How Much Money Do You Need To Open Bank Account

Imagine strolling down Main Street, sunlight glinting off the glass facades of the local bank branches. You pause, a gentle breeze rustling through the trees, considering taking the plunge and opening your first bank account. The question lingers: how much do you actually need to get started? The answer, thankfully, might be more welcoming than you think.

This article delves into the surprisingly accessible world of opening a bank account, revealing the typical minimum deposits required and highlighting the growing number of options that require little to no initial investment. Knowing your options empowers you to take control of your financial future, regardless of your current budget.

The Landscape of Minimum Deposits

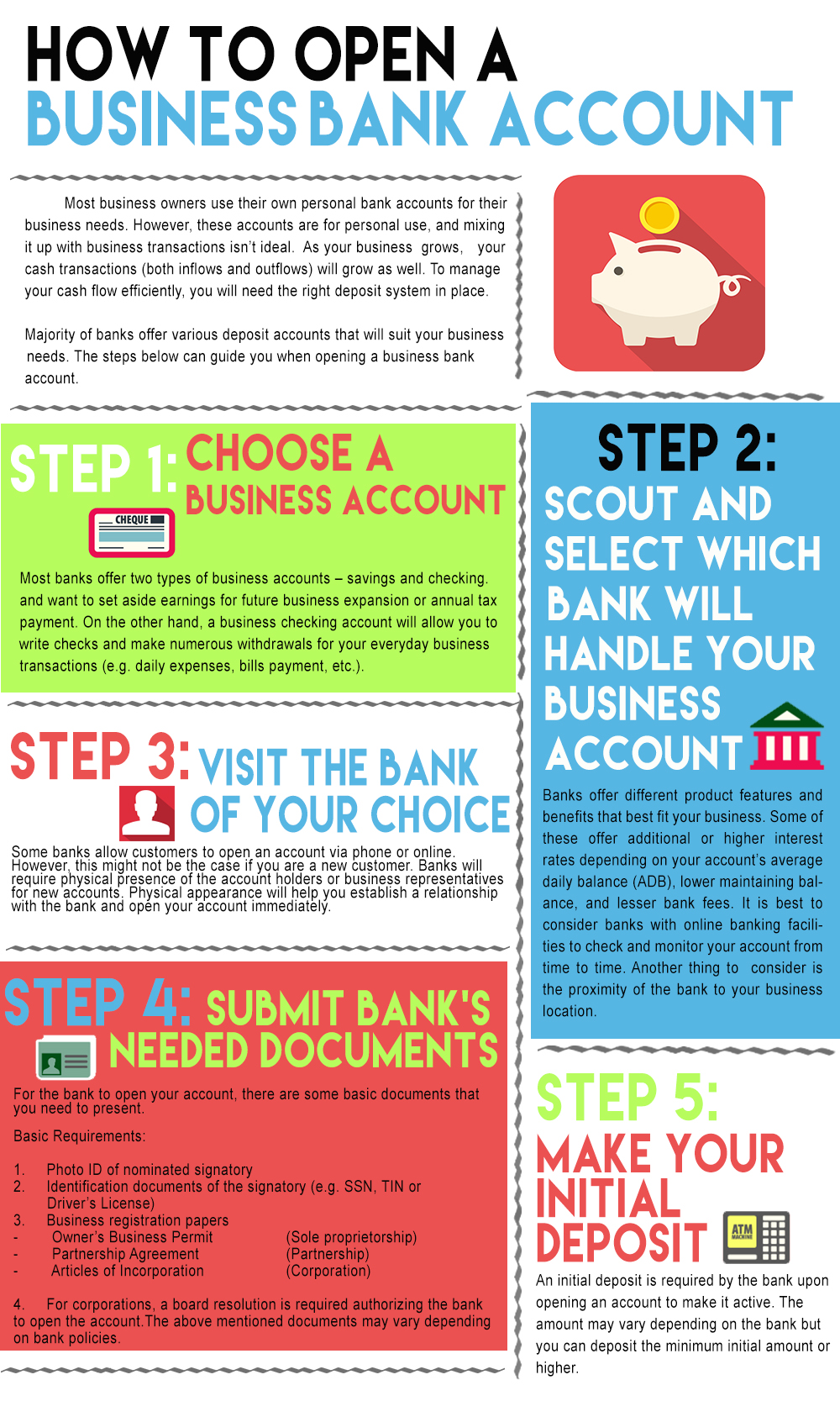

Historically, opening a bank account often came with the expectation of a substantial initial deposit. This requirement acted as a barrier for many, especially those just starting their financial journey. But the banking landscape has evolved.

