How Much Would A Car Cost Per Month

Sky-high inflation and relentless interest rate hikes are squeezing car buyers, pushing monthly ownership costs to alarming levels. Experts warn that budgeting is now more critical than ever.

It's not just the sticker price anymore. Understanding the true monthly cost of owning a vehicle requires a deep dive into multiple factors, from loan payments and insurance premiums to fuel and maintenance expenses. Ignoring these details can quickly derail your finances.

Breaking Down the Monthly Bill

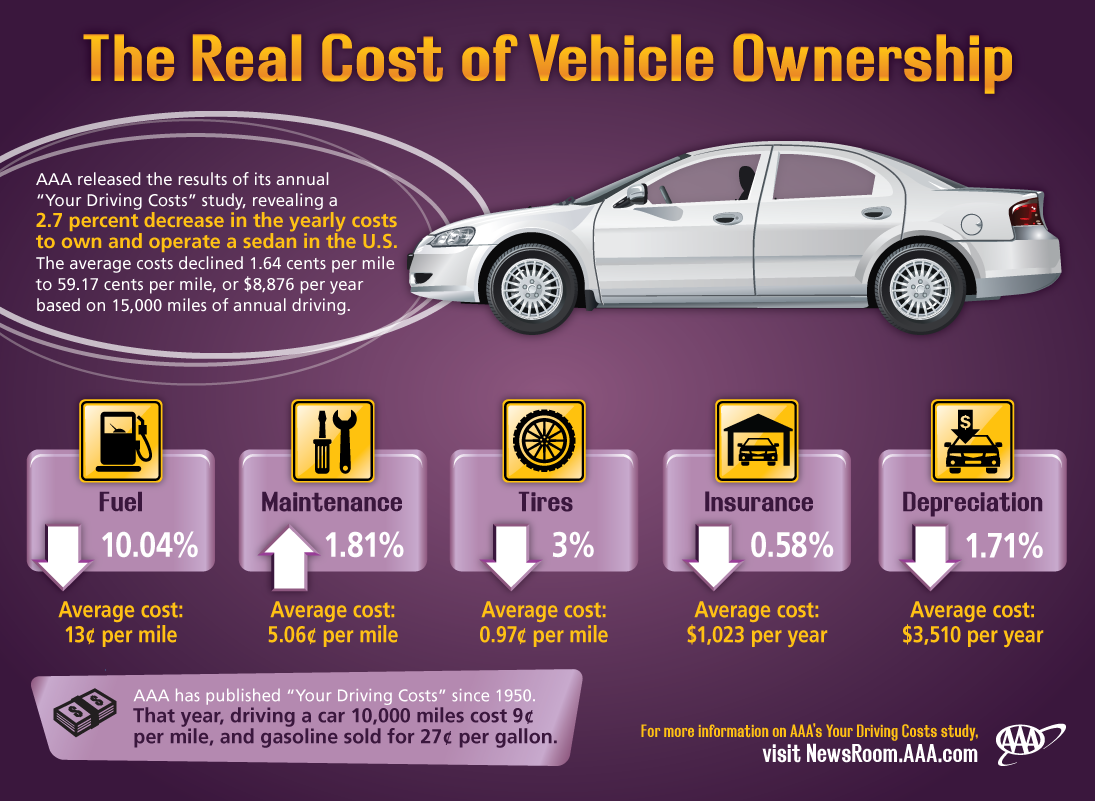

According to recent data from AAA, the average monthly cost of new car ownership in 2024 hovers around $950 to $1,200. This figure incorporates several crucial elements.

