How To Calculate Salary For Small Business Owner

Imagine a cozy café, the aroma of freshly brewed coffee mingling with the scent of cinnamon rolls. You see the owner, bustling behind the counter, greeting regulars by name, and ensuring everything runs smoothly. But beyond the smiles and the perfectly poured lattes, lies a crucial question: How does this small business owner, and countless others like them, determine their own salary?

This article delves into the often-murky waters of calculating a salary for a small business owner, offering a practical guide to navigate this critical aspect of entrepreneurship. It examines the various approaches, factors to consider, and the importance of separating personal finances from business profits.

Understanding the Landscape

Many aspiring entrepreneurs dream of being their own boss. They want to escape the 9-to-5 grind and build something lasting. Yet, the reality of running a small business often involves juggling numerous responsibilities, from marketing and sales to operations and customer service.

One of the biggest challenges is determining how to pay yourself, especially in the early stages when cash flow is tight and every penny counts. The temptation to reinvest all profits back into the business is strong, but neglecting your own financial needs can lead to burnout and ultimately, jeopardize the business's success.

Methods for Calculating Your Salary

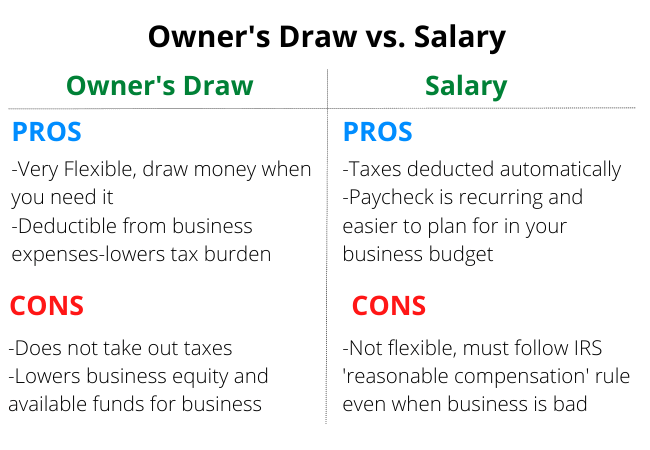

There's no one-size-fits-all solution, but several common methods exist to help small business owners determine a fair and sustainable salary.

