How To Get Cash Advance From Credit One Card

Imagine a sudden flat tire on a deserted highway, a medical bill that unexpectedly arrives, or a fantastic deal you can't miss but your paycheck is still a week away. These are the moments when having access to quick cash can be a lifesaver. If you're a Credit One cardholder, a cash advance might seem like a viable option.

This article provides a clear and comprehensive guide on how to obtain a cash advance from your Credit One credit card, covering the process, associated fees, and crucial considerations to ensure you make informed decisions about your finances. We'll navigate the specifics of Credit One's policies, offering practical advice on how to use this feature responsibly, and explore alternative options you may wish to consider.

Understanding Credit One Cash Advances

A credit card cash advance allows you to borrow cash directly from your credit card's available credit line. Think of it as a short-term loan from your card issuer. It's important to remember that while convenient, cash advances come with fees and interest rates that are generally higher than those for regular purchases.

Credit One, like many credit card companies, offers cash advances as a feature on some of their cards. However, the availability and terms of cash advances can vary depending on the specific card product and your individual creditworthiness.

Eligibility and Limits

Not all Credit One cards automatically include a cash advance feature. To determine if your card allows cash advances, you'll need to review your card agreement or contact Credit One directly.

Your cash advance limit will also be different from your overall credit limit. Credit One sets a specific cash advance limit, which is usually a percentage of your total credit line. This information is typically found in your card agreement or can be obtained by logging into your online account or calling customer service.

How to Request a Cash Advance

There are several ways to obtain a cash advance from your Credit One card. Each method has its own nuances and potential associated fees.

One common method is to use your credit card at an ATM. You'll need to have a PIN (Personal Identification Number) associated with your card. If you don't have a PIN or have forgotten it, you can usually request one from Credit One's customer service.

Another option is to request a cash advance at a bank or financial institution that accepts your card's network (e.g., Visa or Mastercard). You'll typically need to present your card and a valid form of identification.

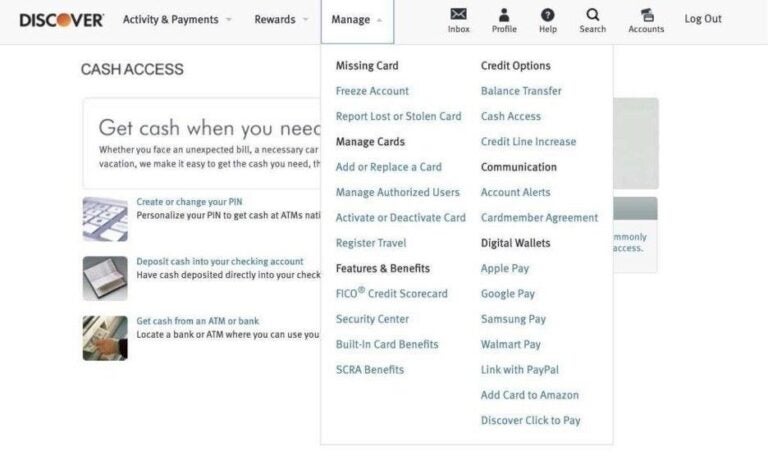

In some cases, Credit One might allow you to request a cash advance online or over the phone, with the funds being deposited directly into your bank account. This option usually takes a few business days to process.

