How To Calculate A Buyout Of A Business Partner

The scent of freshly brewed coffee hung in the air, a comforting aroma that did little to ease the tension radiating from the small conference room. Sarah tapped her pen against the mahogany table, the rhythmic sound a counterpoint to the anxious silence. Across from her, Mark stared out the window, the city skyline blurring through his unfocused gaze. After years of building their business from the ground up, a partnership forged in shared dreams and late nights, they were now facing a difficult reality: a partner buyout.

Navigating a business partner buyout is a complex process, requiring a blend of objective financial analysis, clear communication, and a healthy dose of empathy. This article aims to provide a practical guide, offering insights into various valuation methods and considerations to ensure a fair and equitable resolution for all parties involved.

Understanding the Basics of Business Valuation

Before diving into specific methods, it's crucial to understand that business valuation is more art than science. No single formula guarantees a perfect result. Instead, a combination of approaches, tailored to the specific business and circumstances, is often the most effective.

Common Valuation Methods:

Several methods are commonly used to determine the value of a business, each with its strengths and weaknesses.

Asset-Based Valuation: This approach focuses on the net asset value (NAV) of the business – the total value of its assets minus its liabilities. This method is best suited for companies with significant tangible assets, such as real estate or inventory.

Market-Based Valuation: This method involves comparing the business to similar companies that have recently been sold. It relies on data from publicly traded companies or recent transactions of privately held businesses in the same industry. Finding truly comparable businesses can be challenging.

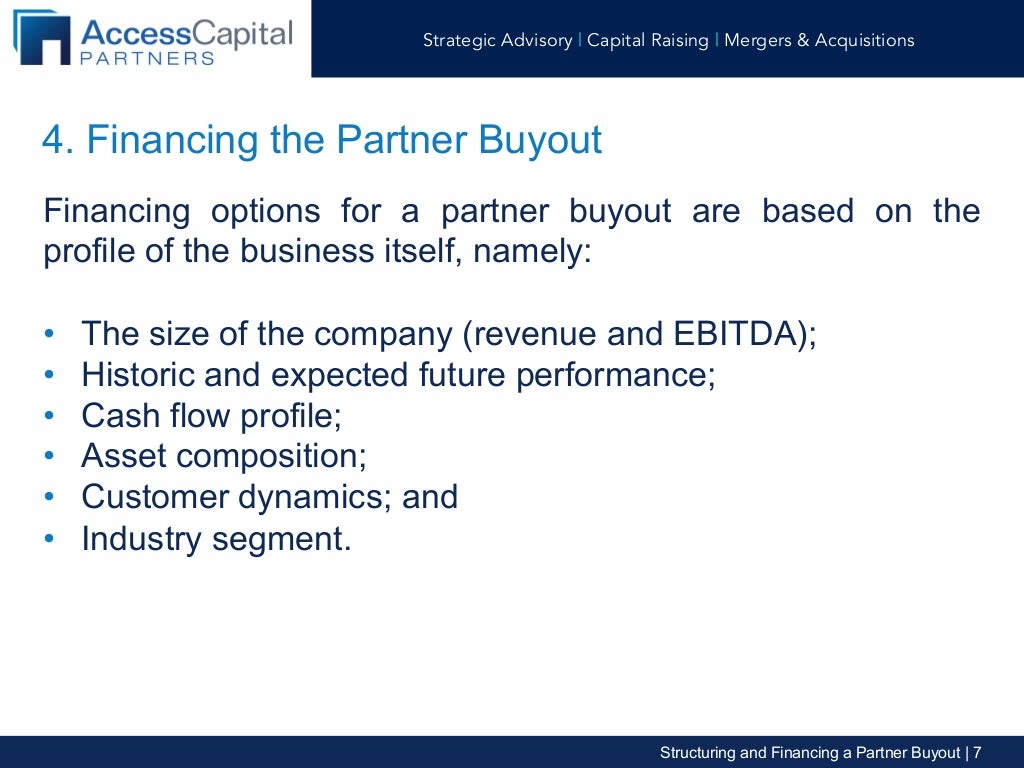

Income-Based Valuation: This method focuses on the business's future earnings potential. The most common income-based method is the discounted cash flow (DCF) analysis, which projects future cash flows and discounts them back to their present value.

"The goal is not to find the absolute 'true' value, but to arrive at a fair and justifiable number that both parties can agree on," says financial analyst, David Miller, in his published article.

Capitalization of Earnings: This method is simpler than DCF, it estimates the value of a company by using a capitalization rate to determine the present value of expected future profits. To calculate the capitalization rate, it is important to consider how risky the industry and the company are.

Negotiating the Buyout: Beyond the Numbers

While valuation provides a foundation, the final buyout price often involves negotiation. Consider factors beyond the numbers, such as the departing partner's contributions to the business.

Consider also the impact of their departure on the remaining business operations. Was the departing partner instrumental in securing key clients, managing employees, or driving innovation? Such factors may justify a premium or discount on the calculated value.

A well-drafted partnership agreement should outline the procedures for a buyout. This helps mitigate disputes and ensures a smoother transition. It should address valuation methods, payment terms, and non-compete clauses.

Seeking Professional Guidance

Navigating a business partner buyout can be emotionally charged and financially complex. Engaging professional advisors is highly recommended.

A qualified business appraiser can provide an objective valuation. Experienced attorneys can help draft the buyout agreement, ensuring it protects the interests of all parties involved. A mediator can facilitate constructive conversations and help bridge any gaps between partners.

The Importance of Communication and Empathy

Beyond the financial aspects, remember that a business partnership often involves strong personal bonds. Approach the buyout process with empathy and a willingness to understand the other partner's perspective.

Open and honest communication is critical to avoid misunderstandings and resentment. Even in difficult circumstances, strive to maintain a respectful and professional demeanor.

Ultimately, a successful buyout protects the interests of both partners and allows the business to continue thriving. While the process may be challenging, it can pave the way for a new chapter for all involved.