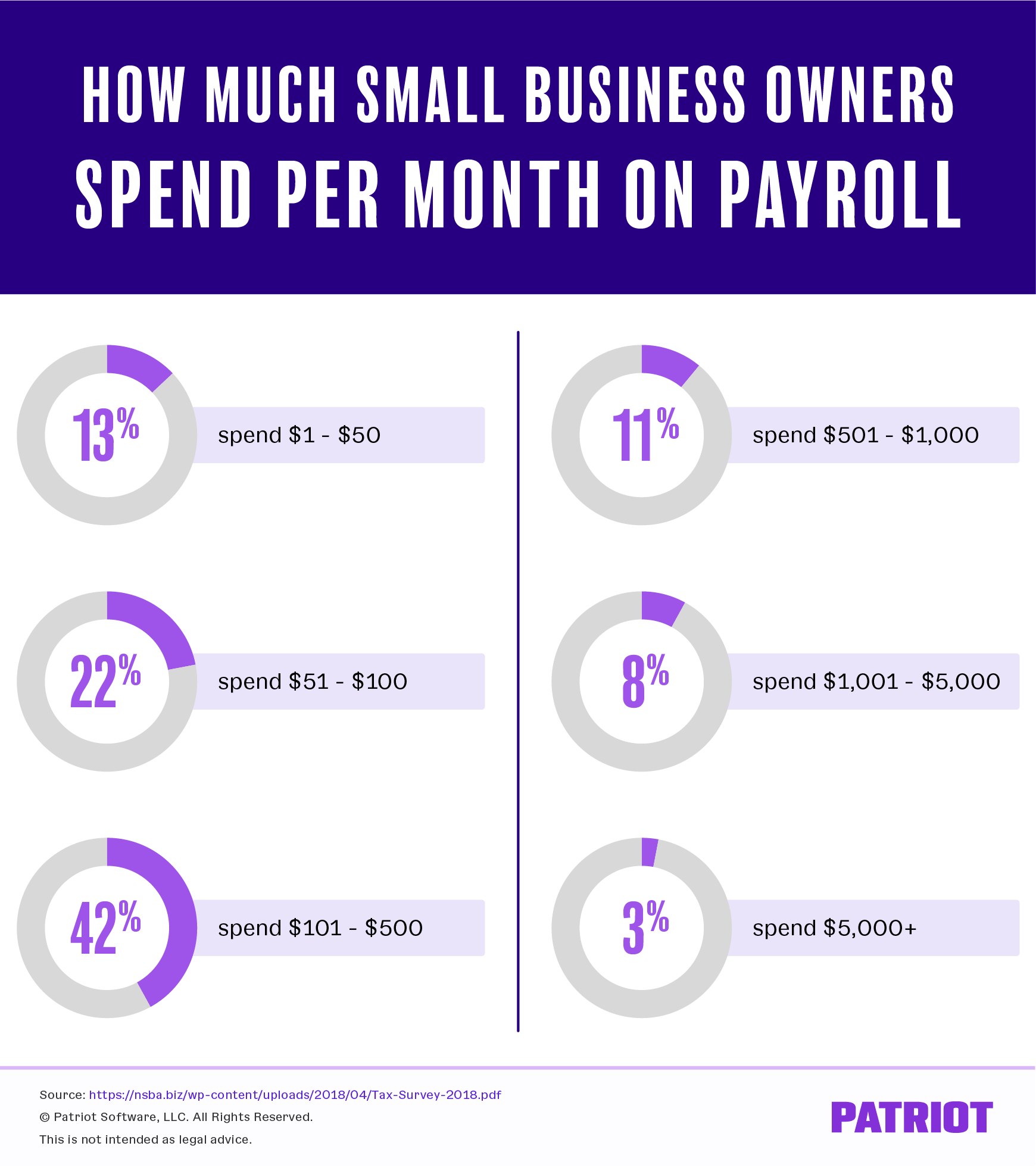

Salaries and Wages: If the business hires employees, payroll expenses, including salaries, wages, benefits, and payroll taxes, become a recurring cost. The Bureau of Labor Statistics (BLS) provides data on average wages for various occupations, which can help estimate these expenses.