Fees and Interest Rates: A Critical Consideration

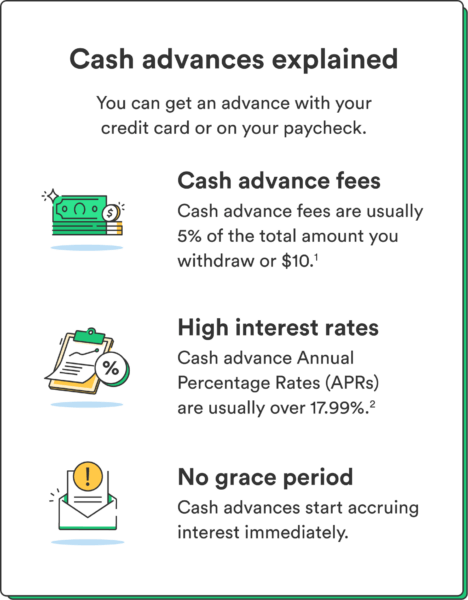

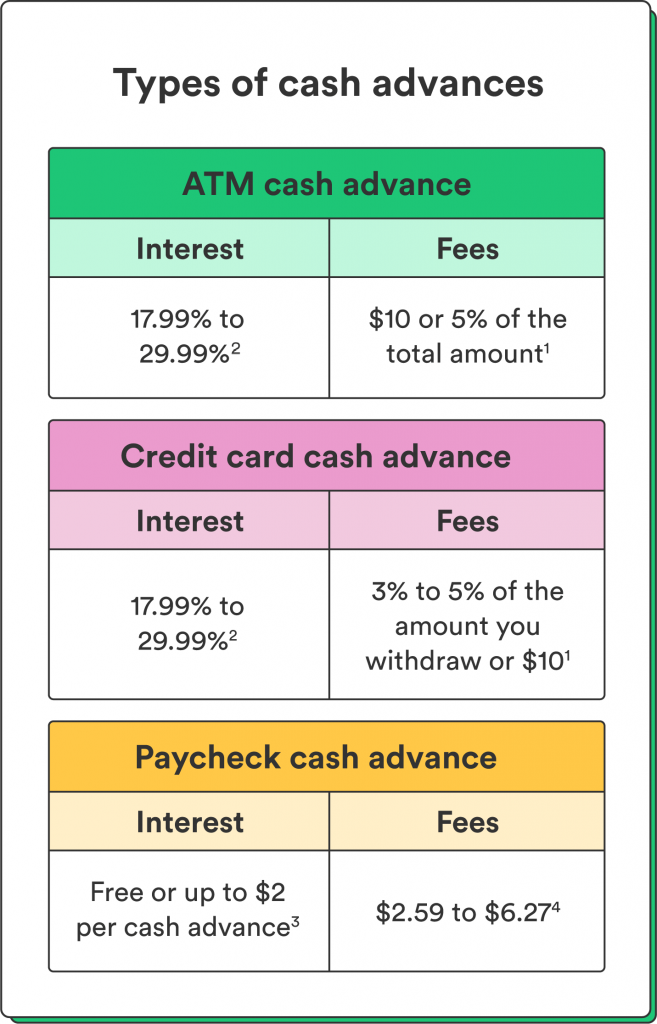

Before taking out a cash advance, it's crucial to understand the associated costs. Cash advances come with both fees and interest charges.

Cash advance fees are typically a percentage of the amount you borrow, or a flat fee, whichever is greater. Credit One will disclose the exact fee structure in your card agreement.

The interest rates on cash advances are almost always higher than the interest rates for regular purchases. Furthermore, interest on cash advances usually begins accruing immediately, without a grace period. This means you'll start paying interest from the moment you take out the advance.

According to data from the Consumer Financial Protection Bureau (CFPB), cash advance interest rates can be significantly higher than purchase APRs. It's essential to check your Credit One card's specific terms to understand the applicable rates and fees.

Example Scenario

Let's say you take out a $500 cash advance with a 3% cash advance fee and a 25% APR. The fee would be $15 (3% of $500). Interest would start accruing immediately at a rate of 25% per year, compounded daily. This quickly adds up, making the cash advance a costly form of borrowing.

Responsible Use and Alternatives

Due to the high costs associated with cash advances, it's crucial to use them responsibly and explore alternative options whenever possible.

If you need cash for an emergency, consider options such as borrowing from friends or family, taking out a personal loan, or exploring a 0% APR balance transfer card (if you're eligible). These options may offer lower interest rates and more favorable repayment terms.

Budgeting and financial planning can also help you avoid the need for cash advances in the future. Creating a budget can help you track your income and expenses, identify areas where you can save money, and build an emergency fund to cover unexpected costs. The Financial Planning Association (FPA) offers resources and guidance on creating a budget and managing your finances effectively.

Only use cash advances when absolutely necessary and when you have a clear plan for repayment. Pay off the balance as quickly as possible to minimize the amount of interest you accrue.

Contacting Credit One

If you have any questions about your Credit One card's cash advance feature, fees, or limits, the best course of action is to contact Credit One directly. You can usually find their contact information on your card statement, online account, or on their website. Be sure to have your card number and other identifying information readily available when you call.

Credit One offers customer service via phone and often provides online chat support for quick inquiries. This allows you to get the information you need to make informed financial decisions.

A Final Thought

While a Credit One cash advance can provide quick access to funds in an emergency, it's important to understand the costs and use it responsibly. Prioritize building an emergency fund and exploring alternative borrowing options whenever possible. Informed financial decisions are the cornerstone of financial well-being, helping you navigate unexpected challenges and secure your financial future.