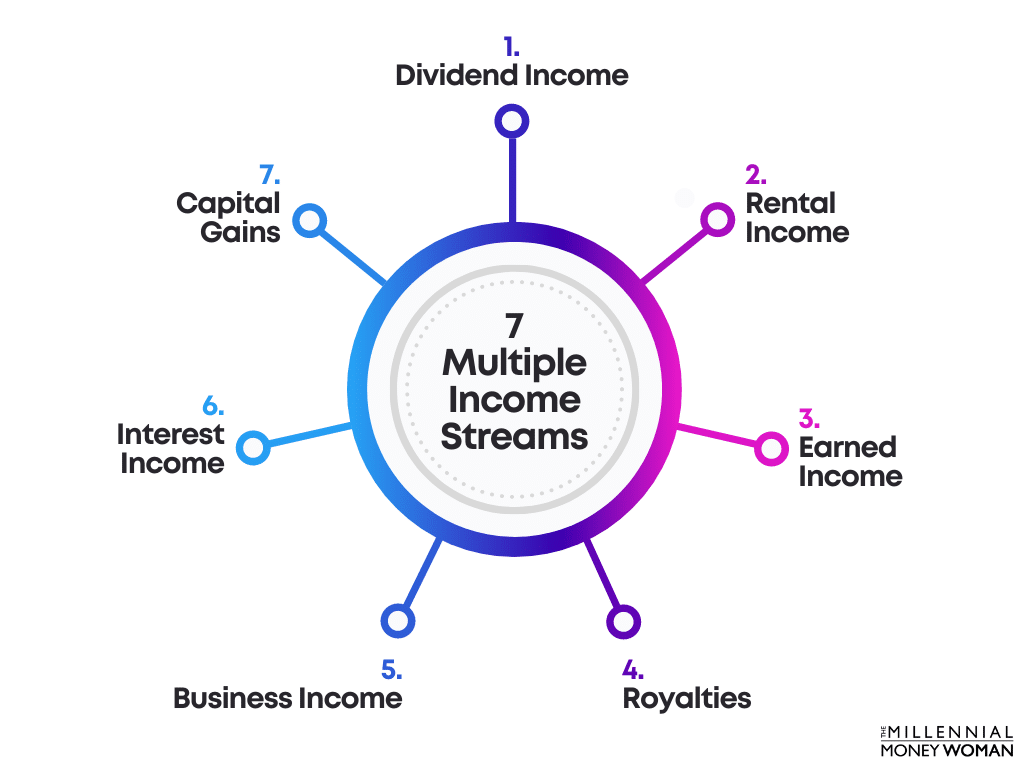

How To Have Multiple Sources Of Income

The relentless churn of the modern economy, coupled with anxieties about job security and inflation, has ignited a fervent search for financial stability. For many, the traditional 9-to-5 job is no longer enough. Diversifying income streams is rapidly evolving from a luxury into a necessity for individuals seeking to bolster their financial well-being and navigate an increasingly unpredictable world.

This article delves into the strategies and considerations involved in building multiple income sources. It explores diverse avenues, from side hustles and investments to real estate and online ventures, offering practical guidance on how to navigate this path effectively. The goal is to equip readers with the knowledge and tools to build a robust and resilient financial future.

Side Hustles and Freelancing

One of the most accessible entry points to multiple income streams is the world of side hustles and freelancing. Platforms like Upwork, Fiverr, and Freelancer connect individuals with clients needing skills ranging from writing and graphic design to web development and virtual assistance.

According to a 2023 report by Side Hustle Nation, approximately 50% of Americans have engaged in a side hustle. This highlights the increasing popularity of supplementing traditional income with freelance work or other entrepreneurial pursuits.

However, it's crucial to consider the time commitment and tax implications. Self-employment taxes can be a significant factor, and careful planning is essential for managing finances effectively. Time management is crucial, as balancing a full-time job with a side hustle requires discipline and prioritization.

Investing in the Stock Market and Other Assets

Investing in the stock market is a classic method for generating passive income and building long-term wealth. Index funds and ETFs (Exchange Traded Funds) offer diversified exposure to the market with relatively low risk. Investing involves inherent risks, and thorough research is critical.

Real estate remains a popular investment avenue, offering the potential for both rental income and property appreciation. According to the National Association of Realtors (NAR), median existing-home sales prices rose in 2023, suggesting continued demand in the housing market. However, real estate investment requires significant capital and careful management.

Other investment options include bonds, mutual funds, and even alternative investments like cryptocurrency. It is important to consult a financial advisor before making any investment decisions. Diversification is key to mitigating risk across different asset classes.

Creating and Selling Online Products

The digital age has created countless opportunities for creating and selling online products. E-books, online courses, and digital art are all potential sources of income. Platforms like Etsy, Shopify, and Udemy provide tools and resources for entrepreneurs to reach a global audience.

Content creation on platforms like YouTube and TikTok can also generate revenue through advertising and sponsorships. Building a strong online presence and engaging with your audience is crucial for success. These are time consuming but if successful, they generate a great passive income.

Intellectual property protection is a key consideration when creating and selling online products. Copyrights and trademarks can help protect your work from infringement. Focus on providing high-quality content to stand out in a crowded online marketplace.

Leveraging Skills and Expertise

Many individuals possess skills and expertise that can be monetized through consulting, coaching, or workshops. These services can be offered online or in person, providing flexibility and control over your schedule. Sharing your expertise can be a rewarding and profitable venture.

Building a strong personal brand is essential for attracting clients and establishing credibility. Networking and marketing are crucial for promoting your services. The Bureau of Labor Statistics projects strong growth for management consulting services over the next decade.

Consider offering specialized services that cater to a specific niche market. This can help you differentiate yourself from the competition. Continuous learning and professional development are crucial for staying ahead in your field.

Potential Pitfalls and Considerations

Building multiple income streams is not without its challenges. Time management, tax planning, and potential burnout are all important considerations. Prioritization and organization are key to maintaining a healthy work-life balance.

It's crucial to carefully assess the risk and reward associated with each income stream. Thorough research and due diligence are essential before investing time and resources. Do not go into debt to start a business.

Seek advice from financial professionals to navigate the complexities of managing multiple income sources. A financial advisor can provide guidance on tax planning, investment strategies, and risk management.

The Future of Income Diversification

As the gig economy continues to expand and technology evolves, the importance of multiple income streams is likely to grow. Adapting to new trends and embracing innovation will be crucial for long-term financial success. Income diversification is a safeguard in case one income source fails.

The rise of automation and artificial intelligence may disrupt traditional job markets. Diversifying income streams can provide a buffer against potential job displacement. Don't neglect to be frugal and save money.

Ultimately, building multiple income sources is about taking control of your financial future and creating a more secure and resilient lifestyle. By exploring different avenues and carefully managing your resources, you can build a foundation for long-term financial well-being.