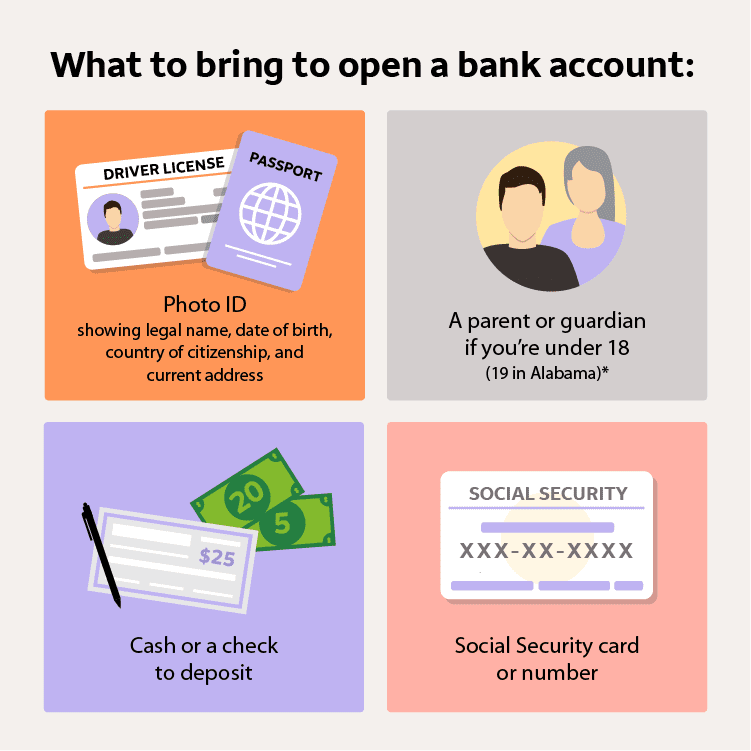

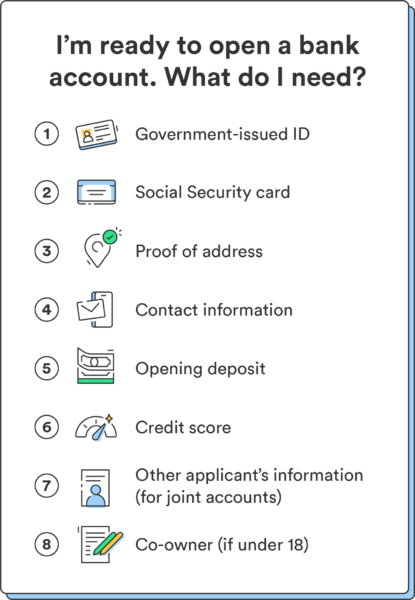

According to a recent survey by the Federal Deposit Insurance Corporation (FDIC), the average minimum deposit to open a checking account ranges from $25 to $100 at many traditional banks. Savings accounts may have similar requirements.

However, it's important to note that these are just averages. Many banks, especially online institutions, are breaking the mold.

Online Banks: A Low-Cost Alternative

The rise of online banking has brought with it a wave of fee-free and low-minimum deposit options. Online banks often have significantly lower overhead costs than traditional brick-and-mortar institutions. This allows them to offer more competitive terms.

Many online banks require absolutely no minimum deposit to open an account. This is a game-changer for individuals looking to start saving without a large upfront investment.

These banks often offer attractive interest rates as well, making them a compelling choice for both checking and savings accounts.

Credit Unions: Community-Focused Banking

Credit unions, member-owned financial cooperatives, often present another attractive alternative. They tend to prioritize customer service and community involvement over profit maximization.

Minimum deposit requirements at credit unions are typically lower than those at traditional banks. Some may require as little as $5 to open an account, often used to purchase a share in the credit union itself.

Membership in a credit union is usually based on specific criteria, such as residing in a particular geographic area or working for a specific employer.

Beyond the Minimum: Factors to Consider

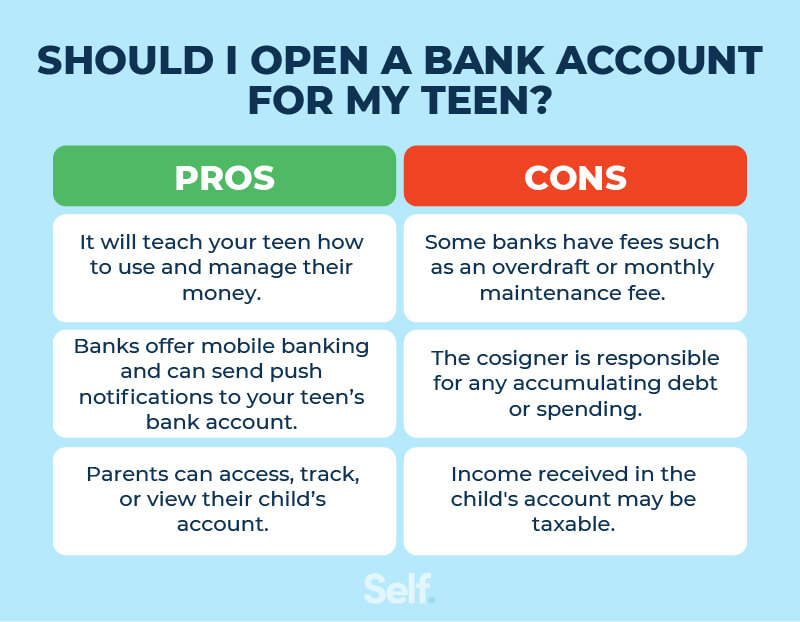

While the minimum deposit is a crucial factor, it's not the only consideration when choosing a bank account. It's important to look at the big picture.

Consider monthly fees, ATM access, interest rates, and the convenience of online and mobile banking services. Read the fine print carefully to avoid any hidden fees.

Think about your banking needs and choose an account that aligns with your financial goals. A high-yield savings account might be ideal if you're focused on growing your savings.

"Opening a bank account is a foundational step towards financial well-being," says Sarah Johnson, a certified financial planner. "Don't let the perceived barrier of a high minimum deposit hold you back. Explore your options and find an account that works for you."

Opening a bank account doesn't have to be a daunting experience. With a little research and an understanding of the available options, it can be a simple and rewarding step towards securing your financial future. Take the leap, explore the possibilities, and watch your financial confidence grow.

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)