How To Keep Track Of Finances For A Small Business

Small business owners face a relentless challenge: mastering their finances amidst daily operations. Neglecting this crucial aspect can lead to cash flow crises, missed opportunities, and ultimately, business failure.

This article provides actionable strategies to effectively track and manage your small business finances, ensuring stability and paving the way for growth. The information offered here comes from expert insights and proven financial management practices, providing practical steps for immediate implementation.

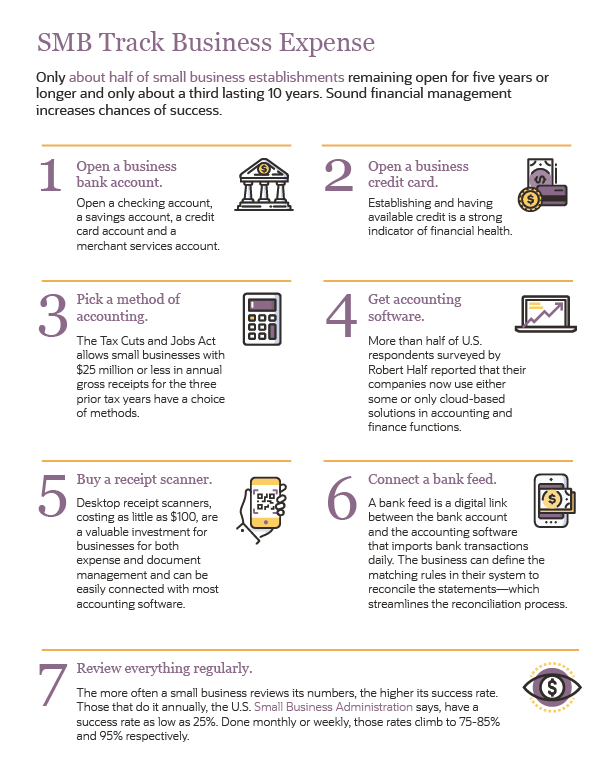

Establish a Separate Business Bank Account

Mixing personal and business finances is a recipe for disaster. Open a dedicated business bank account to clearly distinguish your company's transactions from your personal ones.

This simplifies bookkeeping, ensures accurate tax reporting, and provides a clear picture of your business's financial health.

