How Much Is Car Insurance In The Us

The cost of car insurance in the United States is a significant expense for many drivers, but pinpointing an exact national average is a complex endeavor. Premiums fluctuate widely depending on a multitude of factors, creating a dynamic and often confusing landscape for consumers.

Understanding these contributing elements is crucial for drivers seeking affordable coverage. This article aims to dissect the average cost of car insurance in the US, while also detailing the variables that can dramatically influence individual rates.

National Averages and Key Influencers

According to recent data from organizations like the Insurance Information Institute (III) and NerdWallet, the average annual cost of car insurance in the US hovers around $1,771 for full coverage. This figure includes liability, collision, and comprehensive coverage.

Minimum coverage, which typically only includes liability, averages around $565 per year. However, these are just averages, and the actual price you pay could be significantly higher or lower.

Factors Affecting Car Insurance Rates

Several factors impact the price of your car insurance. Your driving record is one of the most significant.

Accidents, tickets, and DUIs can lead to substantial rate increases. Insurance companies view drivers with a history of violations as higher risk.

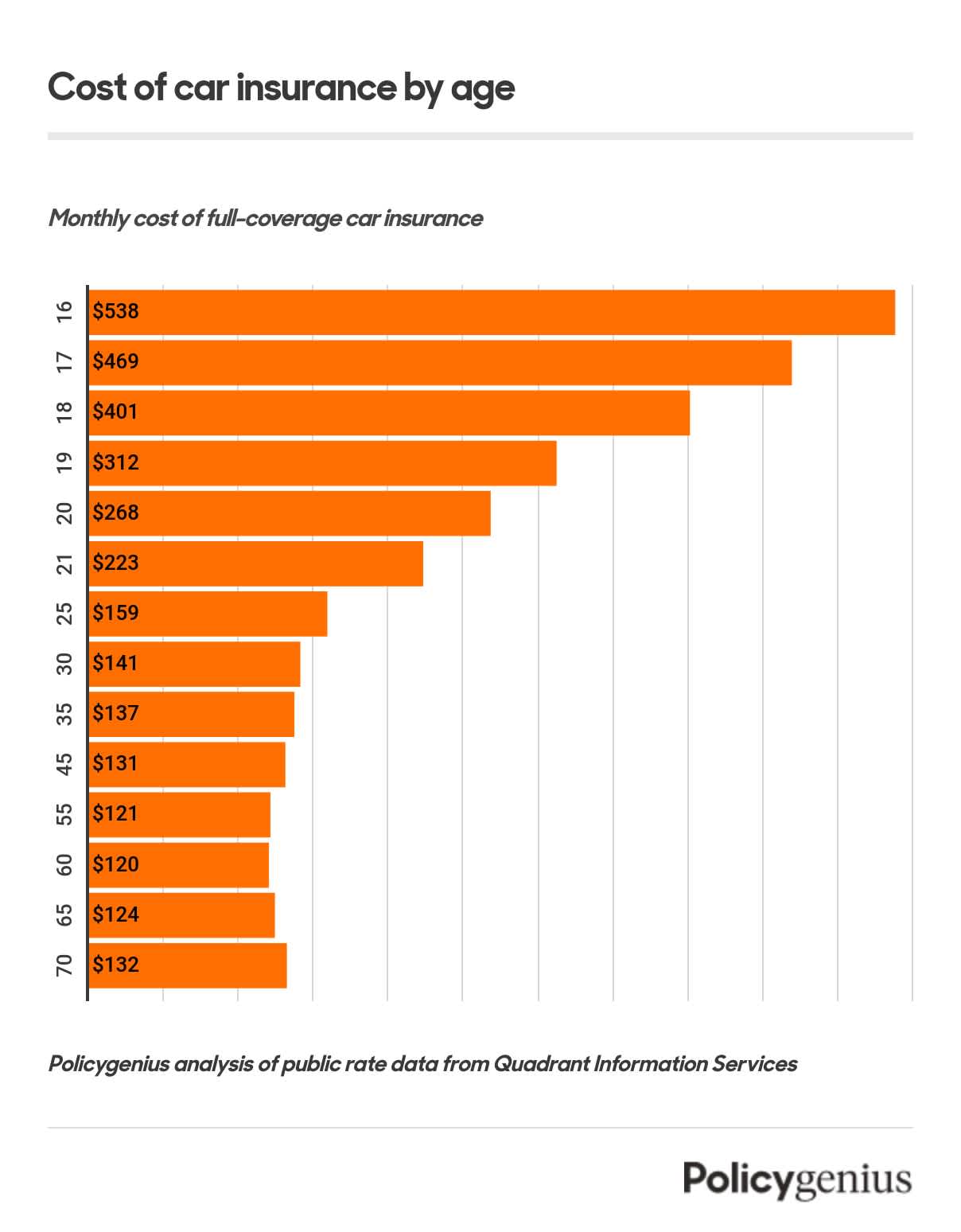

Your age and gender also play a role. Younger drivers, particularly those under 25, typically pay more due to their relative inexperience. Some states prohibit the use of gender as a rating factor.

The type of car you drive is another important consideration. More expensive cars, those with high repair costs, or those frequently targeted by thieves generally cost more to insure.

Your location matters too. Urban areas with higher population density and traffic congestion often have higher rates than rural areas. State laws and regulations also impact premiums.

Finally, the coverage levels you choose directly influence the price. Opting for higher liability limits, lower deductibles, or adding optional coverages will increase your premium.

