How Much Money Does A Business Owner Make

The allure of entrepreneurship often glimmers with the promise of financial independence, but the reality for many business owners is a complex tapestry woven with hard work, risk, and often, a less-than-glamorous initial salary. Understanding the financial landscape faced by those who dare to build their own ventures is crucial for anyone considering taking the entrepreneurial leap, and for policymakers shaping the economic environment in which these businesses operate.

This article delves into the often-murky waters of business owner compensation, exploring the factors that influence income, the realities faced by owners of different-sized businesses, and the long-term financial potential of entrepreneurship. We'll examine data from reputable sources, including the Small Business Administration (SBA) and industry-specific reports, to provide a comprehensive and balanced view of the financial rewards, and challenges, that await those who choose to be their own boss.

Factors Influencing Business Owner Income

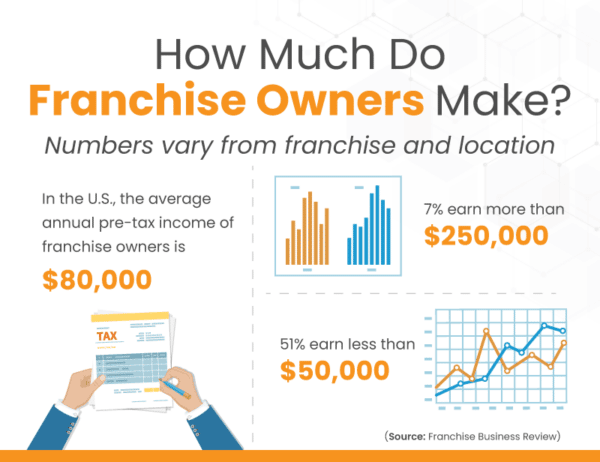

A multitude of factors dictate how much a business owner takes home. Business size is a primary determinant; a sole proprietor operating a small service business will likely earn significantly less than the owner of a multi-million dollar corporation.

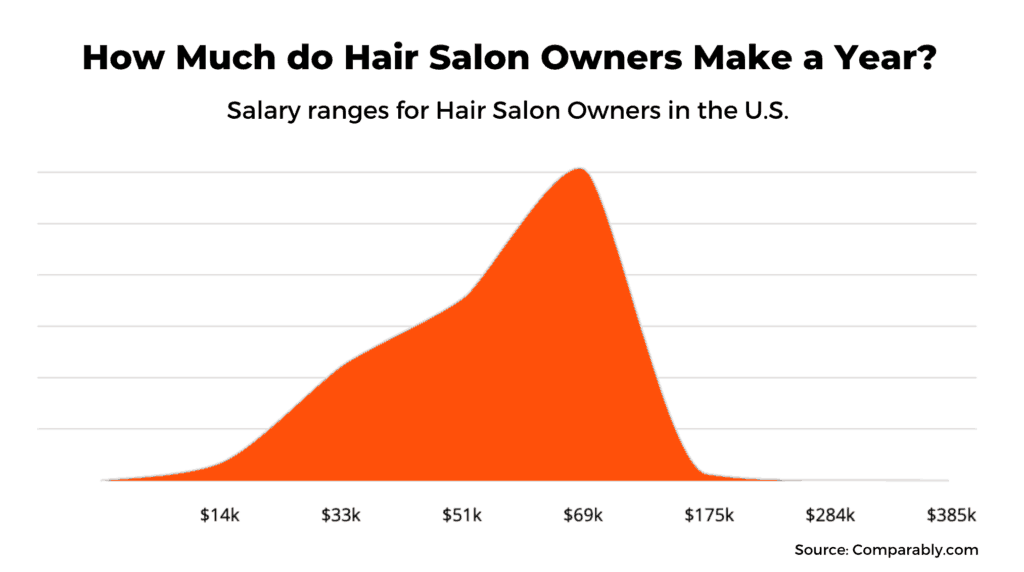

Industry also plays a crucial role. Sectors with high profit margins, like technology or finance, may offer greater earning potential than industries with lower margins, such as retail or hospitality.

Finally, the business's stage of development is a key factor. Startups often require owners to reinvest heavily in the business, resulting in little or no income in the initial years.

