How Much Does Lifelock Cost For Husband And Wife

In an era defined by escalating digital threats, identity theft protection services like LifeLock have become increasingly popular. Many couples seek comprehensive coverage to safeguard both their finances and personal information. Understanding the cost structure for husband and wife plans is a crucial aspect of this decision.

This article aims to provide a clear and concise breakdown of LifeLock's pricing for couples, outlining the various plan options and associated costs. It will also explore the features included in each tier and the potential value they offer. This will help readers make informed decisions about protecting themselves and their families from identity theft.

LifeLock Plan Options and Pricing for Couples

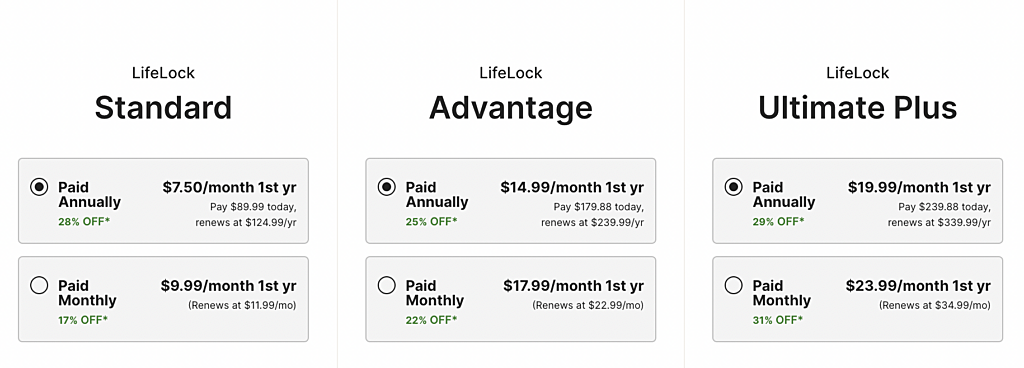

LifeLock offers various tiers of protection, each with different features and price points. The cost for a husband and wife plan generally involves an individual plan for each spouse. This usually means paying for two separate memberships. However, discounts are occasionally offered, particularly during promotional periods.

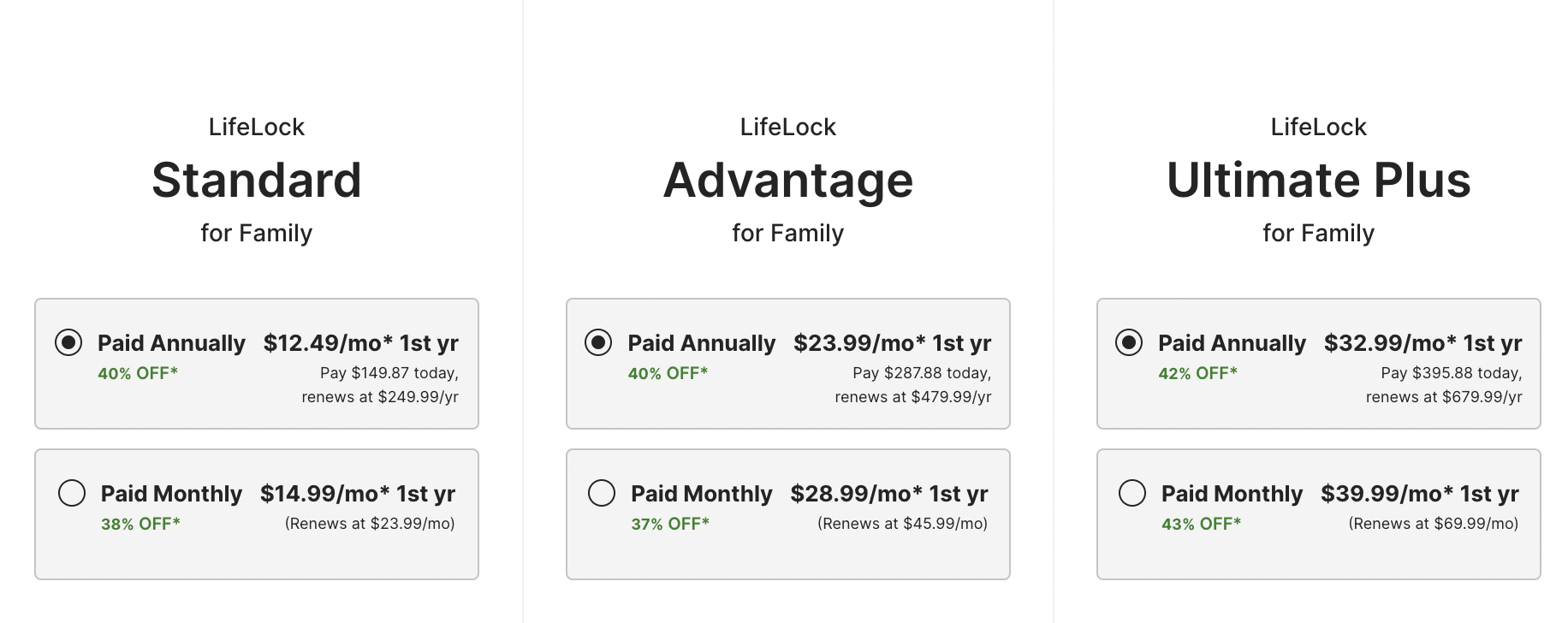

LifeLock Standard

The LifeLock Standard plan, the most basic option, typically includes features like identity monitoring, dark web monitoring, and alerts for potential fraud. Pricing for an individual LifeLock Standard plan can range from $9.99 to $11.99 per month when billed annually. This translates to approximately $20 to $24 per month for a couple.

