How Much Is Allstate Motorcycle Insurance

Motorcycle enthusiasts know the open road comes with a price, and beyond the cost of a bike, gear, and maintenance, insurance looms large. Understanding the costs associated with Allstate motorcycle insurance, one of the nation's largest providers, is crucial for riders looking to stay protected without breaking the bank. The premiums can vary widely based on several factors, making it difficult to pinpoint a single "how much" answer.

Navigating the complexities of motorcycle insurance premiums requires a comprehensive look at the elements that drive pricing. From rider demographics and location to the bike's make and model, and the coverage levels chosen, each variable plays a significant role in determining the final cost. This article dives deep into the factors influencing Allstate motorcycle insurance rates, providing riders with the information needed to make informed decisions and potentially save money.

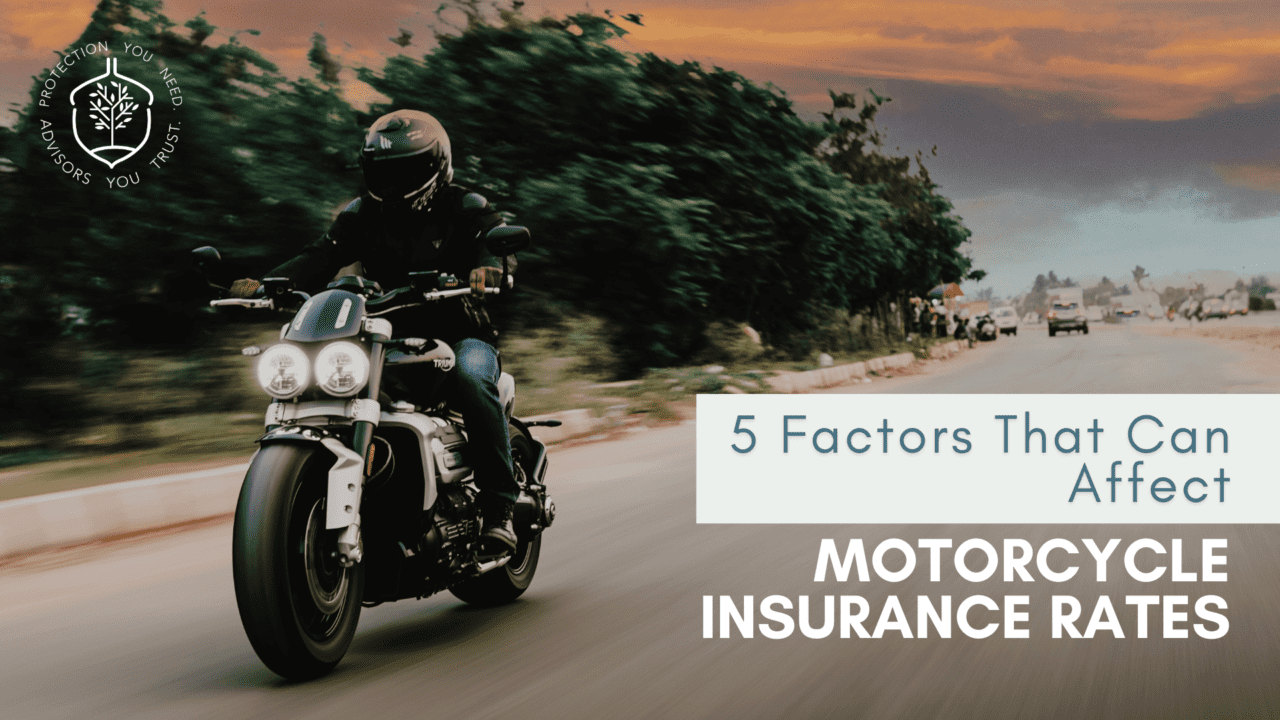

Factors Influencing Allstate Motorcycle Insurance Rates

Rider Demographics

Age and experience are critical determinants for insurance companies. Generally, younger, less experienced riders face higher premiums. This is due to statistical data indicating a higher likelihood of accidents within this demographic, according to the Insurance Information Institute (III).

