How Much Money Does It Take To Open A Business

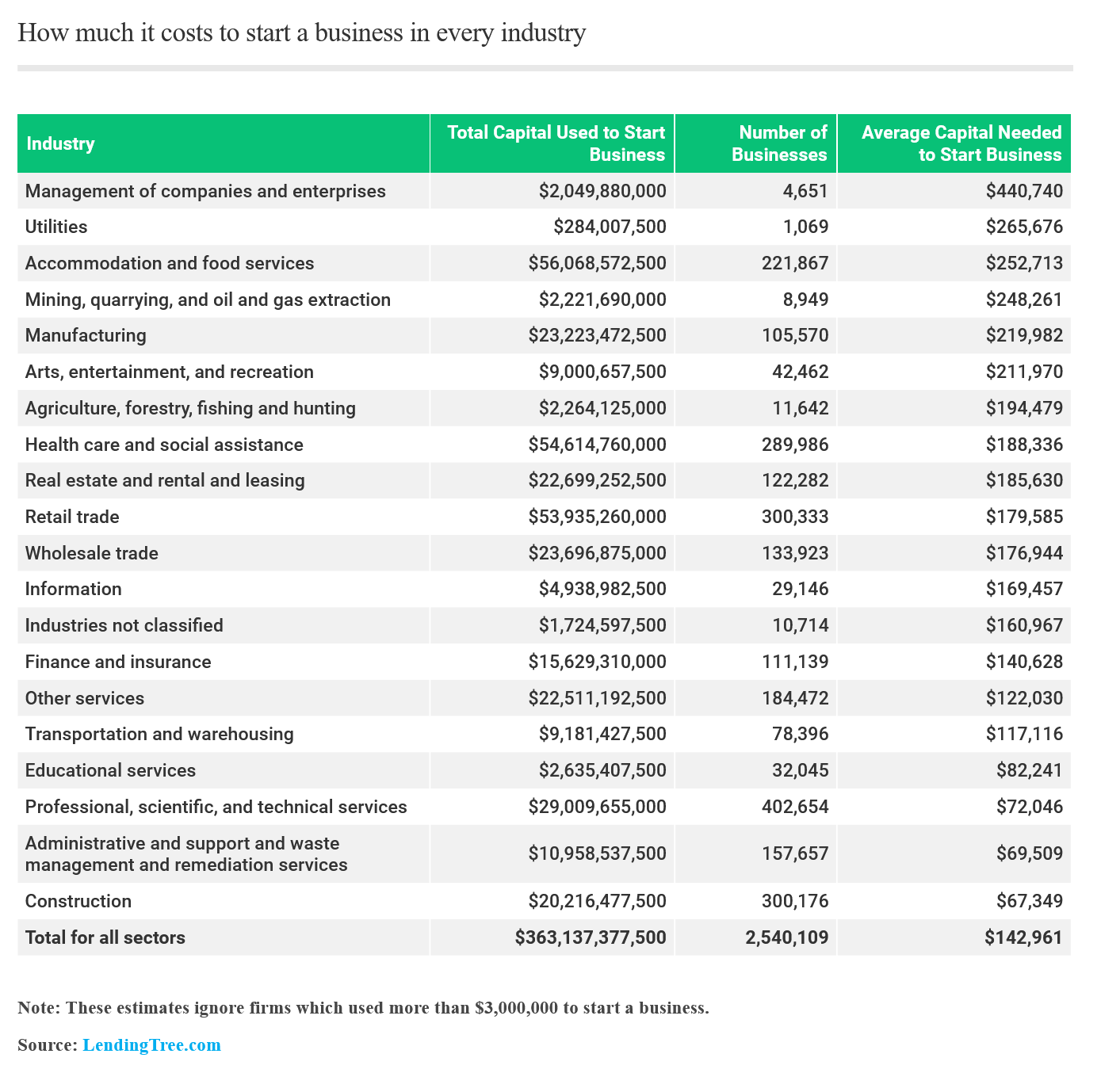

Opening a business demands careful financial planning. Costs can range drastically depending on industry, location, and scale, making accurate budgeting crucial.