Small Business Owners: A Closer Look

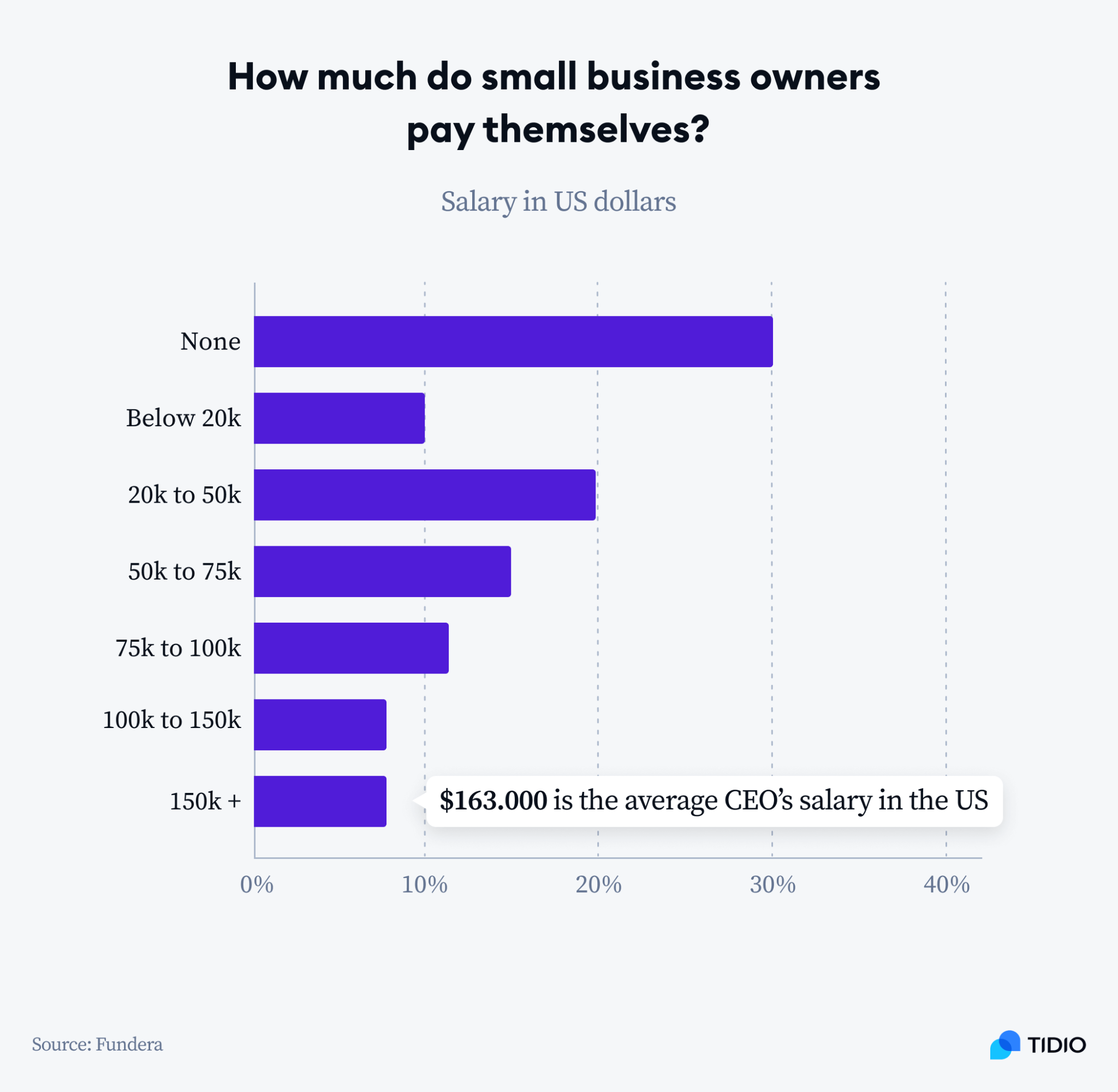

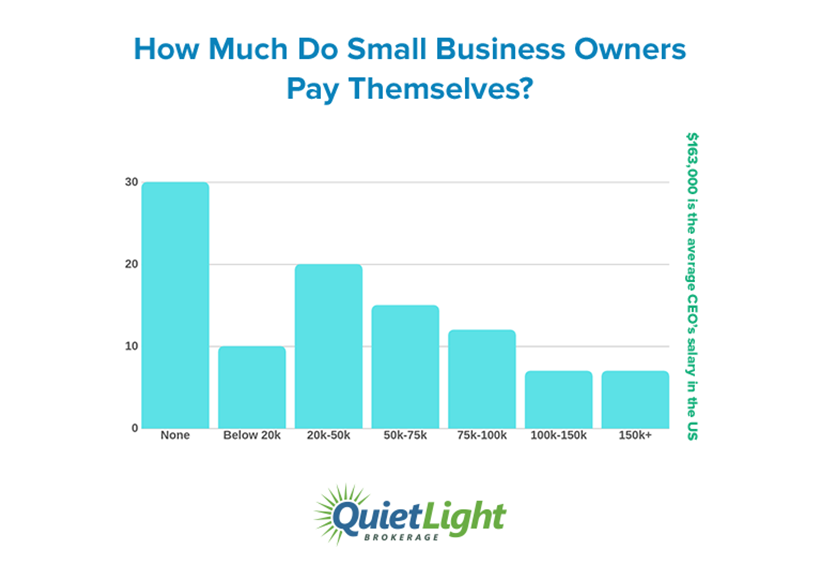

Data from the SBA indicates that the median income for self-employed individuals and small business owners is lower than that of wage-earning employees. This is particularly true in the early stages of a business.