Implement a Bookkeeping System

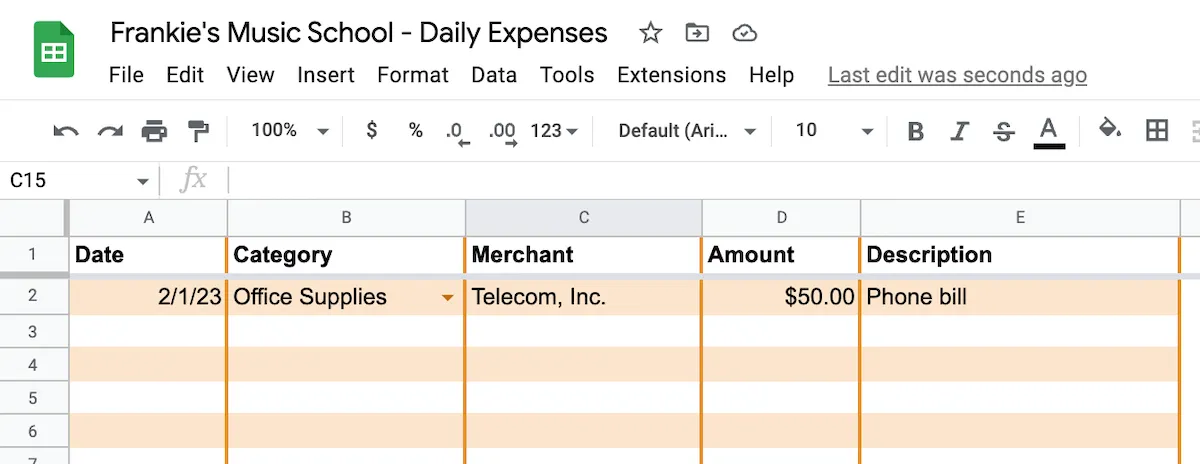

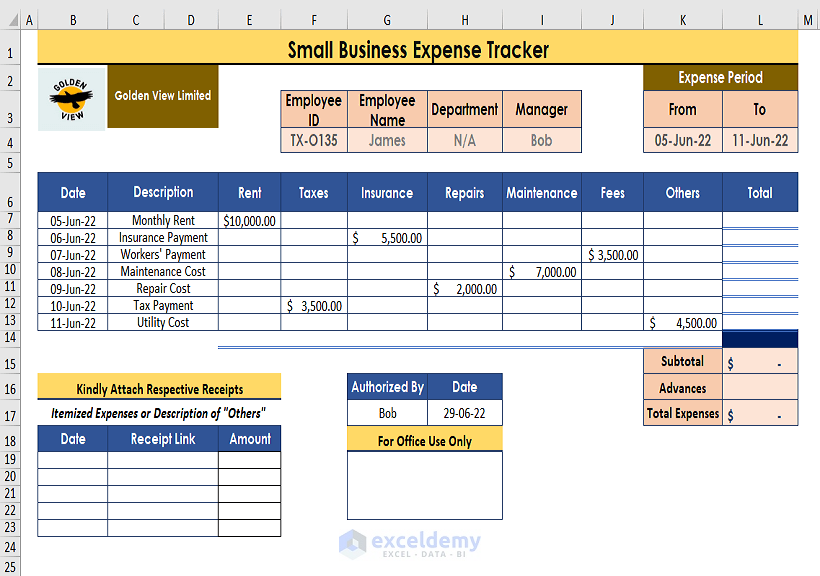

Choose a bookkeeping system that suits your needs and technical expertise. Options range from manual spreadsheets to cloud-based accounting software like QuickBooks, Xero, and Zoho Books.

According to a recent survey by Small Business Trends, businesses using accounting software are 30% more likely to report improved cash flow management. Regularly record all income and expenses, categorizing them appropriately for reporting purposes.

Track Income and Expenses Diligently

Meticulous tracking of every dollar earned and spent is essential. Keep receipts, invoices, and bank statements organized, either physically or digitally.

Utilize accounting software to automate this process and generate reports that offer insights into your business's profitability and spending habits.

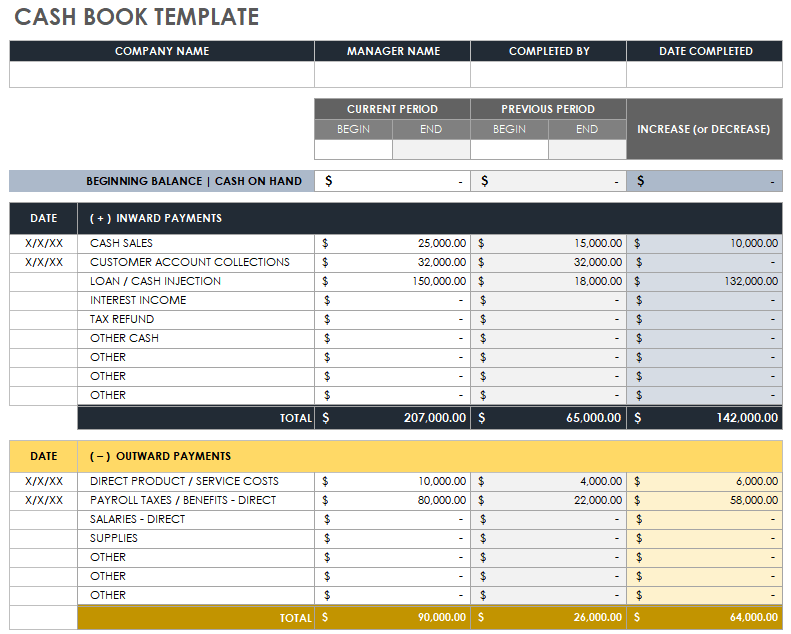

Monitor Cash Flow Projections

Don't wait for a cash crunch to understand your financial situation. Create a cash flow projection that anticipates future income and expenses.