Rent and Utilities: Businesses with physical locations incur monthly expenses for rent, utilities (electricity, water, gas), and maintenance. Negotiating favorable lease terms and implementing energy-efficient practices can help control these costs.

Marketing and Advertising: Consistent marketing efforts are crucial for maintaining brand awareness and attracting new customers. This includes ongoing expenses for online advertising, social media marketing, content creation, and potentially traditional advertising channels.

Inventory: Businesses that sell physical products need to maintain an adequate inventory to meet customer demand. Managing inventory effectively and minimizing waste is essential for controlling costs.

Funding Options and Strategies

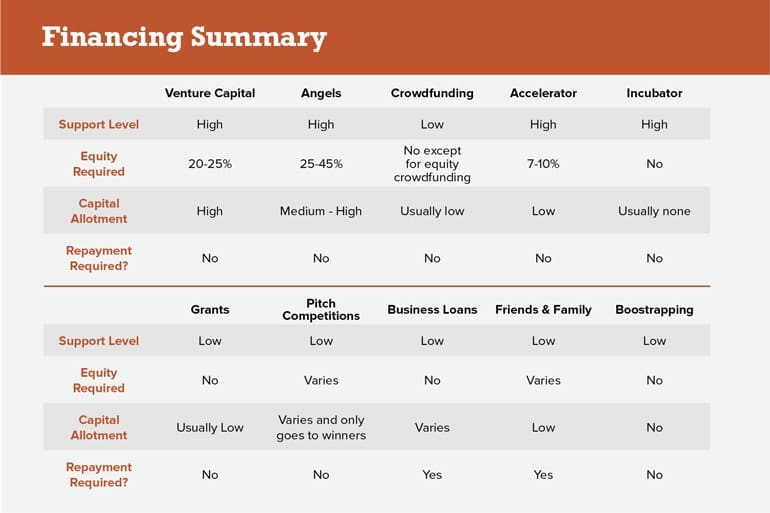

Securing adequate funding is a critical step in launching a small business.