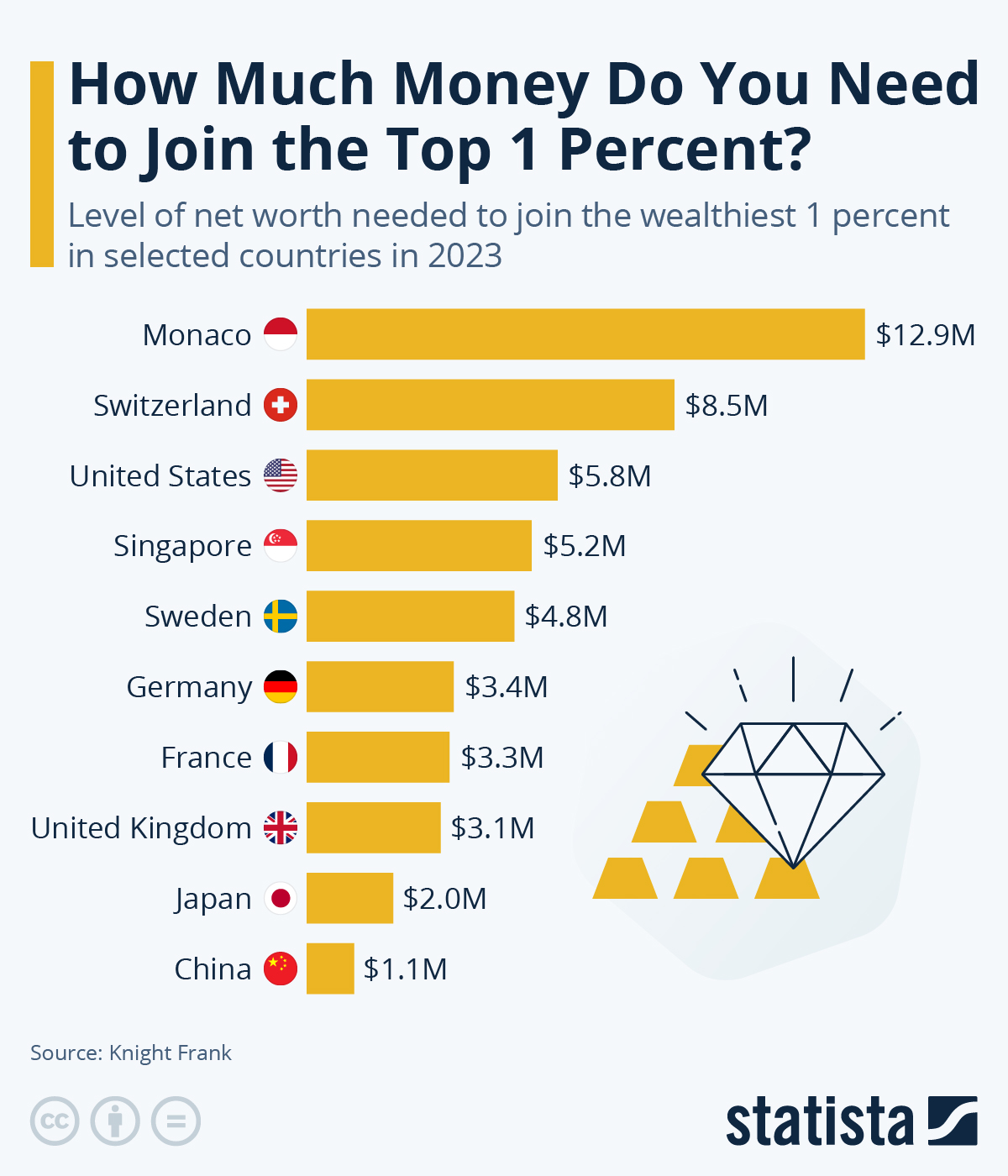

The funds needed to launch a business vary wildly, from a few thousand dollars for a home-based venture to millions for a large-scale manufacturing operation. Understanding these financial requirements is the first step towards entrepreneurial success.

Startup Costs: A Breakdown

The Small Business Administration (SBA) reports that most microbusinesses, requiring minimal upfront investment, can be started with under $3,000. This typically covers basic supplies, marketing materials, and initial licensing fees.

For businesses requiring physical locations, like retail stores or restaurants, costs can skyrocket. Lease deposits, renovations, and equipment purchases can easily exceed $50,000, according to industry averages.

Key Cost Categories

Leasehold Improvements: Modifying a rented space to suit your business needs can be a major expense. Costs depend on the extent of renovations required.

Inventory: Stocking shelves with products requires significant capital. The amount needed depends on the volume and type of goods you plan to sell.

Equipment: From computers and office furniture to specialized machinery, equipment costs can vary widely. Leasing options can help reduce upfront expenses.

Marketing & Advertising: Creating a brand and attracting customers requires a dedicated budget. Online advertising, social media campaigns, and traditional marketing methods all contribute.

Licensing & Permits: Obtaining the necessary licenses and permits is a legal requirement. Costs vary depending on your industry and location. Check with your local Chamber of Commerce for accurate figures.

Legal & Accounting Fees: Setting up your business structure and managing finances requires professional assistance. Budget for legal advice and accounting services.

