How Much Is A $5 Gold Coin Worth

The value of a $5 gold coin fluctuates wildly, driven by gold prices and rarity. Certain coins can fetch thousands more than their melt value; act fast to understand what your coin is worth.

This article breaks down the factors impacting the current value of a $5 gold coin, offering essential information for collectors and sellers alike. Knowing the key drivers of value is essential to ensure a fair evaluation.

Key Factors Determining Value

The price of gold is a primary driver. Coin value is intrinsically linked to the current spot price of gold.

Rarity plays a pivotal role. Certain mint years and mint marks are far scarcer, driving up prices exponentially.

Condition significantly impacts value. Coins in pristine condition, graded by services like PCGS or NGC, command premiums.

Gold Content and Spot Price

A $5 gold coin typically contains approximately 0.2419 troy ounces of gold. This directly affects its base value, calculable using the live gold spot price.

As of October 26, 2023, gold is trading around $1,985 per ounce. This puts the intrinsic gold value around $480, but the actual value depends on other factors.

Keep in mind, this is just the melt value. Numismatic value can be much higher.

Identifying Key Dates and Mint Marks

Pay close attention to the coin's date and the mint mark, typically found on the reverse.

San Francisco (S), Carson City (CC), and Dahlonega (D) mint marks often denote higher rarity. 1854-S Half Eagle (a $5 coin) would be a significantly high value coin.

For example, an 1864-S $5 gold coin can be worth tens of thousands of dollars in higher grades.

Grading and Condition Matters

Professional grading by PCGS or NGC authenticates and assesses a coin's condition. These services assign a grade from 1 (Poor) to 70 (Mint State).

A coin graded MS-65 will be worth significantly more than one graded AU-50. This is due to the difference in wear and preservation.

Handle coins with extreme care. Improper handling can damage the coin and lower its value.

Common Types of $5 Gold Coins

Several types of $5 gold coins were minted in the United States. Each has its own unique characteristics and potential value.

The most common are the Liberty Head and the Indian Head designs. These are the most popular among collectors.

Understanding the nuances of each type is crucial for accurate valuation.

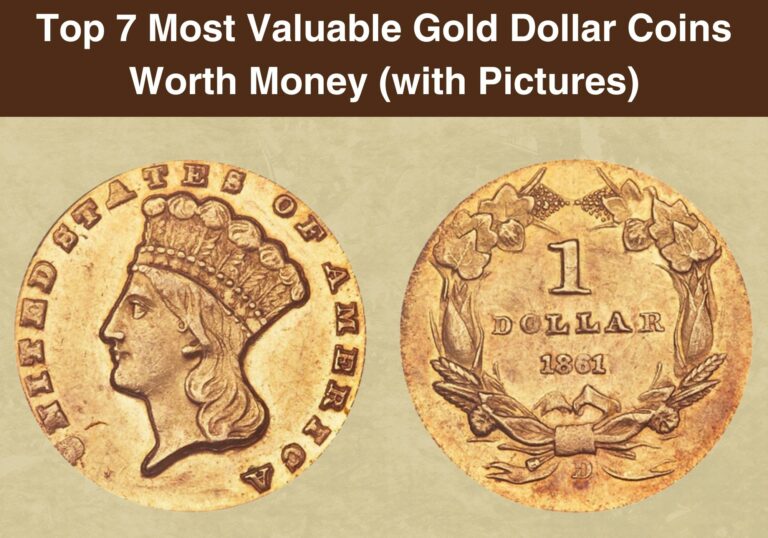

Liberty Head Half Eagle

Minted from 1839 to 1908, the Liberty Head Half Eagle features a bust of Liberty on the obverse. The reverse displays an eagle with a shield.

Key dates include 1854-O and 1864-S, which command significant premiums. These are generally sought after by collectors.

Condition and mint mark are the two most important factors for this type of coin.

Indian Head Half Eagle

Designed by Bela Lyon Pratt, the Indian Head Half Eagle was minted from 1908 to 1929. The design is incuse, meaning the image is pressed into the coin.

This coin features an Indian wearing a feathered headdress on the obverse. The reverse features an eagle standing on arrows and an olive branch.

While generally more common than the Liberty Head, certain dates and high grades still command high prices.

Where to Get Your Coin Appraised

Several options exist for getting your $5 gold coin appraised. Choose wisely to ensure an accurate and fair valuation.

Reputable coin dealers, auction houses, and online grading services are all possibilities. Research their reputations before proceeding.

Avoid pawn shops, as they may offer below-market value.

Professional Coin Dealers

Local coin dealers can offer expert appraisals based on market conditions and coin condition. Look for dealers affiliated with professional organizations.

Ensure the dealer is knowledgeable and experienced in dealing with gold coins. Seek a second opinion if needed.

Getting multiple opinions is crucial to understand true market value.

Auction Houses

Major auction houses like Heritage Auctions and Stack's Bowers Galleries specialize in rare coins. They can reach a wider audience of potential buyers.

Auctions can realize higher prices, but fees and commissions will apply. Thoroughly research the fees involved.

This can be a good option if the coin is rare and high grade.

Next Steps and Ongoing Developments

Monitor gold prices and the rare coin market. Stay informed about trends and auction results.

Consider having your coin professionally graded to maximize its value. The long-term investment in grading is often justified.

Continue researching your specific coin to uncover its full potential value. The market can change quickly, so staying up-to-date is essential.