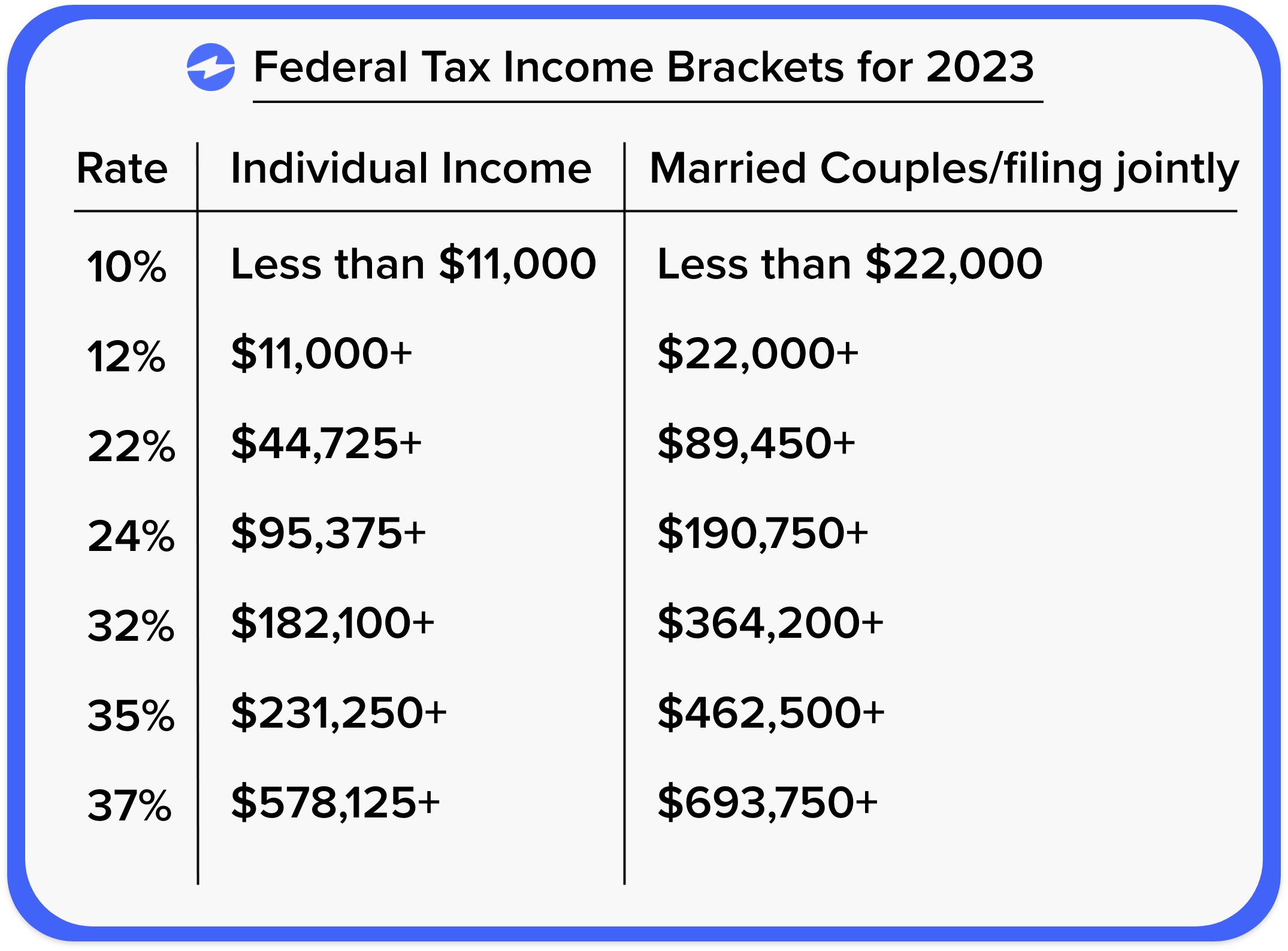

Personal Savings: Many entrepreneurs start by investing their own savings. This demonstrates commitment and can make it easier to attract external funding.

Loans: SBA loans, bank loans, and microloans are common sources of funding for small businesses. These loans typically require a strong credit history and a detailed business plan.

Grants: Government agencies and private organizations offer grants to support small businesses, particularly those in underserved communities or specific industries. Grants are often highly competitive.

Angel Investors and Venture Capital: For high-growth potential businesses, angel investors and venture capitalists can provide significant funding in exchange for equity. However, this option is typically only available to businesses with a proven track record or a highly innovative product or service.

"The cost to start a business can vary greatly, but thorough planning and realistic budgeting are essential for success," says Maria Rodriguez, a small business consultant.

Bootstrapping: Many entrepreneurs choose to bootstrap their businesses, minimizing expenses and reinvesting profits to fuel growth. This approach requires discipline and resourcefulness.

