How Much Is A Share Of Coca Cola Stock

In the ever-fluctuating world of the stock market, understanding the value of a blue-chip company like Coca-Cola is crucial for investors. The price of a single share of Coca-Cola stock (KO) is more than just a number; it's a reflection of the company's performance, market sentiment, and broader economic trends.

This article provides a detailed overview of Coca-Cola's current stock price, factors influencing its value, and expert perspectives on its future potential.

Current Coca-Cola (KO) Stock Price

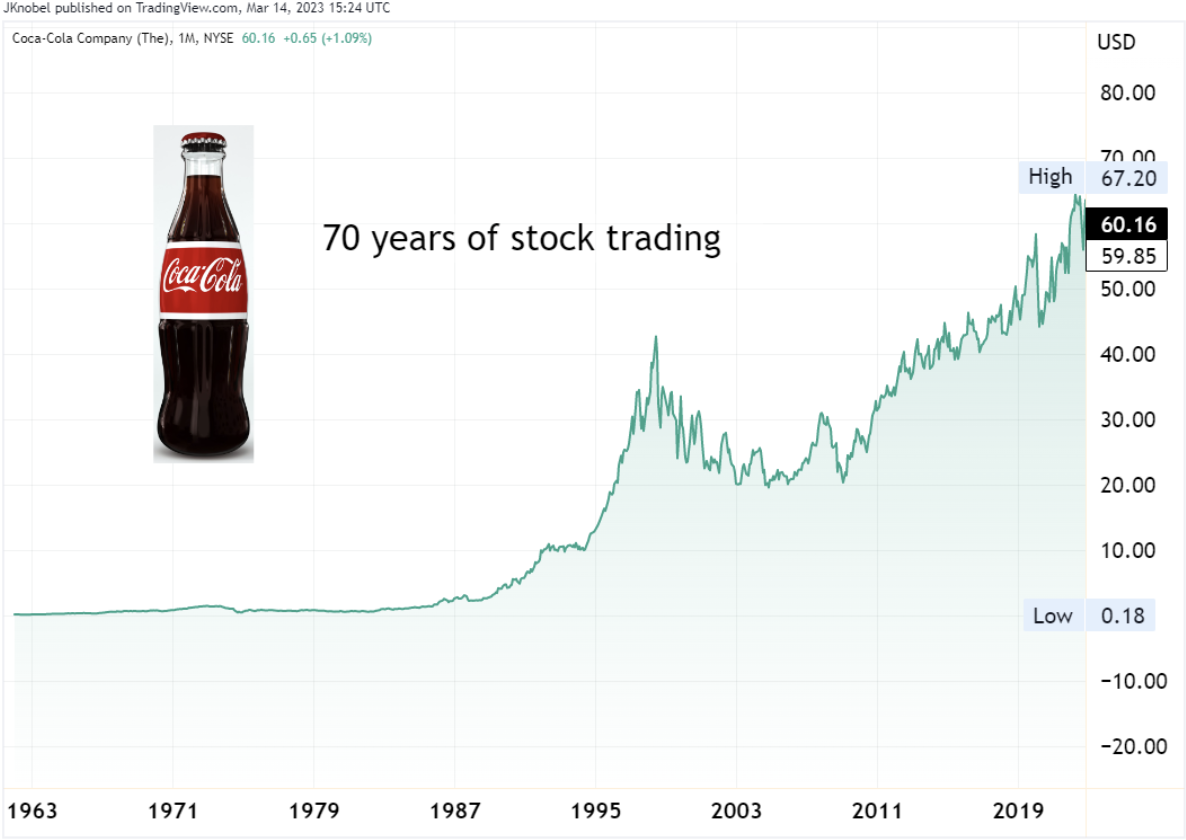

As of late October 2024, Coca-Cola stock (KO) is trading around $50 per share. However, this figure is dynamic and can fluctuate throughout the trading day based on various market forces.

Investors can find the most up-to-date price on major financial websites like the New York Stock Exchange (NYSE).

Factors Influencing Coca-Cola's Stock Price

Several key factors contribute to the price movements of Coca-Cola stock.