Funding Options

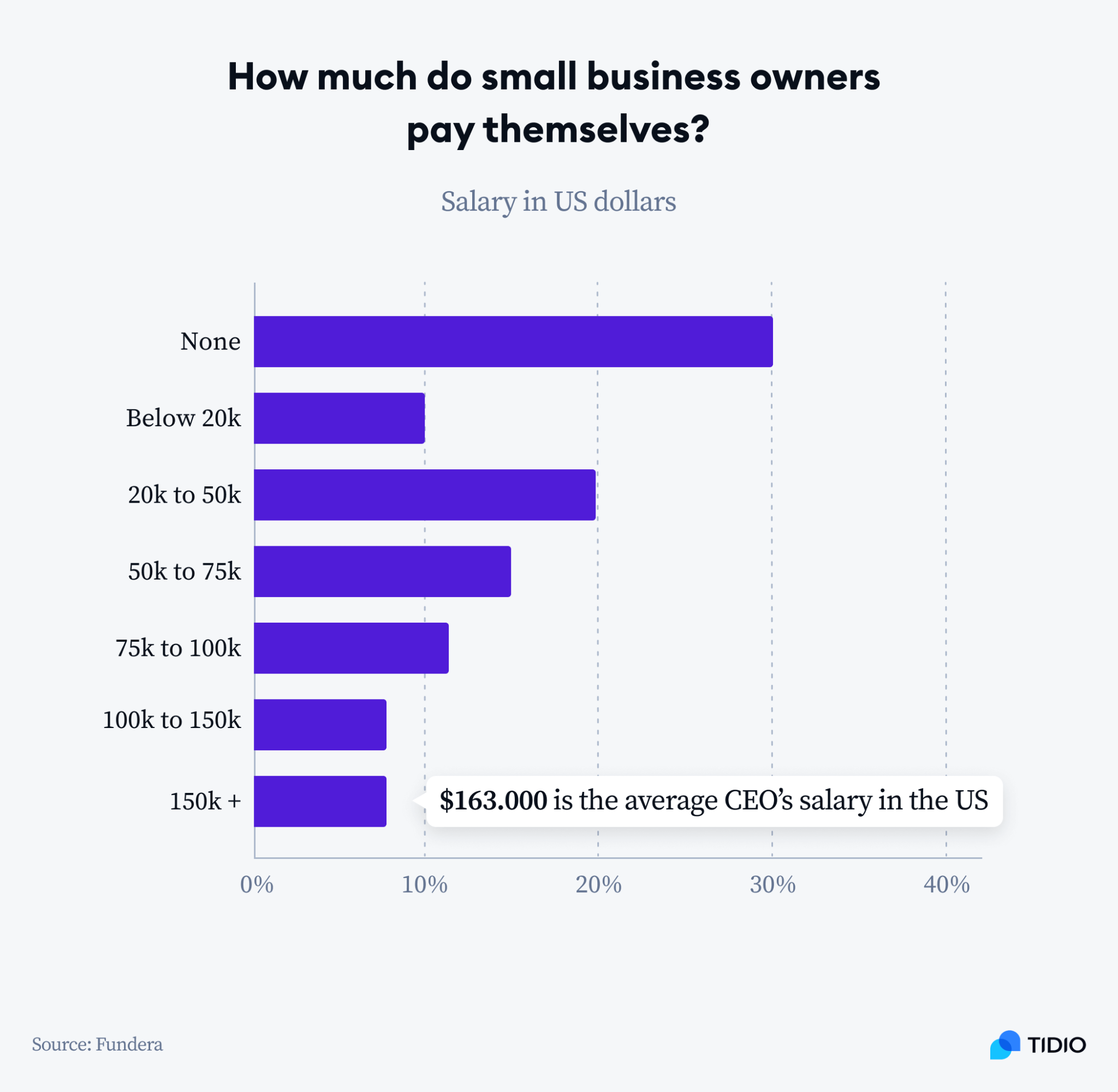

Self-Funding: Using personal savings is a common approach. However, it's crucial to avoid depleting all personal resources.

Loans: Small Business Loans are available from banks and credit unions. They require a solid business plan and good credit history.

Grants: Government grants and private foundation funding can provide financial assistance. Competition for grants is fierce, requiring a compelling application.

Investors: Angel investors and venture capitalists provide funding in exchange for equity. This option requires giving up partial ownership of your business.

Real-World Examples

A freelance writer can start with minimal investment, possibly under $500 for a website and software. A food truck, however, needs around $30,000 - $80,000 to cover the vehicle, equipment, and permits.

Opening a boutique clothing store can necessitate $50,000 - $150,000 for inventory, rent, and marketing, based on national estimates.

Mitigating Costs

Start small and scale gradually to reduce initial financial burden. Consider bootstrapping and reinvesting profits to fund growth.

Negotiate favorable lease terms and explore shared office spaces to minimize rent costs. Leverage free marketing tools and social media to save on advertising expenses.

Prioritize essential expenses and delay non-essential purchases. Focus on generating revenue before investing in luxury items.

Next Steps

Develop a detailed business plan outlining projected costs and revenue streams. Seek advice from experienced entrepreneurs and financial advisors.

Research funding options and prepare a compelling pitch for investors or lenders. Continuously monitor expenses and adjust your budget as needed.

The SBA and local business development centers offer resources and guidance. Stay informed about industry trends and financial best practices.