How To Break Into Hedge Fund

Imagine stepping into a world of sleek offices overlooking bustling cityscapes, a world fueled by data, strategy, and the pursuit of alpha. The air crackles with intellectual energy, the hum of Bloomberg terminals a constant soundtrack. For many aspiring finance professionals, the hedge fund industry represents the pinnacle of achievement, a landscape of high stakes and potentially high rewards. But how does one navigate the labyrinthine paths that lead to a coveted role within these secretive institutions?

Breaking into the hedge fund world requires a potent mix of exceptional skills, strategic networking, and a deep understanding of the industry's nuances. This article serves as a comprehensive guide, offering actionable insights and expert advice for those determined to carve their path into this competitive, yet rewarding sector. We'll explore the essential qualifications, networking strategies, and the importance of developing a unique edge that will help you stand out from the crowd.

Understanding the Hedge Fund Landscape

Before embarking on this journey, it’s crucial to understand what hedge funds are and how they operate. Unlike mutual funds, which typically adhere to stricter regulations and focus on broader market indices, hedge funds employ diverse and often complex investment strategies.

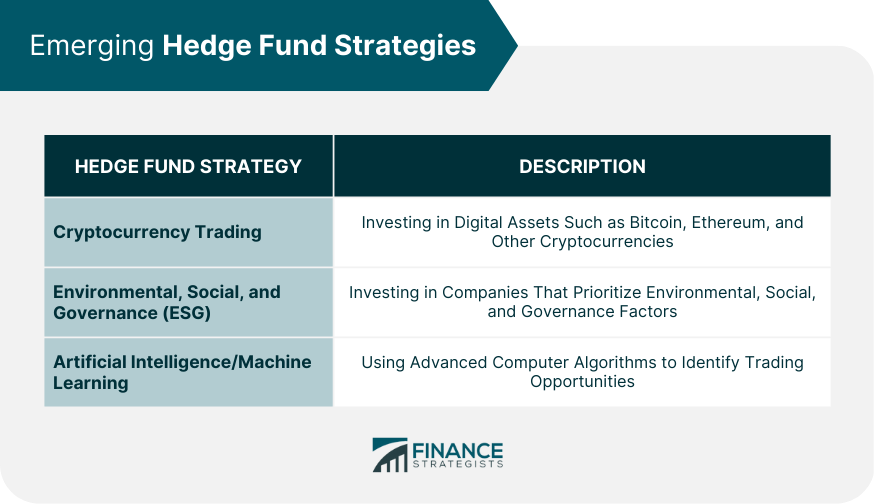

These strategies can range from long-short equity and distressed debt to macro trading and quantitative analysis, each requiring specialized knowledge and skills. Understanding these different approaches is the first step in identifying where your skills and interests align.

Essential Skills and Qualifications

A strong academic background is generally a prerequisite. Top-tier undergraduate and graduate programs in finance, economics, mathematics, or computer science are highly valued.

However, academic excellence is only the foundation. Demonstrable skills in financial modeling, data analysis, and programming (particularly Python and R) are increasingly essential.

Furthermore, strong analytical and problem-solving abilities, coupled with excellent communication and interpersonal skills, are crucial for thriving in the fast-paced, collaborative environment of a hedge fund.

Building a Relevant Track Record

Experience is invaluable, and the earlier you start building a relevant track record, the better. Internships at investment banks, asset management firms, or even corporate finance departments can provide valuable exposure and hands-on experience.

Seek out opportunities to work on projects that involve financial analysis, valuation, or portfolio management. Even participating in investment competitions or managing a personal portfolio can demonstrate your passion and abilities.

Consider certifications like the Chartered Financial Analyst (CFA) designation, which signals a commitment to professional development and a deep understanding of investment principles.

The Power of Networking

In the hedge fund world, networking is not just important; it’s often the key to unlocking doors. Attend industry events, conferences, and workshops to connect with professionals in the field.

Leverage platforms like LinkedIn to identify and connect with individuals working at hedge funds that interest you. Reach out for informational interviews to learn more about their experiences and gain valuable insights.

Don't underestimate the power of your alumni network. Connecting with alumni who work in the industry can provide invaluable mentorship and potential opportunities.

Crafting a Compelling Narrative

Your resume and cover letter are your first opportunity to make a strong impression. Tailor them specifically to each hedge fund you're applying to, highlighting the skills and experiences that align with their investment strategy and culture.

Quantify your accomplishments whenever possible, using data to demonstrate the impact you've made in previous roles. Focus on showcasing your analytical abilities, problem-solving skills, and passion for the markets.

Prepare a compelling “stock pitch,” a concise and persuasive argument for a particular investment opportunity. This demonstrates your analytical prowess and ability to identify potential value.

Aceing the Interview Process

The interview process for hedge fund roles can be rigorous, often involving multiple rounds of interviews, technical assessments, and case studies. Be prepared to discuss your investment philosophy, your understanding of the markets, and your ability to analyze complex financial situations.

Practice your technical skills, including financial modeling, valuation, and statistical analysis. Be ready to explain your thought process and defend your assumptions.

Most importantly, be yourself. Authenticity and genuine enthusiasm for the industry can go a long way in making a positive impression.

Standing Out From the Crowd

In a highly competitive field, it’s essential to differentiate yourself. Developing a unique skill or expertise can significantly increase your chances of landing a role.

Consider specializing in a particular sector or investment strategy. Deep knowledge and expertise in a niche area can make you a valuable asset to a hedge fund that focuses on that area.

Building a strong online presence, such as a blog or a portfolio of your investment analyses, can showcase your expertise and passion to potential employers.

The Importance of Continuous Learning

The hedge fund industry is constantly evolving, with new technologies, investment strategies, and market dynamics emerging all the time. A commitment to continuous learning is crucial for long-term success.

Stay up-to-date on the latest market trends, economic developments, and regulatory changes. Read industry publications, attend conferences, and pursue continuing education opportunities.

Embrace new technologies and analytical techniques. The ability to leverage data and technology to gain an edge in the market is increasingly important.

Navigating Setbacks and Rejections

The path to landing a hedge fund role can be challenging, and setbacks are inevitable. Don't be discouraged by rejections. Instead, view them as opportunities to learn and improve.

Seek feedback from mentors and industry professionals on how you can strengthen your skills and improve your application. Use each rejection as a chance to refine your approach and become more competitive.

Persistence, resilience, and a positive attitude are essential for navigating the ups and downs of the job search.

The Ethical Considerations

The hedge fund industry operates in a highly scrutinized environment, and ethical conduct is paramount. Adhere to the highest ethical standards in all your dealings.

Understand and comply with all applicable laws and regulations. Maintain confidentiality and avoid conflicts of interest.

A strong ethical foundation is essential for building trust and credibility in the industry.

A Glimpse into the Future

The hedge fund industry is undergoing significant transformations, driven by technological advancements, evolving investor preferences, and increasing regulatory scrutiny. Understanding these trends is crucial for aspiring professionals.

The rise of artificial intelligence and machine learning is reshaping investment strategies and risk management. The increasing focus on ESG (Environmental, Social, and Governance) factors is influencing investment decisions.

Adapting to these changes and embracing new technologies will be essential for success in the future.

Breaking into the hedge fund world is a challenging but achievable goal. It requires a combination of exceptional skills, strategic networking, and unwavering determination. By focusing on building a relevant track record, crafting a compelling narrative, and continuously learning, you can increase your chances of landing a coveted role in this dynamic and rewarding industry. Remember, the path may be arduous, but the rewards of intellectual stimulation, financial opportunities, and professional growth can be immense.

.webp)