State-by-State Variations

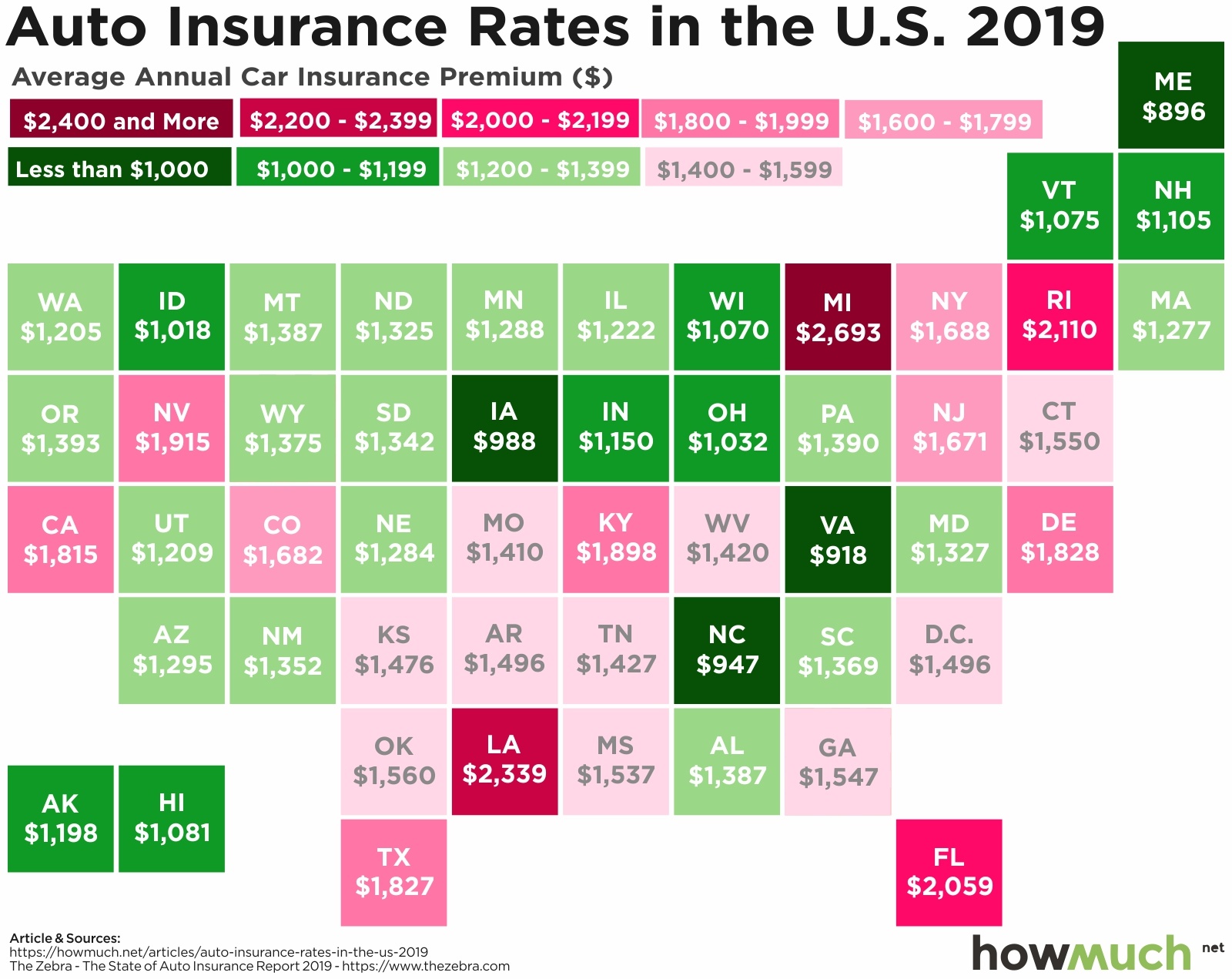

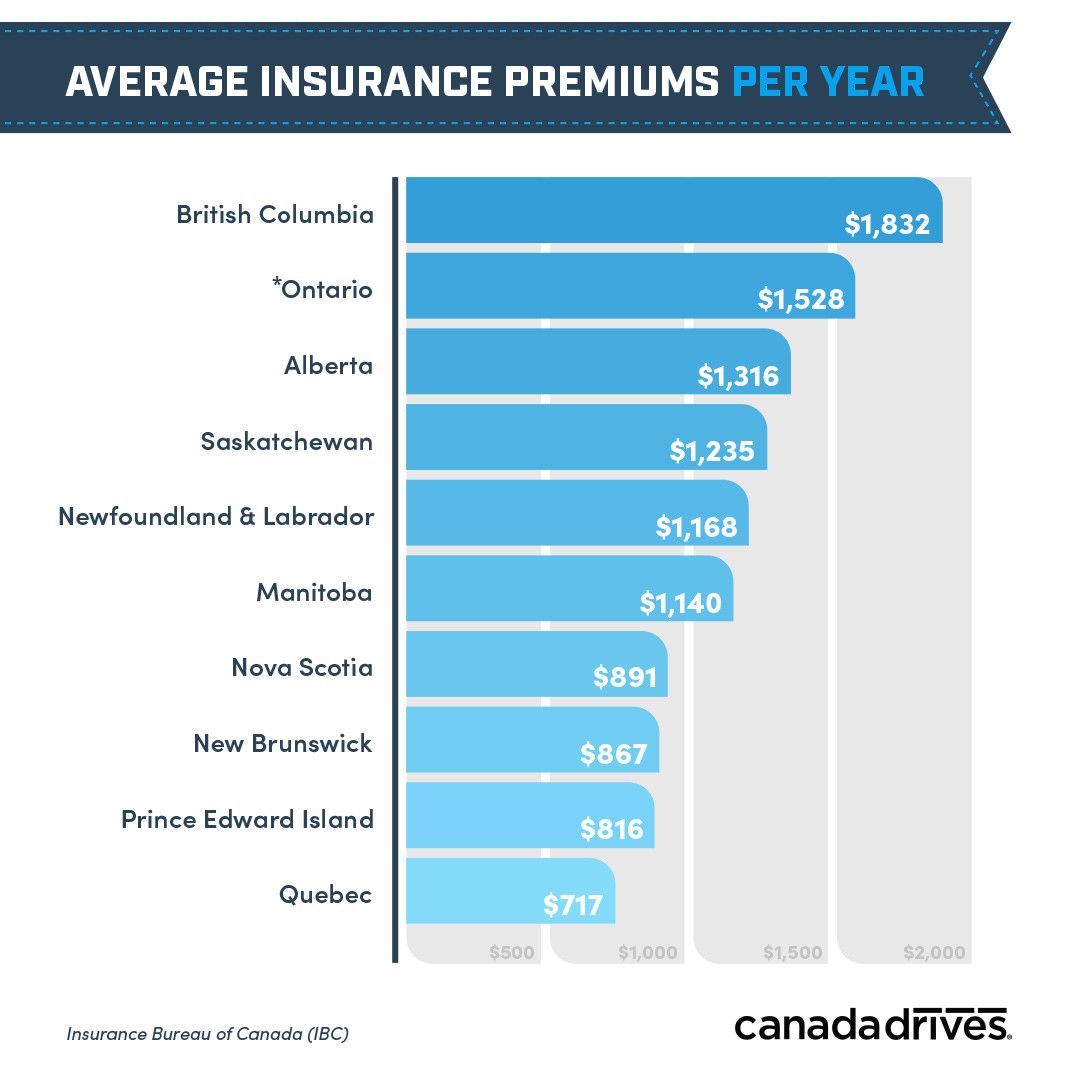

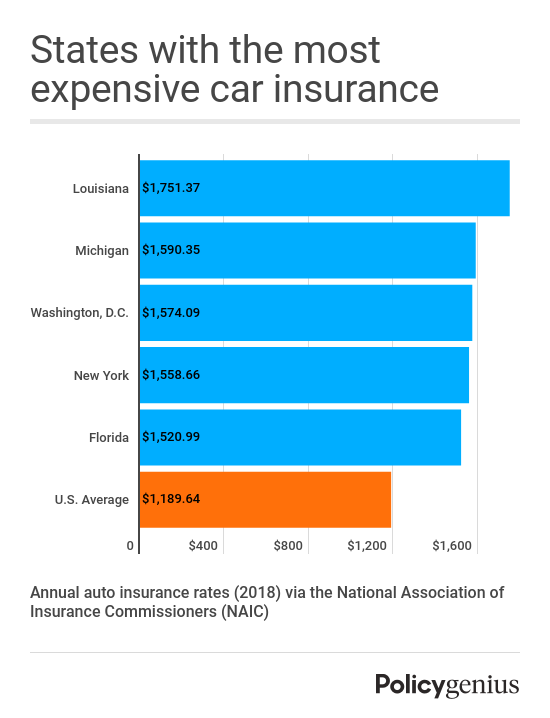

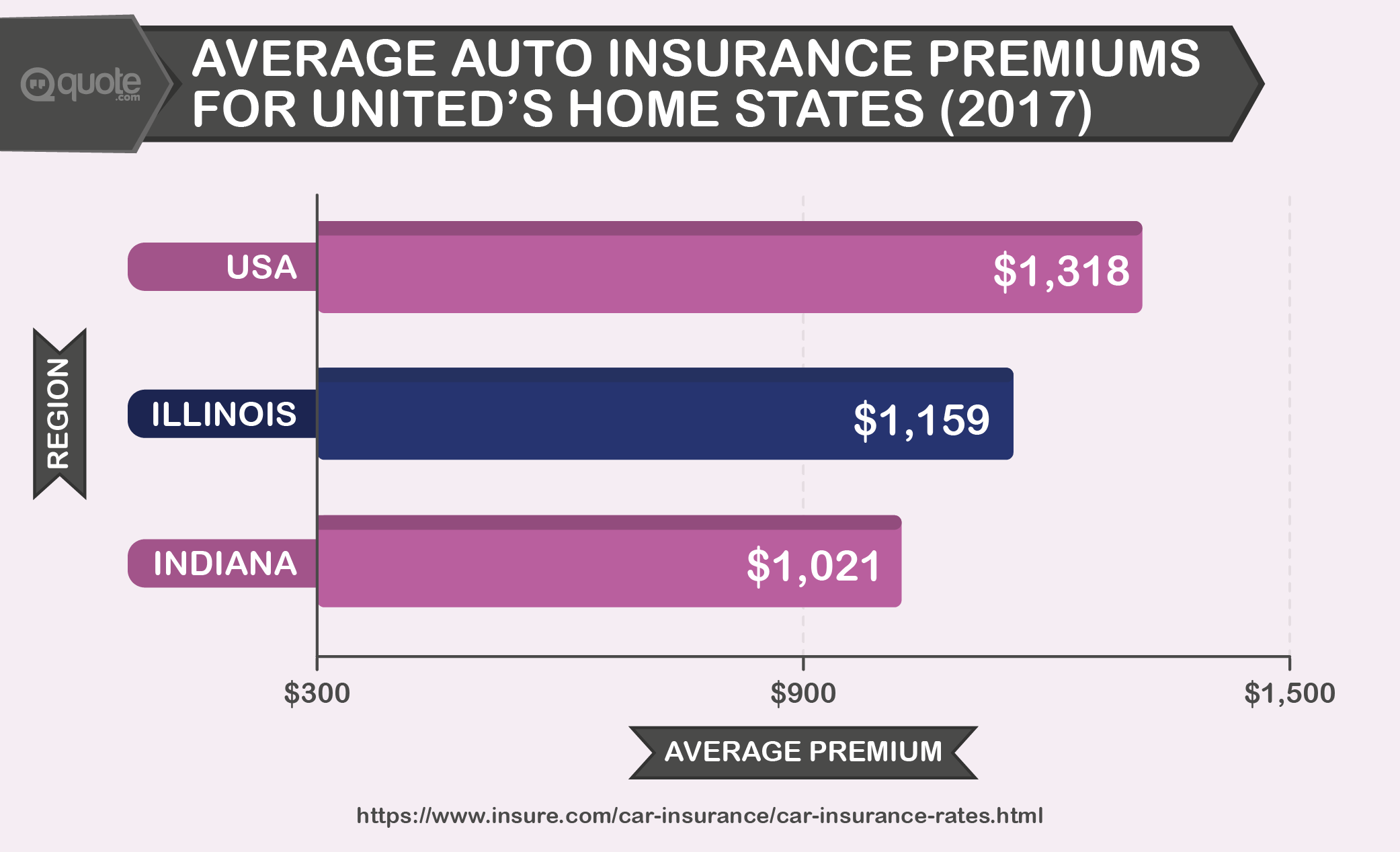

Car insurance rates vary widely from state to state. Factors such as state laws, population density, and the prevalence of uninsured drivers can contribute to these differences.

For example, states like Michigan and Louisiana consistently have some of the highest average rates. According to the III, Michigan's average premium is significantly higher due to its unique no-fault insurance system.