1. The "Replacement Salary" Approach

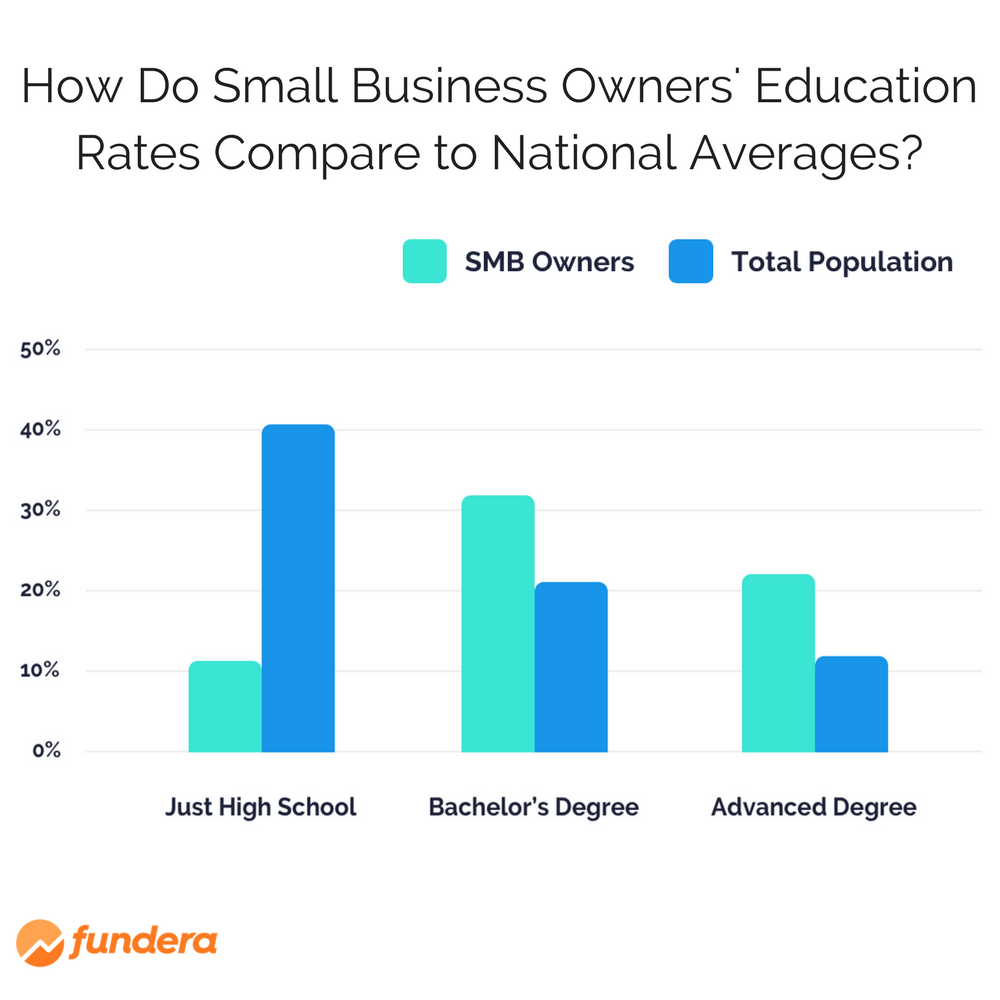

This method starts by asking a fundamental question: What would it cost to replace yourself? Consider the salary you'd expect if you were performing a similar role for another company. Factor in your experience, skills, and the market rate for your position.

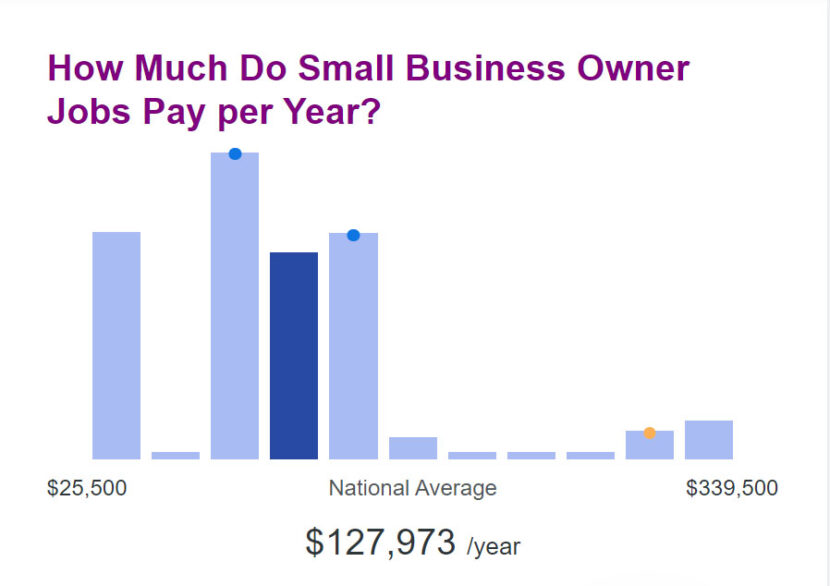

This approach provides a baseline for your salary, ensuring you're compensated fairly for your contributions. Be realistic and research industry benchmarks using resources like the U.S. Bureau of Labor Statistics to get an accurate estimate.

2. The "Affordability" Assessment

This method focuses on the financial health of your business. It involves carefully analyzing your business's profitability and cash flow to determine how much you can realistically afford to pay yourself without jeopardizing its operations.

Start by forecasting your revenue and expenses. Then, allocate funds for essential business needs such as inventory, marketing, and operating costs. Whatever remains can be used to determine the owner's salary, debt repayment or future investments.

3. The "Combination" Strategy

Often, the most effective approach involves a blend of the two methods above. Start with the replacement salary as a target, but adjust it based on the affordability assessment. If your business can't currently support your ideal salary, consider phasing it in over time as your revenue grows.

This approach allows you to balance your personal financial needs with the long-term sustainability of your business. It also encourages you to focus on growth and profitability, knowing that your salary will increase as your business thrives.

Key Considerations

Beyond the specific method you choose, several other factors should influence your salary calculation.

Industry and Location: Salaries vary significantly across different industries and geographic locations. Research industry standards and cost of living in your area to ensure your salary is competitive.

Business Stage: Startups and early-stage businesses typically have less financial flexibility than established companies. Be prepared to take a lower salary initially and gradually increase it as your business matures.

Personal Needs: Consider your personal financial obligations, such as mortgage payments, healthcare costs, and family expenses. Your salary should be sufficient to meet your basic needs and provide a reasonable standard of living.

The Importance of Separation

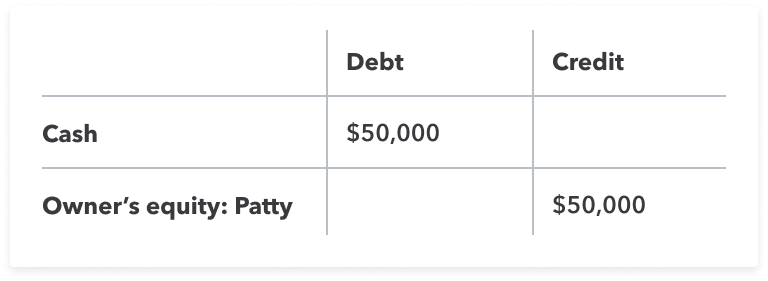

One of the most crucial aspects of running a small business is maintaining a clear separation between your personal and business finances. This not only simplifies accounting and tax preparation but also protects you from personal liability in case of business debts or lawsuits.

