How To Generate Capital For Business

Access to capital is the lifeblood of any business, especially for startups and growing enterprises. Securing funding can be a daunting task, but a strategic approach, coupled with diligent research and preparation, can significantly increase the odds of success. This article explores several avenues for generating capital, offering practical insights for entrepreneurs seeking financial resources.

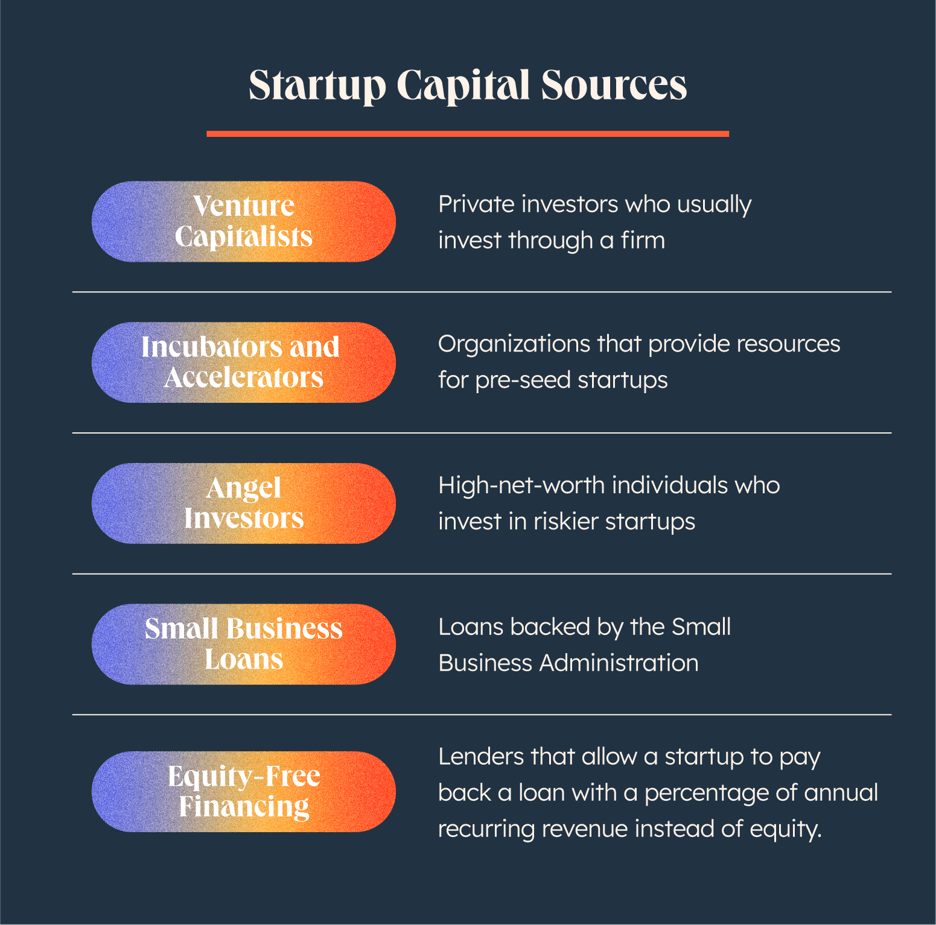

Understanding the various funding options is crucial before embarking on the capital-raising journey. From bootstrapping to venture capital, each method has its own advantages, disadvantages, and suitability depending on the business stage and needs. The key lies in identifying the most appropriate strategy aligned with the company's goals and risk tolerance.

Bootstrapping and Self-Funding

For many early-stage businesses, bootstrapping, or self-funding, is the initial and often only option. This involves using personal savings, revenue generated from early sales, and minimizing expenses to fuel growth. It allows entrepreneurs to maintain complete control of their company, but it can also be a slow and challenging path.

Many entrepreneurs start with money from friends and family. This is one of the most common forms of early-stage funding. While this can be a convenient option, it's crucial to treat these relationships with the same level of professionalism as any other investor, clearly outlining terms and expectations to avoid future conflicts.

Debt Financing: Loans and Credit Lines

Debt financing involves borrowing money that must be repaid with interest over a set period. Small business loans from banks or credit unions are a common source of capital. These loans typically require a solid business plan, good credit history, and collateral.

Lines of credit offer more flexibility than traditional loans, allowing businesses to borrow funds as needed, up to a certain limit. They are particularly useful for managing short-term cash flow gaps or seasonal fluctuations in revenue. However, interest rates on lines of credit can be higher than those on term loans.

Equity Financing: Investors and Venture Capital

Equity financing involves selling a portion of your company's ownership in exchange for capital. This is often the route for high-growth startups seeking substantial funding to scale rapidly. Angel investors, wealthy individuals who invest in early-stage companies, are one potential source.

Venture capital (VC) firms invest in companies with high growth potential in exchange for a significant equity stake. Securing VC funding is a highly competitive process, requiring a compelling business plan, a strong team, and a clear path to profitability. VC investments often come with the expectation of rapid growth and a potential exit strategy, such as an acquisition or IPO.

Government Grants and Programs

Numerous government agencies offer grants and programs to support small businesses, particularly those in specific industries or demographics. These programs can provide non-dilutive funding, meaning that businesses do not have to give up equity. However, obtaining these grants can be competitive, often involving a rigorous application process.

The Small Business Administration (SBA) offers a variety of loan programs, including guaranteed loans provided through partner lenders. These programs can help small businesses access capital that they might not otherwise be able to obtain. These programs are available to businesses meeting specific criteria.

Crowdfunding: Engaging the Community

Crowdfunding platforms like Kickstarter and Indiegogo allow businesses to raise capital from a large number of individuals, often in exchange for rewards or early access to products. This can be a powerful tool for startups with a strong community or a compelling product.

Equity crowdfunding allows individuals to invest in startups in exchange for equity. This allows start-ups to generate awareness and potential customers, but it requires careful planning and execution.

Strategic Partnerships

Forming strategic partnerships can also be a way to generate capital. This may involve partnering with a larger company for distribution, marketing, or product development. Such partnerships can provide access to resources and expertise that might otherwise be unavailable.

Ultimately, the best approach to generating capital depends on the individual business and its specific circumstances. A comprehensive understanding of the available options, combined with a well-developed business plan and a persuasive pitch, is essential for success. Entrepreneurs need to carefully evaluate each option, considering its implications for ownership, control, and future growth.