How To Find Money To Start A Business

For aspiring entrepreneurs, the dream of launching a business often collides with the stark reality of securing funding. Navigating the financial landscape can feel overwhelming, but with careful planning and diligent research, viable funding options exist.

This article explores diverse strategies for sourcing capital, providing a roadmap for budding business owners to turn their visions into reality. From traditional loans to innovative crowdfunding platforms, understanding the available avenues is the first crucial step.

Traditional Funding Sources

Banks and credit unions remain a primary source of funding for many startups. Securing a loan, however, requires a solid business plan, strong credit history, and often, collateral.

The Small Business Administration (SBA) doesn't directly lend money, but it guarantees loans made by participating lenders. This guarantee reduces risk for lenders, making them more willing to finance small businesses.

According to the SBA, their loan programs are specifically designed to help small businesses access capital. These programs can be a vital resource for businesses that might not qualify for conventional financing.

Venture Capital and Angel Investors

For high-growth potential startups, venture capital (VC) firms and angel investors can provide substantial funding in exchange for equity. These investors are typically high-net-worth individuals or firms that invest in early-stage companies.

Securing VC funding is highly competitive. Startups need a compelling business model, a strong team, and a clear path to profitability to attract their attention.

Angel investors often provide smaller amounts of capital than VC firms, but they can be more accessible for early-stage startups. These individuals typically offer mentorship and guidance alongside financial support.

Government Grants and Programs

Various government agencies offer grants and programs to support small businesses, particularly those in specific industries or demographics. These grants often require a detailed application process and have specific eligibility criteria.

The Grants.gov website is a central repository for federal grant opportunities. It allows businesses to search for grants based on their industry, location, and other criteria.

State and local governments may also offer grant programs. Researching opportunities within your specific region is essential.

Crowdfunding and Peer-to-Peer Lending

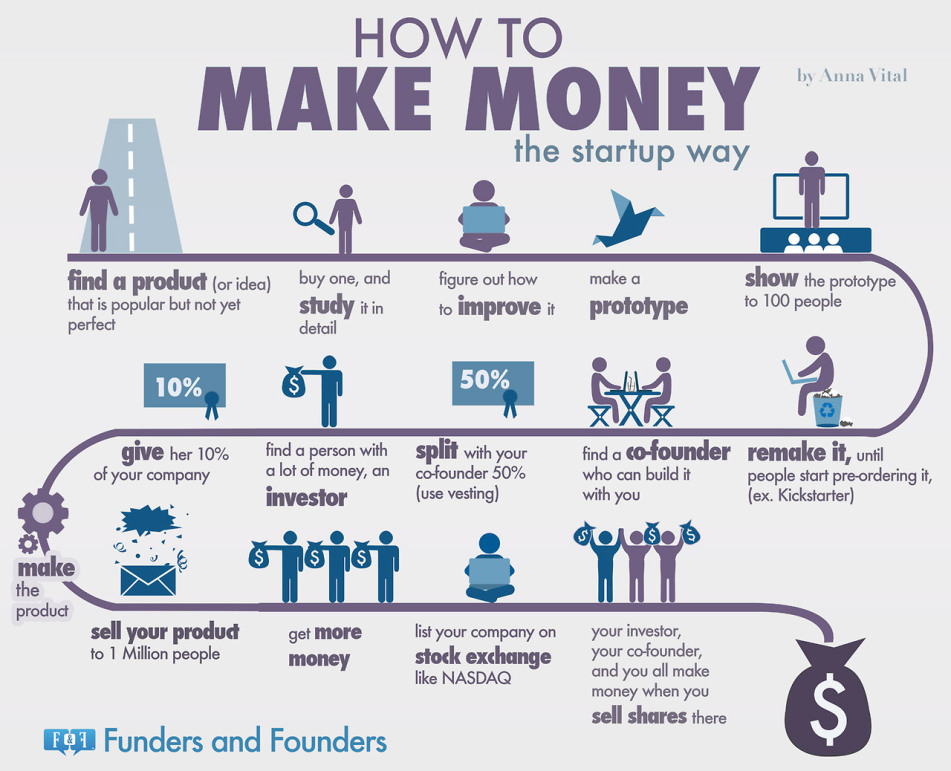

Crowdfunding platforms like Kickstarter and Indiegogo allow businesses to raise capital from a large number of individuals. This option is particularly suitable for businesses with a compelling product or service that resonates with a wide audience.

Peer-to-peer lending platforms connect borrowers directly with individual lenders. These platforms can offer more flexible terms than traditional lenders, but interest rates may be higher.

Both crowdfunding and peer-to-peer lending require effective marketing and communication to attract investors or lenders.

Bootstrapping and Personal Savings

Bootstrapping, or self-funding, involves using personal savings and revenue generated by the business to finance its growth. This option requires careful budgeting and financial discipline.

Many successful businesses started with minimal external funding. Bootstrapping allows entrepreneurs to maintain full control of their company and avoid diluting equity.

It's important to remember that building a business through personal savings involves risk. Seek professional financial advice before committing significant personal assets.

The Human Element

Sarah Chen, a local entrepreneur, launched her sustainable clothing line using a combination of bootstrapping and a successful Kickstarter campaign. "I started with my savings," she said, "but crowdfunding allowed me to reach a wider audience and pre-sell my products."

Her story highlights the importance of combining different funding strategies to achieve success. Flexibility and adaptability are crucial in the ever-changing business landscape.

Chen also emphasized the value of networking and seeking advice from other entrepreneurs. "Don't be afraid to ask for help," she advised.

Conclusion

Securing funding is a critical step in launching and growing a business. Exploring the various options, from traditional loans to innovative crowdfunding platforms, is essential for finding the right fit.

A solid business plan, strong financial management, and a willingness to adapt are key to attracting investors and securing the necessary capital. The entrepreneurial journey requires perseverance, but with the right funding strategy, success is attainable.

Ultimately, the best funding approach depends on the specific needs and circumstances of the business. Thorough research and careful planning are crucial for navigating the financial landscape and achieving long-term sustainability.