How Much Does Liferx Md Cost With Insurance

The cost of prescription medications can be a significant burden for many Americans, especially those managing chronic conditions. LifeRx MD, a service offering personalized medication management and home delivery, presents a potentially attractive option. However, the crucial question remains: How much does LifeRx MD cost, especially when factoring in health insurance coverage?

Understanding the financial implications of LifeRx MD requires a multi-faceted approach. This article delves into the complexities of LifeRx MD's pricing structure, exploring how different insurance plans impact the overall cost. It examines factors such as co-pays, deductibles, and formulary coverage, while also considering potential out-of-pocket expenses and alternative options for managing medication costs.

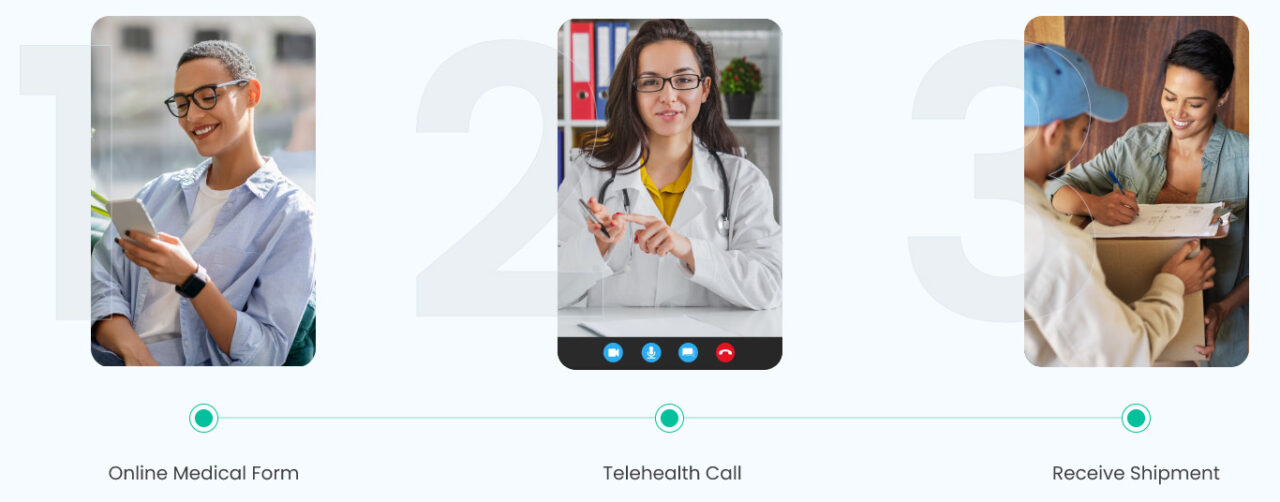

Understanding LifeRx MD's Service and Pricing

LifeRx MD provides a comprehensive service that goes beyond simply filling prescriptions. It includes medication synchronization, home delivery, and consultations with pharmacists.

The core value proposition is convenience and improved adherence to medication regimens.

The pricing model typically involves a combination of factors, influenced by the medications themselves and any service fees associated with the medication management program.

The Role of Insurance in Covering LifeRx MD Costs

Insurance coverage is a pivotal determinant of the final cost for LifeRx MD users. The extent of coverage depends heavily on the specific insurance plan, its formulary, and any pre-authorization requirements.

Formulary coverage dictates which medications are covered by the plan and at what tier.

LifeRx MD needs to be an in-network provider for the insurance plan to receive the maximum benefit.

