How To Break The Habit Of Spending Money

In an era defined by enticing online advertisements and the ease of one-click purchases, overspending has become an increasingly pervasive challenge. Many find themselves caught in a cycle of impulsive buying, struggling to reconcile their spending habits with their financial goals.

The consequences of unchecked spending can be far-reaching, impacting everything from long-term savings to overall well-being. Breaking free from this habit requires a conscious effort and a strategic approach.

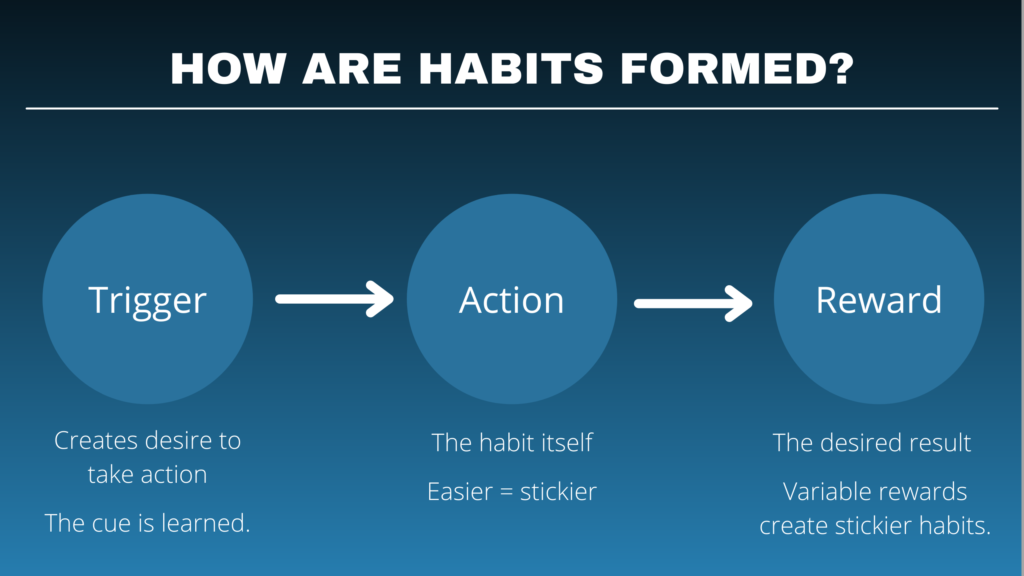

Understanding the Root Causes

The key to conquering overspending lies in understanding the underlying triggers. Often, spending is not simply about acquiring material possessions; it's linked to emotional needs. Identifying these triggers is a crucial first step.

