How To Create Other Streams Of Income

In an era defined by economic uncertainty and evolving job markets, the pursuit of multiple income streams is gaining traction among individuals seeking financial security and independence. Diversifying revenue sources, once considered a niche strategy, is now becoming a mainstream approach to building a more resilient financial future. But how can individuals effectively create these additional income streams?

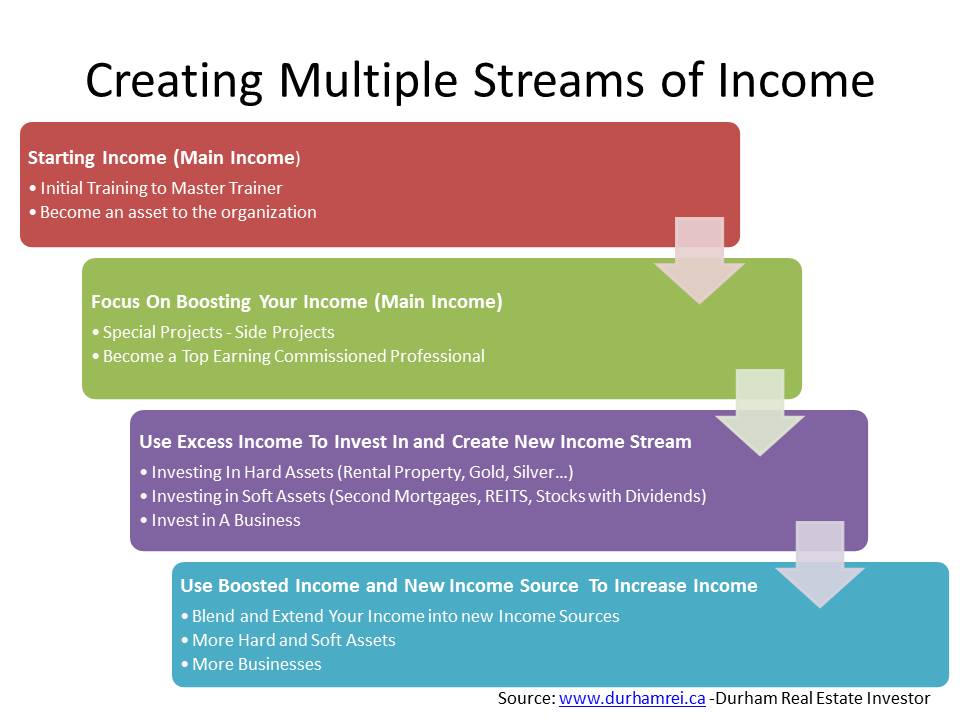

The concept of multiple income streams revolves around generating income from various sources, rather than relying solely on a single job. This article explores strategies and insights into building a diversified income portfolio.

Identifying Skills and Interests

The foundation of any successful income stream strategy lies in self-assessment. Individuals should start by identifying their skills, passions, and areas of expertise. What are you good at? What do you enjoy doing? These answers will guide you toward suitable income-generating opportunities.

Leveraging Existing Skills

Consider how your current skills can be monetized beyond your primary job. Could you offer freelance services in your field? Maybe consulting, tutoring, or creating online courses based on your expertise? According to a recent report by Statista, the freelance economy continues to grow, offering ample opportunities for individuals to monetize their existing skill sets.

"The gig economy allows individuals to take control of their earning potential and build a more flexible lifestyle," says Sarah Jones, a financial advisor specializing in multiple income strategies.

Learning New Skills

Acquiring new skills can open doors to entirely new income streams. Online platforms like Coursera, Udemy, and Skillshare offer a wide range of courses, from coding and graphic design to digital marketing and project management. Investing in skills development can significantly expand your income-generating potential.

Exploring Income Stream Options

Once you have a clear understanding of your skills and interests, it's time to explore potential income stream options. These can be broadly categorized into active and passive income sources.

Active Income

Active income requires direct effort and time investment. Examples include freelancing, consulting, driving for ride-sharing services, or working part-time jobs. While active income demands ongoing involvement, it can provide immediate financial returns.

Passive Income

Passive income, on the other hand, generates revenue with minimal ongoing effort after the initial setup. Examples include investing in dividend-paying stocks, renting out property, creating and selling digital products (eBooks, online courses), or affiliate marketing. Building passive income streams requires upfront investment, but they can provide a more sustainable and hands-off revenue source over time.

The Role of Investing

Investing is a crucial component of building long-term financial security and creating passive income. Investing in stocks, bonds, and real estate can generate dividends, interest, and rental income, respectively. Understanding investment principles and risk management is essential for maximizing returns and minimizing losses.

Managing Your Time and Resources

Successfully managing multiple income streams requires careful planning and time management. Prioritization and delegation are essential skills for avoiding burnout and maximizing efficiency. Utilize tools like calendars, task management apps, and automation software to streamline your workflow and stay organized.

The Impact on Financial Stability

The benefits of multiple income streams extend beyond just increased earnings. Diversifying income sources provides a financial safety net in case of job loss, economic downturns, or unexpected expenses. It also allows individuals to pursue their passions, build wealth, and achieve greater financial freedom.

Creating multiple income streams is a strategic approach to building a more resilient and prosperous financial future. By identifying their skills, exploring diverse income options, and managing their time effectively, individuals can unlock their earning potential and achieve greater financial independence. The key is to start small, be patient, and continuously learn and adapt to the ever-changing economic landscape.