Investigating Different Insurance Plan Scenarios

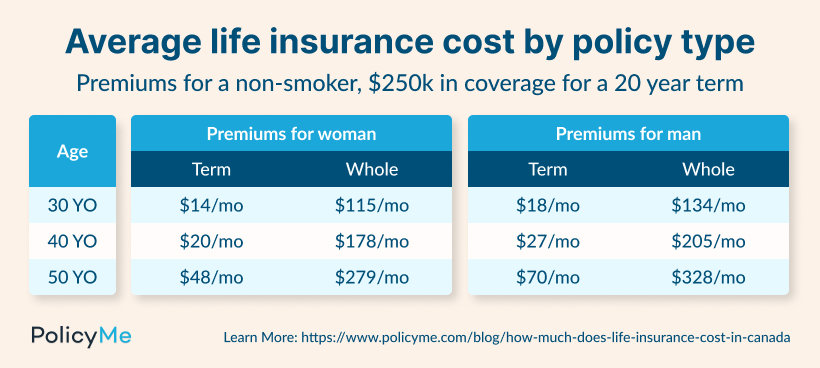

The cost of LifeRx MD varies significantly depending on the type of insurance plan: HMO, PPO, or high-deductible health plan (HDHP).

HMO plans often require members to use in-network providers and may have lower co-pays but less flexibility.

PPO plans offer more flexibility in choosing providers but typically have higher premiums and potentially higher co-pays.

HDHP plans have lower monthly premiums but higher deductibles, meaning individuals pay more out-of-pocket before insurance coverage kicks in.

Individuals with HDHPs could face substantial upfront costs with LifeRx MD until their deductible is met.

Co-pays, Deductibles, and Out-of-Pocket Maximums

These cost-sharing elements significantly influence how much individuals pay for LifeRx MD. A co-pay is a fixed amount paid for each prescription.

The deductible is the amount paid out-of-pocket before insurance starts covering costs.

The out-of-pocket maximum is the maximum amount one has to pay in a year for covered healthcare services.

Navigating Formulary Restrictions and Prior Authorizations

Insurance formularies list the medications covered by the plan, often categorized into tiers with different cost-sharing levels. If a medication is not on the formulary, it may not be covered or may require prior authorization.

Prior authorization is a process where the insurance company requires approval before covering a medication.

This may involve a physician submitting documentation to justify the medical necessity of the drug.

Comparing LifeRx MD with Traditional Pharmacies

Traditional pharmacies often offer lower prices on certain generic medications, especially with discount programs. However, LifeRx MD provides added convenience and medication management services.

It's essential to weigh the cost savings of traditional pharmacies against the benefits of LifeRx MD's services.

Consider factors such as time savings, adherence support, and access to pharmacist consultations.

Exploring Alternative Options for Medication Cost Savings

Several strategies can help individuals reduce their medication costs, regardless of whether they use LifeRx MD or a traditional pharmacy. Generic medications are typically much cheaper than brand-name drugs.

Generic medications have the same active ingredients and are equally effective but are often available at a fraction of the cost.

Patient assistance programs offered by pharmaceutical companies can provide free or discounted medications to eligible individuals.

The Role of Medication Adherence and Long-Term Cost Implications

Improved medication adherence, facilitated by LifeRx MD's services, can potentially lead to better health outcomes and reduced healthcare costs in the long run. Poor adherence can lead to complications, hospitalizations, and increased medical expenses.

Therefore, the cost of LifeRx MD should be considered in the context of its potential impact on long-term health and healthcare spending.

Obtaining Accurate Cost Estimates from LifeRx MD and Insurance Providers

The best way to determine the exact cost of LifeRx MD with insurance is to contact both the company and the insurance provider directly. Inquire about specific medications, formulary coverage, co-pays, and deductibles.

Request a cost estimate for the specific medications needed and clarify any potential out-of-pocket expenses.

Understanding the nuances of insurance coverage and medication costs is crucial for making informed healthcare decisions. While LifeRx MD offers convenience and medication management benefits, it is important to carefully evaluate the cost implications in relation to individual insurance plans and healthcare needs.

Looking forward, increased transparency in prescription drug pricing and greater access to affordable healthcare options are essential for improving patient outcomes and reducing the financial burden of medications. This includes advocating for policies that promote competition among pharmacies, streamline prior authorization processes, and expand access to patient assistance programs.