Company Performance

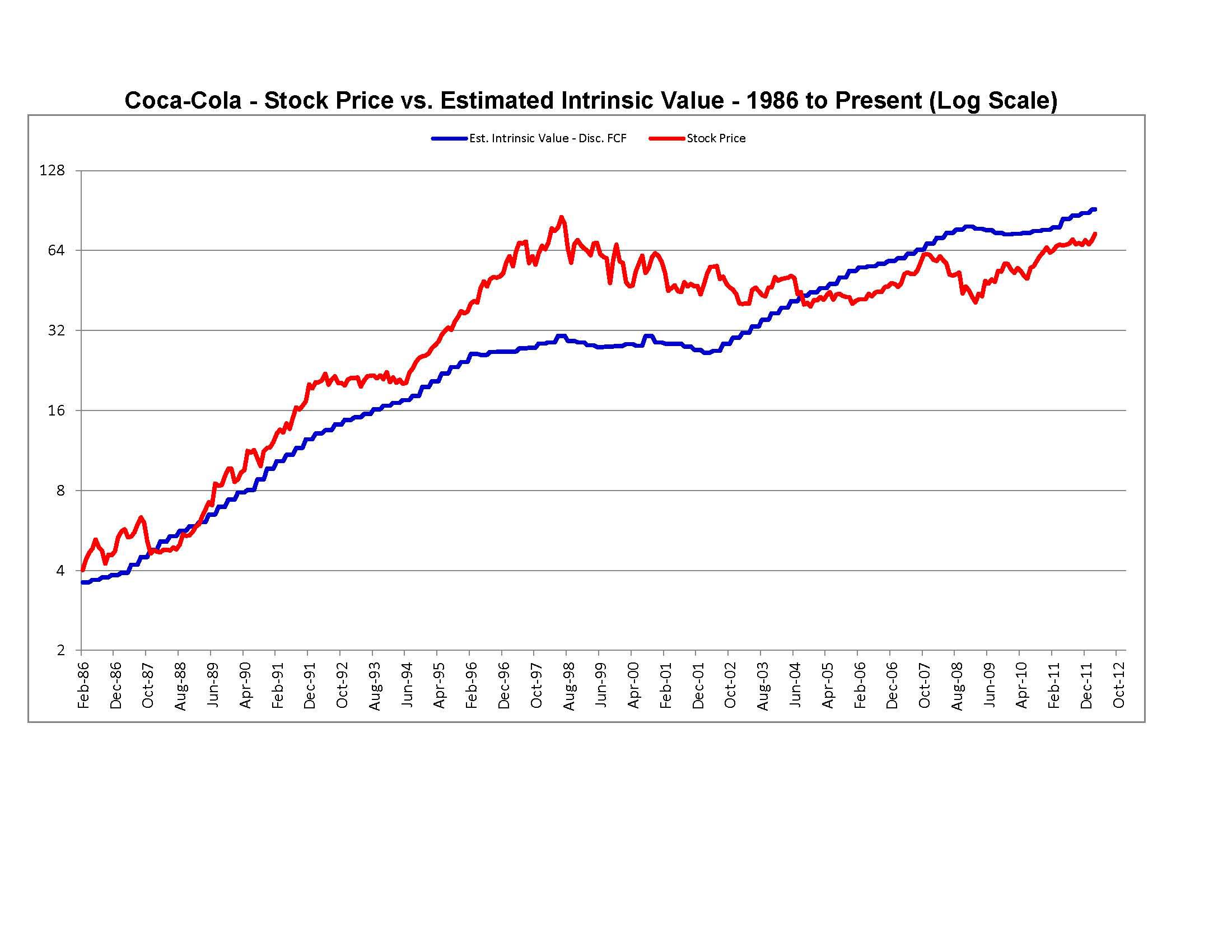

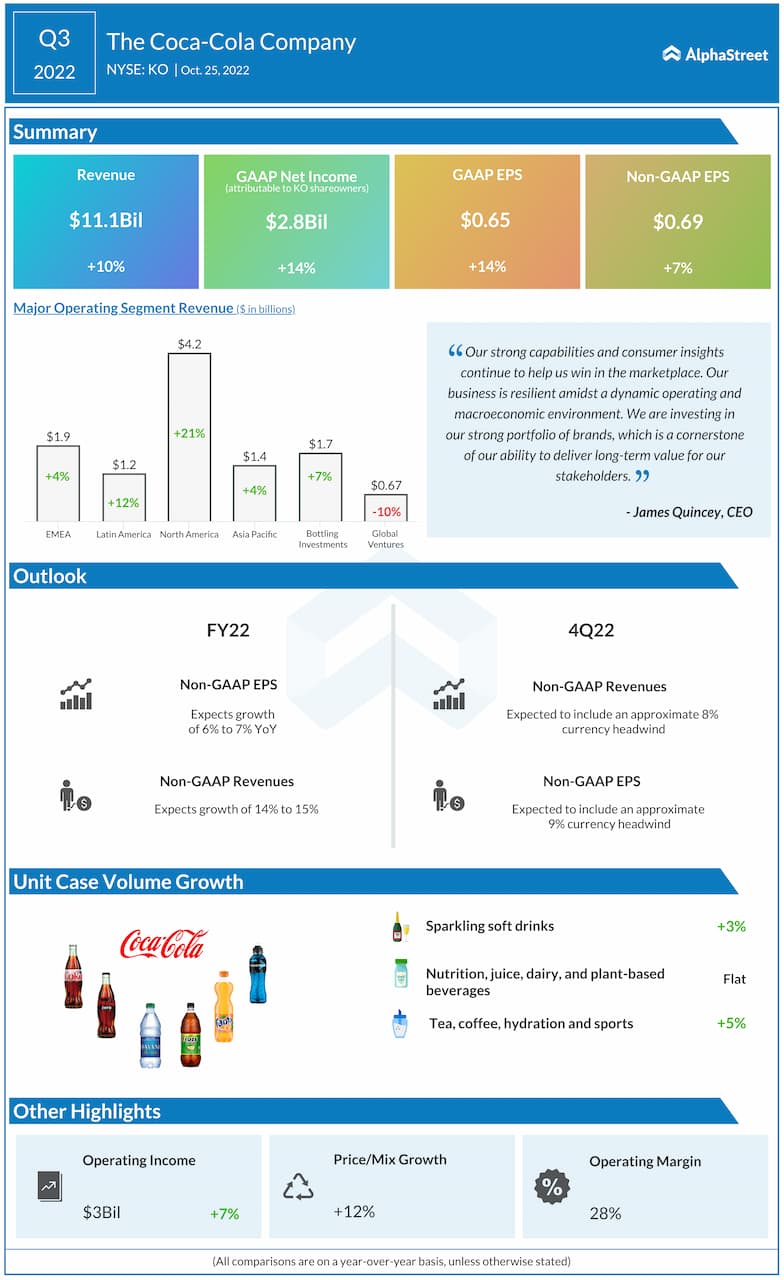

Coca-Cola's financial health, as reflected in its quarterly and annual earnings reports, is a primary driver.

Strong revenue growth, healthy profit margins, and positive earnings per share (EPS) generally lead to increased investor confidence and a higher stock price.

Market Sentiment

Broader market trends and investor sentiment play a significant role.

A bullish market often lifts most stocks, including Coca-Cola, while a bearish market can exert downward pressure.

Economic Conditions

The overall health of the economy impacts consumer spending and, consequently, Coca-Cola's sales.

During economic downturns, consumers may cut back on non-essential purchases, affecting Coca-Cola's revenue and stock price.

Dividend Payments

Coca-Cola is known for its consistent dividend payments, making it an attractive investment for income-seeking investors.

Changes in dividend policy can influence investor perception and stock value.

Expert Perspectives on Coca-Cola Stock

Financial analysts offer diverse opinions on the future prospects of Coca-Cola stock.

Some analysts maintain a "buy" rating, citing Coca-Cola's strong brand recognition, global presence, and ability to adapt to changing consumer preferences.

These analysts point to Coca-Cola's investments in new product categories and its focus on sustainability as positive factors.

Others are more cautious, expressing concerns about the impact of health trends and increasing competition from alternative beverage companies.

These analysts suggest that Coca-Cola needs to continue innovating to maintain its market share and growth momentum.

Investing in Coca-Cola: Risks and Rewards

Investing in any stock involves risks, and Coca-Cola is no exception.

Potential risks include changing consumer preferences, regulatory challenges, and currency fluctuations.

However, Coca-Cola also offers potential rewards, such as dividend income, long-term growth potential, and the stability associated with a well-established company.

Looking Ahead

The future price of Coca-Cola stock will depend on a combination of company-specific factors, market conditions, and broader economic trends.

Investors should carefully consider their own risk tolerance and investment goals before investing in Coca-Cola or any other stock.

Staying informed about Coca-Cola's performance and the factors influencing its stock price is essential for making informed investment decisions.

(002).png)

:max_bytes(150000):strip_icc()/ko1-f55660278d23491bb4dc5d1bb4bf228d.jpg)