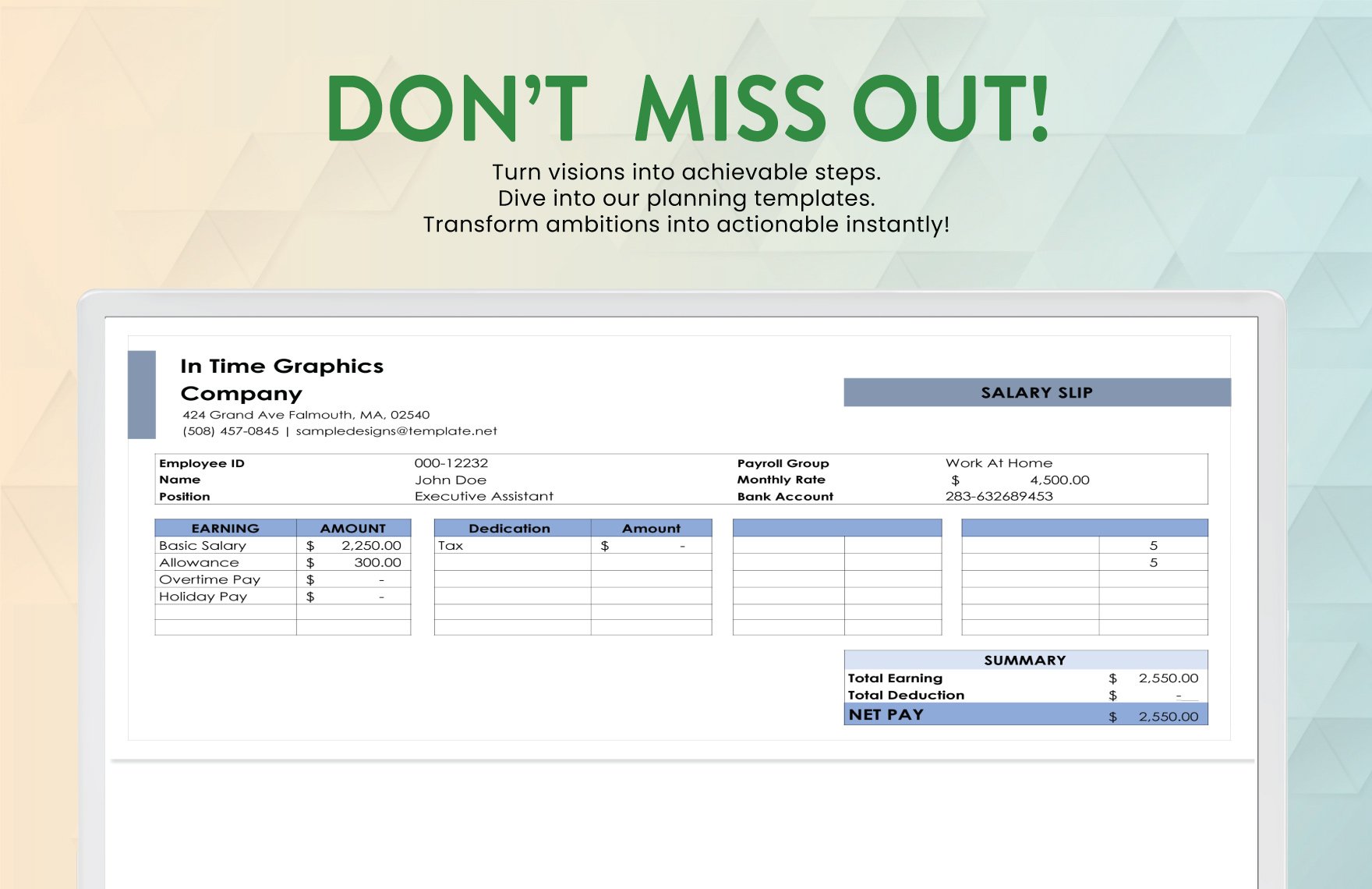

Establish a Formal Payroll: Even if you're the only employee, set up a formal payroll system to track your salary payments. This ensures that you're properly paying taxes and complying with all applicable regulations.

Separate Bank Accounts: Keep your personal and business bank accounts separate. Avoid using your personal funds to pay for business expenses, and vice versa. This will help you maintain accurate financial records and prevent commingling of funds.

Calculating a salary for a small business owner is a complex process that requires careful planning and consideration. By understanding the various methods, factors, and the importance of separation, you can create a sustainable financial plan that benefits both you and your business. Remember, a thriving business starts with a well-compensated owner. Aim to invest wisely in your company and in your life.