How To Get Out Of A Business Partnership

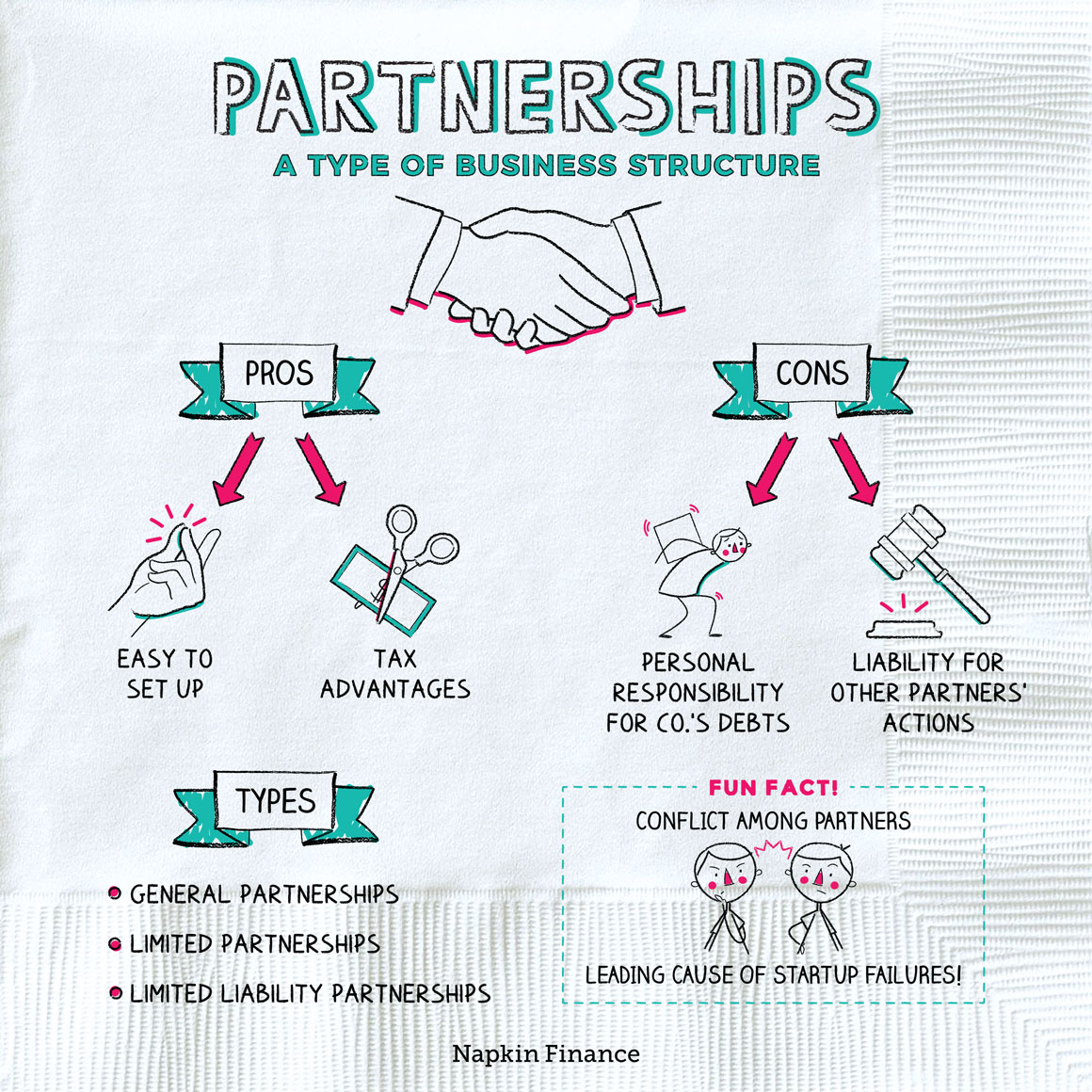

Disentangling from a business partnership can be a complex and emotionally charged process. Navigating this delicate situation requires careful planning, clear communication, and a thorough understanding of legal and financial implications. Knowing the proper steps is essential whether the split is amicable or fraught with conflict.

The dissolution of a partnership, while potentially daunting, can be managed effectively with proper knowledge and preparation. The goal is to protect individual interests, preserve business value where possible, and avoid costly legal battles.

Understanding the Partnership Agreement

The first and most crucial step is reviewing the partnership agreement. This document, often drafted at the outset of the business, outlines the terms and conditions governing the partnership, including the process for dissolution.

Pay close attention to sections addressing buyout clauses, valuation methods, dispute resolution mechanisms, and non-compete agreements. According to Forbes Advisor, a well-defined partnership agreement can significantly streamline the exit process and minimize potential disagreements.

Key Components to Look For:

Valuation Methods: How will the departing partner's share be valued? Buyout Terms: What are the payment terms for the buyout? Dispute Resolution: What process is in place for resolving disagreements?

Communication and Negotiation

Open and honest communication is paramount. Initiating a direct conversation with your partner(s) about your intentions is crucial, even if the relationship is strained.

This conversation should clearly outline your desire to exit the partnership and the reasons behind your decision. Aim for a collaborative approach to negotiation, focusing on finding mutually acceptable solutions.

Legal Counsel and Valuation

Seeking legal counsel from an experienced business attorney is highly recommended. An attorney can advise you on your rights and obligations under the partnership agreement and applicable laws.

Furthermore, they can assist in negotiating the terms of your exit and drafting the necessary legal documents. Obtaining an independent valuation of the business is also critical, particularly if a buyout is involved.

A professional valuation provides an objective assessment of the business's worth, ensuring a fair and accurate determination of the departing partner's share. According to Nolo, independent valuations are vital to minimize the chance of future legal challenges.

Formalizing the Exit

Once an agreement is reached, it must be formalized in writing. This typically involves drafting a separation agreement or buyout agreement.

This document should clearly outline the terms of the departure, including the transfer of ownership, payment schedule, and any ongoing obligations of the departing partner. Consulting with an attorney to draft and review this agreement is essential to ensure it is legally sound and protects your interests.

Tax Implications

Exiting a business partnership can have significant tax implications. It is crucial to consult with a qualified tax advisor to understand the potential tax consequences of your departure, including capital gains taxes, income taxes, and any other relevant taxes.

Proper tax planning can help minimize your tax liability and avoid potential penalties. The IRS provides resources and guidelines on partnership taxation that can be helpful in understanding these implications.

Alternatives to Complete Dissolution

Consider exploring alternatives to a complete dissolution of the partnership. Mediation, for example, can be a valuable tool for resolving disputes and finding common ground.

Restructuring the partnership or modifying the partnership agreement may also be viable options. These alternatives can allow the business to continue operating while addressing the concerns of the departing partner.

The Importance of Documentation

Throughout the entire process, meticulous documentation is critical. Keep records of all communication, negotiations, and agreements related to the partnership dissolution.

This documentation can serve as valuable evidence in the event of a dispute or legal challenge. Maintaining accurate financial records is also essential for determining the value of the business and calculating the departing partner's share.

Navigating the dissolution of a business partnership requires careful planning, open communication, and professional guidance. By understanding the partnership agreement, seeking legal and financial advice, and documenting all steps, you can minimize the risk of conflict and ensure a smoother exit from the business.

![How To Get Out Of A Business Partnership How to Build Lasting Business Partnerships [6 Strategies]](https://referralrock.com/blog/wp-content/uploads/2021/04/how-long-do-marketing-partnerships-last.png)