How To File 1095 B Electronically

Imagine a small business owner, Sarah, buried under a mountain of paperwork, the deadline for 1095-B forms looming large. The thought of printing, stuffing envelopes, and mailing hundreds of these forms fills her with dread. She wishes there was an easier way, a digital solution to navigate this annual compliance task.

For businesses and organizations required to furnish and file 1095-B forms, electronic filing offers a streamlined and efficient alternative to traditional paper methods. This article provides a comprehensive guide on how to file 1095-B forms electronically, covering everything from eligibility and requirements to step-by-step instructions and helpful resources.

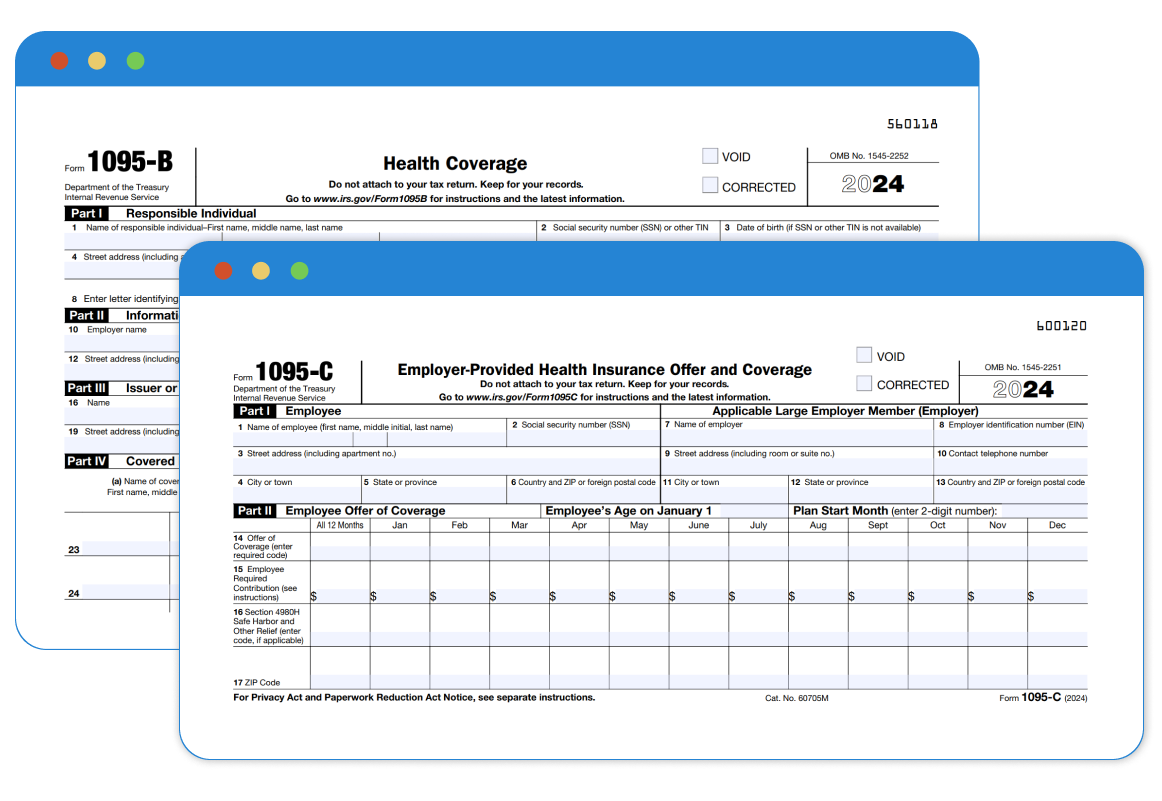

Understanding Form 1095-B and Electronic Filing Requirements

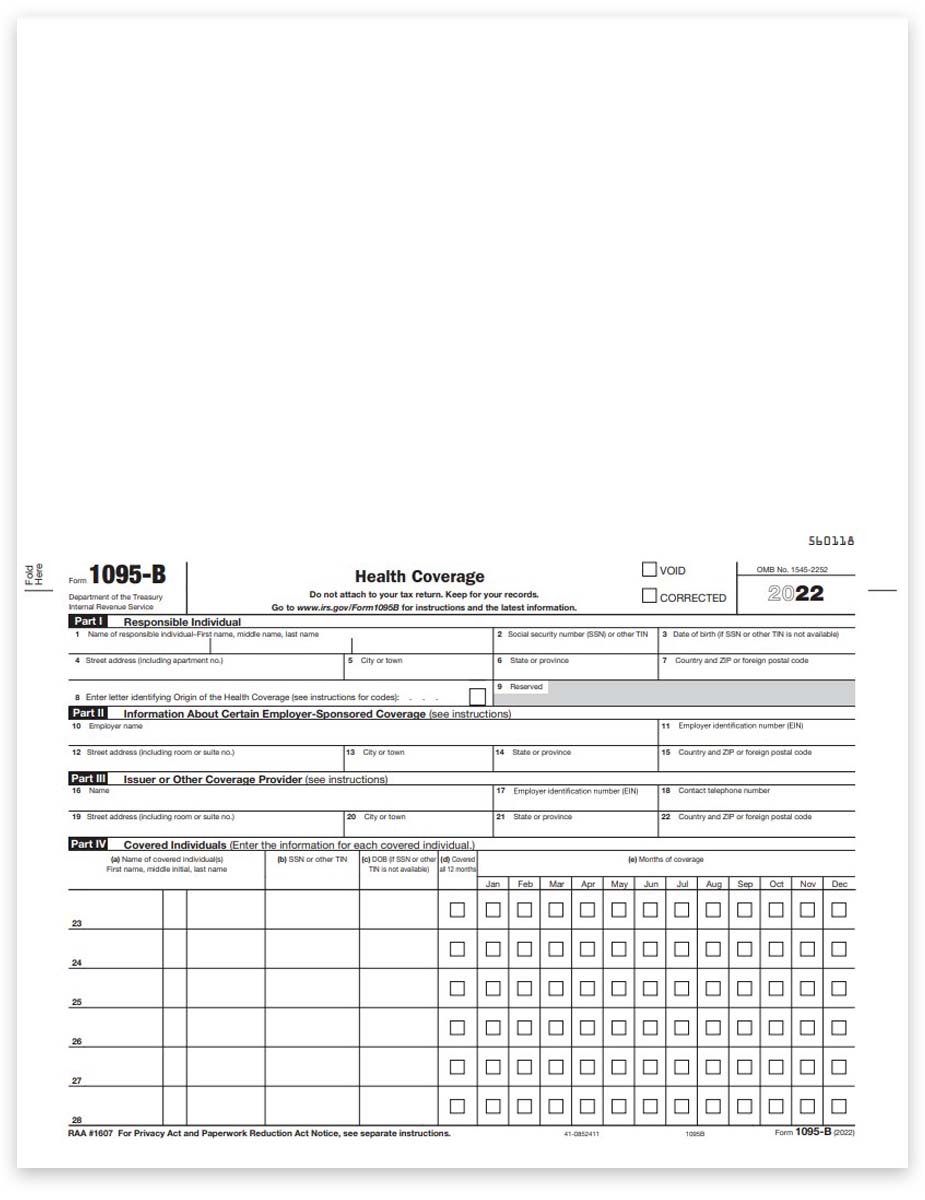

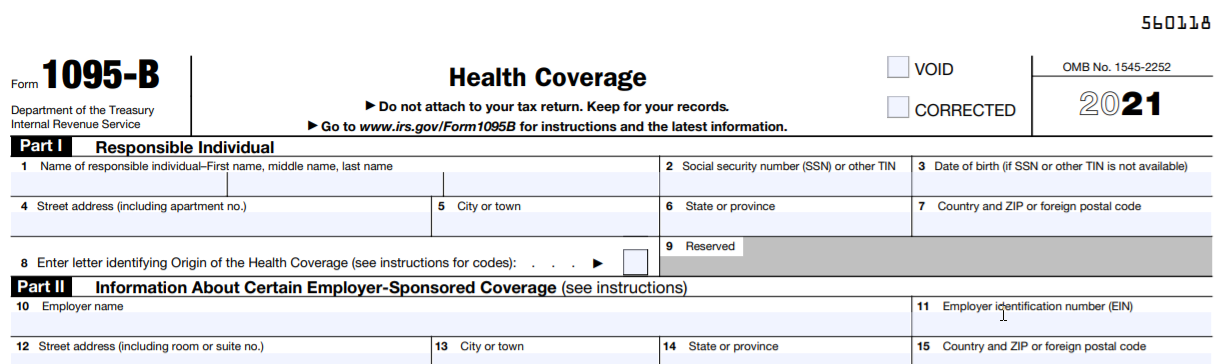

Form 1095-B, Health Coverage, is used to report information to the IRS and to individuals about who was covered by minimum essential coverage during the tax year. Entities that typically file this form include insurance companies, employers providing self-insured health coverage, and government agencies.

The IRS encourages electronic filing for most information returns, including Form 1095-B. In fact, if you are required to file 250 or more information returns of any one type (e.g., 1099-MISC, 1095-B), you are generally required to file them electronically.

Who Can File Electronically?

Almost anyone can file 1095-B forms electronically. Whether you are a large corporation, a small business, or a third-party transmitter, the IRS's electronic filing systems are accessible to all.

Benefits of Electronic Filing

Electronic filing offers numerous advantages over paper filing, including reduced paper waste, faster processing times, and improved accuracy. It also helps to minimize the risk of lost or damaged forms and provides electronic confirmation that the IRS has received your submission.

