How Much Does It Cost To Open A Business

The dream of owning a business is a common one, but the path to entrepreneurship is often paved with complex financial questions. One of the most pressing: How much does it really cost to open a business?

The answer, unfortunately, isn’t simple. Startup costs vary wildly based on industry, location, and the scale of the operation. This article breaks down the key cost factors involved, drawing on data from industry reports and expert opinions to provide a realistic overview of the financial landscape facing aspiring business owners.

Understanding the Variable Costs

The Small Business Administration (SBA) emphasizes that costs are highly individualized. They offer resources and guidance, but tangible dollar figures are ultimately dependent on the business model.

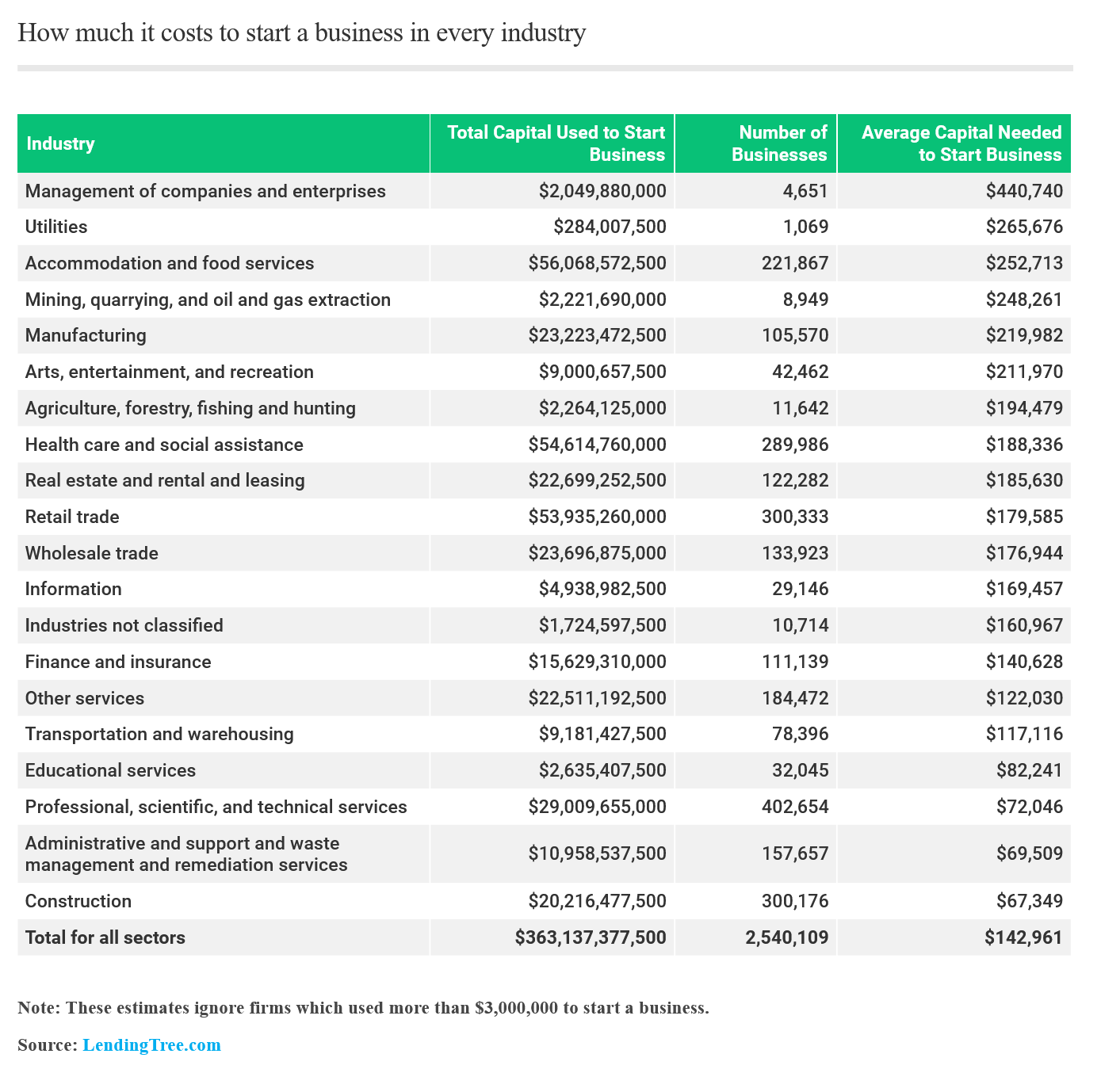

Industry is a major determinant. Opening a tech startup focused on software development will have vastly different costs compared to launching a brick-and-mortar retail store or a food truck. Software companies might prioritize salaries for developers and marketing expenses, while retail businesses face rent, inventory, and point-of-sale systems.

