How Much Money Should You Spend A Month

The question of how much money one should spend each month is a deeply personal and often anxiety-inducing one. While there's no magic number, the answer lies at the intersection of personal income, financial goals, and a clear understanding of both essential and discretionary spending.

This article delves into the core components of creating a realistic monthly budget, offering insights from financial experts and data from reputable organizations. We'll explore various budgeting strategies, consider the impact of factors like income level and geographic location, and ultimately provide a framework for determining your ideal monthly spending limit to achieve financial stability and long-term security.

Understanding Essential vs. Discretionary Spending

The bedrock of any sound budget is distinguishing between essential and discretionary spending. Essential expenses are those necessary for survival and maintaining a basic standard of living.

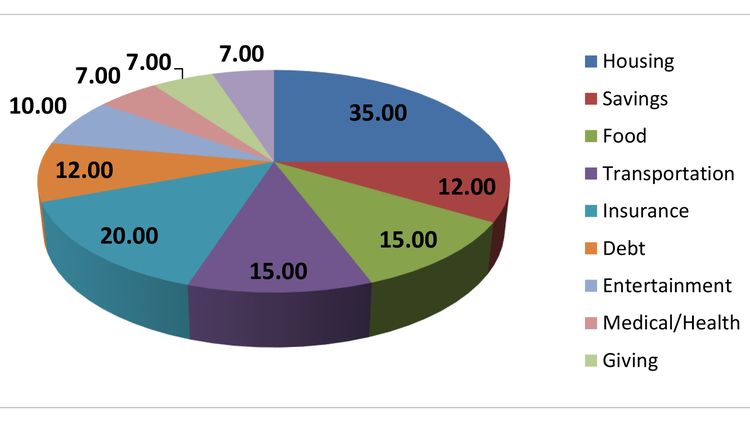

These typically include housing (rent or mortgage payments), utilities (electricity, water, gas), food (groceries), transportation (car payments, public transport, fuel), and healthcare (insurance premiums, medical bills). Discretionary spending, on the other hand, encompasses non-essential items and activities.