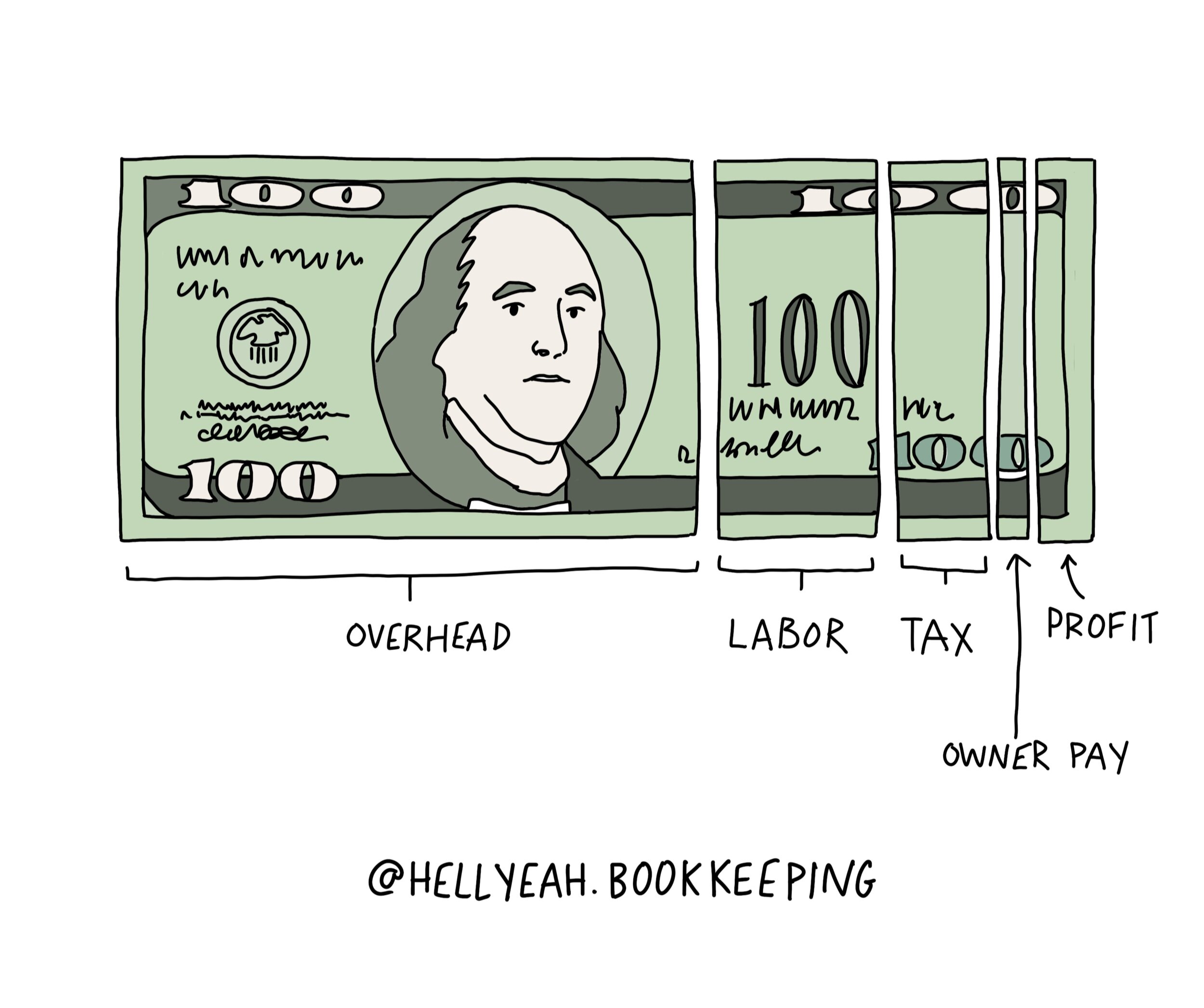

Many small business owners initially sacrifice personal income to ensure their business's survival and growth. They often reinvest profits back into the company, foregoing a larger salary.

However, small business ownership can offer tax advantages, such as deducting business expenses, which can offset some of the lower initial income.

The Impact of Business Size and Structure

As a business grows, so does the potential for the owner to increase their compensation. Larger companies generate more revenue, allowing for higher salaries and bonuses for the owner, or owners in the case of partnerships and corporations.

The business structure also influences how an owner is paid. Sole proprietors typically draw a salary from the business's profits, while owners of corporations may receive a salary, dividends, or a combination of both.

Each structure has its own tax implications, which can significantly affect the owner's net income.

Industry-Specific Income Variations

Certain industries consistently offer higher earning potential for business owners. For example, technology companies and businesses providing specialized professional services often generate substantial profits, leading to higher owner compensation.

Conversely, industries with high competition and low profit margins, such as some retail sectors, may result in lower incomes for business owners. Market demand and competition are key drivers.

Understanding industry benchmarks is crucial for entrepreneurs when assessing their own earning potential and setting realistic financial goals.

Beyond Salary: The Total Value of Ownership

While salary is a primary consideration, the total value of business ownership extends far beyond a regular paycheck. Equity in the company can be a significant asset, potentially generating substantial wealth over time.

Many business owners build equity that can be realized through a future sale or initial public offering (IPO). This potential for long-term wealth creation is a major driver for many entrepreneurs.

