How To Enable Fico Score On Navy Federal App

In today's financial landscape, understanding and monitoring your FICO score is crucial for managing your financial health. Navy Federal Credit Union, a major financial institution serving military members and their families, offers its members the ability to access their FICO score directly through their mobile app. This feature empowers members to stay informed about their creditworthiness and make informed financial decisions.

This article provides a comprehensive guide on how to enable and access your FICO score within the Navy Federal app. It will also cover important information related to the feature and its implications for Navy Federal members.

Enabling Your FICO Score within the Navy Federal App

The process of enabling your FICO score on the Navy Federal app is relatively straightforward. Make sure you have the latest version of the Navy Federal mobile app installed on your smartphone or tablet before proceeding.

Step-by-Step Instructions

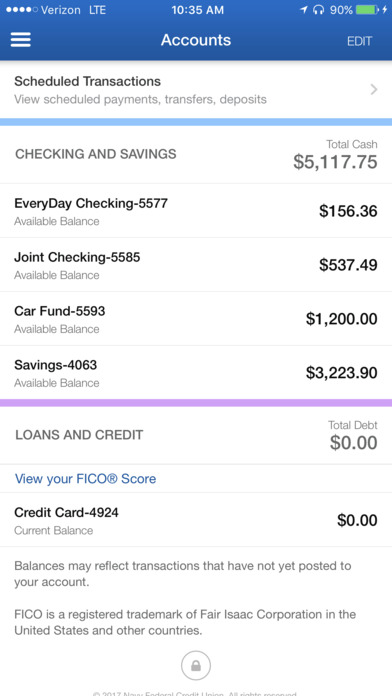

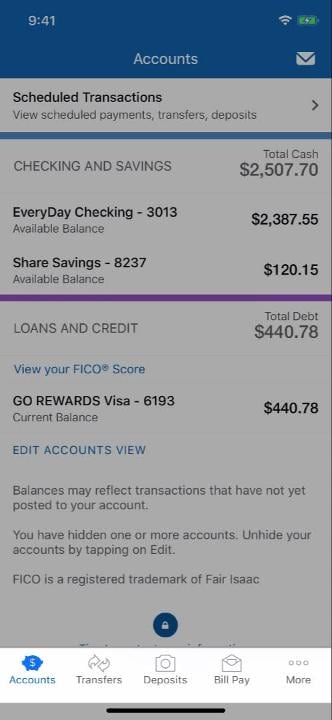

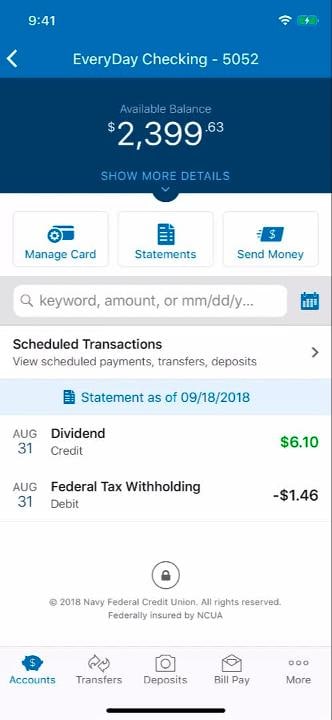

First, open the Navy Federal mobile app and log in using your credentials. Once logged in, navigate to the "Accounts" section of the app. Look for the account overview screen, where you can view all your Navy Federal accounts.

Within the account overview, locate the "More" or "Services" menu, which may be represented by three dots or a similar icon. Tap this option to reveal a list of additional services and features available to you.

From the list of services, find and select "FICO Score". If you haven't enabled the feature before, you may be prompted to agree to the terms and conditions associated with accessing your FICO score. Read through the terms carefully before proceeding.

After accepting the terms, the app should display your current FICO score. This information is typically updated monthly, allowing you to track your credit score's progress over time.

