How Much Should A Business Owner Pay Himself

Navigating the financial complexities of running a business often leaves owners with a crucial question: How much should I pay myself? The answer, while seemingly simple, is a multifaceted calculation balancing personal needs, business profitability, and long-term financial health.

This decision significantly impacts both the owner's livelihood and the company's stability. Understanding the various factors involved is critical for sustainable growth and personal financial security.

Determining Factors for Owner's Compensation

Several key factors influence the appropriate salary for a business owner. These include the company’s profitability, industry standards, geographic location, and the owner's role and responsibilities.

A highly profitable business can generally afford to pay its owner a higher salary. However, it is essential to consider reinvesting profits for future growth and maintaining a healthy cash reserve.

Industry standards provide benchmarks for similar roles in comparable businesses. Resources like the Small Business Administration (SBA) and industry-specific associations often offer data on average salaries.

The Importance of Market Research

Market research is critical in determining a fair salary. Websites like Salary.com and Glassdoor can provide valuable insights into average compensation for similar roles in specific industries and locations.

Comparing your role and responsibilities to those of employees in similar positions can help determine an appropriate salary range. Consider the complexity of the job, the level of expertise required, and the number of hours worked.

Legal and Tax Implications

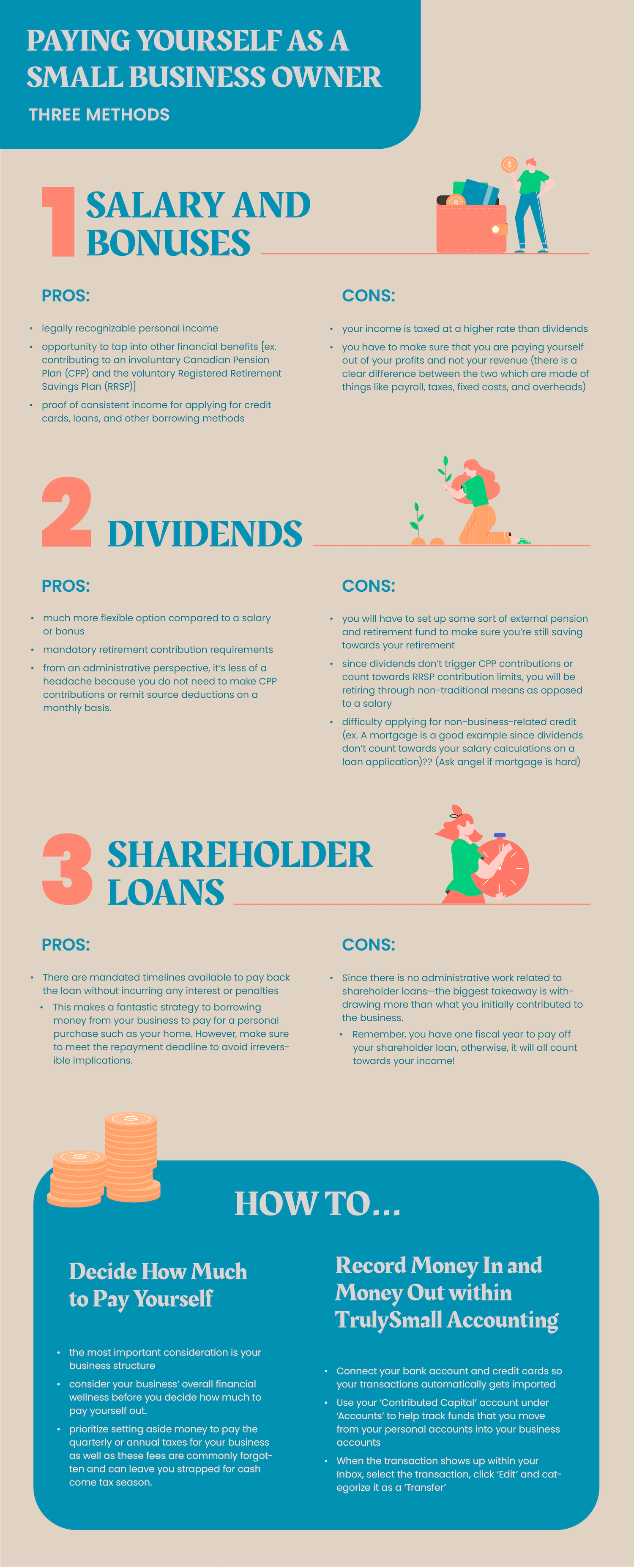

Understanding the legal and tax implications is paramount. The structure of the business (e.g., sole proprietorship, LLC, S-corp) significantly impacts how the owner is compensated and the associated tax liabilities.

Consulting with a tax professional is crucial. They can advise on the most tax-efficient methods of compensation, such as salary, dividends, or owner's draw, based on the business structure and individual circumstances.

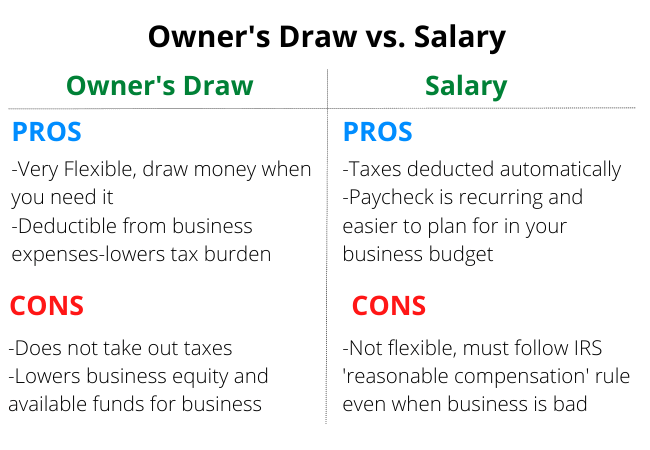

Different Compensation Methods

Business owners have several options for compensating themselves. Each method has different tax implications and may be more suitable depending on the business structure.

A salary is a fixed payment made regularly and is subject to payroll taxes. This is common for owners of S-corporations and C-corporations.

An owner's draw is a withdrawal of funds from the business, typically used by sole proprietorships and partnerships. Draws are not subject to payroll taxes, but the owner is responsible for self-employment taxes.

"Setting your salary is a delicate balance. You need to ensure you're fairly compensated for your work, but also that the business remains financially healthy," says Maria Rodriguez, a small business consultant.

Striking the Right Balance

Finding the right balance between personal financial needs and business sustainability is key. Overpaying yourself can jeopardize the company's financial health, while underpaying can lead to burnout and financial strain.

Regularly reviewing the business's financial performance is essential. Adjust the owner's compensation based on profitability, cash flow, and future investment needs.

Creating a budget that includes both personal and business expenses is highly recommended. This provides a clear picture of the funds needed for personal living expenses and the funds required for business operations.

Consider setting financial goals for both yourself and the business. This helps to prioritize spending and investment decisions, ensuring that both personal and business needs are met.

Ultimately, determining a fair owner's salary requires careful consideration and planning. By understanding the relevant factors, seeking professional advice, and regularly reviewing the business's financial health, owners can strike the right balance between personal financial security and long-term business success.