How To Calculate Profit From Stocks

Don't leave money on the table! Calculating your stock profit accurately is crucial for making informed investment decisions.

This guide provides a straightforward breakdown of how to determine your gains (or losses) from stock investments, ensuring you understand your true financial performance.

Understanding the Basics

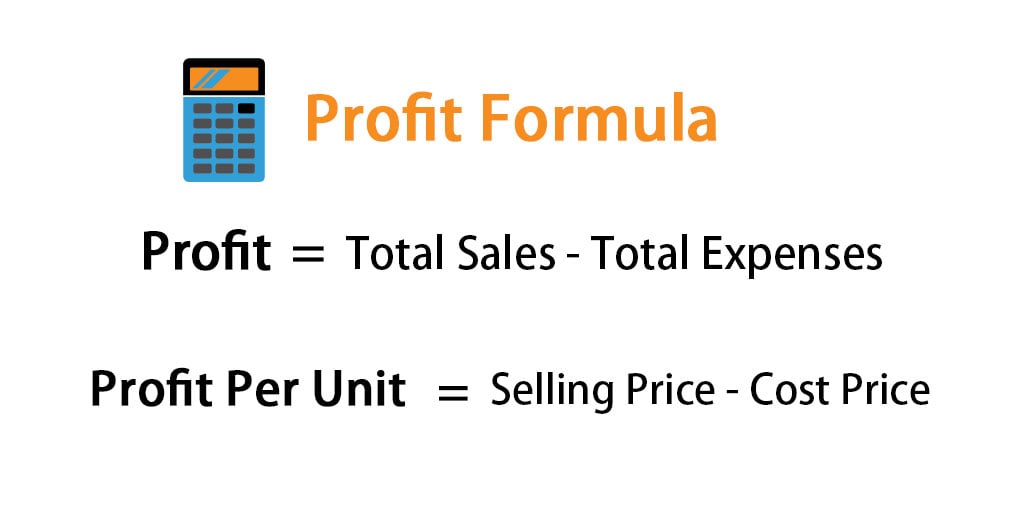

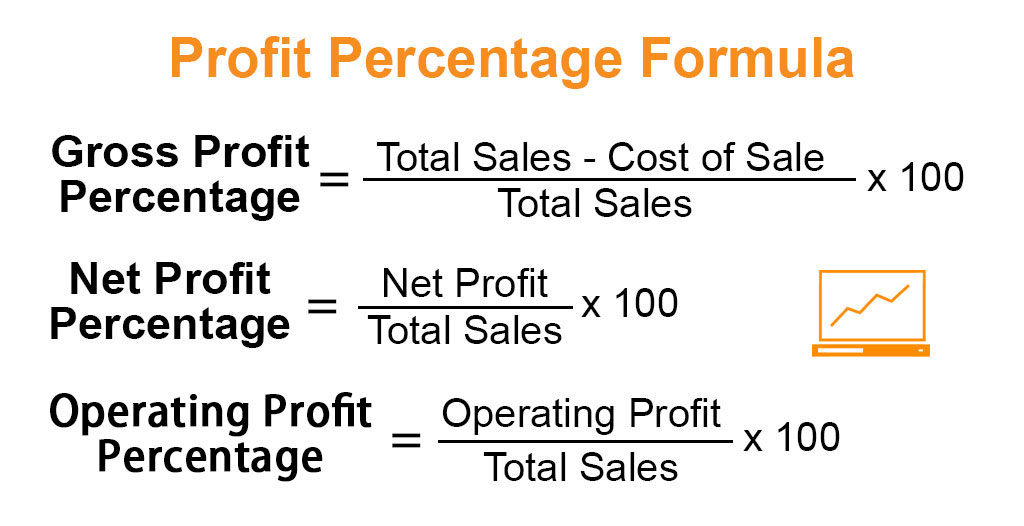

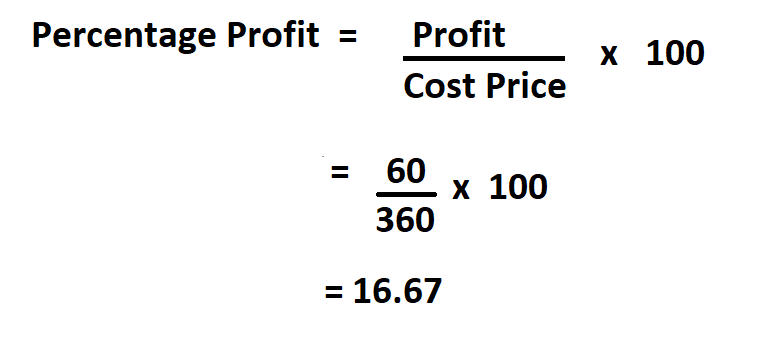

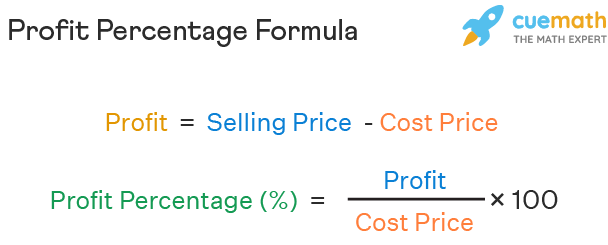

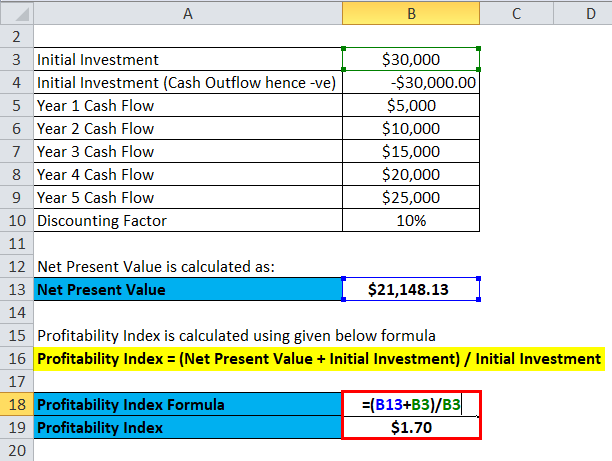

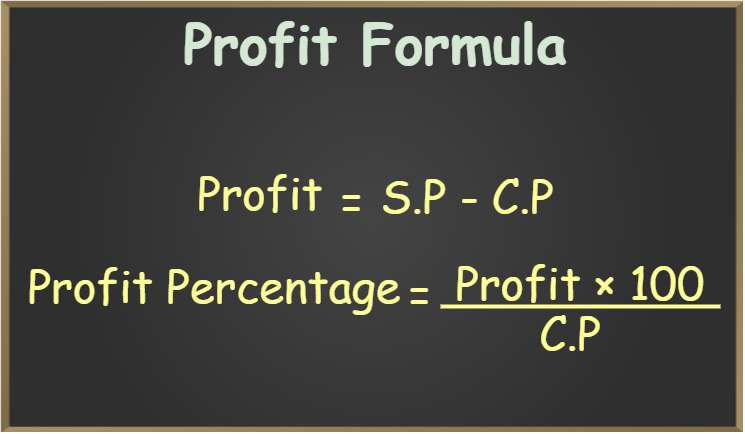

The fundamental profit calculation involves subtracting the total cost of your investment from the total revenue generated.

Profit = Total Revenue - Total Cost. This seems simple, but let's break down what constitutes 'total revenue' and 'total cost' in the stock market.

Total Revenue

Total revenue encompasses all income generated from your stock investment. This primarily includes two components: sale proceeds and dividends.

Sale Proceeds: This is the amount you receive when you sell your shares. Dividends: Some companies distribute a portion of their profits to shareholders in the form of dividends.

To calculate sale proceeds, multiply the number of shares sold by the selling price per share. Remember to factor in any brokerage fees associated with the sale.

Total Cost

Total cost represents all expenses incurred to acquire the stock. This includes the purchase price and any associated fees.

Purchase Price: This is the amount you paid to buy your shares. Brokerage Fees: Most brokers charge a fee for executing buy orders.

