How To Be Financially Stable With Low Income

Achieving financial stability on a low income might seem like an insurmountable challenge, but practical strategies can pave the way for a more secure financial future. It requires careful planning, diligent execution, and a shift in mindset about money management.

This article explores concrete steps individuals and families can take to navigate financial constraints, build savings, and work towards long-term financial well-being. It focuses on budgeting, debt management, resource utilization, and skill development.

Understanding Your Financial Landscape

The cornerstone of financial stability is a clear understanding of your income and expenses. Creating a detailed budget is the first critical step. This involves tracking every dollar coming in and going out, allowing you to identify areas where you can cut back.

Several budgeting methods exist, including the 50/30/20 rule (50% for needs, 30% for wants, and 20% for savings and debt repayment) and zero-based budgeting (allocating every dollar to a specific purpose). Choose the method that best suits your lifestyle and financial goals.

Cutting Expenses and Maximizing Resources

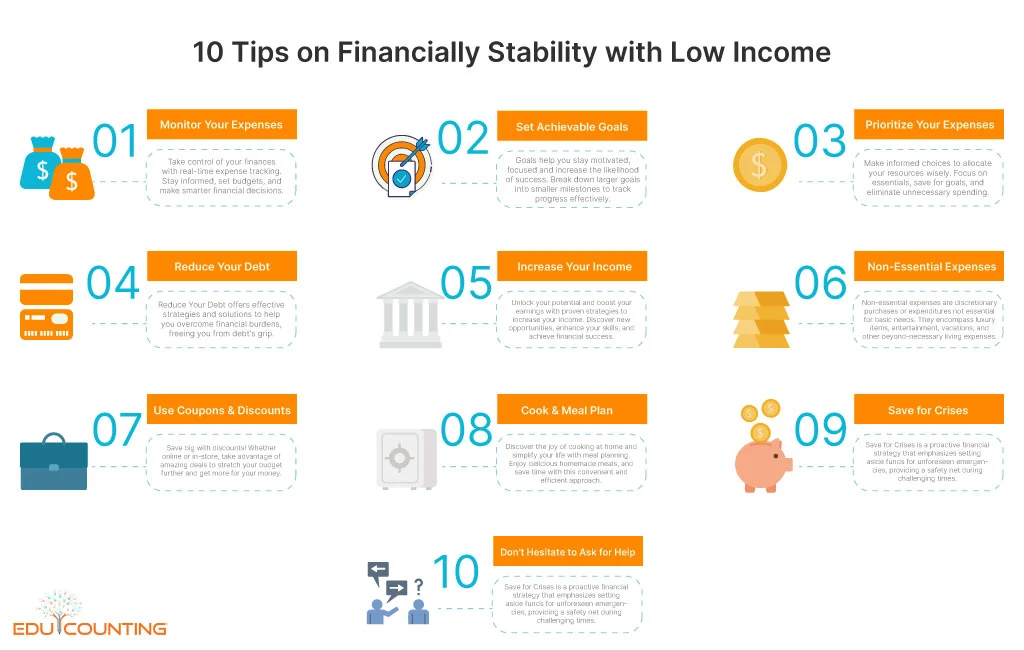

Reducing expenses is often the most immediate way to free up cash flow. Identify non-essential spending and consider making lifestyle adjustments.

Explore ways to lower your bills. Contact service providers to negotiate lower rates for internet, phone, and insurance. Utilize public transportation, cycle, or walk instead of driving whenever possible to save on fuel and car maintenance.

Leveraging Available Resources

Numerous government and non-profit organizations offer assistance to low-income individuals and families. The U.S. Department of Housing and Urban Development (HUD) provides housing assistance programs, while the Supplemental Nutrition Assistance Program (SNAP) helps with grocery costs.

Local charities and community centers often offer food banks, clothing assistance, and financial literacy programs. Research and utilize these resources to alleviate financial pressure.

"Financial stability is not about how much you earn, but how well you manage what you have," says Sarah Johnson, a financial advisor specializing in low-income households.

Debt Management and Credit Building

High-interest debt can be a significant drain on your finances. Prioritize paying down high-interest debts, such as credit card balances and payday loans, as quickly as possible.

Consider debt consolidation or balance transfers to lower interest rates. Avoid taking on new debt unless absolutely necessary. Building good credit is essential for accessing better loan terms and financial opportunities in the future.

Increasing Income and Building Skills

While cutting expenses is important, increasing income can significantly improve your financial situation. Explore opportunities for additional income, such as a part-time job, freelance work, or selling unused items.

Investing in your skills can lead to higher-paying job opportunities. Consider taking online courses, attending workshops, or pursuing certifications in high-demand fields. The Bureau of Labor Statistics offers valuable information on career paths and earning potential.

Saving and Investing for the Future

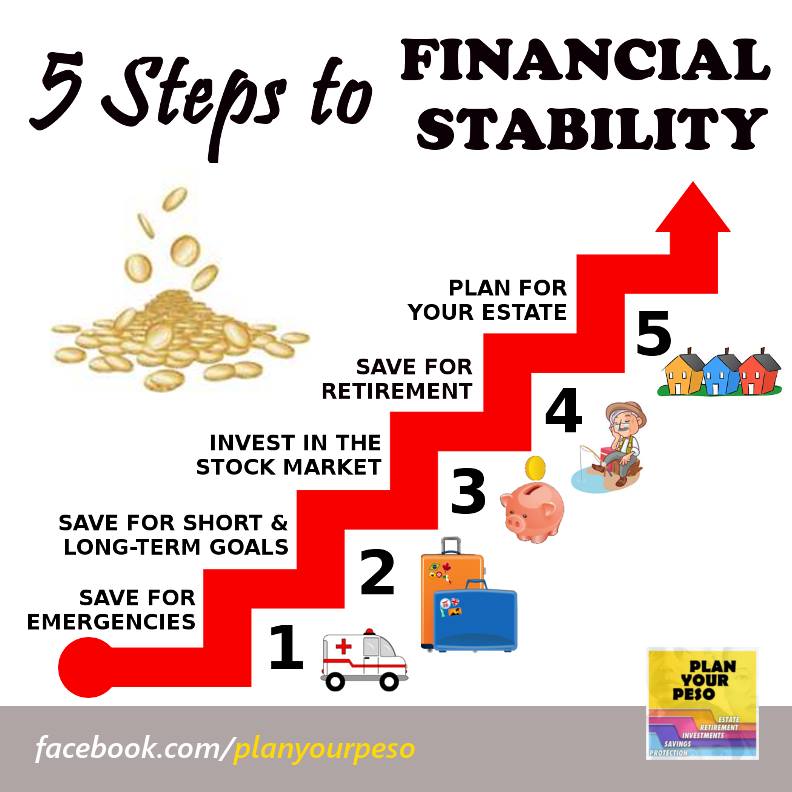

Even small amounts of savings can add up over time. Aim to save a portion of each paycheck, even if it's just a few dollars. Consider opening a savings account with a high-yield interest rate.

Once you have a small emergency fund, explore low-risk investment options, such as bonds or index funds. Consult with a financial advisor to determine the best investment strategy for your risk tolerance and financial goals.

Financial stability on a low income is an ongoing journey, not a destination. By implementing these strategies and maintaining discipline, you can take control of your finances and build a more secure future for yourself and your family.

:max_bytes(150000):strip_icc()/Primary-Image-how-to-get-low-income-loans-everything-you-need-to-know-7254705-c157b334a3bd497f88f0009ce07393f2.jpg)