On the other hand, states like Maine and Idaho tend to have some of the lowest average rates. These states generally have lower population densities, fewer uninsured drivers, and less litigious environments.

Impact on Consumers

The cost of car insurance can have a significant impact on household budgets. For some lower-income families, it can be a substantial financial burden, potentially leading to uninsured driving.

The National Association of Insurance Commissioners (NAIC) has resources available to help consumers understand their coverage options and shop for the best rates.

Many insurance companies offer discounts for things like safe driving, bundling policies, and having anti-theft devices. Taking advantage of these discounts can help lower your premium.

Looking Ahead

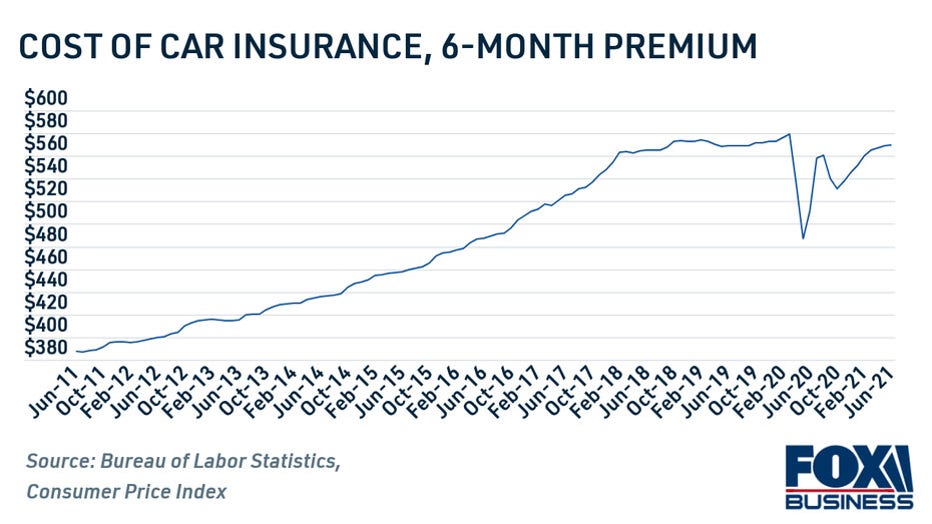

The car insurance market is constantly evolving. Factors such as advancements in vehicle technology and changes in driving behavior are likely to continue to impact rates in the future.

For example, the increasing prevalence of advanced driver-assistance systems (ADAS) could potentially lead to fewer accidents and lower premiums over time. However, the high cost of repairing these systems could also offset some of these savings.

Staying informed about these trends and regularly comparing quotes from different insurers is essential for consumers seeking to manage their car insurance costs effectively. By understanding the factors that influence premiums and taking proactive steps to reduce risk, drivers can potentially save hundreds of dollars per year.

:max_bytes(150000):strip_icc()/how-much-does-car-insurance-cost-5072100_final-915c31d331c9435085f258da3e1e1852.png)

.png)