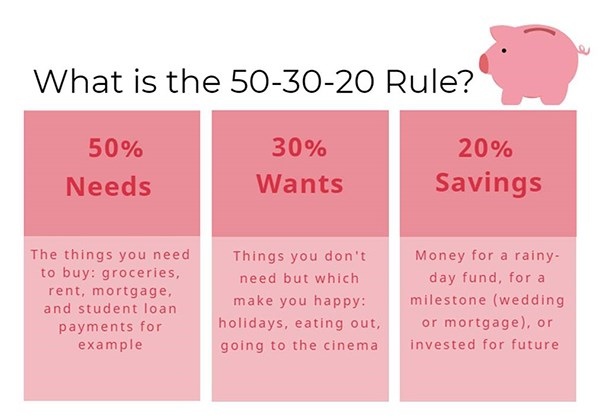

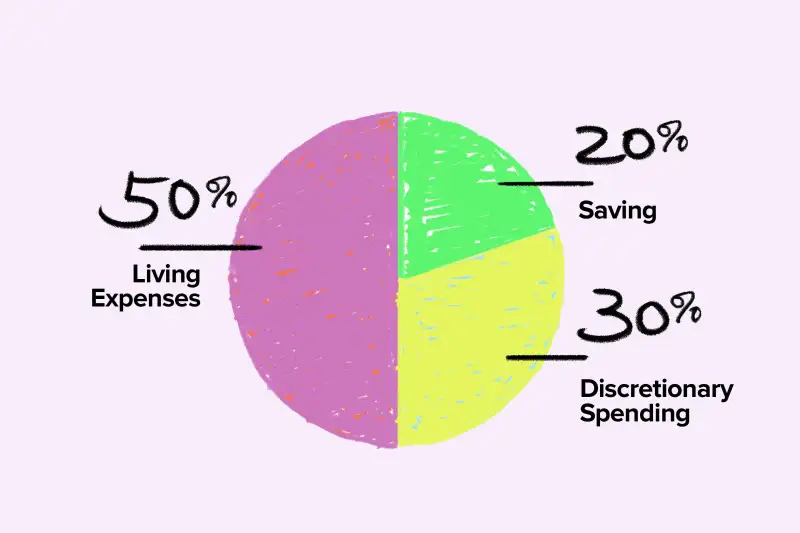

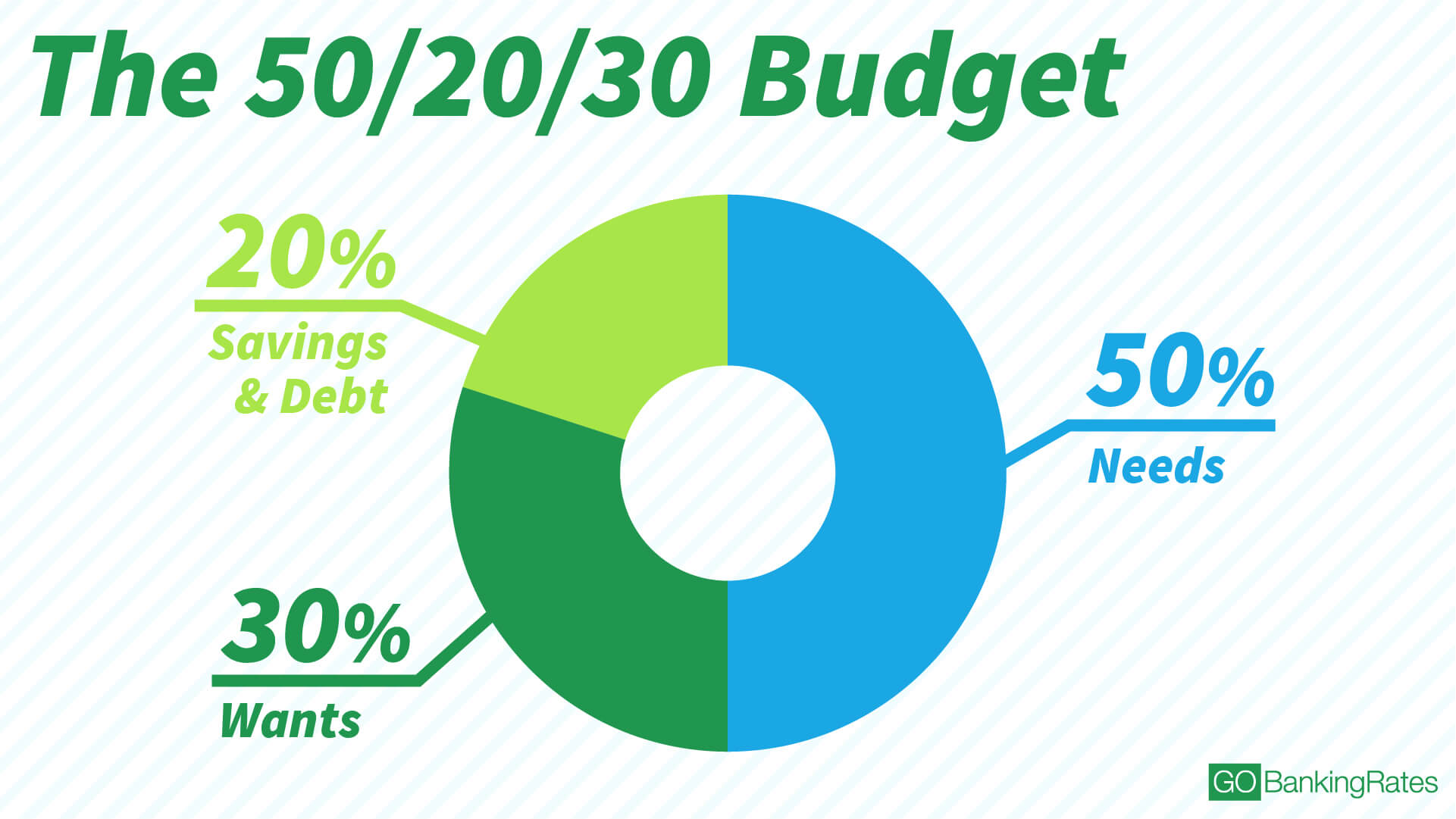

Examples include dining out, entertainment, travel, hobbies, and subscriptions. A common budgeting rule of thumb is the 50/30/20 rule.

The 50/30/20 Rule: A Starting Point

The 50/30/20 rule suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. While this is a helpful guideline, its applicability depends on individual circumstances.

For example, someone living in a high-cost city might find that essential expenses consume more than 50% of their income. Conversely, individuals with lower debt burdens might be able to allocate a larger portion to savings and investments.