Location also significantly impacts expenses. Real estate costs in major metropolitan areas like New York City or San Francisco are substantially higher than in smaller towns or rural areas. This applies not only to rent or mortgage payments but also to local taxes and permitting fees.

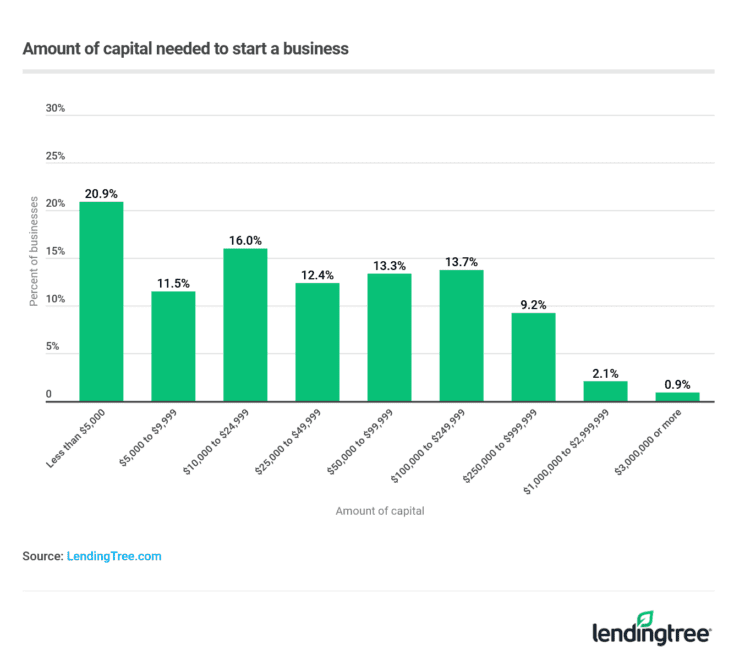

The scale of the business also matters. Starting small with a home-based business will naturally have lower overhead than leasing a large office space and hiring a team of employees.

Breaking Down Common Startup Expenses

Despite the variability, some costs are almost universal across different types of businesses. These include:

Legal and Regulatory Fees

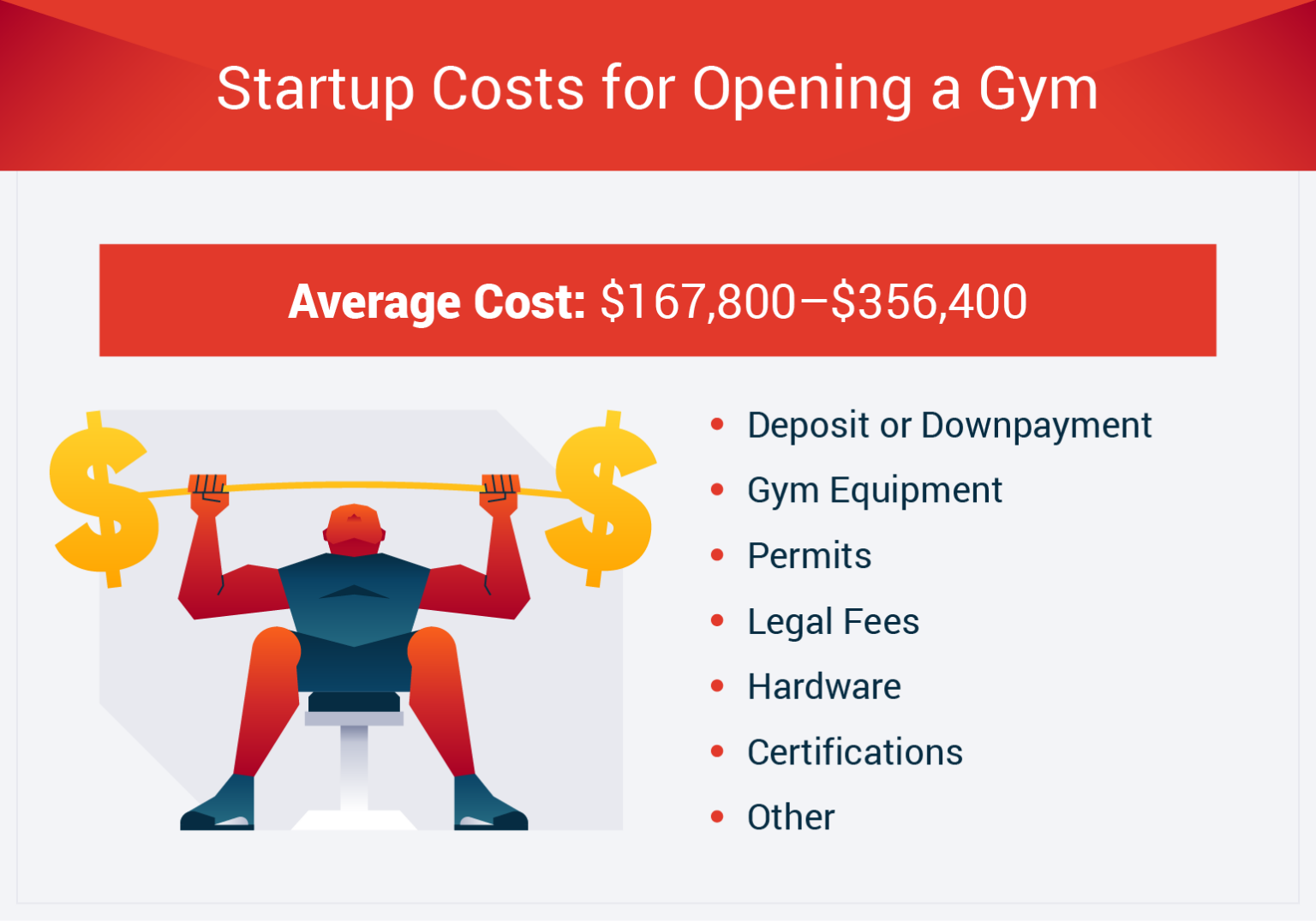

Establishing a legal business entity, such as an LLC or corporation, requires filing fees and potentially legal counsel. According to Nolo, a legal information website, these costs can range from a few hundred to several thousand dollars depending on the complexity and the state.

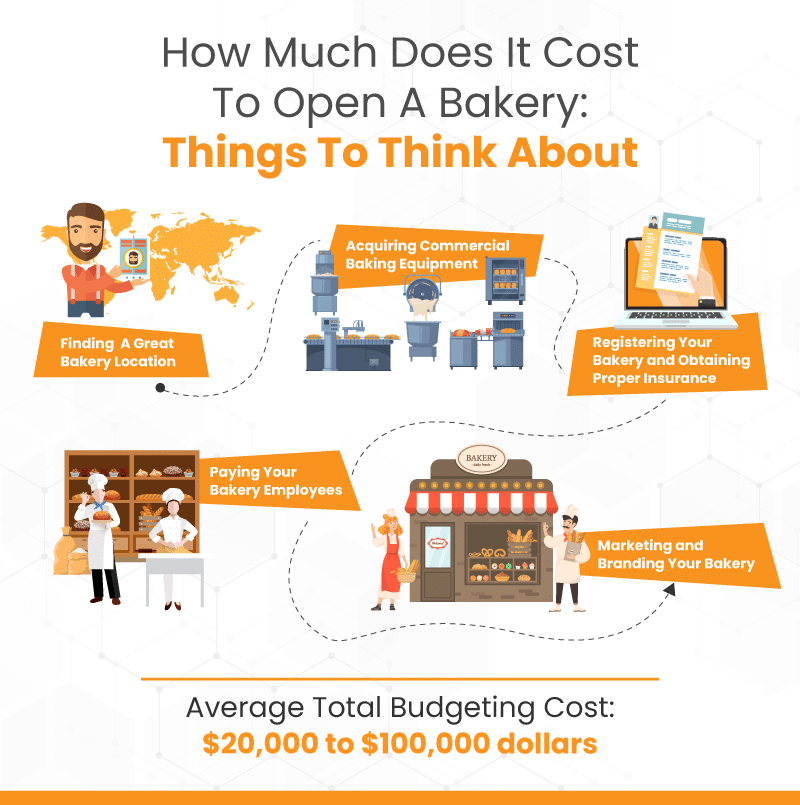

Businesses also need to obtain necessary licenses and permits, which vary by industry and location. Restaurants, for example, require food handling permits and liquor licenses, while construction companies need specific building permits.

Office Space and Equipment

If the business requires a physical location, rent or mortgage payments are a major expense. Even home-based businesses often require dedicated office equipment, such as computers, printers, and specialized software.

Furniture, fixtures, and equipment for retail spaces or restaurants can quickly add up. Point-of-sale (POS) systems are essential for managing transactions and inventory.

Inventory and Supplies

Businesses that sell products need to invest in inventory. The cost of inventory depends on the products being sold and the volume needed.

Consumable supplies, such as packaging materials, cleaning supplies, and office supplies, are also ongoing expenses that need to be factored in.

Marketing and Advertising

Attracting customers is crucial for any new business. Marketing and advertising costs can include website development, social media marketing, online advertising, print advertising, and public relations.

A strong brand identity and a well-defined marketing strategy are essential for reaching the target audience.

Salaries and Wages

If the business requires employees, salaries and wages will be a significant expense. Employer taxes, benefits, and worker's compensation insurance also need to be considered.