This allows you to identify potential shortfalls and take proactive measures, such as securing a line of credit or adjusting spending, to maintain financial stability.

Regularly Reconcile Bank Statements

Reconciling your bank statements with your internal records ensures accuracy and detects any discrepancies. This process helps identify errors, fraud, or overlooked transactions.

Aim to reconcile your accounts monthly to maintain a clear understanding of your financial position.

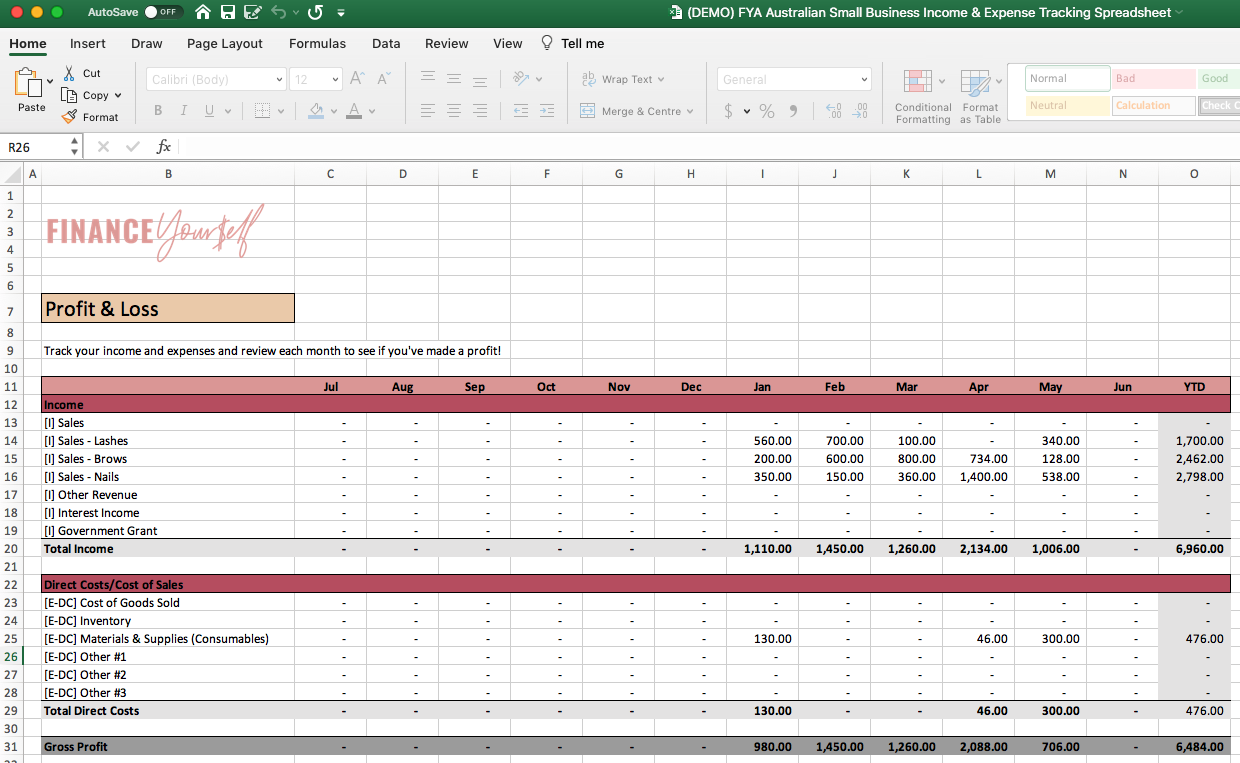

Understand Key Financial Metrics

Familiarize yourself with key financial metrics such as gross profit margin, net profit margin, and cash conversion cycle. These metrics provide valuable insights into your business's performance and efficiency.

Tracking these metrics over time allows you to identify trends, pinpoint areas for improvement, and make informed business decisions. Consult with a financial advisor for guidance on interpreting these metrics.