According to the Bureau of Labor Statistics (BLS), housing typically accounts for the largest share of household spending, followed by transportation and food.

Tailoring Your Budget to Your Income and Goals

Your income level significantly influences how much you should spend each month. Someone earning a modest income will need to prioritize essential expenses and carefully manage discretionary spending.

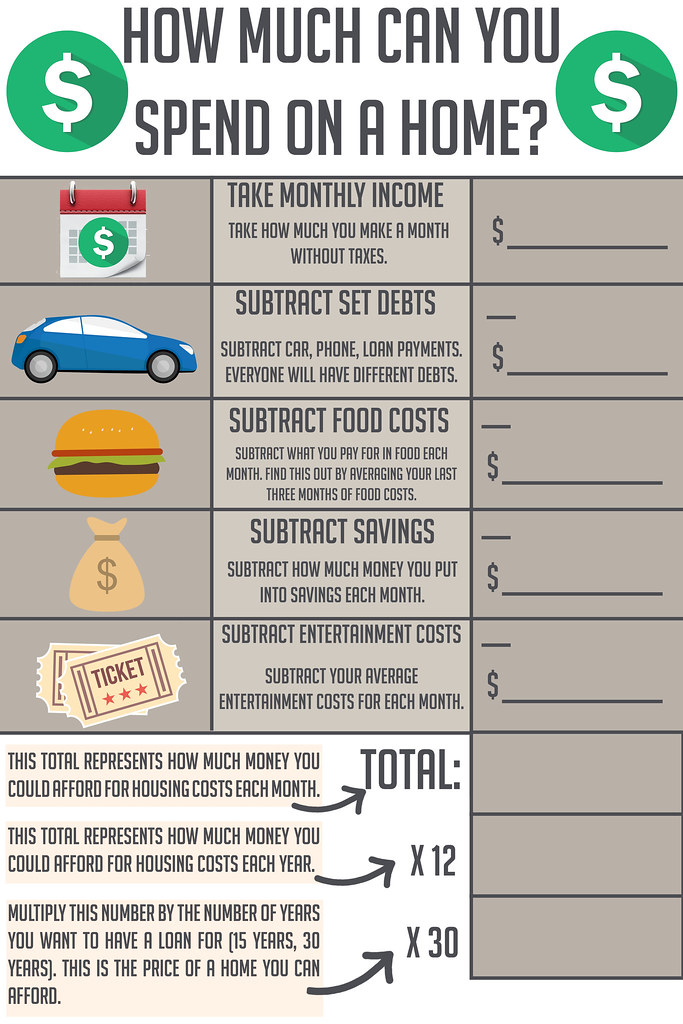

In contrast, a higher-income individual may have more flexibility to allocate funds to wants and savings. Consider your financial goals.

Are you saving for a down payment on a house, paying off debt, or investing for retirement? Your spending habits should align with these objectives.

The Impact of Geographic Location

The cost of living varies dramatically across different regions. Housing, transportation, and food costs can be significantly higher in urban areas compared to rural communities.

Before establishing a monthly budget, research the average cost of living in your area. Websites like NerdWallet and MIT's Living Wage Calculator provide valuable data on living expenses in different locations.

Adjust your spending categories accordingly to reflect the realities of your local economy.

Strategies for Tracking and Managing Spending

Effectively tracking your spending is crucial for maintaining control over your finances. Several budgeting apps and tools can help you monitor your income and expenses.

Popular options include Mint, YNAB (You Need a Budget), and Personal Capital. Alternatively, you can use a spreadsheet or even a simple notebook to record your transactions.

Regularly review your spending patterns to identify areas where you can cut back. Consider automating savings to ensure you consistently allocate funds to your financial goals.

"Budgeting isn't about restriction; it's about empowerment," says Suze Orman, a renowned personal finance expert.

The Future of Personal Spending

As the economic landscape evolves, so too must our approaches to personal spending. Inflation, technological advancements, and changing consumer habits will continue to shape our financial decisions.

Embrace financial literacy and stay informed about economic trends. Regularly re-evaluate your budget to ensure it remains aligned with your goals and the current economic environment.

Ultimately, determining how much you should spend each month is an ongoing process of self-assessment, adaptation, and informed decision-making. By prioritizing financial planning, individuals can gain greater control over their finances and achieve long-term financial well-being.