Industry-Specific Examples

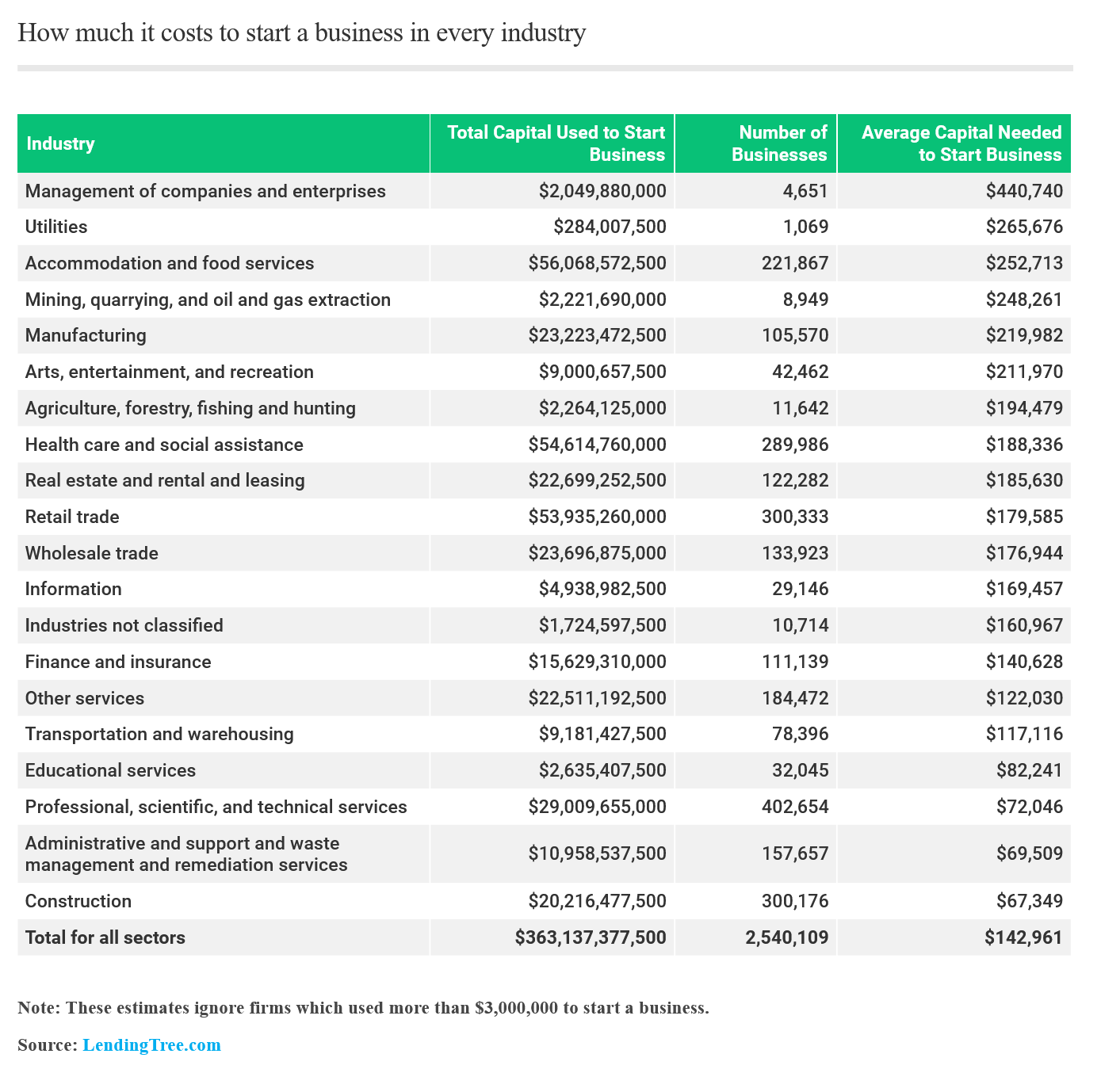

The cost to start a small business varies widely depending on the industry.

Restaurant: Starting a restaurant can be expensive, requiring significant investment in equipment, real estate, and inventory. The average startup cost for a restaurant can range from $100,000 to $500,000 or more.

Online Retail Store: Launching an online retail store can be relatively inexpensive, particularly if the business operates from home. Startup costs typically include website development, inventory, and marketing expenses. The average startup cost for an online retail store can range from $5,000 to $50,000.

Consulting Business: Starting a consulting business can be relatively low-cost, requiring minimal equipment and overhead. Startup costs typically include marketing and advertising expenses. The average startup cost for a consulting business can range from $1,000 to $10,000.

