How To Get A Copy Of W2 From Walmart

Tax season looms, and for millions of Americans who've worked at Walmart, the annual scramble for W-2 forms begins. Missing or misplaced W-2s can throw a wrench into tax filing, leading to delays, penalties, and unnecessary stress. Navigating the process of obtaining this crucial document doesn't have to be difficult, however, if you understand the available options and necessary steps.

This article serves as a comprehensive guide on how to obtain a copy of your W-2 form from Walmart, ensuring a smooth and timely tax filing experience. We will explore various methods, including online access, contacting Walmart's support services, and requesting a copy through mail, while highlighting potential challenges and offering solutions.

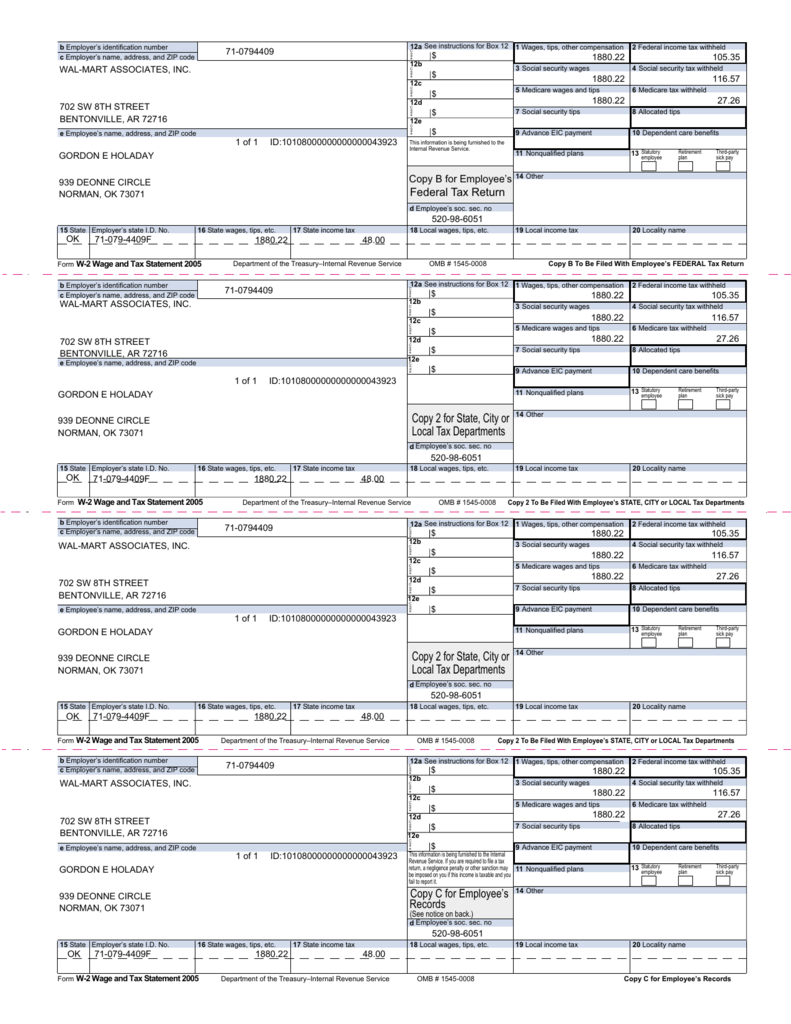

Accessing Your W-2 Online

The most convenient way for many current and former Walmart associates to access their W-2 is online through the company's secure platform. This method often provides the quickest and easiest access to your tax information.

Current associates can typically access their W-2 forms through the My Money section on the One.Walmart.com website. You'll need your Walmart login credentials, including your User ID and password, to access this portal.

Former associates may still be able to access their W-2s online, but the process might differ slightly. If you no longer have access to One.Walmart.com, you may need to contact Walmart's support services to regain access or explore alternative methods of obtaining your W-2.

Contacting Walmart's Support Services

If you're unable to access your W-2 online, contacting Walmart's support services is the next logical step. Walmart provides various channels for associates to request assistance with their W-2 forms.

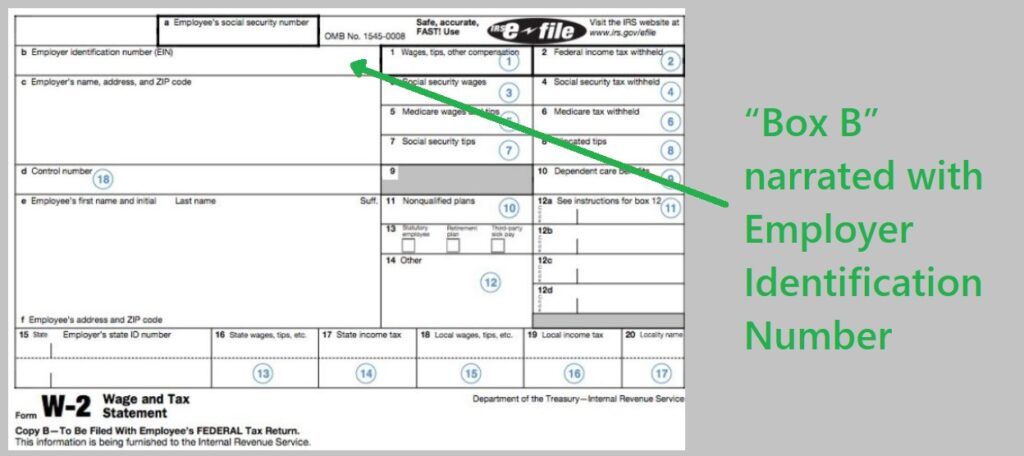

You can contact the Associate Service Center (ASC) via phone. Be prepared to provide identifying information such as your name, social security number, date of birth, and dates of employment to verify your identity.

Alternatively, you might be able to submit a request through Walmart's online help desk or portal, if available. Clearly state your request for a copy of your W-2 and provide all necessary information.

Requesting a W-2 Through Mail

If online access and contacting support services prove unsuccessful, requesting a copy of your W-2 through mail remains a viable option. This method might take longer than the other two.

Contact the Associate Service Center to inquire about the specific procedure for requesting a W-2 via mail. They will likely require you to submit a written request with your identifying information and mailing address.

Ensure your request includes your full name, social security number, dates of employment, and the address where you want the W-2 mailed. Sending the request via certified mail with return receipt requested can provide proof of delivery.

Potential Challenges and Solutions

Obtaining your W-2 from Walmart isn't always seamless. There might be challenges, such as forgotten login credentials, outdated contact information, or delays in processing requests. It is important to identify these challenges and work out solution to avoid any penalties.

If you've forgotten your login credentials for One.Walmart.com, utilize the password recovery options available on the website. If you’re unable to recover your credentials, contact the Associate Service Center for assistance.

If your contact information is outdated, promptly update it with Walmart to ensure timely delivery of important documents, including your W-2. You can typically update your information through One.Walmart.com or by contacting the Associate Service Center.

Looking Ahead

As tax regulations evolve, Walmart may introduce new or updated methods for accessing W-2 forms. Staying informed about these changes is crucial for a smooth tax filing experience. It is always a good practice to keep track of important dates.

Regularly check One.Walmart.com or communicate with the Associate Service Center for any updates regarding W-2 access. Proactive communication and awareness of potential changes can save time and reduce stress during tax season.

By understanding the various methods for obtaining your W-2 from Walmart and being prepared to address potential challenges, you can navigate tax season with confidence and ensure a timely and accurate tax filing.