How To Apply Hdfc Personal Loan In 10 Seconds

Need cash fast? HDFC Bank announces a revolutionary way to apply for a personal loan, promising approval in a mere 10 seconds for eligible customers.

This breakthrough service dramatically reduces application time, offering immediate financial assistance to those who qualify.

Instant Loan Approval: Here's How

The speed lies in HDFC Bank's pre-approved loan system.

This means if you already have a good relationship with the bank and meet their internal criteria, the process is streamlined.

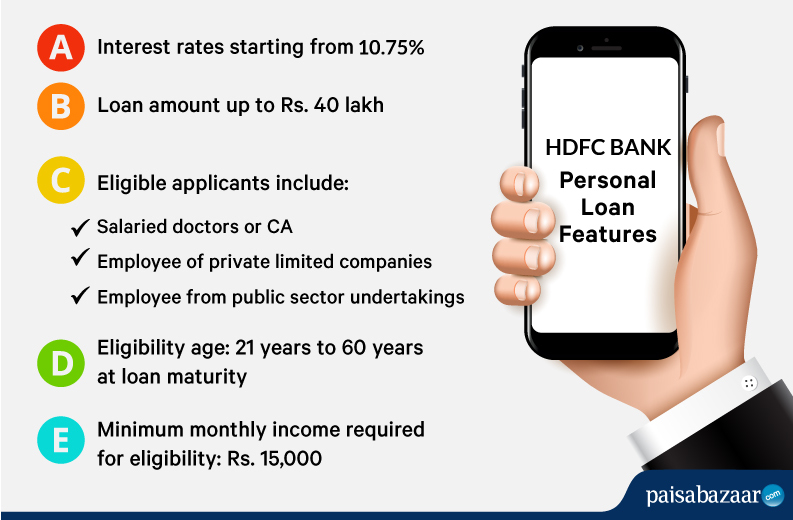

Eligibility Criteria

To be eligible for the 10-second loan, you generally need to be an existing HDFC Bank customer.

Maintain a good credit score and have a stable repayment history.

Pre-approved offers are based on your banking behavior and creditworthiness.

Application Process

The application is primarily through HDFC Bank's NetBanking or mobile app.

Login and check for pre-approved personal loan offers.

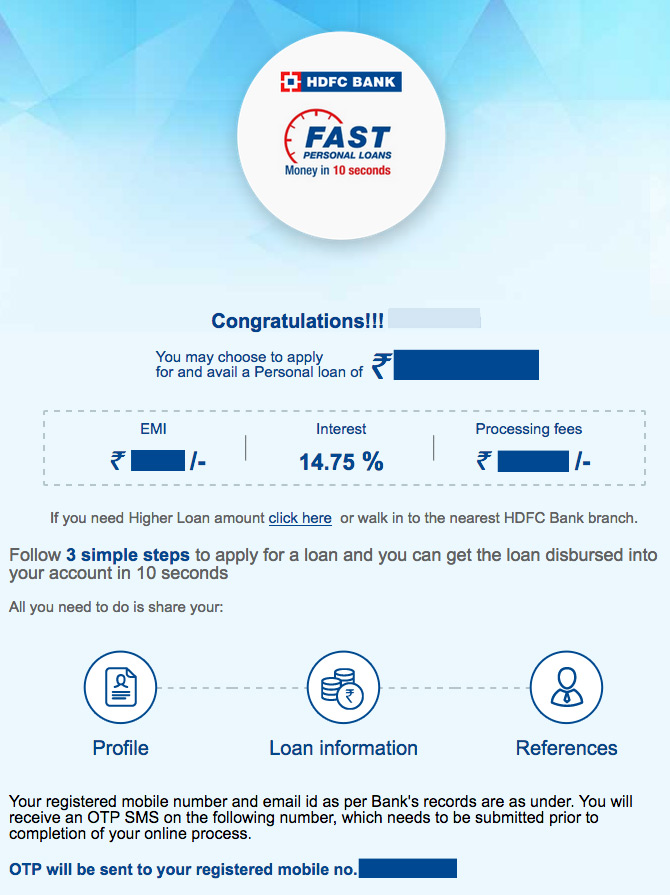

If an offer is available, review the details (loan amount, interest rate, and tenure).

Accept the terms and conditions, and the loan is processed.

Key Details

Loan Amount: Varies based on eligibility.

Interest Rates: Competitive rates are offered.

Processing Fees: Standard fees apply.

Repayment Tenure: Flexible tenure options available.

Securing Your Loan

Visit the HDFC Bank NetBanking portal or mobile app.

Find the pre-approved loan section.

Verify your details and accept the loan offer.

Important Considerations

The 10-second approval is conditional.

It applies only if you have a pre-approved offer and no further verification is required.

Carefully review the loan agreement before accepting the offer.

HDFC Bank is committed to providing instant financial solutions to its valued customers.

Keep track of new updates on HDFC Bank's official website for more information.