How To Kick Partner Out Of Business

Imagine the scene: Late nights fueled by lukewarm coffee, scribbled ideas on napkins morphing into a tangible reality, and the shared thrill of building something from the ground up. The energy crackles, the potential feels limitless. But what happens when the initial spark fades, and the partnership that once felt like a perfect synergy turns into a source of constant friction?

Navigating a business partnership dissolution is a delicate dance, a process requiring careful consideration, legal expertise, and a healthy dose of emotional intelligence. While the goal is to separate professionally, doing so with grace and respect can minimize damage and pave the way for future success, for everyone involved. This exploration focuses on the crucial steps to take when considering ending a business partnership, emphasizing the importance of planning, legal counsel, and clear communication.

Understanding the Foundation: The Partnership Agreement

The bedrock of any business partnership is the partnership agreement. This document, ideally drafted at the outset of the venture, outlines the rights, responsibilities, and obligations of each partner, including the procedures for dissolving the partnership.

Pay close attention to clauses addressing buy-out options, valuation methods, and dispute resolution mechanisms. Consulting with a legal professional to review and interpret the agreement is paramount before taking any action.

Seeking Expert Guidance: The Role of Legal Counsel

Engaging a qualified attorney is non-negotiable. A lawyer specializing in business law can provide invaluable guidance on navigating the legal complexities of dissolving a partnership.

They can help you understand your rights and obligations, assess the potential risks and liabilities, and negotiate a fair and equitable settlement. Furthermore, they will ensure compliance with all applicable state and federal regulations.