Preparing to File Electronically

Before you can begin filing 1095-B forms electronically, you need to take a few preliminary steps. These include obtaining the necessary software, acquiring a Transmitter Control Code (TCC), and gathering the required information for each individual.

Software Options

You have two primary options for filing 1095-B forms electronically: using the IRS's Filing Information Returns Electronically (FIRE) system or using a third-party software vendor. The FIRE system is free to use, but it requires technical expertise to format and transmit the data.

Third-party software vendors offer user-friendly interfaces and often provide additional features, such as data validation and error correction. However, these services typically come with a fee.

Obtaining a Transmitter Control Code (TCC)

To file electronically, you will need a Transmitter Control Code (TCC) from the IRS. This code identifies you as an authorized transmitter of information returns.

To obtain a TCC, you must submit Form 4419, Application for Filing Information Returns Electronically (FIRE) to the IRS. The application process can take several weeks, so it's important to apply well in advance of the filing deadline.

The IRS offers detailed instructions for completing Form 4419 on its website. Be sure to provide accurate and complete information to avoid delays in processing your application.

Gathering Required Information

Before you begin entering data into your chosen software, gather all the necessary information for each individual covered by minimum essential coverage. This includes the individual's name, address, Social Security number (SSN) or Taxpayer Identification Number (TIN), and the months of coverage.

Having this information readily available will streamline the filing process and minimize the risk of errors. Double-check all information for accuracy before submitting your forms.

Step-by-Step Guide to Filing Electronically

Once you have your software, TCC, and required information, you are ready to begin the electronic filing process. The specific steps may vary slightly depending on the software you are using, but the general process is outlined below.

Step 1: Create Your Data File

Using your chosen software, create a data file containing the information for all the 1095-B forms you need to file. The data file must be in the format required by the IRS, which is typically a text file with specific formatting conventions.

Consult the IRS Publication 1220, Specifications for Filing Information Returns Electronically (FIRE) for detailed information on the required file format. Your software vendor may also provide tools to help you create the data file correctly.

Step 2: Validate Your Data File

Before submitting your data file to the IRS, it's crucial to validate it to ensure that it meets the IRS's requirements and contains no errors. Most software programs offer built-in validation tools that can help you identify and correct any issues.

Common errors include missing information, incorrect formatting, and invalid SSNs or TINs. Correcting these errors before submitting your file will prevent delays in processing and potential penalties.

Step 3: Transmit Your Data File

Once you have validated your data file, you can transmit it to the IRS using the FIRE system or your chosen software. The transmission process typically involves logging into the system, uploading your data file, and entering your TCC.

The IRS provides detailed instructions on how to transmit data files through the FIRE system on its website. Your software vendor will also provide specific instructions for using their software to transmit files.

Step 4: Verify Receipt and Acceptance

After transmitting your data file, it's important to verify that the IRS has received and accepted your submission. The FIRE system will typically provide a confirmation message indicating whether your file was successfully transmitted.

The IRS will also send you an acknowledgement file indicating whether your file was accepted or rejected. If your file was rejected, the acknowledgement file will provide information on the errors that need to be corrected.

Correcting Errors and Filing Amendments

Even with careful preparation, errors can sometimes occur during the filing process. If you discover an error after submitting your 1095-B forms, you will need to file an amended return.

To file an amended return electronically, you will need to correct the errors in your data file and resubmit it to the IRS. Be sure to indicate that you are filing an amended return and include the appropriate correction codes.

The IRS provides detailed instructions on how to file amended returns in Publication 1220. Consult this publication for specific guidance on correcting errors and submitting amended forms.

Resources and Support

The IRS offers a variety of resources and support to help you file 1095-B forms electronically. These resources include:

- The IRS website: This website contains detailed information on Form 1095-B, electronic filing requirements, and related topics.

- Publication 1220: Specifications for Filing Information Returns Electronically (FIRE).

- IRS Customer Service: You can contact the IRS by phone or mail for assistance with filing your 1095-B forms.

- Tax Professionals: Consider consulting with a qualified tax professional for personalized assistance with your filing requirements.

Remember to always consult the official IRS website for the most up-to-date information and guidance. Staying informed is the best way to ensure compliance and avoid penalties.

Conclusion

Filing 1095-B forms electronically might seem daunting at first, but with careful preparation and the right resources, it can be a manageable and even efficient process. By embracing digital solutions, businesses can streamline their compliance obligations, reduce administrative burdens, and contribute to a more sustainable future.

Imagine Sarah, no longer overwhelmed by piles of paper, but instead confidently submitting her 1095-B forms electronically, knowing she has saved time, money, and a whole lot of stress. This is the power of embracing technology and simplifying complex tasks.

.png)