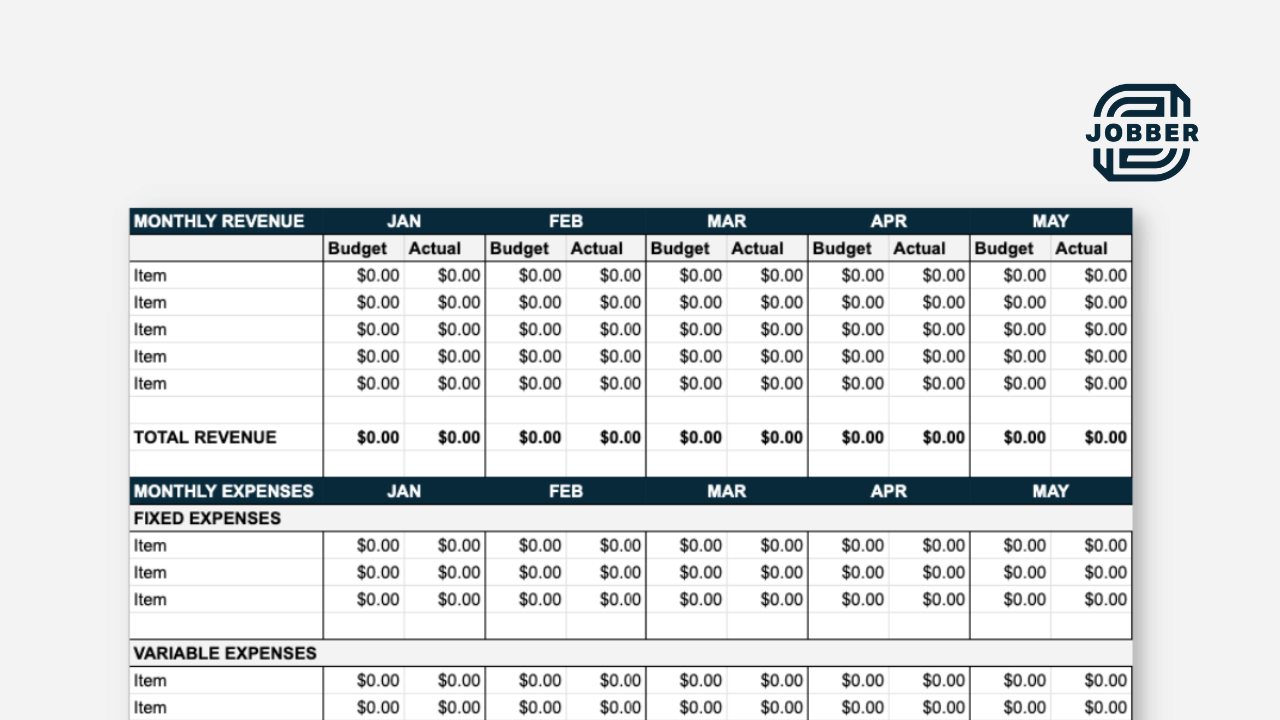

Budgeting and Forecasting

Develop a budget that aligns with your business goals and financial projections. A well-defined budget serves as a roadmap for spending and revenue generation.

Regularly compare your actual results against your budget to identify variances and adjust your strategies accordingly. Forecasting provides insights into future financial performance.

Invoice Promptly and Follow Up on Payments

Delayed payments can significantly impact your cash flow. Invoice clients promptly and clearly, specifying payment terms and due dates.

Implement a system for tracking outstanding invoices and following up with clients to ensure timely payment. Consider offering early payment discounts to incentivize prompt payments.

Seek Professional Advice

Don't hesitate to seek professional guidance from a qualified accountant or financial advisor. They can provide expert advice on tax planning, financial management, and business strategy.

A professional can help you navigate complex financial issues, optimize your tax position, and make informed decisions that drive your business's success.

What's Next?

Implementing these strategies will require commitment and consistency, but the rewards – financial stability, improved decision-making, and sustainable growth – are well worth the effort. Take action now by selecting and implementing at least one strategy outlined above.

Monitor your progress and adapt your approach as needed. Your business's financial health depends on it.

![How To Keep Track Of Finances For A Small Business [Free] Small Business Spreadsheet for Income and Expenses](https://storage.googleapis.com/driversnote-marketing-pages/US-smallbusiness-expenses-template.png)