The Road Ahead

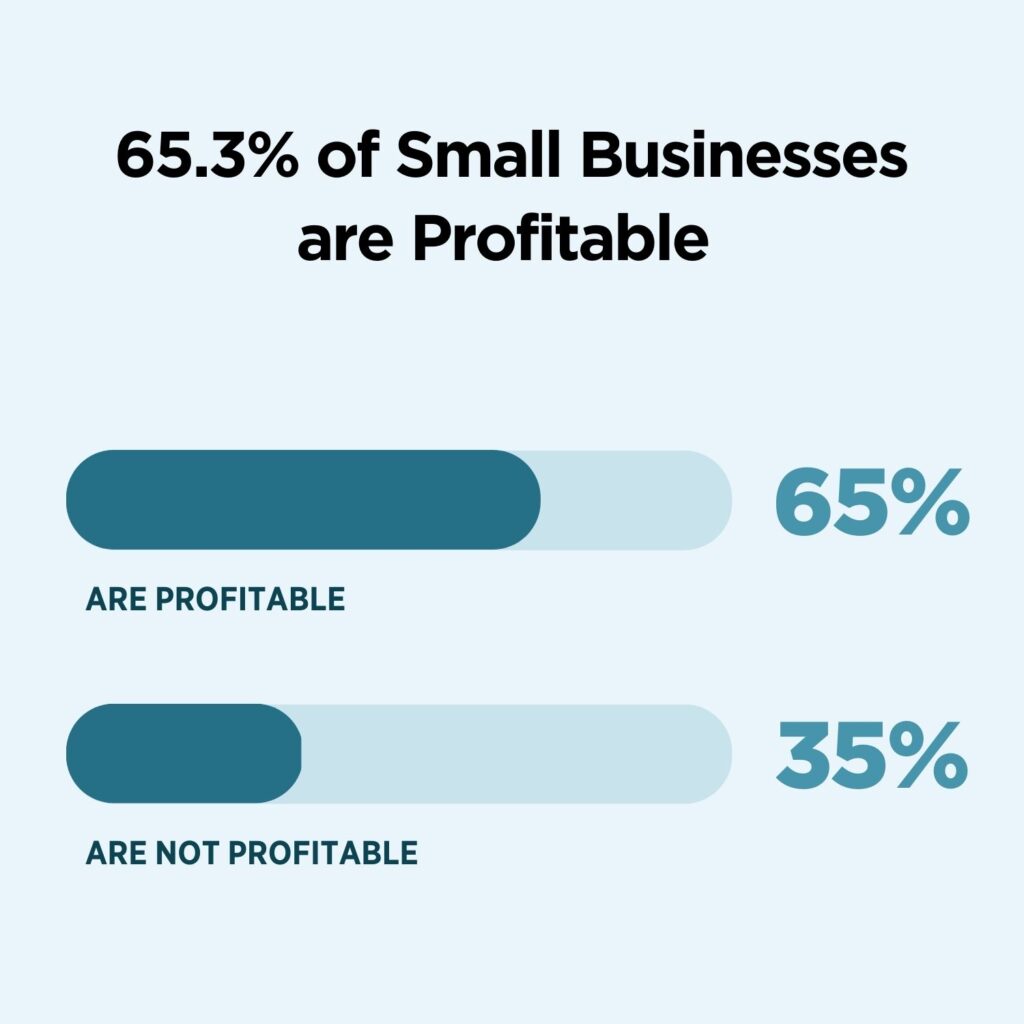

Launching a small business is a challenging but rewarding endeavor. While the initial investment can be substantial, careful planning, cost management, and access to funding can significantly increase the chances of success.

The future of small business is likely to be shaped by technological advancements, evolving consumer preferences, and changing economic conditions. Entrepreneurs who are adaptable, innovative, and customer-focused will be best positioned to thrive in this dynamic environment.

By understanding the various costs involved and exploring available funding options, aspiring entrepreneurs can turn their business dreams into reality and contribute to the economic vitality of their communities.