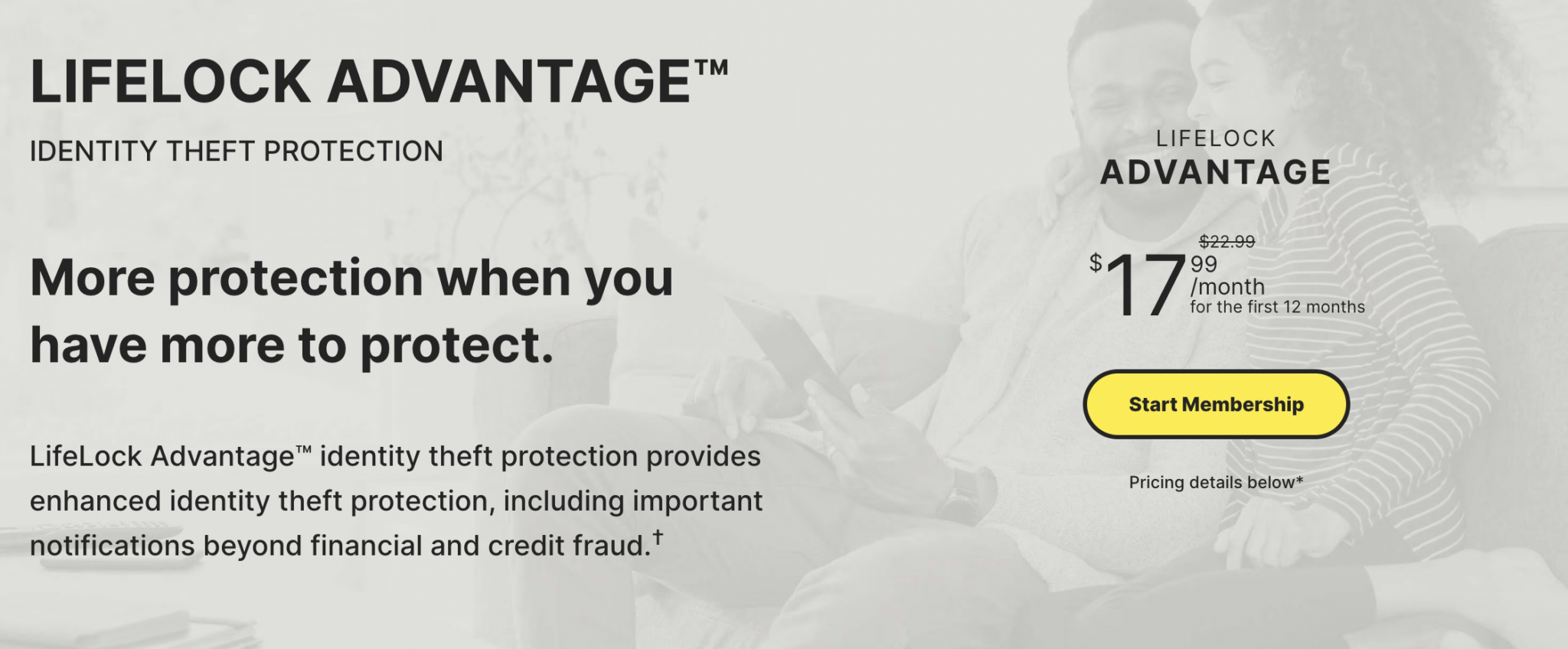

LifeLock Advantage

Stepping up to LifeLock Advantage provides additional protection, often including features such as bank account alerts and credit card activity monitoring. Individual pricing for LifeLock Advantage typically ranges from $19.99 to $24.99 per month when billed annually. A couple could expect to pay between $40 and $50 per month for this level of protection.