Conversely, older, more seasoned riders often receive more favorable rates. A clean driving record, devoid of accidents and violations, further strengthens a rider's position, resulting in lower insurance costs.

Motorcycle Type

The make, model, and engine size of the motorcycle significantly impact insurance costs. Sport bikes and high-performance models, known for their speed and acceleration, typically attract higher premiums. Allstate considers the inherent risk associated with these bikes, as they are more prone to accidents.

Cruisers, touring bikes, and standard motorcycles are often less expensive to insure. These bikes are typically viewed as less risky compared to sport bikes, resulting in lower premiums for responsible riders.

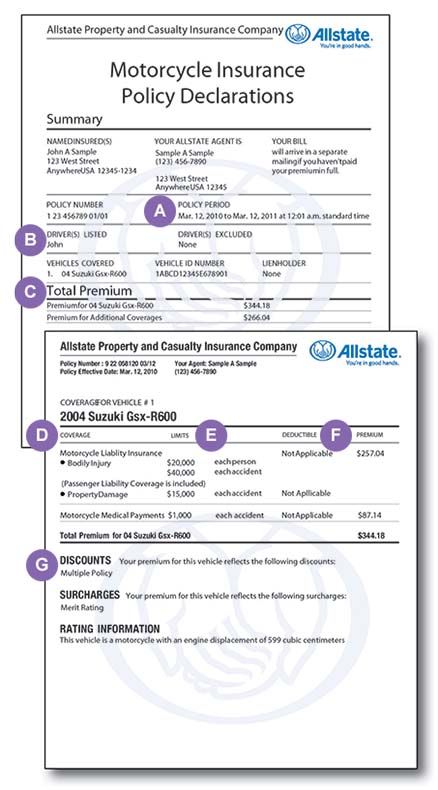

Coverage Levels

The type and amount of coverage chosen significantly affect the overall insurance cost. Liability coverage, which covers damages to others in an accident you cause, is usually the minimum required by law.

However, comprehensive and collision coverage offer broader protection, covering damages to your own motorcycle, regardless of fault. Opting for higher coverage limits and additional features, such as uninsured/underinsured motorist protection, will increase your premium.

Location

Location plays a significant role in determining insurance rates. Urban areas with higher traffic density and a greater risk of accidents tend to have higher premiums compared to rural areas.

State laws and regulations also influence insurance costs. Some states have stricter insurance requirements, leading to potentially higher premiums for Allstate customers.

Average Cost Estimates

Providing an exact "how much" answer is impossible without specific rider and motorcycle information. However, industry data and sample quotes can provide a general idea of Allstate motorcycle insurance costs.

According to various sources, the average annual cost for motorcycle insurance can range from a few hundred dollars to over a thousand, depending on the factors mentioned above. Getting personalized quotes is essential for an accurate assessment.

Discounts and Savings

Allstate offers various discounts that can help riders lower their insurance premiums. Common discounts include safe rider courses, multiple policy discounts (bundling with auto or home insurance), and affiliation discounts (e.g., with motorcycle clubs).

Maintaining a clean driving record is crucial for earning and retaining discounts. Exploring all available discount options with an Allstate representative can lead to significant savings.

The Future of Motorcycle Insurance

The motorcycle insurance landscape is constantly evolving. Advancements in motorcycle technology, such as anti-lock brakes (ABS) and traction control, may influence future insurance rates.

Telematics, which uses data from onboard sensors to track riding behavior, could also play a role in personalized insurance pricing. As motorcycle technology advances, insurance companies will adapt their pricing models accordingly, potentially offering greater incentives for riders with safer habits and technologically advanced bikes.

Ultimately, understanding the factors that influence Allstate motorcycle insurance rates empowers riders to make informed decisions, shop around for the best coverage, and potentially save money. By carefully considering their individual needs and circumstances, riders can find the right balance between protection and affordability on the open road.

:max_bytes(150000):strip_icc()/what-is-the-average-cost-of-motorcycle-insurance-527362_FINAL-50c0673de76a4d478a4040b170acadb3.png)