Valuation and Buyout: Determining Fair Compensation

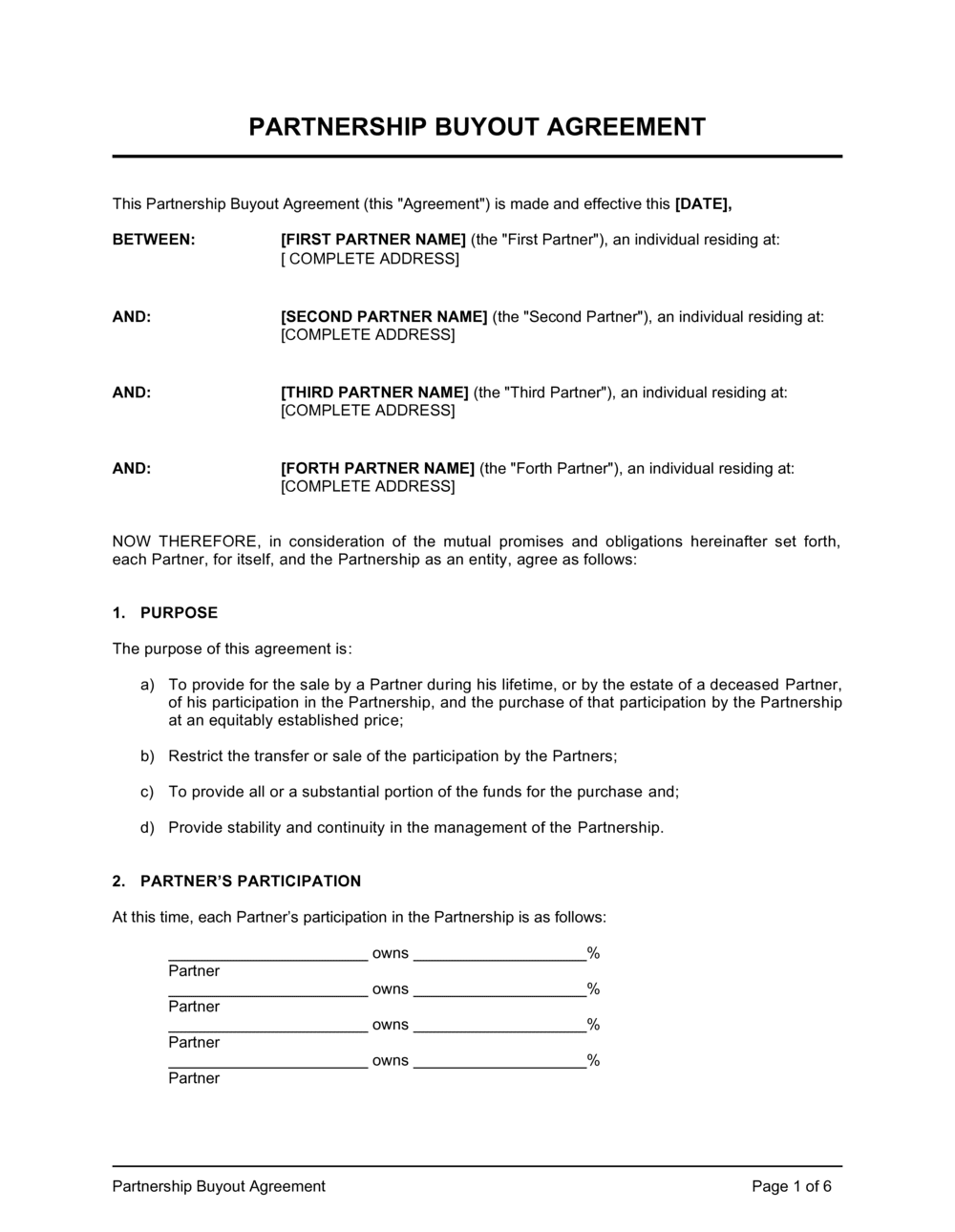

Determining the fair market value of the departing partner's share is a critical step. This often involves engaging a professional business appraiser to assess the company's assets, liabilities, and future earnings potential.

Various valuation methods exist, including asset-based valuation, income-based valuation, and market-based valuation. The partnership agreement may specify a preferred valuation method, but it’s essential to ensure that the chosen method accurately reflects the company's true value.

Once the valuation is complete, the remaining partner(s) can offer a buyout to the departing partner. The terms of the buyout should be clearly documented in a written agreement, outlining the purchase price, payment schedule, and any other relevant conditions.

Communication and Negotiation: Maintaining a Respectful Dialogue

Open and honest communication is essential throughout the dissolution process. While emotions may run high, strive to maintain a respectful and professional dialogue with your partner.

Clearly articulate your reasons for wanting to dissolve the partnership, and be willing to listen to your partner's perspective. Negotiation may be necessary to reach a mutually agreeable settlement.

Consider utilizing a mediator to facilitate discussions and help bridge any gaps in understanding. A mediator can act as a neutral third party, guiding the conversation and helping to find creative solutions.

Alternative Dispute Resolution: Mediation and Arbitration

If direct negotiation fails, consider alternative dispute resolution (ADR) methods such as mediation or arbitration. These processes offer a less adversarial and more cost-effective alternative to litigation.

Mediation involves a neutral third party facilitating discussions between the partners, helping them reach a mutually acceptable agreement. Arbitration, on the other hand, involves a neutral arbitrator hearing evidence and rendering a binding decision.

Formalizing the Separation: The Dissolution Agreement

Once an agreement is reached, it must be formalized in a written dissolution agreement. This document outlines the terms of the separation, including the distribution of assets, the allocation of liabilities, and any ongoing obligations.

It should also address issues such as non-compete agreements, confidentiality agreements, and intellectual property rights. Consulting with legal counsel to draft and review the dissolution agreement is essential to ensure that it accurately reflects the agreed-upon terms and protects your interests.

Legal and Regulatory Compliance: Ensuring a Smooth Transition

Dissolving a business partnership involves several legal and regulatory requirements. These may include notifying government agencies, canceling business licenses and permits, and filing tax returns.

Ensure that you comply with all applicable state and federal regulations to avoid potential penalties or legal issues. Closing bank accounts and notifying vendors and clients of the change in ownership is crucial for a smooth transition.

Moving Forward: Embracing New Opportunities

Dissolving a business partnership can be a challenging and emotional process. However, it can also be an opportunity for new beginnings and renewed focus.

By approaching the process with careful planning, legal expertise, and a commitment to open communication, you can minimize damage and pave the way for a successful future. Remember the lessons learned, both positive and negative, and use them to inform your future endeavors.

Ultimately, the ability to navigate complex business relationships with integrity and respect is a valuable asset, one that will serve you well in all your future endeavors. It allows to look towards new horizons with confidence and resilience.