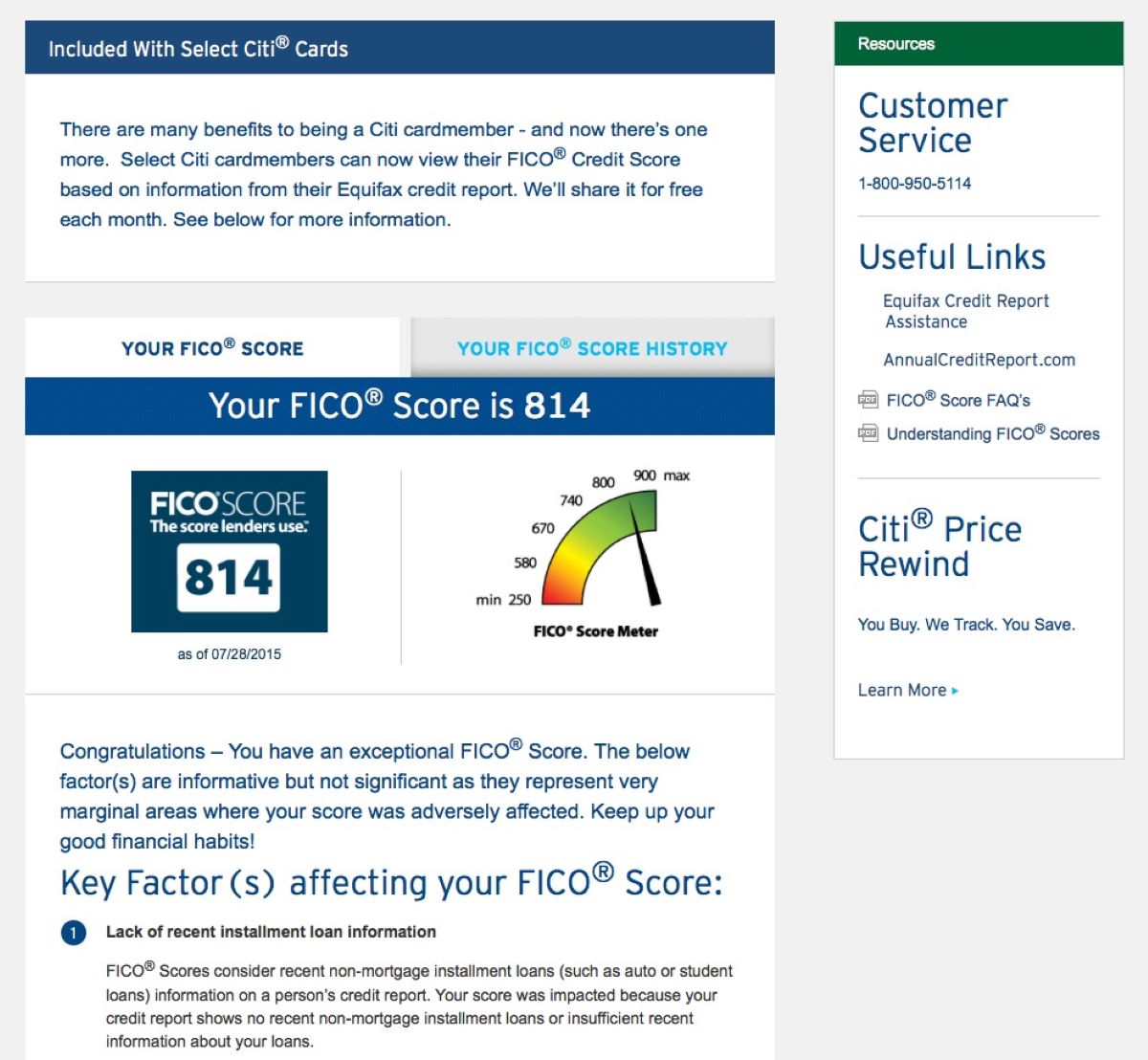

Understanding the FICO Score Displayed

The FICO score displayed within the Navy Federal app is provided by Experian, one of the three major credit bureaus. Your FICO score falls within a range of 300 to 850, with higher scores indicating better creditworthiness.

The app will also typically provide a brief explanation of the factors influencing your score. This information can help you identify areas where you can improve your credit profile.

Remember that your FICO score is just one factor that lenders consider when evaluating your credit application. Other factors include your income, debt-to-income ratio, and overall credit history.

Benefits of Monitoring Your FICO Score

Accessing your FICO score through the Navy Federal app offers several significant benefits. It allows you to proactively monitor your credit health, identifying any potential issues or errors on your credit report early on.

By tracking your FICO score, you can also gauge the impact of your financial decisions on your creditworthiness. This can help you make informed choices about managing your debt and building credit.

Furthermore, knowing your FICO score can empower you to negotiate better interest rates on loans and credit cards. A higher credit score often translates to more favorable terms from lenders.

Addressing Potential Issues and Concerns

While accessing your FICO score is generally a smooth process, some users may encounter issues. If you are unable to locate the FICO score feature within the app, ensure that you have the latest version installed.

If problems persist, contact Navy Federal's customer service for assistance. Their representatives can guide you through the process and troubleshoot any technical difficulties you may be experiencing.

It's also important to remember that the FICO score provided through the app is for informational purposes only. It should not be considered a definitive guarantee of loan approval or interest rate.

The Future of Financial Monitoring

The integration of FICO score access into mobile banking apps represents a growing trend in the financial industry. Financial institutions are increasingly recognizing the importance of empowering consumers with tools to manage their credit health.

As technology advances, we can expect to see even more sophisticated features and insights integrated into mobile banking platforms. This will enable consumers to take greater control of their financial well-being.

For Navy Federal members, the ability to easily monitor their FICO score is a valuable resource that can help them achieve their financial goals. Staying informed and proactive about your credit health is a crucial step towards building a secure financial future.