Furthermore, business owners often have greater control over their work schedule and environment, which can be a valuable, though often unquantifiable, benefit.

"The rewards of entrepreneurship are not always immediate or solely monetary, but the potential for long-term financial gain and personal fulfillment is immense." - Small Business Administration Report

Challenges and Considerations

Entrepreneurship is not without its financial challenges. Business owners often bear the full brunt of financial risk, including personal liability for business debts.

Economic downturns and unforeseen circumstances can significantly impact business revenue and owner income. Sound financial planning and risk management are essential for navigating these challenges.

Moreover, the long hours and intense pressure associated with business ownership can take a toll on personal well-being, highlighting the importance of work-life balance.

Looking Ahead: The Future of Business Owner Income

The future of business owner income is closely tied to the evolving economic landscape. Technological advancements and changing consumer preferences are creating new opportunities for entrepreneurs, but also presenting new challenges.

As the gig economy continues to grow, more individuals are choosing self-employment and small business ownership as viable career paths. This trend is likely to increase competition and potentially impact income levels in certain sectors.

Ultimately, the success of a business owner hinges on their ability to adapt, innovate, and effectively manage their finances. While the financial rewards may not always be guaranteed, the potential for growth and independence remains a powerful draw for aspiring entrepreneurs.

![How Much Money Does A Business Owner Make 40 Stand-Out Small Business Statistics [2023]: How Many Small](https://www.zippia.com/wp-content/uploads/2022/01/small-business-customers.jpg)