How To Deposit Money To Prepaid Card

Urgent alert: Millions relying on prepaid cards need immediate access to deposit methods. Don't get caught off guard; your funds depend on knowing these options.

This article provides a concise guide on how to deposit money onto your prepaid card quickly and efficiently. Understanding these methods is crucial for maintaining access to your funds and avoiding potential disruptions.

Deposit Methods: Your Quick Guide

Several options exist for adding money to your prepaid card. The best method depends on your card provider and personal circumstances.

Direct Deposit

Setting up direct deposit is often the most convenient option, especially for recurring income. To set this up, you'll need your card's routing number and account number, which can typically be found on your cardholder agreement or online account portal.

Give this information to your employer or the entity issuing your payments (e.g., Social Security Administration). Ensure all details are accurate to prevent delays or rejected deposits.

Retail Reload Locations

Many retailers partner with prepaid card companies to offer reload services. Common locations include Walmart, CVS, Walgreens, and 7-Eleven.

Simply visit the customer service desk or designated reload station with cash and your prepaid card. Fees typically apply for this service, usually ranging from $3 to $5 per transaction.

Bank Transfers

You may be able to transfer funds from your bank account to your prepaid card. This often requires linking your bank account to your prepaid card account online.

Check with your card issuer to confirm if this option is available and any associated fees or limitations. Transfer times can vary, typically taking one to three business days.

Cash Reload Networks

Companies like Green Dot and MoneyGram provide cash reload networks. These networks have thousands of locations where you can add funds to your prepaid card.

Find a participating location near you and provide the cashier with the cash and your prepaid card information. Again, expect to pay a fee for this service.

Mobile Check Deposit

Some prepaid cards offer mobile check deposit through their mobile app. This allows you to deposit checks by taking a picture of them with your smartphone.

This method may be subject to holds, meaning the funds won't be immediately available. Check your card agreement for specific terms and conditions regarding mobile check deposits.

Peer-to-Peer Transfers

Certain prepaid cards allow you to receive funds via peer-to-peer payment apps like Venmo or Cash App. Confirm with your card issuer if this is supported.

Link your prepaid card to your Venmo or Cash App account and request or accept the transfer. Funds availability depends on the app's policies.

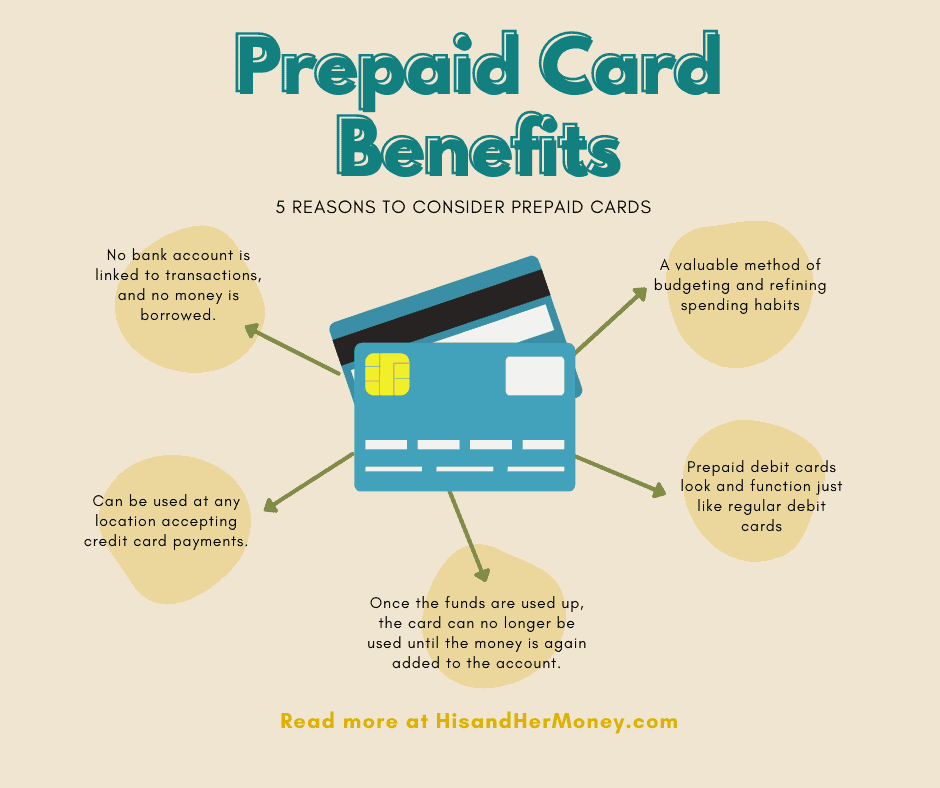

Important Considerations

Fees: Always be aware of any fees associated with depositing money onto your prepaid card. These fees can vary depending on the method and card issuer.

Limits: Prepaid cards often have daily or monthly deposit limits. Exceeding these limits can result in rejected transactions or account restrictions.

Security: Protect your card information and PIN to prevent unauthorized access and fraud. Report any suspicious activity to your card issuer immediately.

Availability: Deposit methods and locations may vary. Check with your card issuer or visit their website for the most up-to-date information.

Next Steps

Review your prepaid card agreement and online account portal for detailed information on deposit methods, fees, and limits. Contact your card issuer directly with any questions or concerns.

Stay informed about any changes to deposit policies or available options. This knowledge is key to efficiently managing your prepaid card funds.

:max_bytes(150000):strip_icc()/_How-does-a-prepaid-card-work-960201_Final2-a914cdbc7901430d80de45153461af0a.png)