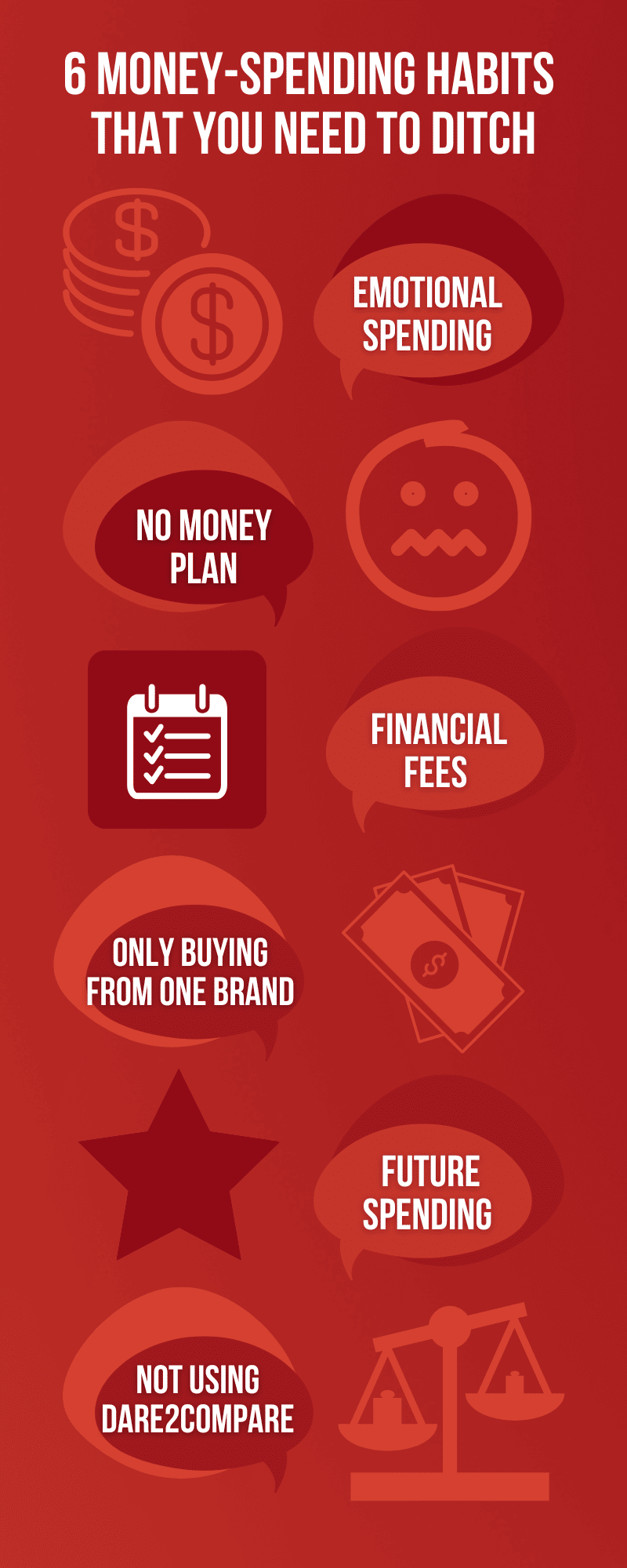

Emotional Spending

Many people use shopping as a coping mechanism for stress, sadness, or boredom. This emotional spending provides a temporary boost but ultimately leads to regret and financial instability.

Recognizing these emotional triggers and developing healthier coping mechanisms, such as exercise or mindfulness, can significantly reduce impulsive purchases.

The Influence of Marketing

The modern advertising landscape is designed to stimulate desire and encourage consumption. Targeted ads on social media and personalized recommendations can make it incredibly difficult to resist temptation.

Being aware of these manipulative tactics allows consumers to make more informed choices. Unsubscribing from promotional emails and limiting exposure to targeted ads can be a helpful strategy.

Practical Strategies for Breaking the Habit

Once the root causes are understood, concrete steps can be taken to curb spending. These strategies involve both mindset shifts and practical tools.

Budgeting and Tracking Expenses

Creating a realistic budget is essential for gaining control over finances. Tracking expenses, whether through a spreadsheet, budgeting app, or simply a notebook, provides a clear picture of where money is going.

Several apps, such as Mint and YNAB (You Need A Budget), offer comprehensive budgeting and tracking features. This increased awareness can reveal areas where spending can be reduced.

The 24-Hour Rule

Before making a non-essential purchase, implement a 24-hour waiting period. This pause allows time to consider whether the item is truly needed or simply a fleeting desire. "This cooling-off period often helps to prevent impulse buys," says financial advisor Sarah Chen.

During this waiting period, assess whether the purchase aligns with financial goals and values. If it doesn't, it's easier to resist the urge to buy.

Cash-Only Approach

Using cash instead of credit cards can make spending feel more tangible. The physical act of handing over money often creates a stronger awareness of the cost.

"Studies have shown that people spend less when using cash compared to credit cards,"according to a report by the Consumer Finance Protection Bureau (CFPB).

This method forces individuals to be more mindful of their spending decisions. It also helps avoid accumulating debt from credit card interest.

Setting Financial Goals

Having clear financial goals, such as saving for a down payment on a house or paying off debt, provides a strong motivation to curb spending. These goals serve as a constant reminder of what's at stake.

Visualizing these goals can further strengthen the commitment to saving. Creating a vision board or writing down specific objectives can be highly effective.

Seeking Professional Help

For some, overspending may be a sign of a deeper issue, such as a spending addiction. In these cases, seeking professional help from a therapist or financial counselor may be necessary.

Organizations like Debtors Anonymous offer support groups and resources for individuals struggling with compulsive spending. Therapy can help address underlying emotional issues contributing to the habit.

The Long-Term Benefits

Breaking the habit of overspending leads to significant long-term benefits. Not only does it improve financial stability, but it also reduces stress and increases overall well-being.

The ability to save and invest wisely opens doors to future opportunities. It also creates a sense of security and control over one's life.

Ultimately, breaking the cycle of overspending is an investment in oneself. It's a commitment to building a more secure and fulfilling future. By understanding the triggers, implementing practical strategies, and seeking help when needed, anyone can achieve financial freedom and live a life aligned with their values.

.png)