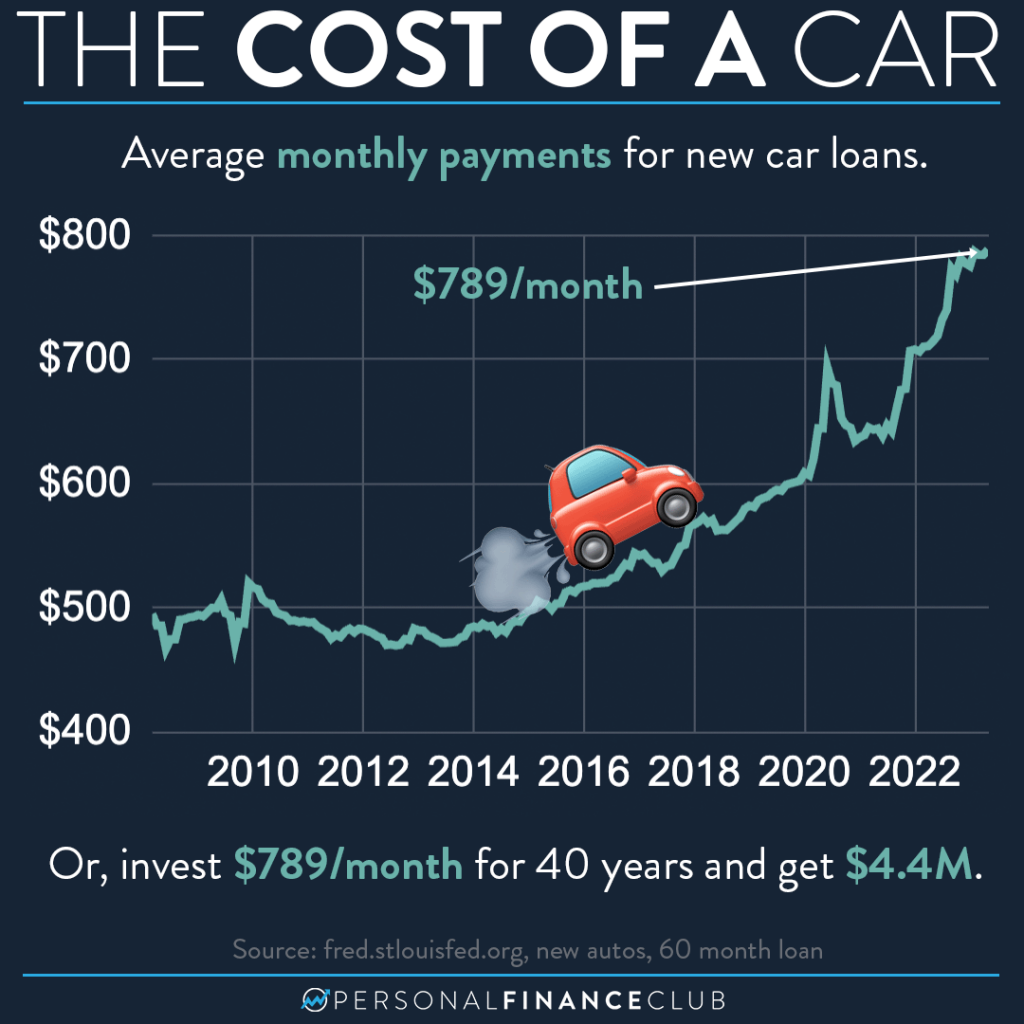

Loan Payments: The Biggest Bite

The average new car loan interest rate is currently around 7%, with the loan term often extending to 60-72 months. This means a $30,000 car could easily translate into a $500-$600 monthly payment, depending on your down payment and credit score. Used car loan rates are even higher.

Experian's latest automotive finance market report highlights a growing trend: longer loan terms. While this might seem attractive in lowering monthly payments, it significantly increases the total interest paid over the life of the loan.

