How To Create Another Income Stream

In an era defined by economic uncertainty and evolving career landscapes, the pursuit of supplemental income streams is no longer a niche interest, but a growing necessity for many. Diversifying income sources offers a financial safety net, accelerates debt repayment, and can even fuel entrepreneurial ambitions.

This article examines practical strategies and actionable steps individuals can take to generate additional income. It explores avenues ranging from freelancing to passive income investments.

Understanding Your Skills and Resources

The first step in creating another income stream involves a careful assessment of your existing skills and resources. Consider your professional expertise, hobbies, and any assets you possess that could be monetized. "Identifying your strengths is crucial," advises Sarah Chen, a financial consultant at Clarity Financial.

Do you have strong writing or editing skills? Are you proficient in graphic design or web development? Perhaps you have a knack for photography or enjoy teaching others.

Alternatively, think about physical assets. Do you own a spare room that could be rented out through platforms like Airbnb? Or perhaps a car that could be used for ridesharing services like Uber or Lyft? Analyzing these aspects is paramount for identifying suitable opportunities.

Exploring Freelancing and Gig Economy Platforms

The rise of the gig economy has created numerous opportunities for individuals to offer their services on a freelance basis. Platforms like Upwork, Fiverr, and TaskRabbit connect freelancers with clients seeking assistance with various tasks.

These platforms offer a wide range of categories, including writing, design, marketing, and virtual assistance. Freelancing allows you to set your own hours and work from anywhere.

Success in freelancing requires building a strong profile, showcasing your skills, and consistently delivering high-quality work. Client reviews and ratings are crucial for attracting new opportunities.

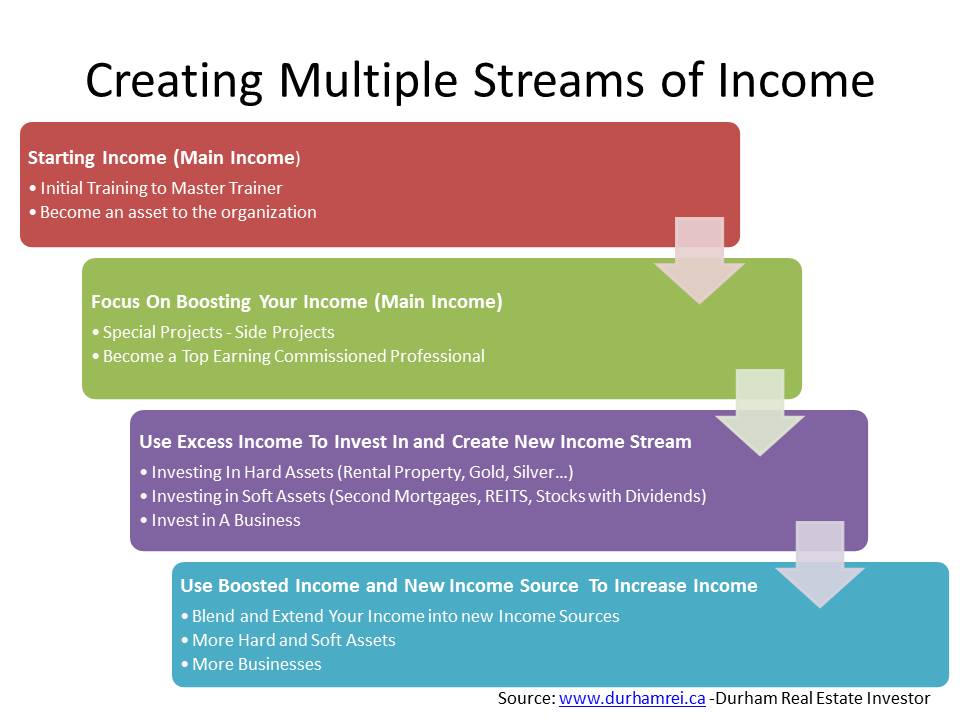

Investing in Passive Income Opportunities

Passive income involves earning revenue with minimal ongoing effort. "While it requires initial investment, passive income can provide a steady stream of cash flow," states David Lee, a certified financial planner at Future Wealth Advisors.

One popular option is investing in dividend-paying stocks or rental properties. Dividend stocks provide regular payments based on company profits, while rental properties generate income through tenant rent.

Other passive income ideas include creating and selling online courses, writing and selling ebooks, or investing in peer-to-peer lending platforms. Thorough research and due diligence are essential before investing in any passive income opportunity.

Creating and Selling Digital Products

In the digital age, creating and selling digital products can be a highly lucrative avenue for generating additional income. Ebooks, online courses, templates, and digital art are all examples of products that can be sold online.

Platforms like Etsy, Teachable, and Gumroad provide marketplaces for creators to showcase and sell their products. Marketing your digital products effectively is crucial for driving sales.

Consider leveraging social media, email marketing, and search engine optimization to reach a wider audience. Providing exceptional customer service and offering valuable content can also foster customer loyalty and repeat purchases.

The Importance of Financial Planning and Consistency

Regardless of the chosen path, effective financial planning is crucial for managing and maximizing your new income stream. Track your income and expenses, set realistic financial goals, and consider consulting with a financial advisor.

Consistency is key. Building a sustainable income stream requires dedication, perseverance, and a willingness to adapt to changing market conditions.

By identifying your skills, exploring various opportunities, and implementing sound financial practices, individuals can successfully create another income stream and achieve greater financial security.

Remember to adapt your strategy and remain flexible to maximize your results.