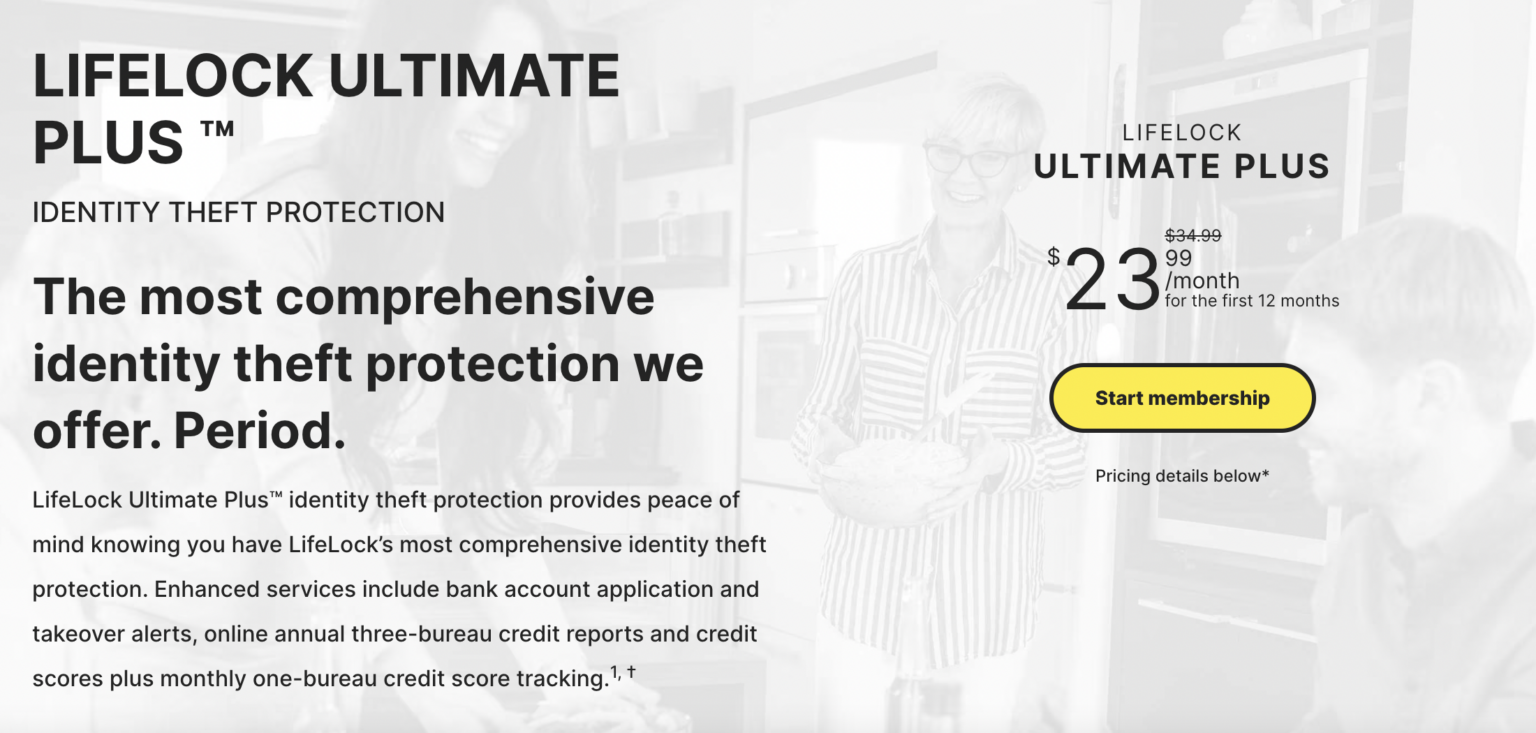

LifeLock Ultimate Plus

The most comprehensive plan, LifeLock Ultimate Plus, offers the most extensive features, including credit monitoring with all three major credit bureaus (Equifax, Experian, and TransUnion), investment account alerts, and more substantial identity theft insurance. Expect to pay around $30 to $35 for one person, which is approximately $60 to $70 for a couple.

It's crucial to note that these prices are estimates and can fluctuate based on promotional offers, subscription length (monthly vs. annual billing), and any discounts applied. Potential customers should always check the official LifeLock website for the most up-to-date pricing information.

Factors Affecting LifeLock Costs

Several factors can influence the overall cost of a LifeLock plan for a couple. The chosen plan tier is the most significant factor, as more comprehensive plans naturally command a higher price. Billing frequency also plays a role, with annual subscriptions often providing a discount compared to monthly payments.

Promotional periods, such as Black Friday or Cyber Monday, frequently feature discounted rates for new subscribers. Bundling options, if available, might offer a slight reduction in the total cost. Always compare offers from multiple identity theft protection services to ensure you are getting the best value for your money.

"Identity theft is a serious threat that can have devastating consequences. Investing in identity theft protection can provide peace of mind and financial security," states a representative from the Identity Theft Resource Center (ITRC).

The Value Proposition

While the cost of LifeLock for a husband and wife can range from approximately $240 to $840 per year, the value lies in the potential cost savings associated with preventing and resolving identity theft. The financial burden of recovering from identity theft can be substantial, encompassing expenses like legal fees, credit repair costs, and lost income.

Beyond the financial aspect, LifeLock provides invaluable peace of mind. Knowing that a dedicated service is monitoring your identity and providing support in the event of a breach can alleviate stress and anxiety. Consider both the financial and emotional benefits when evaluating the cost-effectiveness of identity theft protection.

Ultimately, the decision to invest in LifeLock or a similar service is a personal one. Weigh the costs against the potential risks and benefits. By carefully evaluating your needs and budget, you can make an informed choice that provides the right level of protection for you and your spouse.