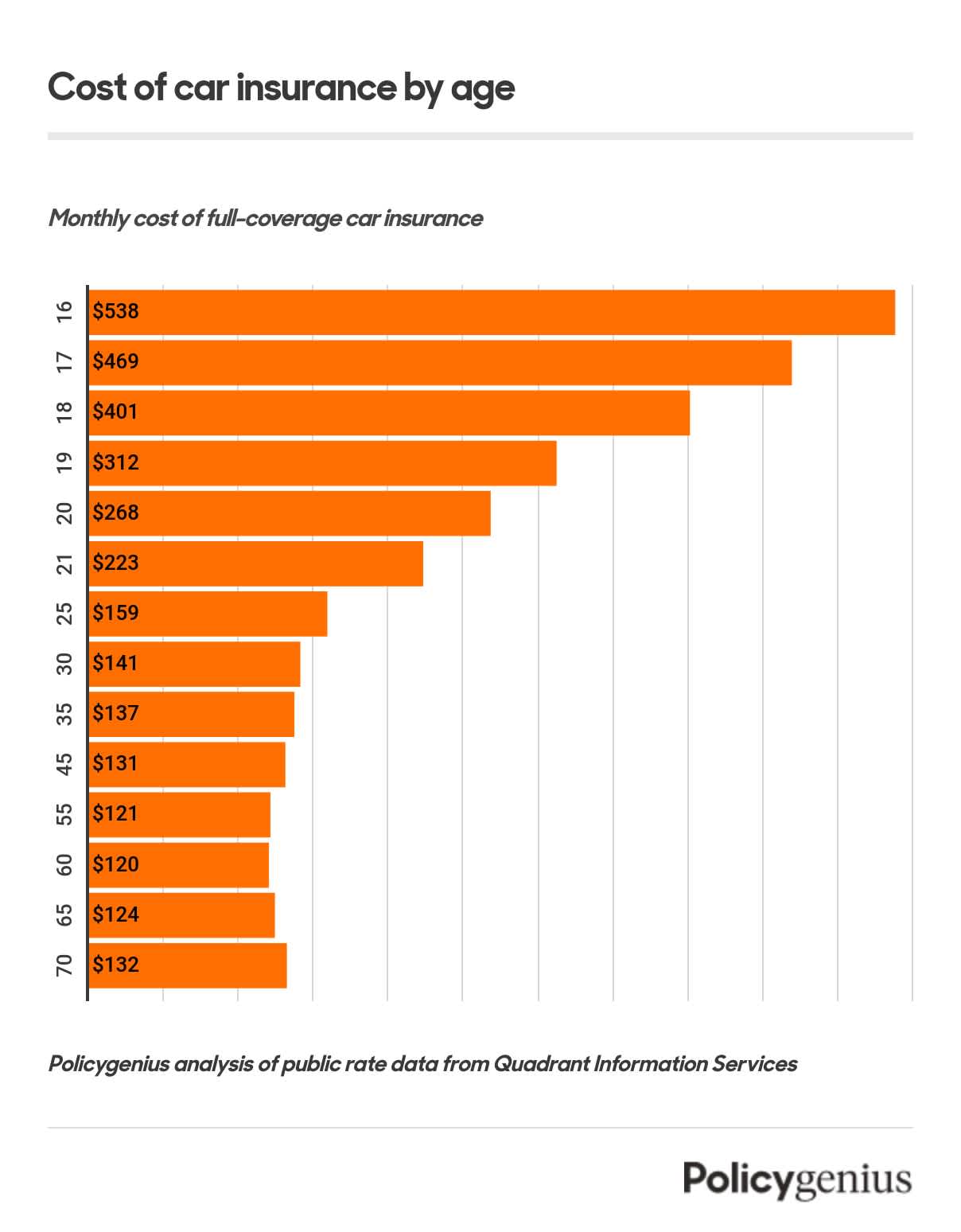

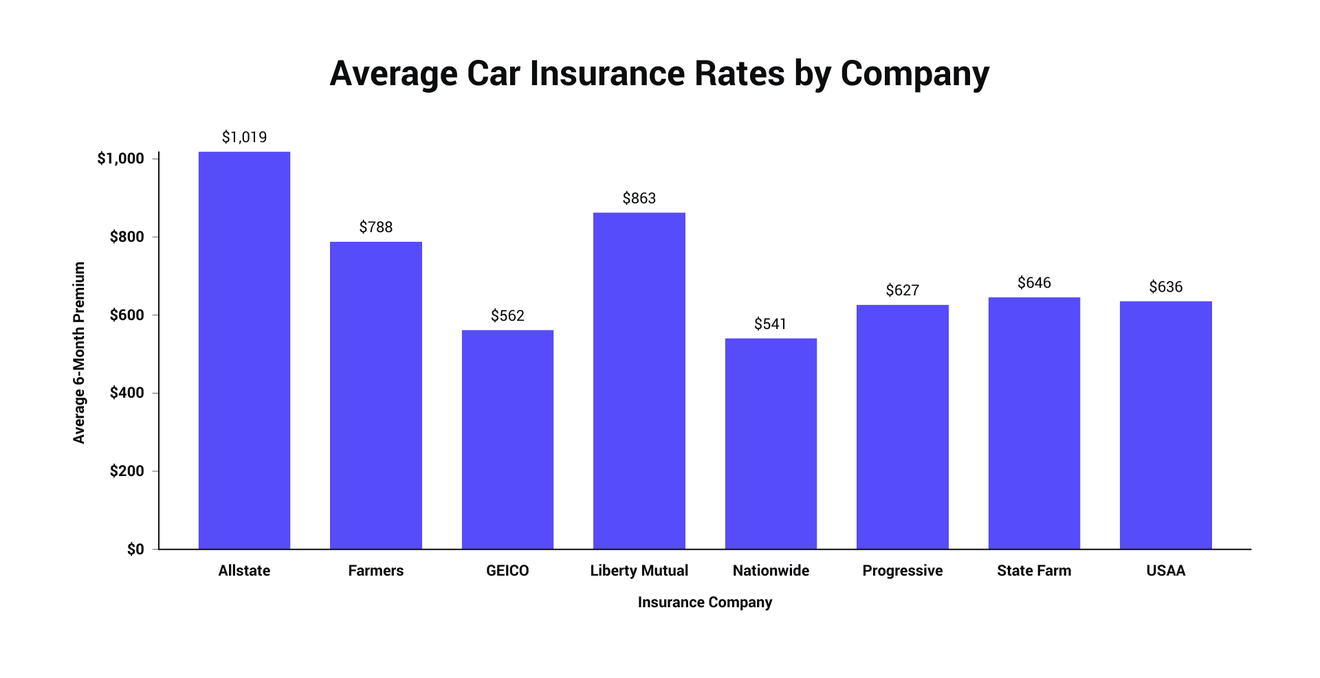

Insurance: Protecting Your Investment

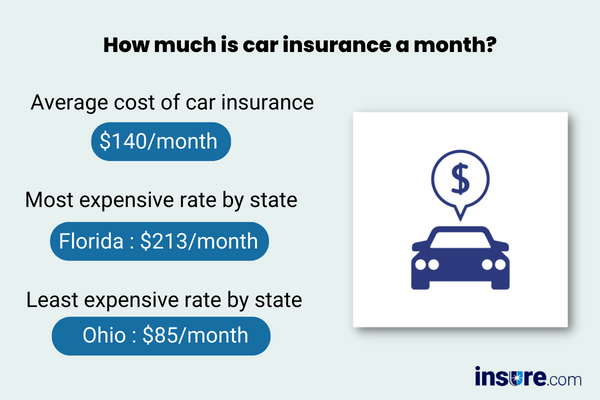

Car insurance premiums vary greatly depending on your location, driving record, and the type of vehicle you own. Expect to pay anywhere from $100 to $300 per month for full coverage.

QuoteWizard, a leading insurance comparison site, reports that the states with the highest average insurance rates are Michigan, Louisiana, and Florida. Drivers in these states can expect to pay considerably more.

Fuel Costs: A Volatile Factor

Gas prices remain unpredictable, fluctuating based on global events and seasonal demand. Your monthly fuel expenses will depend on your car's fuel efficiency and your daily commute.

AAA estimates that the average driver spends between $150 and $300 per month on gasoline. Consider a more fuel-efficient vehicle or explore electric vehicles (EVs) to mitigate this cost.

Maintenance and Repairs: The Unavoidable Expenses

Even with a new car, routine maintenance is essential to keep it running smoothly. Oil changes, tire rotations, and other services can add up quickly.

Unexpected repairs can also throw a wrench in your budget. Setting aside a dedicated emergency fund for car repairs is a wise move.

Depreciation: The Silent Cost

Vehicles lose value over time. Depreciation is a hidden cost of ownership that's often overlooked.

Certain makes and models depreciate faster than others. Researching a car's depreciation rate before buying can help you make a more informed decision.

Strategies for Managing Car Costs

Shop around for the best loan rates and insurance quotes. Compare prices from multiple lenders and insurers to ensure you're getting the best deal.

Consider buying a used car instead of a new one. Used cars typically have lower sticker prices and insurance premiums.

Increase your down payment. A larger down payment reduces the amount you need to borrow, lowering your monthly payments and overall interest costs.

"Negotiate the price of the car aggressively. Don't be afraid to walk away if you're not getting a fair deal," advises Consumer Reports.

Looking Ahead

Experts predict that car ownership costs will continue to rise in the coming months due to persistent inflation and supply chain disruptions. Stay informed about market trends and adjust your budget accordingly.

Consumers should closely monitor interest rate announcements from the Federal Reserve and consider the long-term financial implications of their car buying decisions.