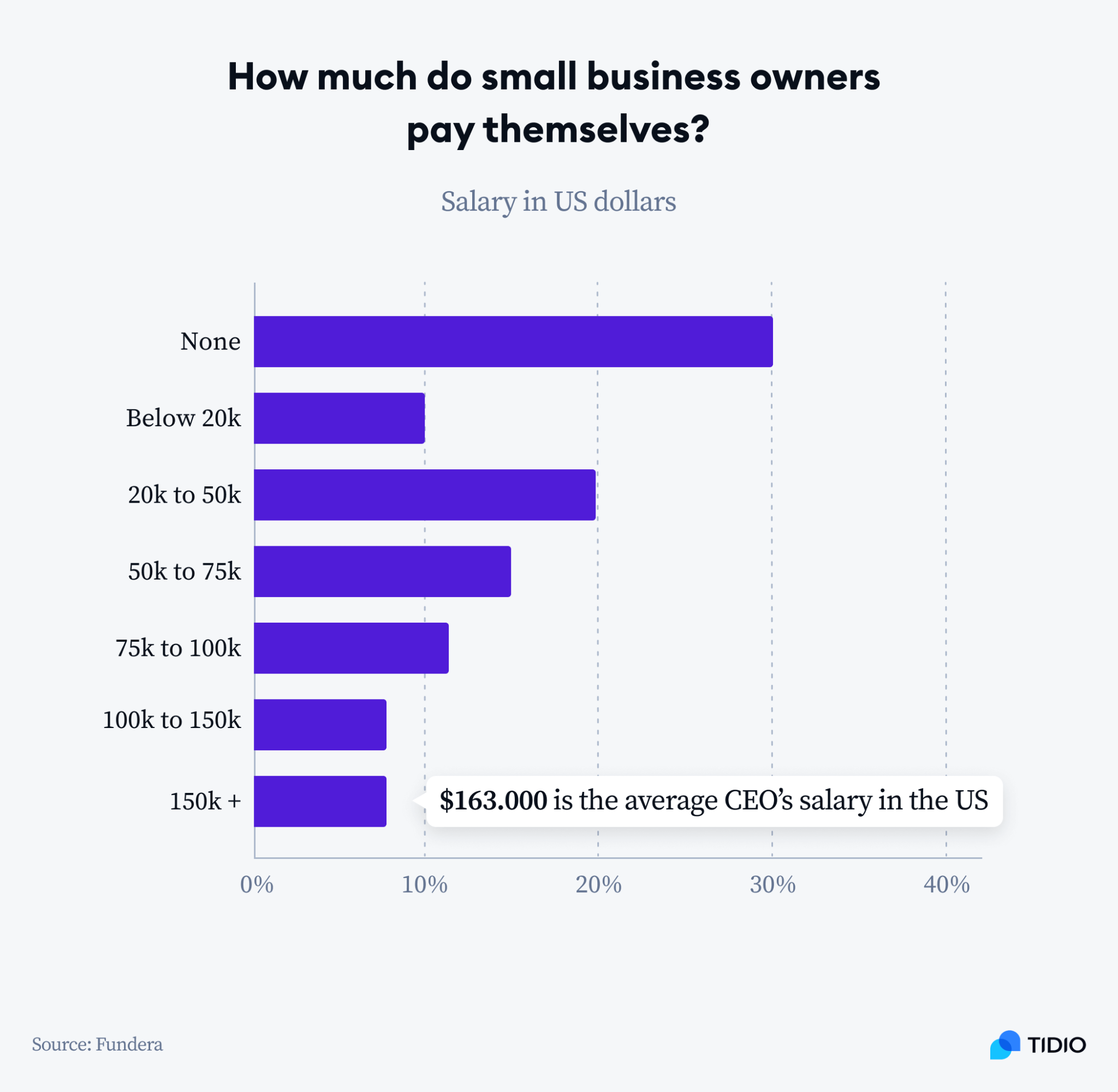

Even if the owner is the only employee initially, drawing a salary or wage needs to be accounted for in the financial projections.

Funding Your Startup

Several funding options are available to aspiring business owners. These include:

- Personal savings: Using personal savings is the most common way to fund a startup.

- Loans: Small business loans are available from banks, credit unions, and online lenders.

- Grants: Government grants and private grants can provide funding for specific types of businesses.

- Angel investors: Angel investors are individuals who invest in early-stage companies.

- Venture capital: Venture capital firms invest in high-growth potential businesses.

The SBA also offers loan programs designed to help small businesses get off the ground.

The Bottom Line

Opening a business can cost anywhere from a few thousand dollars for a micro-business to hundreds of thousands or even millions for a large-scale venture. Thorough research, a well-developed business plan, and careful financial projections are crucial for determining the specific costs involved.

Consulting with business advisors, accountants, and legal professionals can also provide valuable insights and guidance. While the financial commitment is significant, for many, the rewards of entrepreneurship outweigh the risks.