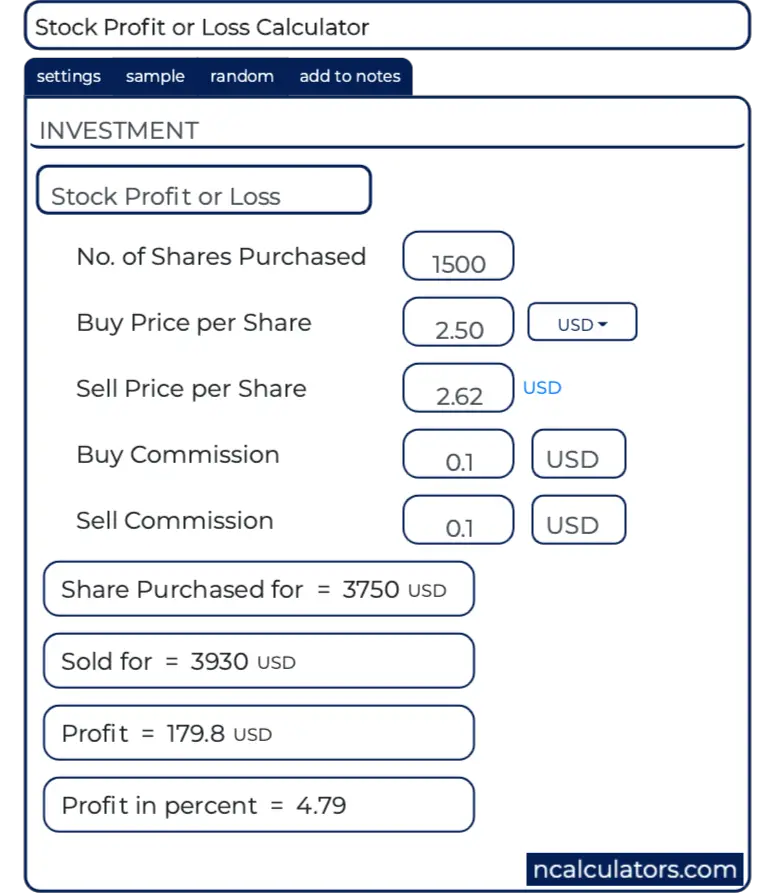

Calculate the total purchase price by multiplying the number of shares purchased by the purchase price per share. Add any brokerage commissions to that amount.

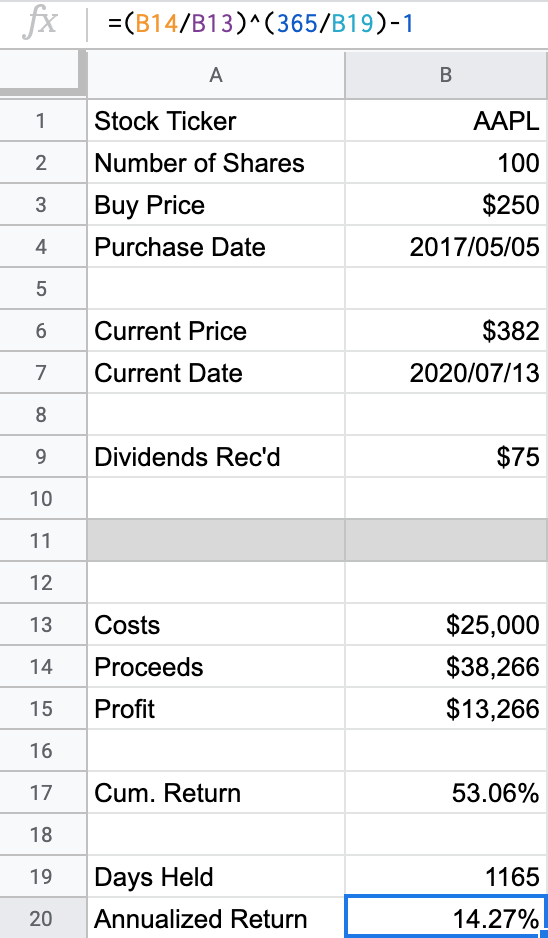

Step-by-Step Calculation

Let's illustrate the calculation with an example.

Example: You bought 100 shares of Company X at $50 per share, with a $10 brokerage fee. You later sold those shares for $60 per share, again with a $10 brokerage fee. You also received $50 in dividends.

1. Calculate Total Revenue: (100 shares * $60/share) + $50 (dividends) = $6050

2. Calculate Total Cost: (100 shares * $50/share) + $10 (brokerage fee) = $5010

3. Calculate Profit: $6050 (Total Revenue) - $5010 (Total Cost) = $1040

Therefore, your profit from this investment is $1040.

Important Considerations

Taxes can significantly impact your overall profit. Consult a tax professional to understand your tax obligations related to stock market gains.

Always factor in inflation. While you may have a nominal profit, the real value of that profit may be less due to the decreased purchasing power of money over time.

Don't forget to track all transactions carefully. Accurate record-keeping is essential for calculating profit and for tax purposes.

Next Steps

Review your brokerage statements regularly. These statements provide a summary of your transactions and can simplify profit calculation.

Utilize online investment calculators. Many free tools are available to help you quickly calculate profit and assess your investment performance.

Consider seeking advice from a financial advisor. A professional can help you develop a personalized investment strategy and optimize your returns.